Wentz Weekly Insights

Eight Straight Weeks and Counting..

We hope everyone had a Merry Christmas and wish everyone a safe and Happy New Year!

Here is a recap of last week:

Week in Review:

The week began with several M&A headlines including U.S. Steel agreeing to be acquired by Japanese steelmaker Nippon Steel, Adobe terminating its agreement to acquire Figma over regulatory concerns, building material company Masonite acquiring PGT Innovations, and software company Alteryx taken private by a consortium. The other big news was multiple Fed officials making the first public comments since the FOMC meeting, with comments mixed reflecting the growing divergence in opinions between policymakers (see the other news section below). Cyclical sectors drove the gains on a day that was mixed, with the S&P 500 up 0.45% while the equally weighted index was flat.

Tuesday headlines included data on housing starts that surged to a six-month high in November while the Bank of Japan kept its policy unchanged and did not provide any additional updates on its ‘zero interest rate’ policy, one of the only central banks to keep rates at 0%. There was more Fed speak with comments noting the Fed is in a good spot with policy and it will respond appropriately to the incoming data, adding there is still work to do on inflation. It was a solid day for stocks and a 0.59% increase in the S&P 500 left it within 1% of the all-time closing high nearly two years ago.

Geopolitics picked up in recent days with the news of the Houthi rebel attacks on ships in the Red Sea, reports came Wednesday that the US was contemplating military strikes against the rebels in Yemen. In addition, China’s President Xi warned the US it plans to reunify Taiwan, just uncertain on when. Markets opened mixed, moved higher in morning trading and appeared to be on track for the tenth straight day of gains for the Dow and NASDAQ. However, around 2:00 stocks took a sudden turn lower and ended the day down 1.47% with no specific reason for the swift move.

Jobless claims remained steady in the latest week, third quarter GDP was revised slightly lower, and manufacturing surveys continued to show the industry remains in a recession – those were the data points released Thursday. Elsewhere, it was a quiet day with stocks reversing Wednesday’s decline and moving higher on a very low volume day. The S&P 500 rose 1.03% while Treasuries increased slightly.

Friday was another positive day, despite disappointing earnings and forecast from Nike, with management caution on the consumer as spending habits slow. The most important data of the week was released in the morning and included consumer spending that slowed to a 0.2% increase in November, while incomes rose more than expected, and the PCE price index was in line with expectations and was consistent with data seen from the consume price index that price increases slowed again in November. Stocks were mostly higher, driven by small caps, with the S&P 500 and NASDAQ posting their eighth straight week of gains, after a rise of 0.17% and 0.19% on Friday, respectively.

The rally over hopes for more rate cuts continued last week and pushed both stocks and bonds higher again with the S&P 500 finishing higher for the eighth consecutive week and small caps seeing the strongest gains for the week. The 2-year Treasury yield fell another 9 basis points to 4.34% while the 10-year was relatively unchanged at 3.90%. The dollar index declined again last week, falling 0.8% and now down 5% from its highs two months ago, while gold rose 1.6%. Crude oil was up 3.0% for the biggest gain in two months after concerns of attacks in the Red Sea sent the commodity higher. Stocks were higher across the board and finished as follows: Russell 2000 +2.46%, NASDAQ +1.21%, S&P 500 +0.75%, and Dow +0.22%.

Recent Economic Data

- The personal income and spending report for November was all around mostly as expected. Personal incomes rose 0.4%, coming after a 0.3% increase in October, and are now 4.2% higher than a year ago, still above the longer-run average. Wages and salaries were up a hot 0.6%, now up 4.2% from a year earlier. This may be a one time thing with auto workers returning back to work from the strike. Consumer spending rose 0.2% in the month, slightly less than the 0.3% increase expected, and spending is now up 6.2% from a year ago, slowing from the 12-month increase of 7.0% in October. Spending on goods fell 0.2% in the month while spending on services rose 0.5%, which has been the trend for nearly two years now. The savings rate was 4.1%, ticking up from 4.0% from October, but still well below the long-run average of 7.5%. The most important number, the PCE price index, fell 0.1% in the month, matching the inflation readings we saw from the consumer price index. The price index is down 0.1% over the past two months but the 12 month rate is still 2.6%. The core price index rose 0.1% and is up 3.2% from a year ago, slowing from the 3.5% annual rate in October and the lowest since March 2021.

