Wentz Weekly Insights

Inflation Is Still A Problem as US Economy Shows Continued Strength

US stocks finished lower for the second consecutive week, but yet again, it was the mega cap and tech stocks that held up better than the average stock. The S&P 500 fell 1.56% while small caps fell 2.92%, measured by the Russell 2000. It was also a week where Treasuries sold off as yields spiked, rising to the highest level since October, coming after another hotter than expected inflation report.

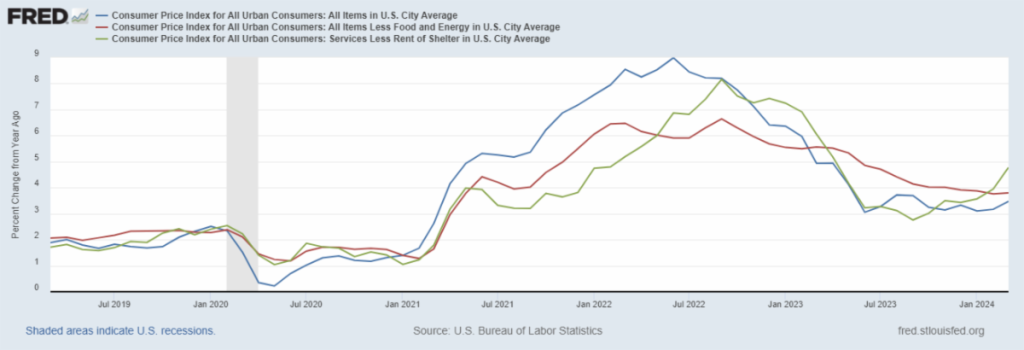

That was one of the highlights of the week – the latest inflation data showed consumer prices rose more than expected at both the headline level and the core index. The index was up 0.4% in March and increased 3.5% from a year ago, accelerating from the 3.2% annual rate in February. Energy played a role, rising 1.1% in the month as commodity prices have increased about 13% this year. The core index, which strips out the volatile food and energy categories, rose 0.4% as well and was up 3.8% from a year ago. Annualizing the first three months of the year, inflation is running at a 4.4% pace, over double the Fed’s 2% target.

Even more, the Fed and markets have been more focused on a category referred to as ‘super core’ – consumer inflation that excludes food, energy, certain goods, and shelter prices and is better at measuring inflation in the service sector which is arguably the strongest part of the economy currently. This index rose 0.8% in March and is running at an 8.0% annualized pace over the past three months, nearly the peak level inflation was at in 2022. Some of the hottest categories include transportation, where prices are up nearly 11% from a year ago, medical care services, and shelter as home prices and related costs continue to push the index higher.

The chart below shows the 12-month change in consumer prices. The blue line includes all categories and is the broadest inflation measure, the red line looks at core prices which excludes food and energy prices, and the green line looks at services inflation which has accelerated since the second half of 2023.

January and February saw the consumer price index move higher than expected and the reaction was mixed. Some saw it as a result of seasonal adjustments as the calendar rolled over, while others saw it as early signs inflation was reaccelerating. With another month of stronger data, it is appearing that inflation has reaccelerated.

Stocks immediately moved lower while bond yields spiked – the two year Treasury yield rose 24 basis points on Wednesday after the data was released and hit 5.00% for the first time in five months. At the same time, markets have been repricing the probability of rates cuts this year. The odds of one or less rate cuts this year is at 45%, after being near 5% just one month ago, while the odds of three rate cuts is now at just 20% after being the overwhelming consensus just one month ago. Looking more short term, the chance of a rate cut at one of the next two meetings is at 20%, after being at 50% the beginning of last week and 75% just one month ago.

It is hard to make the argument inflation is not sticky. If anything, inflation has accelerated lately and makes the picture more complicated for Fed officials. In recent public appearances, many Fed policymakers have sounded more hawkish, suggesting less policy easing this year (less rate cuts) as progress on inflation has stalled. However, in Chairman Powell’s latest public comments, he was more vague, sticking to the message from the latest FOMC meeting that progress is being made and it is likely rate cuts will begin this year. Powell is scheduled to speak Tuesday afternoon and we expect greater focus on what he says.

