Wentz Weekly Insights

Job Growth Slows Further, Stocks Experience Worst Week in 18 Months

It was not the best week for US stocks after the S&P 500 ended with a decline of 4.25%. In fact, it was the worst week since the Silicon Valley Bank collapse in March 2023. But this time the market decline wasn’t led by banks; it was the technology sector. The sector underperformed with a 7.06% decline, led by Nvidia’s 14% drop. More specifically, it was centered around semiconductors. The sector has experienced a rally for months, but it took a pause last week as investors went in risk-off mode and as worries mount that the AI related trade is getting too expensive. Defensive and high income sectors like consumer staples, real estate, and utilities performed the best.

There has been a growing concern in the market of a broader economic slowdown, with more attention paid to the employment data, which differs with the past two years where all focus has been on inflation. According to Bloomberg, option traders are betting the market will move 0.85% in either direction the day of the CPI release (this Wednesday), which would be the smallest CPI-day move this year. On the other hand, traders were pricing a move of 1.1% for Friday’s labor market data. The S&P 500 outdid that, dropping 1.7% on Friday.

The headline data for Friday’s employment report wasn’t too bad either – US payrolls increased 142,000 in the month of August, slightly less than the 160,000 increase expected. We believe it was the revisions that caught the eye of many and was the catalyst for the selloff Friday. Every month we receive new data on the latest month as well as revisions for the two months prior. The revisions shows 86,000 less jobs added than initially though, with payroll gains of just 207,000 between the two months. Not only that, but this comes several weeks after the Department of Labor revised the past 12 months of payroll gains down a total of 818,000.

The government either cannot get the data right, or the economy is slowing more than we originally thought. Looking at the other labor data from the week, job openings fell nearly 500k from June to July, with a total of 7.673 million job openings as of the last day of July. This is a big move downward from the record high 12.2 million job openings after the economic reopening, although still just above the pre-pandemic trend of around 7 million. At this time, there are 1.08 job openings for every unemployed persons, now below the pre-pandemic level of about 1.22.

As a result, markets have aggressively re-priced interest rate cut expectations. The CME FedWatch Tool, which shows the probability of where interest rates will be at a future date based on pricing of interest rate futures, is showing 100% chance we will see a rate cut at the Fed’s next meeting next week. But after the employment data, it began showing a 60% probability of two rate cuts (in this case we refer to every 0.25% cut in rates as one cut, a 0.50% cut would equal two cuts). This was up from 30% a week ago.

There are three Fed meetings remaining this year – one next week, one just after the election November 7, and the final one of 2024 on December 18. Investors have begun pricing in a chance of six rate cuts by year-end, which is much higher than the expectations the beginning of summer when markets were expecting two rate cuts at most this year. This also compares with the Fed’s latest projections of just one rate cut when it was last released in June.

At the end of the day, the Fed (and markets) believe the current policy interest rate is in a “restrictive” territory, meaning keeping it where it is will risks economic growth, and since inflation has come down, as New York Fed President John Williams said Friday, “The risks to our two goals are now in better balance, and policy needs to adjust to reflect that balance.” This will result in a cut in interest rates at the Fed’s FOMC meeting next week, and likely more cuts at the two remaining meetings of 2024. We will keep focus on how markets take the news – a more aggressive move may send a signal that the economy is weaker than anyone had thought and in need of further support/less restrictiveness.

Week in Review:

US stocks saw their worst week since the mini banking crisis 18 months ago. The major US indices finished as follows: Dow -2.93%, S&P 500 -4.25%, Russell 2000 -5.69%, and Nasdaq -5.77%. Fixed income markets had a good week as yields fell across the curve. In fact, the yield curve (difference between the 2-year and 10-year Treasury yields) un-inverted with longer-term bonds now yielding more than shorter term bonds for the first time in nearly 26 months, the longest on record. The 2-year Treasury yield fell 27 basis points to 3.65% the lowest since last April, while the 10-year yield fell 20 basis points to 3.71%, the lowest since last June. Oil continued its slide over global growth concerns and fell 8.0% for the week. The dollar index fell 0.51%, gold was down 0.1%, and Bitcoin fell 8.75%.

