Wentz Weekly Insights

Stocks Rally in Hopes of Larger Rate Cuts

After experiencing a risk-off week after the latest round of employment data two weeks ago, it was a complete reversal for stocks last week, which were in risk-on mode. It was more of a quiet week, but one that saw a rally in stocks that was led by tech, particularly semiconductors after upbeat comments from executives at a technology brokerage conference. Wednesday’s session saw the most extreme reversal we have seen in two years – stocks were down 1.6% shortly after an hour into trading but ultimately finished the day up 1.1%.

By weeks end, the S&P 500 gained 4.02%, nearly erasing the whole loss from the week prior. The Nasdaq was the clear outperformer with a 5.95% gain thanks to a 7.33% gain for the technology sector.

Meanwhile, investors in Chinese markets have not fared as well. The Chinese market, measured by the CSI 300 index, is at the lowest level since 2019. After reaching a new high in 2021, Chinese stocks are down 45% since then. Over the last five years, Chinese stocks are down 19% while the S&P 500 is up 83%. The problem is its economic growth has remained weak and it has avoided any significant stimulus.

At the Goldman Sachs Communacopia and Technology Conference, comments were generally positive and created a renewed optimism in the artificial intelligence (AI) space. Microsoft said the AI driven demand for infrastructure (think data centers, etc) is materially outpacing the ability to supply it while Nvidia said the $1 trillion worth of data centers are going to need to get modernized into accelerated computing. Nvidia CEO Jensen Huang also touched on its supply chain, alleviating growing worries that Nvidia would be unable to meet all the demand for its next generation chip system that powers accelerated computing. Semiconductor equipment maker Lam Research touched on worries of slowing growth, saying it gained a large set of new customers and the growth does not appear to be fading anytime soon.

Not only that, but several companies unveiled new AI capabilities including Adobe who previewed its AI video features with its Firefly video model that will allow users to create videos based on text prompts or bringing still images to life by transforming them to live action videos.

Up until recently, all focus was put on the latest rounds of monthly inflation data. This latest round came out last Wednesday and felt like a non-event. The consumer price index came in mostly as expected, rising 0.2% in August and up 2.5% from a year ago while core prices rose 0.3%, slightly more than expected and up 3.2% over the past year, unchanged from July’s 12-month rate. With inflation continuing to decelerate, there has been less emphasis on the data with investors nearly declaring victory on the inflation front and instead focusing more on employment.

The big event, and what has been highly anticipated for weeks/months now, is the Fed’s Federal Open Market Committee policy meeting that takes place this Tuesday and Wednesday with the policy decision Wednesday at 2:00pm.

The Fed has indicated for several weeks that it is ready to cut rates for the first time this cycle (first time since the pandemic lockdowns in 2020). As of early Monday morning, the futures market (based on pricing of interest rate futures) was putting a 60% likelihood that the Fed will cut rates 50 basis points (equal to 0.50%) with a 40% chance of just a 25 basis point cut (equal to 0.25%), according to the CME FedWatch Tool. These odds of a 50 bps cut were at just 30% one week ago, but have bounced back and forth since the July jobs report six weeks ago.

The issue is on economic growth and the labor market and no longer inflation. Interest rates were kept high to slow the economy to bring demand back in balance with supply which would bring inflation under control. Now that inflation is trending to a more normal level, the focus is on unemployment where the unemployment rate has risen from 3.7% in January to 4.2% in August. If the Fed cuts 50 basis points it could be seen as a sign it sees the labor market slowing more than it previously thought or more than it wants and possibly a greater concern on employment.

The other thing we will be looking at is the release of the Summary of Economic Projections (SEPs) where all Fed officials give their projections on things like interest rates, economic growth, unemployment, and inflation. This will provide us an idea of how policymakers see economic conditions shaping out the remainder of his year and next.

As we expected heading into the second half of this year, volatility has returned. It is a good time to remember to keep your long term investment objectives in mind. It is easy to make emotional decisions in volatile times, but keeping these objectives in mind will help you stay on track with your goals. With markets near highs and uncertainty building, it may also be a good time to review allocations for potential profit taking and rebalancing. We will continue to monitor client accounts for these opportunities and are happy to provide recommendations or advice on outside accounts, such as 401k’s. As always, we are here to help so please reach out if any questions or concerns arise.