One piece of positive news on the inflation front is consumers’ expectations have remained stable. According to the New York Fed’s survey of consumer exceptions, inflation expectations over the next 12 months remained stable at 3.0% since December, after peaking at 6.8% mid-2022 (although still slightly above the 2.5% pre-pandemic trend). The longer term 5-year ahead inflation expectation was 2.6%, which has remained between 2.5% and 3.0% since the pandemic. The consumer sentiment survey on the other hand showed a slight uptick in expectations last week – the one year inflation expectation moved to 3.1% while the five year expectation moved to 3.0%, both the highest of the year. If consumers expect higher inflation, it is likely to turn into a self-fulfilling prophecy as people would be more inclined to buy things now before prices rise, therefor increasing the velocity of money and making inflation worse. Having inflation expectations anchored helps create a more stable inflation environment.

The other big topic was the start of first quarter earnings season. The unofficial beginning of each quarter is when several of the big banks, like JPMorgan, Wells Fargo, and Citigroup, report around the end of the second week of the quarter. It was a weak day for each of the stocks as net interest income was forecasted to be slightly lower than expected, among with uncertain comments from JPMorgan CEO Jamie Dimon that “the global landscape is unsettling” and that persistent inflationary pressures may likely continue.

Earnings pick up pace this week with around 50 S&P 500 companies reporting results, among many others. It is still early in the earnings season, but earnings expectations moved down slightly after last week’s results.

Week in Review:

It was a slow start to the week with the total eclipse on Monday resulting in the lowest trading volume day of the year, but was the second straight week of declines for the S&P 500 and third straight for the NASDAQ, even though it hit a new record high mid-week. The major indices finished as follows: NASDAQ -0.45%, S&P 500 -1.56%, Dow -2.37%, and Russell 2000 -2.92%. Treasuries saw one of the worst weeks of the year as well as yields picked up across the curve. The 2-year yield rose 15 basis points to 4.91% while the 10-year yield rose 12 bps to 4.53%. Commodities continue the move higher, but oil fell 1.4% for the week despite ongoing tensions in the Middle East. The dollar index rose 1.6% for the biggest gain since mid-2022, while gold had another record high with a 1.2% increase.

Recent Economic Data

- Consumer Price Index: The CPI rose 0.4% in March, slightly higher than the 0.3% increase expected with the index up 3.5% from a year ago, matching expectations but accelerating from the 3.2% annual change in February. Meanwhile, core price, which exclude food and energy, rose 0.4% which was also slightly higher than the 0.3% expected with the change from a year ago at 3.8%, more than expected and matching February’s change. For the first three months of 2024, inflation is running at a 4.4% annualized pace, over double the 2% inflation target. We have seen a pickup in commodity prices lately, particularly oil where energy rose 1.1% in the month, while food prices have seen very small increases in the past several months with just a 0.1% increase in March. Elsewhere, transportation services continues to be one of the hottest categories with a 1.5% monthly increase and 10.7% increase from a year ago. New and used vehicle prices both declined, medical care services rose 0.6%, and the largest category in the index, shelter, rose 0.4%, cooling from recent months though still up 5.4% from a year ago. Finally, one of the most important readings, which is service prices excluding shelter and reflects inflation in the service sector, rose 0.8% in March and is up 8.0% annualized over the past three months.

- Producer Price Index: Producer inflation rose slightly less than expected at the headline level with the producer price index rising 0.2% in March and the index up 2.1% over the past year, accelerating from the 1.6% annual rate in February. There was a surprise 1.6% decline in energy prices which may have led to the lower than expected number. Core prices, excluding food and energy, rose 0.2% as expected and were up 2.4% from a year ago, more than expected and up from 2.0% from February. Prices for final demand services rose 0.3%, driven again by a large increase in transportation/warehousing. Overall a pretty inline with expectations report, markets ended up moving higher as a ‘relief rally’ after the data.

- Jobless Claims: The number of jobless claims filed the week ended April 6 was 211,000, a decline of 11k from the prior week and keeping the four-week average unchanged at 214,250. The number of continuing claims was 1.817 million, up 28k from the prior week with the four-week average up only slightly to 1.803 million. No big surprises here.

- Consumer Sentiment Survey: The consumer sentiment survey’s index was 77.9 for the preliminary April survey, lower than expected and falling 1.5 points from March. The survey on current conditions was 79.3, down 3 points from March while the survey on expectations dropped slightly to 77.0. The big focus is on inflation expectations where expectations over the next year ticked higher to 3.1%, up from 2.9% last month with the long term inflation expectation also increasing to 3.0%, up from 2.8%.

