Wentz Weekly Insights

Market Selloff Gains Steam,

Fed Indicates Balance of Risks More Even, &

Jobs Growth Slows

——–

Stocks ended last week much lower than where they started, and that selloff appears to have gained steam. As of the beginning of trading Monday morning, stocks opened much lower – the S&P 500 opened down over 4%, the Nasdaq opened down over 6%, while the Russell 2000 opened over 5% lower. Stocks have recovered a couple percentage points since (as of about 11:00am), but it is still early in the session and we are going to continue to monitor the situation closely. We will be in contact with clients about opportunities we see, as well as if this develops into a broader or more serious situation/selloff.

When markets are in a downtrend or a selloff phase like they were last week, which picked up pace the end of the week with Friday being the worst day of the week, you typically do not see stocks bottom on a Friday. What happens is market participants digest more information over the weekend and the panic rises and they begin the week selling more which exacerbates the situation. In addition, the weakness in US markets carried over into international markets which created more fear, along with many technical factors that triggered more selling. At the end of the day, a lot of short term selloffs tend to be technical in nature and create opportunities.

It is also important to remember where we came from. US stock were up over 15% since the beginning of the year, and over 35% since the October 2023 low, without seeing a correction (a pullback in stocks of at least 10%). The longer we went without a correction the steeper the correction would be. Remember, corrections are healthy in a bull market.

——–

Regarding last week – it was certainly the busiest week of the quarter, if not year, for markets, full of economic data, earnings, and central bank meetings. The two key events, the Fed’s policy meeting and the July labor report, were two of the catalysts that triggered a broader selloff.

On the earnings side, reports have remained very mixed but those that miss estimates are being punished while those that are better than estimates are not being rewarded as much, evidence of markets that were priced for perfection. There were a couple big tech earnings – Apple shares were roughly flat after it gave an optimistic tone that its AI feature in its upcoming iPhone will help boost sales, despite worries about growth in China, Amazon shares were almost 10% lower after reporting slowing sales growth in its cloud segment AWS, Meta (Facebook) shares about 10% higher over better ad sales, and Microsoft shares lower after reporting slowing sales growth in its Azure cloud segment. But it was Intel with one of the most disappointing reports we have seen – its shares were down nearly 30% after another quarterly miss with headwinds in ramping its AI computer product and announcing a cost reduction plan with 15,000 job cuts, realignment of its operations, reducing capex by $10 billion, and suspending its dividend.

The market did not expect the Fed to make any changes to monetary policy at its meeting last week, and that’s exactly what the Fed did. However the bigger focus was on any clues Chairman Powell gave to markets on timing of and extent of rate cuts for this year and next. Our biggest takeaway from Powell’s commentary was not about rates, but the Fed using this meeting as one to reveal to markets that the risks to high inflation and rising unemployment are both more balanced.

Recall that the Federal Reserve was given two mandates by Congress – to promote maximum employment and stable prices. Powell explained that since the pandemic, the risks to the mandate were on the inflation side with prices rising too fast, and little risk to employment due to the strong and recovering labor market. However, as recent data has shown, inflation is coming back to a more normal level and the labor market is losing steam. As a result, there is an increasing risk that unemployment will rise and the risks of the two mandates is more balanced.

We believe markets took this as a sign the Fed is more ready to cut rates and that it views the economy as weakening. For example, the market odds of a rate cut of 50 basis points (0.50%) at the Fed’s next meeting in September was about 10% prior to the meeting Wednesday. After the meeting, those odds rose to 75% (and are near 90% this morning). The consensus was for two rate cuts by the end of the year and after the meeting the futures were pricing in five rate cuts.

The immediate market reaction was limited, but stocks ended up having a positive day with the S&P 500 rising 1.6% while Treasury yields saw another big decline over higher expectations of more rate cuts. But stocks reversed course Thursday after digesting the meeting details.