Week in Review:

It was a solid week across the board as investors switched back to risk-on mode. Stocks rose across the board led by technology and the Nasdaq with the major US Indices finishing as follows: Nasdaq +5.95%, Russell 2000 +4.36%, S&P 500 +4.02%, and Dow +2.60%. Treasuries continue to rally as yields continue their slide over the expectation of rate cuts, helping pull down consumer rates. The 2-year Treasury yield fell 5 basis points to 3.60% while the 10-year Treasury yield fell 5 bps to 3.66%. Gold finished the week up 3.4% to a new all-time high. Crude oil ended up 1.2% after four consecutive weekly declines over demand worries. The dollar index was relatively unchanged and Bitcoin increased 12.3%.

Recent Economic Data

-

Consumer Price Index: Inflation data was just about exactly as expected for August. The consumer price index increased 0.2% in August, matching July’s increase. The index is up 2.5% from a year ago, decelerating from the 2.9% pace in July. Food prices rose 0.1%, up 2.1% over the past year, while energy prices have declined another 0.8% in the month and down 4.0% over the past year due mostly to a 10.3% drop in gas prices. The core index, which excludes food and energy prices, increased 0.3%, slightly higher than the 0.2% expected and higher than the 0.2% increase from July. The core index has increased 3.2% over the past year, unchanged from July’s pace. Looking more into the details, new and used car prices continue to decline, now down 1.2% and 10.4% over the past year, respectively, while commodity prices have fallen for five of the past six months. More importantly, services prices remain pretty high with shelter seeing a 0.5% increase and transportation prices up 0.9%. The subindex that gives us the best reading on services prices increased 0.3% and is still up 4.8% from a year ago.

-

Producer Price Index: The producer price index increased 0.2% in August, meeting expectations with the index up 1.7% from a year ago, down from the 2.2% rate from July. Food prices rose 0.1% while energy prices fell 0.9%. Excluding these two categories and trade, the core index rose 0.3% and is up 3.3% from a year ago, which is higher than the 3.2% rate from July. Final demand services prices increased 0.4%, bouncing back after a 0.3% decline in July and is up at an annualized rate of 3.0% over the past six months.

-

Jobless Claims: The number of jobless claims the week ended September 7 was 230,000, an increase of 2k from the prior week with the four-week average up just slightly to 227,000. The number of continuing claims was 1.850 million, up 5k from the prior week with the four-week average down slightly to 1.853 million. After a bump higher mid-summer, jobless claims have held steady.

-

Mortgage Rates: The prime 30-year mortgage rate averaged 6.20% last week, down another 15 basis points from the week prior. Since the late-spring peak, the average mortgage rate has fallen over one percent from 7.22% in May. The cycle, and 20-year high, was 7.79% from last October, while the lowest since then is the current rate. Rates are the lowest since February 2023.

-

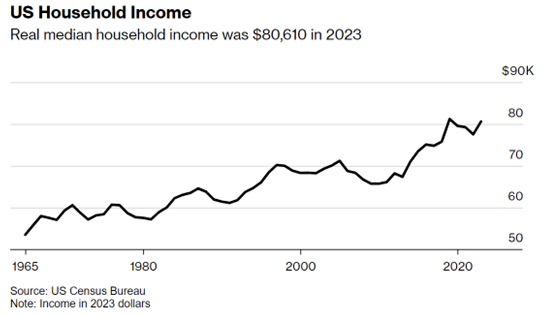

Household Income: The Census Bureau said real (inflation adjusted) median household income rose 4% to $80,610 in 2023, the first “statistically significant” increase since 2019. Despite the increase in “real” income, the report says incomes have still not fully recovered from pre-pandemic levels. The poverty rate was 11.1%, falling 0.4% in the year.

Company News

-

Apple’s Event: Apple held its “Glowtime” event where it unveiled its next line of products. The highlight was its iPhone 16 that was designed for AI and what CEO Tim Cook says is the beginning of a new era with the new phones being “built for Apple Intelligence from the ground up.” It contains a new CPU chip that is 30% faster than the iPhone 15 CPU and uses 30% less power. The AI features will slowly be added to devices through ongoing software updates. Investors were unimpressed with shares unchanged for the day.