- The housing market index, an index on homebuilder sentiment, ticked up to 37 for December up just 3 points from November. The rise snaps four straight months of declines, but remains in very depressed territory (an index of 50 is breakeven – below 50 is considered weaker/contracting activity). The index on present sales remained at 40, matching the lowest since January, expectations on sales over the next six months rose 6 points to 45, while the index on traffic of potential buyers rose 3 points from a extreme low of 21 to 24.

- The number of housing starts in November surprised significantly to the upside with housing starts rising 14.8% in the month to a seasonally adjusted annualized pace of 1.460 million. Perhaps the upside surprise was due to better weather in November. Starts are 9.3% above the level a year ago. On the other hand, the number of permits authorized to build a new home fell 2.5% to an annualized rate of 1.460 million. Permits are 4.1% above the level from a year ago. The number of homes currently under construction has remained relatively unchanged all year, at an annualized pace of 1.685 million in November.

- Existing home sales for November snapped a five month decline, rising 0.8% from October to a seasonally adjusted annualized sales rate of 3.820 million homes. Although this was an small improvement, it improved from the worst sales pace seen since data started. The sales pace was down 7.3% from the pace a year earlier, and a 38% drop from the pace two years ago. The amount of existing homes on the market has been an issue all year, and saw no improvement in November with inventories down 2% to 1.13 million homes, equivalent to just 3.5 months supply (a balanced market is considered 6 months supply). Even though the sales pace is unusually low, the median sales price continues to rise because of the low inventory. The median price was up 4.0% over the past year to $387,600. It should be noted this data lags slightly as existing home sales are based on closings, so this reflects contracts signed in October when rates were at the highest point of the cycle.

- Sales of new homes fell 12% in November to a seasonally adjusted annual rate of 590,000, according to the latest data from the Census Bureau, which was a big disappointment versus expectations. This is 1.4% above the level from a year ago. Supply of new homes is much better than existing homes as builders are doing their best in keeping up with still strong demand. Inventory of new homes improved to 451,000, increasing the months supply to 9.2, up from 7.9 last month. The number of home sales fell the most for homes that have not seen construction started yet, while sales for homes completed and under construction were stable.

- Manufacturing has been a weak part of the economy through the year and December appears no different, based on recent manufacturing surveys and again with the Philly Fed Manufacturing index. The index was -10.5 in December, worsening from the -5.9 from November. The report notes new orders turned sharply lower, while general activity and shipments remained negative. Employment fell back into negative territory and price increases were near their long-run averages. It noted 26% of firms saw decreasing activity, (up from 18%) and 56% saw no change (down from 70%).

- Durable goods orders rose a very strong 5.4%, however this could be numbers reverting back after a 5.1% decline from October. This is all transportation related, as orders ex transportation were up 0.5%, although still much better than 0.2% expected, while core capital goods orders were up 0.8% – also pretty strong and well above expectations. The big number, as this is a direct calculation in GDP, is shipments of non defense core capital goods excluding aircraft, which fell 0.1% and has fallen for three straight months.

- The final estimate on third quarter GDP shows growth came in at an annual rate of 4.9% in the quarter, down from 5.2% in the second estimate but back down to what was measured in the first estimate two months ago. The update is based on more complete source data. There was slight downward revisions to consumer spending, inventory investment, and exports, and partially offset by small upward revisions in government spending and housing and business fixed investments.

- The number of unemployment claims filed for the week ended December 16 was 205,000, relatively unchanged from the prior week with the four-week average at 212,000. The number of continuing claims was also relatively unchanged, coming in at 1.865 million, which appears to have plateaued recently after a steady increase since September. The four-week average of continuing claims was 1.878 million.