This selling intensified on Friday after the Department of Labor’s monthly employment report was released. The data showed 114,000 new jobs in July, a little more than 60k below estimates. In addition, the revisions for the prior two months show 25k less jobs added than previously thought. The total hours worked fell 0.3% with the average workweek falling to 34.2 hours. The average wage increased 0.2%, lower than the 0.3% increase expected and up 3.6% over the past year, just enough to keep up with inflation, and a deceleration from 3.9% in June.

The household survey, which measures civilian employment, showed employment gain of just 67,000. However, the data shows only 83,000 more people are employed compared to the beginning of the year. This differs significant with the establishment survey that shows 1.419 million new jobs over the same period (we highlighted potential reasonings for this difference in our May 6 Newsletter here). Not only that, but the number of people unemployed increased another 352,000 in July and we now have 895,000 more people unemployed since the beginning of the year and 1.259 million more over the past year.

Combine this with weekly jobless claims that just hit a new one-year high and you can see why there are some concerns that the labor market is slowing. However, we will note the labor market was coming off nearly historically tight levels – jobless claims and the unemployment rate were historically low. Whether this is a “normalizing” of the labor market or the early signs of a bigger issue is yet to be seen.

Taking all the recent economic data together, it is consistent with a weakening economy, but not one that is in a recession. These are all things we will continue to monitor. As with any selloff such as the current one we are in, it is always a good time to take a look at your retirement plans like 401k accounts to see if any rebalancing is necessary. As always, we are here to help so please do not hesitate to reach out.

Performance Recap:

Value and defensive stocks were the outperformers last week with Utilities, Real Estate, Communication Services, Consumer Staple, and Healthcare positive and all other sectors down. The major US stock indices finished as follows: S&P 500 -2.06%, Dow -2.10%, Nasdaq -3.35%, and Russell 2000 -6.67%. Treasury yields saw one of their largest declines in months with prices rising as investors rotated to “safe haven” assets. The 2-year Treasury yield fell 50 basis points to 3.89% for its lowest level since April 2023, while the 10-year yield fell 41 bps to 3.79% for its lowest since June 2023. Not only that but gold had a strong week, rising 3.7%, and Bitcoin fell 9.6% as investors continued to rotate out of risky assets. The dollar index fell 1.1% as the Japanese yen saw strength. Crude oil fell 4.7% with growth concerns outweighing geopolitical tensions in the Middle East.

Recent Economic Data

-

Job Openings & Labor Turnover Survey: The number of job openings on the last day of June was 8.184 million, a slight decline from 8.230 million in May (which was revised higher by 100k in this report) and a decline of 1 million from a year ago. Because of the revision, June’s 8.184 million job openings is the lowest since April 2020. Recall that job openings peaked around 12.2 million in March 2022 and the pre-pandemic level was around 7.2 million. The number of hires has steadily declined and was at 5.341 million in July, falling about 550k from a year ago. Meanwhile, the number of quits has steadily declined – now at 3.282 million quits, down 121k from last week and 434k from a year ago, and below pre-pandemic levels, indicating workers are less confidence in the jobs market and less confident in finding a better or higher paying job.

-

ADP Employment: ADP reported it saw payroll growth of 122,000 in July, a little below the 155,000 gain expected and below 155,000 increase saw in June. Most employer sizes and industries saw payroll gains, led by trade/transportation, construction, and leisure & hospitality and offset by a small decline in professional services.

-

Jobless Claims: Jobless claims for the week ended July 27 were at 249,000, an increase of 14k from the prior week with claims hitting a new 52-week high (highest since August 2023). The four-week average rose slightly to 238,000. The number of continuing claims was 1.877 million, up 33k from the prior week for a new cycle high (highest since November 2021), with the four-week average at 1.857 million.