-

Boeing Production Delays & Worker Strike: Reuters reported that Boeing is telling its suppliers that it is delaying its 737 MAX production target by six months, in another sign it continues to deal with production issues amid safety and regulatory issues. It now expects to hit its key production milestone of 42 737 Max planes per month in March 2025. Boeing workers voted to reject Boeing’s proposed labor contract by an overwhelming majority and as a result went on a strike at late last week. The proposed contract included a 25% pay raise over four years, with the union seeking 40% raise. A CNBC report said a 30-day strike could cost Boeing around $1.5 billion and have a big impact on supply chains.

-

Financial Updates: At a Barclays Financial Services Conference, JPMorgan said next year’s net interest income is going to be lower than what analysts are expecting and consensus estimates are “too high.” JPMorgan’s net interest income current consensus is $90 billion which its Chief Operating Officer said is “not very reasonable” with markets calling for lower interest rates. In addition, Goldman Sachs said its trading business is trending down close to 10% this quarter, worse than current expectations, while Ally Financial said credit challenges have intensified with consumers having a harder time paying on time, and had a downward revision to its Q3.

-

Under Armour’s Costly Restructuring: Under Armour gave an update to its 2025 restructuring plan by cutting its 2025 outlook with restructuring and related charges double what it had previously expected while increasing its expected net loss.

-

OpenAI New Capital Raise: OpenAI, creator of ChatGPT and one of the first movers/biggest in the AI space, is in discussion on raising $6.5 billion from investors that would value the company at $150 billion, in addition to a new $5 billion revolving credit facility with banks. This would nearly double its valuation from where it was earlier this year.

-

Tech Updates: There were many updates in the artificial intelligence (AI) space last week at the Goldman Sachs Communacopia & Technology conference. Microsoft said the generative AI driven demand for infrastructure is materially outpacing the ability to supply it. Nvidia CEO said when speaking about the data center market that $1 Trillion worth of general datacenters are going to get modernized into accelerated computing. He also downplayed worries of supply issues in the industry. Lam Research said despite worries in the industry of slowing growth, it has gained a large set of new customers in China and that does not appear to be fading any time soon (China is nearly 40% of Lam’s sales). Adobe previewed its generative AI video capabilities with its Firefly video model that will allow users to use text prompts, a variety of camera controls, and reference images to generate videos.

-

Free WiFi While Flying: United said it reached a new agreement with SpaceX’s Starlink and its WiFi service to be implemented across its fleet. This will allow customers to have free high speed internet while in the air. Timing is over the next several years with testing beginning in early 2025.

Other News:

-

European Central Bank: The European Central Bank cut interest rates for the second time this cycle with its policy rate now at 3.50%, which was widely expected. The ECB committee said it was “appropriate to take another step in moderating the degree of monetary policy restriction.”

-

OPEC Oil Demand Forecast Lowered: Oil continued its move lower last week, this time coming after a report OPEC cut its forecast for global oil demand growth for 2024 reflecting YTD data. It cut its demand growth forecast by about 0.1 million barrels/day to 2.03 million bbl/day, which would still be a 2% increase in global consumption (at 104.2 million bbl/day), with China accounting for most of the downgrade. Demand concerns are the main reason oil is at a new 33 month low at $67/barrel. It was a couple days ago the group agreed to delay its planned increase to oil production.

-

US Sovereign Wealth Fund: Trump and Biden have voiced support for setting up a sovereign wealth fund, or any other alternative investment arm of the government. There is uncertainty on where funds would come from, but Trump proposed using cash from tariffs and “other intelligent things.” Such fund would be used to invest in security interest of the US including infrastructure, supply chains, defense capabilities, and nuclear projects.