- The Conference Board’s consumer confidence index finished the year on a strong note, with the index rising to 110.7, up nearly 10 points from November and the highest level since summer. The present situations index rose 8 points to 148.5 due to more positive views on business conditions and employment while the expectations index rose 8 points to 85.6, the highest since July, reflecting improved views on job availability and incomes.

- The University of Michigan’s consumer sentiment index was 69.7 for December, up from the beginning of the month survey of 69.4, which is still historically low. The index on current conditions fell from 74 to 73.3, which is still the best since August. The index on expectations rose to 67.4 from 66.4, the best since July. The expectations on inflation over the next 12 months was 3.1%, unchanged from the prior survey and the lowest since January 2021.

Company News

- Apple is in the middle of an ongoing patent dispute with the medical device company Masimo regarding its watches that have a blood oxygen feature, and as a result said it will halt the sales of its Apple Watches. Sales will be halted online on the 21st and in Apple stores on the 24th. Reports following this news said Apple is planning to make software changes, adjusting how it decides oxygen saturation and presents the data, as a workaround to continue sales.

- Buy now pay later service provider Affirm said it has expanded its services with Walmart to bring its buy now pay later option to self check out lanes in over 4,500 stores across the U.S. Affirm said its recent research showed 54% of Americans are wanting retailers to provide a buy now pay later option at checkout.

- According to a report by Axios, the CEOs of Warner Bros Discovery and Paramount met earlier in the week to talk about the possibility of merging the companies. Bloomberg later confirmed the report, saying the talks were described as preliminary. The reports follow other recent reports that controlling shareholder of Paramount, Shari Redstone, has been holding talks about a possible sale of the company’s movie studio and other media assets.

- Bristol Myers said it has agreed to acquire Karuna Therapeutics for $330 per share for a value of $14.0 billion, a 53% premium to where shares traded prior to the announcement. Karuna’s biggest asset is its drug candidate developed for the treatment of schizophrenia which was accepted for review by the FDA.

- The Biden Administration, along with many politicians and those in the industry, have called for “serious scrutiny” of the acquisition of U.S. Steel by Japan’s Nippon Steel. The Committee on Foreign Investment in the United States (CFIUS) is expected to take a long review of the deal, but experts say it is more likely than not to get the approval. There are reports it will be scrutinized by the Department of Defense as well due to national security and its operations.

Other News

- Fed speak, it is always insightful seeing what different policymakers have to say immediately following the Fed meeting as it provides more context at an individual level and could give additional hints about what policymakers are thinking given how they interpreted the market reaction following the FOMC meeting. Several remarks from last week are below:

- After hawkish comments from NY Williams Friday, Mary Daly from the San Francisco Fed said she thinks it is appropriate for the Fed to start considering cutting rates since inflation has improved, but it is still too early to speculate on when cuts would happen. She said since inflation continues to cool, interest rates are in a good place, but its now time for policymakers to pay attention to full employment more. These are the first comments we have seen that suggest inflation is not 100% the focus (remember the Fed has just two mandates – stable inflation and full employment).

- Chicago Fed’s Goolsbee provided more caution, saying it is still too early to say the fight against inflation is over, adding that incoming data will drive policy decision. He is still cautiously optimistic the economy can avoid a recession. He also said the market’s reaction to last week’s Fed meeting (stocks rose, bond yields fell) was the markets hearing what they want to hear and the reaction was not rational, suggesting it was an overreaction.

- Cleveland Fed’s Mester said she believes the market has moved a “little bit ahead,” and said the Fed is not likely to normalize policy (cut rates) quickly.

- Crude oil saw a small decline after OPEC member Angola said it was leaving the cartel, which seems to have been driven by a dispute about production quotas at its meeting two weeks earlier. It said in a statement it felt it does “not gain anything by remaining in the organization.” In November, they produced 1.13 million barrels/day, which is 4.1% of the group’s 27.8 million bbl/day production and about 1% of global production.