Recent Economic Data

-

Job Openings & Labor Turnover Survey: The number of job openings on the last day of July was 7.673 million, down 237k from the prior month and a new cycle low (lowest since January 2021). The number of unemployed persons per job opening is 0.9, now back above the level it was prior to the pandemic and excluding the pandemic, is the highest since February 2018. The number of separations saw a slight bump higher with the number of quits relatively unchanged and the quit rate at 2.1 (a higher number would indicate a healthier labor market and reflect employees confidence in finding a better or higher paying job).

-

Jobless Claims: The number of unemployment claims the week ended August 31 was 227,000, a decrease of 5k from the prior week, with the four-week average down 2k to 230,000. The number of continuing claims was 1.838 million, decreasing 22k from the prior week. The four-week average fell 8k to 1.853 million.

-

ADP Employment: ADP reported in its monthly payroll report that it saw 99,000 new payrolls added in August, below the expectation of 140,000 and below last month’s 111,000 increase for the fifth consecutive month of slowing payroll growth.

-

Employment Report: August employment data showed a continued slowdown in the labor market, although still not a decline. The establishment data showed payrolls increased by 142,000 in August, slightly below the 160,000 increase expected. However, June and July saw a downward revision of 86,000, seeing payroll gains of just 207,000 between the two months. Manufacturing and retail saw job losses while education, health services, leisure & hospitality, construction, and government saw the most job gains and all other industries relatively unchanged. The average work week rose 0.1 hours to 34.3 hours. The average hourly earning increased 0.4%, more than the 0.3% expected and a bump higher from the 0.2% increase in July. Wages have increased 3.8% over the past year, up from 3.6% annual rate in July. The household survey, which has showed the number of people employed has slowed at a much faster pace than payroll data, showed employment increased 168,000 and the number of people unemployed declined 48,000. This resulted in a 0.1% decline in the unemployment rate to 4.2%. Over the past year the number of employed people has declined 66,000. Also of note, more people are getting multiple jobs (which on the payroll data may count as a “new job added” to the economy), which has increased almost 500k over the past year, making up 21% of total payroll gains.

-

PMI Manufacturing Index: The PMI manufacturing index was 47.9 for August, just below the estimate and down about 2 points from July, suggesting manufacturing activity in the month continued to decline. The report noted a decline in demand prompted firms to scaled back output, a renewed decline in employment, but inflationary pressures that strengthened.

-

ISM Manufacturing Index: The ISM manufacturing index was 47.2 for August, below the estimate and slightly above July’s 46.8, but continuing to indicate contraction activity in the sector in the month. In fact, the index has suggested declining manufacturing activity for 21 of the past 22 months. Conditions remained weak and demand slowed further, evident by a further drop in new orders, and a decline in production, backlogs, and employment. Meanwhile, price increases picked up.

-

Construction Spending: Construction spending declined 0.3% in July, the fourth consecutive monthly decline, and was worse than the 0.1% increase that was expected. The decline was due to a 0.4% decline in residential construction spend and a 0.2% decline in nonresidential spending, which was spread across basically all categories. Compared to a year ago construction spending is up 6.7% with a 7.7% increase in residential and 5.9% increase in nonresidential.

-

Trade Deficit: The latest trade data shows the US trade deficit widened in July to $78.8 billion, an increase of $5.8 billion compared to the $73.0 billion deficit in June. The reason for the wider deficit was due to a $7.1 billion, or 2.1%, increase in imports, which was only slightly offset by a $1.3 billion, or 0.5% increase in exports. Year-to-date, the deficit is $36 billion larger than the same period from 2023. Over this period exports are up 3.7% while imports are up 4.5%. The volume of trade increased $8.4 billion, or 1.4% in the month – a solid monthly increase, while the 12-month change was 6.9%.

-

ISM Services Index: The ISM services index was 51.5 for August, relatively unchanged from July and slightly above consensus estimates of 51.5. The business activity index at 53.3 grew in August but at a slower pace, employment was just barely above breakeven, while inflation index was 57.3, rising in the month. Comments on employment noted hiring freezes and some companies no longer backfilling positions when people leave or retire. Of the 18 major industries, 10 of them reported growth in the month and 7 reported contraction.

Company News

-

Nvidia’s Subpoena: Nvidia led the decline to open the week last Tuesday with an 8% decline in shares which represented a $279 billion loss in market cap, the largest loss of any stock in any single day ever (which itself is larger than all but 25 companies in the S&P 500). Then after the close Nvidia reportedly received a subpoena relating to the DOJ’s probe into whether it violated antitrust laws. Officials recently reached out to other semiconductor companies like Intel and AMD to gather information about the complaints. The concern is Nvidia is making it harder to switch to competitors.