-

Government Deficit Balloons: The US government deficit ballooned to $380.0 billion in August (spent $380B more than it earned), which was much bigger than the $285 billion deficit that was expected, and increased about $136 billion from July’s $244 billion deficit. The (fiscal) year-to-date deficit stands at $1.90 trillion (ends at end of September), up 24% from last year’s period. Also, the Treasury report said the governments interest payments of its debt totaled $1.05 trillion through the first 11 months of the fiscal year, the highest ever, and up 30% from a year ago.

-

China’s Retirement Age: China said it will gradually raise its retirement age, the first time since 1978, due to its shrinking workforce, increased life expectancy, and more years of education. Men’s retirement age goes from 60 to 63 (gradually over the next 15 years), with women’s from 50 to 55.

Did You Know…?

Growing Consumer Credit:

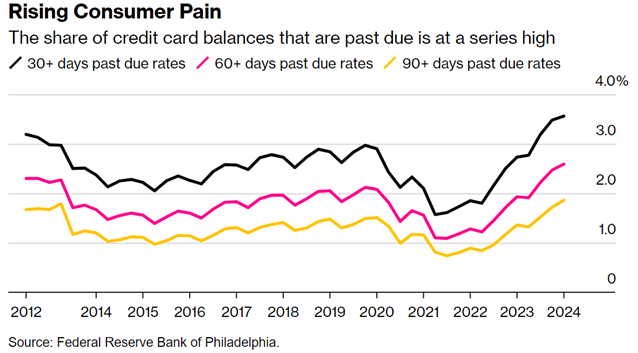

Concerns over consumer credit hit markets early last week after the latest data release and led to more growth worries. The latest consumer credit data by the Federal Reserve showed consumers’ borrowing increased in July by a more than expected $25.5 billion, the most since November 2022. Consumer borrowing outstanding now totals $5.07 trillion. Revolving credit, things like credit cards, increased $10.6 billion, or a 9.4% annualized rate while nonrevolving credit, like mortgages and auto loans, increased $14.8 billion, a 4.8% increase annualized. A separate report from the New York Fed said the share of overall debt that is delinquent held steady around 3.2% in the second quarter, but the share of auto and credit card debt that was newly delinquent has continued to trend higher. Auto loan delinquencies are the highest since 2010 while credit card delinquencies are the highest since 2012. The chart below illustrates the percentage of credit card balances that are past due going back to 2012. A separate report from the New York Fed’s quarterly report on household debt showed the highest rate of credit card balances entering delinquency since the beginning of 2011.

WFG News

Your Money, Your Vote

Join us as we discuss the 2024 Election and take a deeper dive into each of the Presidential Candidates’ campaigns. We will have a specific focus on the economy. All information provided will be obtained directly from each candidates’ platforms.

Please RSVP as soon as possible as seats will fill quickly!

We have three sessions to choose from:

Hudson Office – October 22 @ 6:00pm

Hudson Office – October 29 @ 12:00pm

Ravenna Office (Basement Hall) – October 30 @ 12:00pm

The Week Ahead

This week is the one markets have been anticipating for some time. The big event is the Federal Reserve’s policy meeting that takes place Tuesday and Wednesday with a policy decision on Wednesday at 2:00 followed by Chairman Powell’s press conference. The Fed has indicated they will implement the first rate cut of this cycle this week, with markets putting a 60% probability the Fed will decide to lower rates by 50 basis points (equal to 0.50%), up from 30% just one week ago. There will also be a focus on the Summary of Economic Projections (SEPs) where all Fed officials give their projections on things like interest rates, economic growth, unemployment, and inflation, which provides investors an idea of how policymakers see economic conditions shaping out. The Bank of England will meet this week as well where no change in rates is expected and the Bank of Japan will have its policy meeting Friday and is expected to keep rates unchanged although they are still in tightening mode. Other than central bank news, data on retail sales will receive heightened attention for hints on consumer spending strength. After a surprise 1.0% increase in July, economist see sales falling 0.3% in August. Other data comes from the housing market with the housing market index, housing starts and permits, and existing home sales. In addition we will see the Empire State Manufacturing index, the Philly Fed Manufacturing index, industrial production, and jobless claims. The earnings calendar is very quiet with the only notable reports from General Mills, Darden Restaurants, and FedEx. Also on the corporate calendar is many brokerage conferences across multiple industries where companies could provide financial updates.