- In recent days, Houthi militants backed by Iran have increased attacks on ships traveling through the Red Sea, resulting in some of the largest shipping companies in the world, including Maersk, Evergreen, BP, MSC, and Hapag-Lloyd, to change their routes and avoiding the area. The alternative route takes you on a much longer and more expensive trip around southern Africa. The Houthi rebels, who have taken control of much of Yemen after years of internal conflict, have been attacking ships in the area in response to the Israeli attacks against Hamas in Gaza. The result of the attacks are having an impact of shipping times, the price of oil, and to a higher degree, the price of war risk insurance premiums. To combat the attacks, the US launched a maritime security operations between ten other countries to safeguard commerce in the Red Sea that includes joint patrols in the Southern area of the Red Sea.

Did You Know…?

The Santa Claus Rally

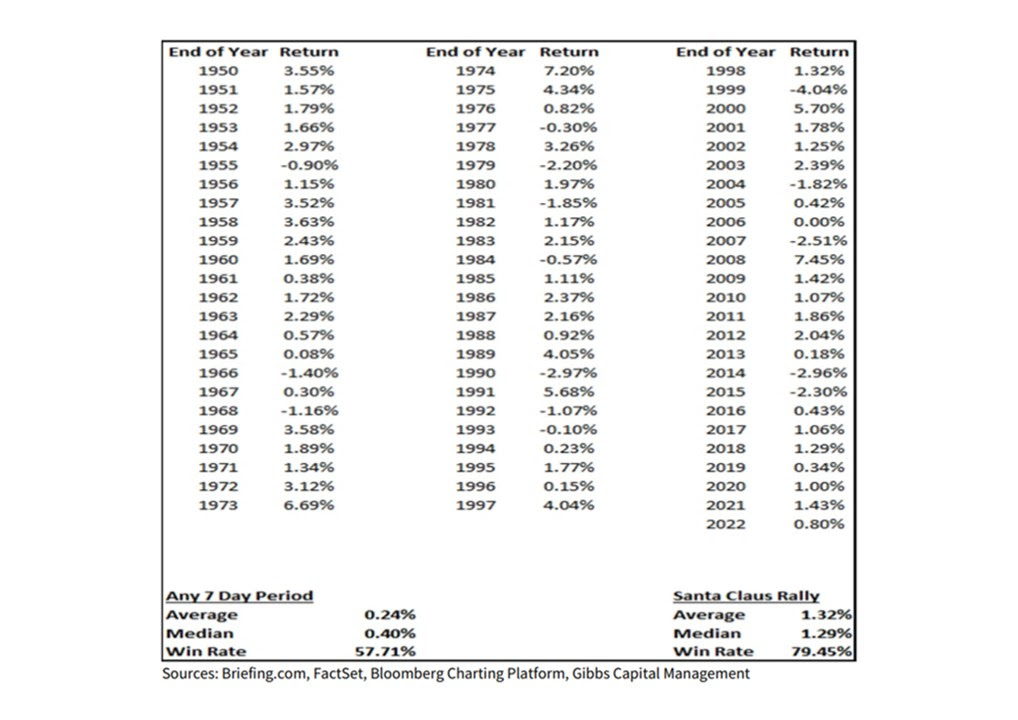

According to the Stock Trader’s Almanac, the “Santa Claus Rally” is a calendar effect that involves a rise in stock prices during the last five trading days of the year and first two trading days of the new year. The almanac says on average stocks rise 1.3% during that 7-day span since 1950, which is far more than the average of any given 7-day period of 0.24%. Over that period stocks are higher 79% of the time, also higher than any given 7-day period of 58%, as seen in the chart below from Raymond James.

The Week Ahead

It is expected to be a very quiet week ahead, one that is shortened due to the holiday Monday, and will see a longer weekend, with markets closed again for New Year Day next Monday. The only data releases on the economic calendar include the Case Shiller home price index and money supply on Tuesday, and jobless claims and pending home sales on Thursday. The corporate calendar is even more quiet, with no corporate events on schedule for the week. Nothing is expected to come out of Washington, with Congress on recess, and no Fed talk is scheduled for the week.