-

iPhone’s New Screens: Nikkei is reporting Apple will use OLED (organic light emitting diode – considered sharper and more vivid colors) displays in all of its new iPhone models it plans to reveal this week, and plans to move away from LCD displays.

-

Nippon Steel’s Acquisition of US Steel: A lot of moving pieces regarding Japan’s proposed acquisition of US Steel – Reuters reported last week the Committee on Foreign Investment in the United States (CFIUS) sent Japanese Nippon Steel a letter saying the deal to purchase US Steel would pose a national security risk by hurting the US steel industry. A day prior to the report, there was another report stating President Biden was preparing to block Nippon’s acquisition of US Steel. The sources said Biden will reject the proposal the second CFIUS sends it to his desk after its review. Several headlines have surfaced the past couple weeks including a $1.3 billion investment commitment into US Steel from Nippon Steel, a commitment to use an American majority proxy board, along with warnings from US Steel that a blocked deal could result in the closure of some of its plants and jeopardize thousands of jobs. On Thursday after the news, Cleveland Cliff’s said in a CNBC interview that its offer to acquire US Steel is still on the table and it is working with JPMorgan and Wells Fargo on a plan.

-

Verizon’s Acquisition: Verizon announced this morning that it will acquire Frontier Communications in an all-cash deal valued at $20 billion, a 35.1% premium to where shares traded prior to the report of a possible acquisition on Wednesday. This will combine the largest “pure-play fiber internet provider in the U.S.” with Verizon and help it expand its fiber footprint across the country. Verizon also expects $500 million in cost synergies by three years from increased scale and distribution and network integration.

-

Callaway’s Split: Callaway Brands said it will split the company into two independent publicly traded companies, with Callaway being the golf equipment business and Topgolf being its own business. It will be a tax-free transaction via a spin-off.

-

Intel’s Reviewing Strategic Alternatives: Amid its struggles and as part of its ongoing strategic review, Intel is reportedly looking to sell part of its stake in Mobileye (its automated driving system company) to the public market, coming two years after it acquired most of the company. Separately, Qualcomm is exploring the possibility of acquiring portions of Intel’s design business, with a specific interest in its PC design business, to complement and boost its product portfolio.

-

Airline Rewards Programs Being Investigated: The Department of Transportation is investigating the rewards program of the four largest US airlines – Delta, American, Southwest, and United. It has asked each of the airlines to submit reports on their programs within 90 days so it can better understand how consumers are “impacted by the devaluation of earned rewards, hidden pricing, extra fees, and reduced competition and choice.”

-

Big Lots Bankruptcy: Big Lots announced it has entered into a sales agreement where Nexus Capital Management will buy all its assets and ongoing business operations. To facilitate the transaction, the company said it has filed for Chapter 11 bankruptcy. It will continue to operate while going through the bankruptcy process and will assess its footprint which will include closing additional stores.

Other News:

-

First Presidential Debate: The Trump and Harris campaigns both agreed to a debate on September 10, to be hosted by ABC, after both sides agreed to ABC News’ rules for the debate. The rules include muted microphones.

-

Trump Economic Plan: Trump is planning to release new economic proposals including cutting the corporate tax rate to 15% for companies that manufacture in the US. He will also support creating a new government efficiency commission that was recommended by Elon Musk. The report also notes he will propose rescinding unspent funds appropriated during the Biden administration.

-

Harris Economic Plan: The Harris campaign proposed a 28% tax rate on long-term capital gains for households with annual income of $1 million or more, which is making news since it was below Biden’s proposal of 39.6% in his 2025 fiscal budget (current rate for that income is 20%). Her campaign sees this as a way to appeal to small business owner votes as well by proposing to provide small businesses a $50,000 tax deduction for startup expenses.

-

OPEC Production: Reuters reported that OPEC+ has agreed to delay its planned production increase that was set to begin in October, instead delaying it by two months. For much of the past couple years, OPEC has agreed to cut its production quotas over 2 million barrels of oil per day, equaling roughly 2% of global consumption. Platts reported OPEC+ will increase its production 189k bbl/day in December and 207,000 bbl/day in January. Crude oil rose somewhat, but comes after falling below $70 per barrel, the lowest since last December, before falling again as worries about US and Chinese demand continue to build.

