Wentz Weekly Insights

Market See Strong Rotation Favoring Small Caps

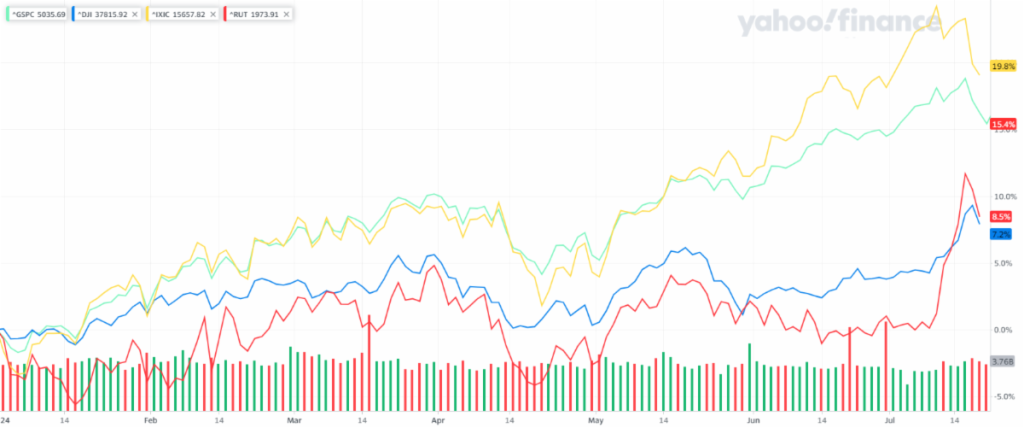

It was a very mixed, and quite volatile, week of trading for US stocks. The week started very strong with most stocks up. But that all took a turn with stocks mostly lower the final three days of the week. The rotation in the market continued – investors rotated out of big tech and growth stocks and into small caps and value. In fact, it was the first weekly loss for technology since May. A much needed breather finally happened. In addition, it was the worst week for the S&P 500 in three months with a 1.97% decline but the index is only back down to the level it was when the month started. Still, the index is up 15.4% so far this year.

It was a different story for small caps and value stocks. The small cap Russell 2000 index was up 1.68% and Dow was up 0.72% for the week. Small caps were up 11.5% the five day period through Tuesday and were near record overbought levels after closing over three standard deviations above its 50-day moving average, noted investment firm Bespoke.

The two charts below show the return of the four major indexes so far this year and for the past month. You will see the yellow line is the Nasdaq which has seen the best performance due to its large weight in mega cap and Technology companies (driven by the AI investment trend). This is followed by the green line which is the S&P 500 that is the next best performer because it is cap weighted and has a high weight in mega caps (the top 7 stocks make up nearly 30% of the index’s weight). Then there is the Dow which has historically represented and been known as the blue chip index and is the blue line. The last is the red line that represents the Russell 2000 index that is an index of 2,000 of the smallest companies. You will notice the difference between year-to-date performance compared with the one-month performance and the strength of the rotation we have seen the past seven trading days.

The reason was momentum from the prior week and the latest inflation data where it came in lower than expected for the third straight month, leading investors to believe we will see more interest rate cuts by the Federal Reserve. Chairman Powell spoke Monday which added fuel to the rally after he said incoming data has given policymakers more confidence inflation is heading sustainably lower, however, refusing to give a timeline on rate cuts.

The ”Trump trade” also gained traction and may be contributing to the upside given the optimism of the return of a pro-business Washington. Bloomberg held an interview with President Trump in which he shared his throughs on taxes, tariffs, Powell, energy, geopolitics, and many other issues. From a market perspective, the more important topics involved an extension to the tax cuts from his prior administration, more friendly energy/drilling policies, a push for deregulation, and more favorable trade terms for the US.

Data from RealClearPolitics show Trump’s chance of wining back the presidency shifted to a cycle high of 66% last week, up from 57% prior to the assassination attempt. However as of Monday morning that is back down to roughly 60%.