-

Employment Report: The Dept of Labor employment report showed there were 114,000 new jobs in July, lower than the 180,000 estimated by economists. Even more, the prior two months saw a net downward revision of 25,000 jobs (25k less jobs added than previously thought). The most job gains were seen in education and health services, leisure & hospitality, construction, and manufacturing, with losses in information and temporary help services. The average wage increased 0.2%, lower than the 0.3% expected and wages are now 3.6% higher from a year ago, a sharp deceleration over the past several months (3.9% in June). Now to the household survey – data was no better. The number of people employed rose 67,000 in the month and the net gain in the number of people employed this year is only 83,000 (whereas the establishment survey suggests 1.419 million new jobs). The number of people unemployed increased 352,000 in July, has increased 895,000 so far this year, and increased 1.259 million over the past year. The number of people unemployed is now 1.434 million more than it was pre-pandemic. As a result of these numbers, the unemployment rate increased from 4.1% to 4.3% and now 0.9% above its cycle low of 3.4% (the U-6 increased from 7.4% to 7.8%). Another disappointing report, especially if you look at all the data including the household survey, which has consistently been much worse than the establishment survey. This should generate a lot more talk and worries about an economic slowdown and puts the Fed right on path to cut in September.

-

Employment Cost Index: The employment cost index (a closely followed data report from the Fed) increased 0.9% in the second quarter, in line with estimates and a slowdown from the 1.2% increase in the first quarter. Beside a brief jump at end of 2023/beginning 2024, the increase in the employment cost index has steadily declined. The index includes wages and salaries which increased 0.9% and benefits which increased 1.0% in the quarter. From a year ago, the employment cost index is up 4.1%, still running at a hotter pace that long-term averages, but decelerating from the past several quarters.

-

Productivity & Costs: US worker productivity saw a solid boost in the second quarter, according to the first estimate productivity increased at an annual rate of 2.3% in the quarter, a pickup from the 0.4% rate in the first quarter. The increase was mostly due to output increasing 3.3%, which is a big positive, and offset by a 1.0% increase in hours worked. Compared to Q2 last year, productivity increased 2.7%. Unit labor costs, the cost to produce each unit of goods/services, increased 0.9% in the quarter due to a 3.3% increase in compensation and the 2.3% increase in productivity. Compared to Q2 2023, unit labor costs are up just 0.5%, the lowest 12-month change since 2019. Worker productivity is such an important data point because it is the main factor that drives longer-term economic growth.

-

Case Shiller Home Price Index: According to the Case Shiller home price index, home prices rose 0.3% in May, the third consecutive monthly increase of 0.3%. Home prices are up 5.9% over the past 12 months, that has decelerated from the 6.4% annual gain in April. Midwest metro areas like Detroit and Cleveland saw the highest monthly increase (+1.8%). The largest annual changes were in New York (+9.4%), San Diego (+9.1%), followed by Las Vegas (+8.6%), and the smallest annual increases in Portland (+1.0%) and Denver (+2.1%).

-

Construction Spending: Construction spending in June fell 0.3%, much worse than the increase that was expected and falling for the third consecutive month now. The drop in construction spending was due to both a 0.4% drop in residential spend and 0.2% drop in nonresidential spend. Compared to a year ago, construction spending is 6.2% higher, drive by a 7.3% increase in residential and 5.3% increase in nonresidential. Just like other economic data, another data point suggesting a slowing (or possibly contracting) economy.

-

ISM Index: The ISM manufacturing index was 46.8 for July, two points lower than expected, about two points lower than June’s index, and below 50 for four straight months and 20 of the past 21 (below 50 means conditions have been contracting). The survey showed only 5 of the 18 major manufacturing industries reported growth. A continued decline in new orders had production at its lowest level since the pandemic lockdowns. As a result of lower production and low backlogs, companies said employment is declining and the index for employment is at the lowest since the pandemic lockdowns as well.

-

PMI Index: The PMI manufacturing index was 49.6 for July, lower than the 51.6 from June and roughly in line with estimates. Commentary was similar to the ISM survey – overall conditions deteriorated which was led by a further decline in new orders, but output/production remained positive due to outstanding business/backlogs.