Did You Know…?

Corporations Rush to Raise Debt:

On Tuesday, a record 29 investment grade companies went to the market to raise cash by issuing new bonds to take advantage of lower borrowing costs, with interest rates the lowest in 1 ½ years, but also doing so before the US election over uncertainty and concerns yields could rise again after. And the demand is there, with money managers eager to buy bonds to lock in higher yields before the Fed begins cutting interest rates later this month, according to Bloomberg. In addition, according to Raymond James, the week following Labor Day is historically one of the busiest of the year for corporate bond issuance. The chart below from Bloomberg shows the average bond yield of an investment grade corporate borrower over the past two years – you can see yields at the lowest level in two years.

WFG News

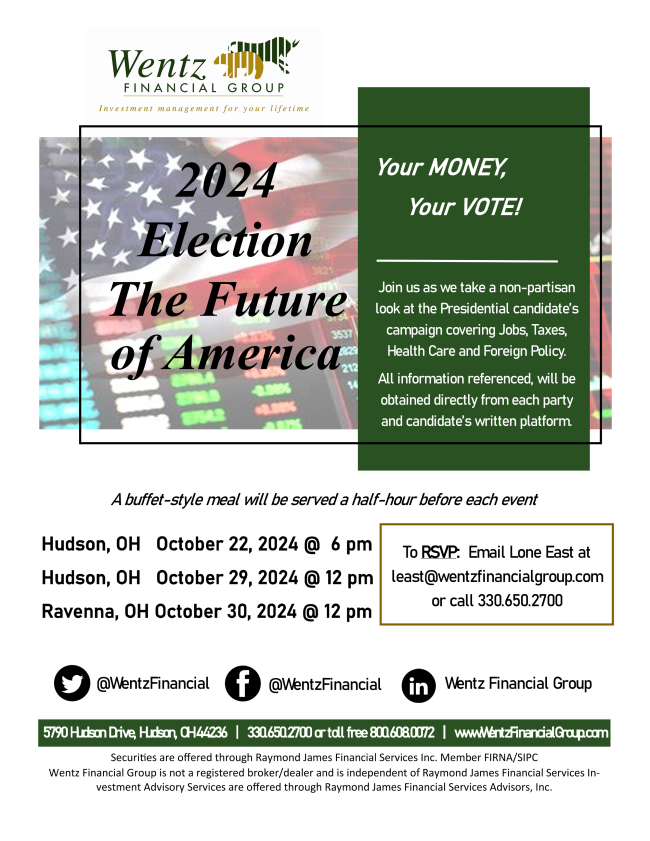

Your Money, Your Vote

Join us as we discuss the 2024 Election and take a deeper dive into each of the Presidential Candidates’ campaigns. We will have a specific focus on the economy. All information provided will be obtained directly from each candidates’ platforms.

Please RSVP as soon as possible as seats will fill quickly!

We have three sessions to choose from:

Hudson Office – October 22 @ 6:00pm

Hudson Office – October 29 @ 12:00pm

Ravenna Office (Basement Hall) – October 30 @ 12:00pm

The Week Ahead

The big highlight on this week’s calendar is the inflation data set to be released Wednesday morning. The consumer price index is expected to show a 0.2% increase for August, matching July’s increase, and up 2.6% from a year ago, a big deceleration from the 2.9% increase in July and that much closer to the Fed’s 2% target. However core inflation (excludes the volatile food and energy) is still expected to show a 3.2% 12-month increase. Other data includes the producer price index, import and export prices, jobless claims, and the consumer sentiment index. The earnings calendar is quiet – the only notable companies reporting quarterly results include Oracle, GameStop, Adobe, and Kroger. On the corporate side, there will be a focus on Apple with its next event taking place Monday where the company is expected to reveal its new iPhone and preview its new AI software Apple Intelligence for the first time. No Fed speak this week as Fed policymakers are in a blackout period prior to the next FOMC meeting that begins next week. In other central bank events, the European Central Bank meets this week to announce its policy decision Thursday where it is widely expected to lower rates for the second time this year. On the political side, Congress is finished with its summer recess and is back in session – the next big focus item for Washington is the September 30 funding deadline where a shutdown will occur if no funding negotiations are made.