After gaining pressure to withdrawal from the Presidential race, President Biden made the decision to do so, announcing the decision by releasing a letter to the world on Sunday afternoon on X (formerly Twitter). We thought it would be difficult for Biden to continue in the race given his cognitive decline and pressure from the Democratic party and expected a withdrawal from him due to the possible consequences to the Democratic party, not just the White House but House and Senate as well.

Vice President Kamala Harris is now the clear front runner. We expect her to continue to be so as she will gain the campaign infrastructure and funds from Biden. However, an open/brokered convention is still possible (to de-escalate/prevent a further split in the party) and we are still a month out from the Democratic National Convention August 19-22 in Chicago.

This creates more uncertainty for the 2024 Presidential race, and with an economy that is painting a mixed picture, we expect the volatility to continue through at least November. With stocks still near highs, valuations rich, and heightened volatility, we still see a decent pullback between now and the election as likely.

Markets will have politics in mind but the major focus will shift to earnings as we get into the peak of earnings season with about one-quarter of the S&P 500 set to report this week. After many financials having reported the prior two weeks (with better profits than expected but some areas of weakness), earnings growth expectations for the index moved to 9.7%, up from the 8.9% estimate two weeks ago. We will also see the first estimate on second quarter economic growth in the GDP report. Economists estimate the economy grew at a 1.8% annualized rate in the quarter, slowing from prior quarters. To wrap up the week, consumer spending, incomes and inflation figures come out Friday morning which could be market moving.

For the week the major stock indexes finished as follows: Russell 2000 +1.68%, Dow +0.72%, S&P 500 -1.97%, and Nasdaq -3.65%. The bond market was mixed with Treasuries seeing shorter term yields continue their decline but longer term yields held steady. The 2-year yield fell 12 basis points to 4.52% while the 10-year yield rose 5 bps to 4.24%. The dollar index rose 0.30%, gold saw a big drop Friday after new all-time highs earlier in the week, which pushed it down 0.1% for the week, while Bitcoin gained 15.2%. Oil saw pressure from demand concerns out of China after it reported disappointing economic data on economic growth (GDP) and oil consumption, with WTI oil settling down 4.3%.

Recent Economic Data

-

Retail Sales: Retail sales for June showed weakness at the headline level with no change in sales compared to May, but was slightly better than the small decline expected with several categories showing strength. However, retail sales have still trended weaker over the past several months. Looking at the details, only three of the 13 major retail categories saw sales declines led by gasoline sales (falling 3%), vehicle sales (falling 2%), and sporting goods/hobby stores (falling 0.1%). Excluding gas and auto sales, retail sales were pretty solid with a 0.8% increase with upside led by online sales up 1.9%, building materials/garden equip up 1.4%, health/personal care up 0.9%, and furniture sales up 0.6%. Compared to a year ago retail sales are up 2.3%, but down almost 1% after adjusting for inflation, and up 3.8% if gas and auto sales are excluded.

-

Empire State Manufacturing Survey: The Empire State Manufacturing index was -6.6 for July, relatively unchanged from June and continuing to suggest manufacturing conditions in the New York region are still declining moderately. The survey showed new orders were steady, shipments were up only slightly with shorter delivery times, but employment remained weak with continued contraction and input prices were modestly higher.

-

Philly Fed Manufacturing Survey: The Philly Fed manufacturing index was 13.9 for July, an improvement from 1.3 in June suggesting manufacturing conditions grew at a moderate pace in the month. The report noted almost 40% of firms surveyed reported increases in general activity, 25% reported a decline while around 30% reported no change. Beside a small bump in April the index has been in or near contraction territory for the year. Employment turned positive while the price indexes continues to suggest price increases.