-

Consumer Confidence Index: The consumer confidence index was 100.3 for the July survey, about unchanged with June’s level (but up 2.5 points after revisions) and has trended in a narrow range of 95 to 115 the past two years. The present situations index fell 2 points to 133.6 for the lowest since April 2021. The expectations index improved about 5 points to 78.2 for the best since January, however still below a key level of 80 which anything below typically signals a recession ahead.

Company News

-

Delta’s System Outage Costs: CNBC reported that Delta has hired a law firm to pursue damages related to the Crowdstrike and Microsoft software outage two weeks ago. Delta said the outages cost the airline $500 million and so far the companies have not offering anything in terms of compensation other than consulting advice. The costs come from lost revenue as well as “tens of millions of dollars per day in compensation of hotels.”

-

Spirit Airline’s New Services: Spirit Airlines said it has introduced new ‘Go Big or Go Comfy’ travel options that include the option for customers to purchase premium amenities. These additions are similar to competitors’ first class offerings that include bigger seats in the front, snacks and drinks, priority check in and boarding, and a checked bag and carry on bag at no extra cost.

-

Apple’s AI Software Delay: Bloomberg reported that Apple’s new artificial intelligence software (Apple Intelligence) will not be released with the new iPhone release, but will rather be rolled out several weeks after the new iPhone is released. The report says Apple is separating its AI rollout from its iOS18 launch due to concerns over the stability of new AI features.

-

Facebook’s Massive Settlement: Meta has agreed to a settlement over a lawsuit by the state of Texas over Facebook’s use of its users’ biometric data. The lawsuit accused the company of capturing and using Facebook user’s biometric data from users uploaded photos and videos without requiring permissions to assist in its then new feature “tag suggestions.” Meta agreed to settle the lawsuit for $1.4 billion and will pay that out to Texas over five years.

Other News:

-

Possible Export Restrictions of Memory Chips: Bloomberg reported the Biden administration is discussing if it should put further restrictions on what memory chips the US exports to China which would focus on chips that are used for AI and the equipment used to make those processors. Micron is one of the world’s largest memory chip makers, but the China government had previously banned its newest memory chips in critical infrastructure in China.

-

Treasury’s Borrowing Plans: The Treasury said it plans to borrow less over the next three months than previously expected, citing the move the Fed made last month to slow quantitative tightening (the amount of bonds the Fed sells from its balance sheet) and a result of having higher cash amount on hand. It plans to borrow $740 billion from July to September, $106 billion less than estimated three months ago. In Q4, the Treasury estimates it will need to borrow $565 billion. Wednesday the Treasury will announce the securities (bills/notes/bonds) it plans to issue to fund this need.

-

Bitcoin Bounce: Bitcoin saw a boost early last week after Trump said as he was speaking at the Bitcoin 2024 Conference that if he is reelected he would hold Bitcoin in a strategic national stockpile while saying he would turn the US into the “Bitcoin superpower of the world.” His reasoning is because if the US doesn’t do it, someone else will be doing it, naming China. He also said he would fire current SEC chairman Gary Gensler and hire a crypto lover.

-

Bank of Japan: The Bank of Japan increased its key interest rate by 15 basis points, taking it to 0.25%, which only some had expected, citing inflation that is on track. It also said it will reduce its monthly purchases of government bonds. Both moves signal the central bank is more confident in its economy with officials noting wages are expected to increase further. Policymakers indicated they are open to additional rate hikes this year. Its 10-year government bond yield is now around 1.05%, near the highest since 2011.

-

Bank of England: The Bank of England cut its key interest rate by 0.25% at last week’s meeting with its Committee voting 5-4 in favor of the cut. Markets odds for a cut were at 60%. Its forward guidance pointed to relatively slow and steady path of further policy normalization but needing policy to remain restrictive for sufficiently long due to inflation remaining high and risks to inflation outlook still to the upside.