Company News

- Apple Production in India: India’s production of Apple’s iPhones has doubled in the latest fiscal year, according to Bloomberg, another sign Apple continues its push to diversify its production and reduce its dependence on China. The article adds Apple now makes about 14%, or one out of every seven iPhones in India.

- Apple’s Newest Chip: Separately, Apple received more attention on Thursday after a Bloomberg report noted the company is working on overhauling its entire Mac product line with its new M4 chips to help it power and expand its artificial intelligence capabilities. The Mac was released with the first processor built by Apple in house and the newer chip, the M4 processor, is being designed to highlight its AI capabilities in attempt to boost struggling Mac sales.

- Boeing’s Quality Issues: Quality issues at Boeing continue – The FAA is now investigating Boeing over separate allegations from a whistleblower who was a Boeing engineer that claimed Boeing disregarded safety when producing the 787 Dreamliner with sections of the 787 plane not fastened together properly and could fall apart after thousands of flights. In addition, Boeing said it delivered the fewest planes since 2001 due to its ongoing quality issues.

Other News:

- China Phasing Out US Chips: The Chinese government reportedly directed its largest telecom companies to begin phasing out foreign chips that go into their networks and have them phased out by 2027 amid increasing US-China tensions regarding technology, according to a WSJ report. It adds the move to remove the chips from networks would be most impactful to Intel and AMD.

- FOMC Meeting Minutes: The release of the FOMC minutes from the Fed’s March meeting showed there was a general agreement fed policy/rates were at its peak, and almost all officials saw rate cuts as necessary at some point this year if the economy evolves as expected. There was a bigger debate around recent inflation readings – some expressed concerns about elevated prices, with others seeing it as the “bumps” in the road that would be expected as inflation moves down.

- Fed speak:

- Boston’s Collins said she still expects rate cuts will be appropriate this year, but “recent data suggest it may take more time than I had previously thought” for inflation to continue its downward progress. She added that may mean less policy easing this year, i.e. less rate cuts, may be warranted and the risks of policy being too tight has receded.

- New York’s Williams said he sees no need to adjust policy in the near term despite the “tremendous progress” made on inflation, adding inflation has a ways to go before reaching its target.

- Bank of Canada: The Bank of Canada left its policy rate unchanged for the sixth consecutive meeting, saying inflation has slowed, but remains very elevated. The central bank said it will be looking for additional evidence that downward momentum in inflation is sustained before cutting rates.

- European Central Bank: The European Central Bank kept its interest rates unchanged after its latest policy meeting last week for the fifth consecutive meeting and continues to indicate rate cuts will be necessary at some time this year after it gains greater confidence inflation is approaching its 2% target, similar to comments by the Fed. Officials have acknowledged inflation has moved lower with a few officials ready to reduce rates at the meeting. The ECB added it is not pre-committed to a specific path of rate cuts or policy loosening.

WFG News

Estate Planning Seminar

May 7, 2024 @ 6:00 pm

Join us on May 7 as we welcome James Contini, Lawyer and Director of Krugliak, Wilkins, Griffiths & Dougherty Co., L.P.A. as he discusses the important need for Estate Planning and effective ways to plan for your future.

See flyer below for details.

The Week Ahead

First quarter earnings season will see more companies reporting quarterly financial results with roughly 10% of S&P 500 companies reporting this week. Notable companies reporting include Goldman Sachs, Charles Schwab on Monday, Bank of America, United Airlines, United Health, Johnson & Johnson on Tuesday, Abbott Labs, CSX, Las Vegas Sands on Wednesday, Netflix, Taiwan Semiconductor on Thursday, and American Express and Procter & Gamble on Friday. The focus on the economic calendar turns to the housing market with updates from the housing market index, housing starts and permits, and existing home sales this week. Other economic releases are the Empire State and Philly Fed Manufacturing surveys, industrial production, jobless claims, and perhaps the most notable release – the March retail sales report releases Monday morning. Fed speak continues with another handful of policymakers making public appearances this week and a speech from Chairman Powell on Tuesday, who we will hear from for the first time since the latest inflation data. Politics and geopolitical tensions will be top of mind as well after Israel was hit with weekend drone strikes from Iran, with the world waiting for Israel’s response.