-

Industrial Production: Industrial production increased by 0.6% in June, doubling the expected increase and is higher by 1.6% from a year ago. The increase was driven by a 2.8% increase in utilities which is typically correlated to weather, a 0.4% increase in manufacturing and a 0.3% increase in mining. The capacity utilization rate has steadily moved higher since January, seeing a nice increase to 78.8% for the highest since last September.

-

Housing Starts: The number of housing starts for June increased 3.0% in the month to a seasonally adjusted annual rate of 1.353 million, a nice bounce after falling to the lowest level since the bottoms of the pandemic May 2020. The number of starts is still 4.4% below the level from a year ago. The number of permits for new housing increased 3.4% in June to a seasonally adjusted annual rate of 1.446 million. Again, this has trended to the lowest level since the pandemic lows and is still 3.1% below the level from a year ago.

-

Housing Market Index: The housing market index, an index of homebuilder sentiment, fell for the third consecutive month to the lowest level since the very depressed reading from December, now at 42. The Northeast market has been the strongest this year, but that saw a substantial drop to sub-50 while the other regions were relatively unchanged, all lower than 43. The index for present sales fell 1 point to 47, the index for expected sales over the next six months rose 1 point to 48, and the index on traffic of prospective buyers fell 1 point to 28. After a solid start to the year, home builder sentiment has quickly deteriorated since April.

-

Jobless Claims: Jobless claims for the week ended July 13 were 243,000, an increase of 20,000 from the prior week and back to matching the highest level since last August. The four-week average rose slightly to 234,750. The number of continuing claims was 1.867 million, up 20k from the prior week for the highest level of continuing claims since November 2021. The four-week average was up 11k to 1.850 million.

Company News

-

Cleveland Cliff’s Acquisition: Cleveland Cliffs announced it has agreed to acquire Canadian steel company Stelco (The Steel Company of Canada) in a cash and stock deal. Current Stelco shareholders will receive 0.454 shares of Cliff stock and $60 (Canadian dollars) for each Stelco share owned, valuing Stelco at about $2.5 billion. Cliffs says it estimates it can achieve $120 million of annual cost savings with the acquisition. At closing Cliffs shareholders will own 95% and Stelco shareholders will own about 5% of the combined company.

-

Bad Week for Semiconductors: The semiconductor industry saw big declines mid-week last week after Bloomberg reported the US is considering more severe trade restrictions as part of its ongoing crackdown on chip exports to China. In addition, semi equipment maker ASML reaffirmed its full year forecast but had disappointing guidance for Q3 and, in addition with Bloomberg saying the export restrictions are targeting ASML, sent ASML shares 12.7% lower and the rest of the industry lower.

-

Macy’s Deal off the Table: Macy’s said it had ended discussions with Arkhouse Management and Brigade Capital on the potential acquisition of the company. Macy’s said its Board decided to terminate the discussions because they failed to bring an actional proposal with a compelling value and certainty of financing to the table. Instead of pursuing an acquisition, the company said it would turn attention to its new strategy to accelerate luxury growth and modernize operations. Macy’s shares fell 12% after the announcement.

-

Schwab Needs to Shrink: Shares of Charles Schwab fell about 10% after its earnings release last week, its biggest decline since the regional banking crisis last year. The bank warned investors it would have to shrink its business in order to protect its profits and maintain profitability. Schwab said it will move to rely more on its partners. It said this after reporting few clients opened new brokerage accounts than expected.

-

OpenAI Potential New Partner: The Information is reporting Broadcom has been in discussions with OpenAI (maker of ChatGPT and big partner of Microsoft) about building a new advanced AI server chip. Creating its own chip would help OpenAI reduce its reliance on Nvidia. This includes memory components as OpenAI sees a high need for high bandwidth memory in its chip plans. The report added if a new chip was built, it would not be available until at least 2026.

-

Warner Bros. Discovery Strategic Options: The Financial Times reported Warner Bros. Discovery is evaluating strategic options that include splitting its Max streaming services and movie studio segment from its legacy TV networks into a separate company, or an outright sale of some of its assets, to unlock shareholder value. Splitting the business would allow the streaming/studio part more flexibility to seek and invest in growth while the legacy business would retain the majority of the company’s debt. It has not hired an investment bank yet, but is in discussion with advisors and industry media businesses.