Did You Know…?

Nvidia Impressive Growth:

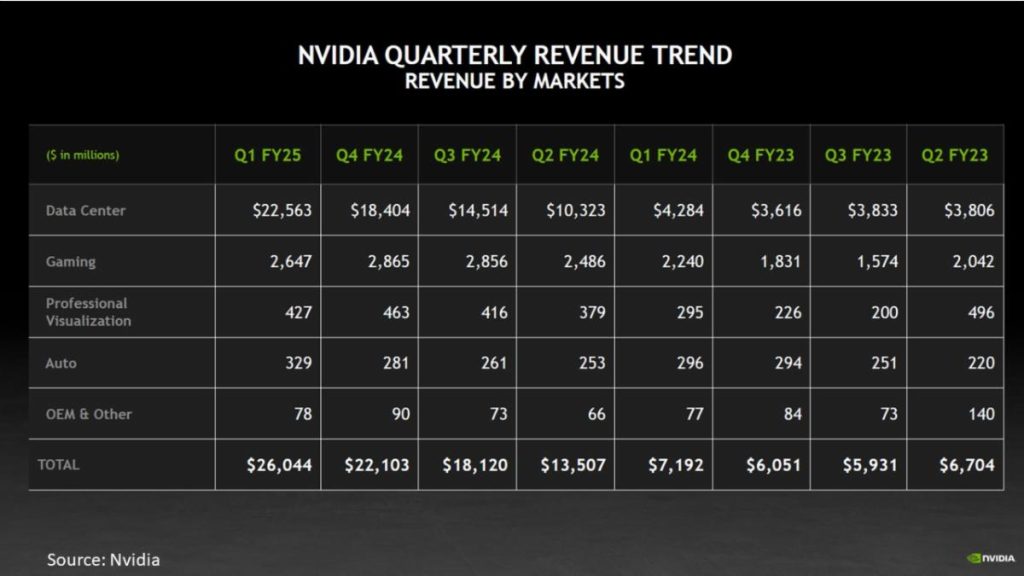

At the SIGGRAPH 2024 conference (computer graphics and interactive techniques) Nvidia CEO Jensen Huang revealed Meta’s (Facebook parent company) artificial intelligence data centers hold approximately 600,000 of Nvidia’s H100 GPUs (graphic processing units) that power its AI capabilities. The H100 GPU is currently the top-of-line data center GPU and according to a company presentation has a cost of $25,000 per GPU. That makes Meta’s cost of just the H100 GPUs equivalent to $15 billion. Nvidia’s new GPU system that powers accelerating computing, the Blackwell, will be released later this year and is said to process information 5x faster than the H100 GPU and will sell somewhere between $30,000 and $40,000, according to Huang. In the chart below you can see the tremendous growth Nvidia has seen over the past 15 months or so, particularly from its accelerated computing chips (which fall under its “data center” business segment). Businesses began invested in data centers to support the build out of their AI systems early 2023 (which is Nvidia’s Q1 FY24). Since then, Nvidia’s data center revenue has growth from $4.284 billion to $22.563 billion, a 427% increase.

The Week Ahead

This week slows down, but market participants will still be worried of a continued selloff and possible economic weakening. However, there is not much economic data to assess. The calendar is pretty quiet with just the ISM services (non-manufacturing) index on Monday, trade data Tuesday, and weekly jobless claims on Thursday. The Fed is out of its blackout period following its meeting last week but not many public appearances are scheduled. The earnings calendar is where most the activity will come from with about 15% of S&P 500 companies set to report, with many other smaller sized companies. Notable results will come from Palantir, Celsius, Caterpillar, Supermicro Computer, Airbnb, Wynn, Reddit, Shopify, Disney, CVS, Robinhood, HubSpot, Paramount, the Trade Desk, and Eli Lilly.