Other News:

-

IMF’s New Warning: The International Monetary Fund (IMF) said the momentum of disinflation across the globe is gradually waning and creates increased risk to global growth driven by prolonged, persistently higher rates. It specifically referred to elevated services inflation that is driven by strong wage growth that is “holding up progress on disinflation,” as well as risks to higher commodity prices from geopolitical tensions.

-

Powell’s Recent Comments: Federal Reserve Chairman Jerome Powell said in at an event hosted by the Economic Club of Washington DC that the Fed did not gain the confidence it wanted to in the first quarter that inflation was moving sustainably lower, because inflation data was coming in higher than expected. However, in the second quarter, it gained more confidence that inflation was moving to its 2% target after seeing additional data that inflation had moderated. He added the labor market is now no longer tighter than it was at the end of 2019 (pre-pandemic) and it is essentially at equilibrium while adding the economy has performed remarkably well over the last couple of years. Nonetheless, Powell refused to send any signals on the timing of the first rate cut. Markets have begun to price in a higher chance of a rate cut at its next meeting July 30 and are now pricing a 100% chance of a cut at its following meeting in September.

-

ECB Meeting: The European Central Bank concluded their July policy meeting last week morning and made no changes to policy, coming after its first rate cut this cycle at its prior meeting, saying incoming data supports its view that inflationary pressures remain in the European economy.

Did You Know…?

Amazon Prime Day:

Amazon’s July 16-17 Prime Day event drove record online sales and items sold during the two day shopping period. Although Amazon did not provide numbers for the event, Adobe Analytics estimates the consumers spent $14.2 billion across retailers. This would be an 11% increase over its two-day period from 2023. Despite the much higher spending figure, consumers spent less on big ticket items, suggesting consumers were more conscious on costs. Data technology company Numerator, who collected data on just under 100,000 orders, said the average order value was $57.97. However, 60% of households had multiple orders, with the average household spending $152. Going into the event, analysts were expecting a new high in sales driven by a still strong economy and new AI-powered shopping tool, which Amazon calls Rufus, that help drive sales, with a new revamped distribution model helping the company meet demand.

The Week Ahead

The week ahead will be filled with plenty of earnings reports and important economic data. Nearly 25% of S&P 500 companies are set to report their quarterly results. With most financial company earnings reports out of the way, the focus shifts to industrials with overall at least 130 S&P 500 companies reporting quarterly results. Some of the most notable reports will come from Verizon, Cleveland Cliff’s, Spotify, UPS, GE, GM, Coca Cola, Comcast, Tesla, Alphabet, Visa, Texas Instruments, AT&T, Thermo Fisher, Chipotle, Ford, IBM, Whirlpool, American Airlines, Hasbro, Honeywell, Juniper, 3M, and Bristol Myers. The main economic data reports are on the housing market, GDP, consumer spending, and inflation. Existing home sales and new home sales for June comes out the first half of the week where continued weakness in sales is expected. The first estimate of second quarter GDP comes out Thursday where economic growth is expected to have seen a 1.8% (annualized) growth rate in the quarter. Then on Friday, the personal income and outlays report is expected to show a 0.4% increase in incomes, 0.3% increase in spending and just a 0.1% increase in inflation in June. Other data coming out this week includes money supply, durable goods orders, consumer sentiment, and jobless claims. There will be no Fed speak as policymakers are in their quiet period ahead of next week’s FOMC meeting. Politics is going to be one of the main talking points for the week, with uncertainty in the Democratic Party over their nominee, although the expectation is it will be current Vice President Kamala Harris. Expect continued heightened volatility as a result. In non-financial related events, the 2024 Summer Olympics begins with the opening ceremony on Friday.