Wentz Weekly Insights

Market Breadth Weakens Again, Major Indexes Mixed

Market trends shifted again last week, with the S&P 500 index performing better than the average stock, which is how most of 2024 has shaped out. It was since the week of the election that the markets really started seeing broad participation – the Russell 2000 (the index used to measure small sized companies) was up over 11% and the equal weight S&P 500 up 6.5% from the election to its highs at the end of November. Since then, the small cap index has lost about 5% and equal weight index losing almost 4%.

Despite that, the S&P 500 is up 1.1%. The reason is the stocks with the highest weighting in the index, referred to as the Magnificent Seven (Apple, Nvidia, Microsoft, Amazon, Alphabet, Meta, and Tesla) are back to being the best performing stocks. There may be a couple reasons to explain why. First, investors may be looking at profit taking in small caps after the strong gains over a short period.

Another is the advancements in artificial intelligence we have seen this year. The most apparent beneficiaries to AI so far have been the largest companies, like Nvidia with its chip making, as well as Amazon, Alphabet, and Meta. In fact, Google parent company Alphabet gained nearly 10% last week, or around $240 billion in market value, after it said it saw a breakthrough in its quantum computing chip with some speculation it could be the breakthrough that transforms the space from an experiment into a practical tool.

The other explanation for the recent performance is the recent concern on inflation staying higher for longer and investors re-pricing rate cut expectations (along with the bounce back in job gains).

Last week we saw the latest inflation data that showed an uptick in inflation, although all data points were exactly as expected. The consumer price index increased 0.3% in November, up from 0.2% in October, and is up 2.7% from a year earlier, accelerating for the third consecutive month. The core index, which excludes food and energy prices, was similar – rising 0.3% in the month, and up 3.3% over the past year.

However, the bigger concern and an area we don’t think markets or the Fed are focusing enough on, is services prices. Prices in this category, which tend to be stickier and are more difficult to bring down to the Fed’s 2% target, have increased 4.1% from a year ago, higher than the 12-month change seen last year, indicating inflation within services has gotten worse over the past year.

Even with this data, the markets increased the odds of a rate cut happening to nearly 100%, up from about 87% prior to the data. We hope to see the Fed talk about this at the policy meeting this week. We see another rate cut of 25 basis points as most likely this week, bringing the Fed funds rate to a range of 4.25%-4.50%.

This meeting will conclude Wednesday with the policy decision at 2:00pm followed by Chairman Powell’s press conference. The policy decision will also come with the release of the latest summary of economic projections (SEP) where each Fed member gives its projections on economic indicators. At the last release of SEP, the Fed expected four rate cuts in 2025.

We would be surprised if this sticks given the recent lack of progress on inflation. The Fed has a biased to cutting interest rates and markets realize that and is one of the reason the high optimism remains. It may be a good idea for Powell to reverse this biased lean, after inflation since summer has slightly re-accelerated with core prices up an annualized 3.6% over the past several months.

But this may also be another reason for some of the recent weakness in most stocks, which may not feel that way given the streak of record highs seen by the S&P 500 this year, reaching its 57th record high of the year last week. As mentioned above, breadth has been quite weak – there have been more stocks declining than increasing for ten consecutive days. That goes back to the initial point above that the market is back to being narrow.

A lot is on the calendar this week before the final week of the year and before the markets head into a historically weaker part of the year with January and February. The most important is the Fed meeting, but there is also a wave of economic data released with a focus on retail sales, inflation, housing market, and manufacturing.

Week in Review:

Stocks were mostly lower last week with the exception of the Nasdaq as technology stocks significantly outperformed the broader market. The major US indices finished as follows: Nasdaq +0.34%, S&P 500 -0.64%, Dow -1.82%, and Russell 2000 -2.58%. Treasuries were weaker for the first time in four weeks with the yield curve steeper. The 2-year Treasury yield rose 14 basis points to 4.25% while the 10-year Treasury yield rose 23 basis points to 4.40%. The dollar index was stronger, particularly against the yen, with the index up 0.89%, while gold rose 0.6%, and Bitcoin rose 1.54%. Meanwhile, oil finished up 6.0% after a recent decline.

Recent Economic Data

- Consumer Price Index: For the second straight month consumer inflation was exactly as expected (although still slightly elevated) which should ink in another rate cut for the Fed at its meeting next week. The consumer price index rose 0.3% in November, accelerating from the 0.2% increase in October. The index is up 2.7% from a year ago, also 0.1% more than the prior month. Food rose 0.4%, the highest increase in months, while energy rose 0.2%, snapping a streak of declines. Excluding these two volatile categories, core prices rose 0.3% and are up 3.3% over the past year, both as expected and both matching the prior month. New and used vehicle prices accelerated, rising 0.6% and 2.0% respectively, but are still lower over the past year. The largest category which is shelter saw a 0.3 increase in prices and up 4.7% over the past year. Finally, what doesn’t get much attention but is where a majority of the sticky inflation is centered is services prices excluding shelter, which increased 0.1% in the month and up 4.1% from a year ago, still over double the Fed’s target.

- Producer Price Index: Producer inflation, unlike consumer inflation, was hotter than expected at the index level and within in most categories. The producer price index increased 0.4% in November, double the increase from October. The annual rate increased to 3.0%, up from 2.2% last month. Food and energy rose 3.1 and 0.2% respectively and excluding these two categories the core index increased 0.2%. The 12-month change in the core index was 3.4%, more than expected and accelerating from 3.1% in October. Prices for final demand goods rose 0.7% (mostly due to the large increase in food) while prices for final demand services rose a more moderate 0.2%.

- Jobless Claims: The number of unemployment claims the week ended December 7 was 242,000, a jump of 17,000 from the prior week for the highest since October. The four-week average rose 6k to 224,250. The number of continuing claims was 1.886 million, up 15k from the prior week, with the four-week average at 1.888 million, the highest since November 2021.

- Small Business Optimism Index:The NFIB small business optimism index jumped 8 points in November to 101.7, the highest level since June 2021 and ending a 34 month streak of record high uncertainty for small businesses. The report noted the “election results signal a major shift in economy policy” with small business owners upbeat on prospects for tax and deregulation that favor growth.

Company News

- Nvidia: Nvidia shares moved lower at the start of the week after a Bloomberg report said China’s regulators started an antitrust probe into the company on monopoly concerns.

- Micron: The White House said the Department of Commerce is finalizing a $6.1 billion award in direct funding under the CHIPS Act to memory chip supplier Micron, which would be the largest award to date. The funds will support the construction of two fabs in New York and another in its hometown of Boise as part of Micron’s $125 billion investment in the US over the next 20 years.

- US Steel: US Steel fell 10% yesterday after Bloomberg reported President Biden will formally block Nippon Steel’s $14 billion deal to buy the company over national security concerns. The formal announcement is expected to come once the Committee on Foreign Investment in the US (CFIUS) completes its review and makes its decision, expected either December 22 or 23.

- Kroger & Albertsons: A federal judge blocked Kroger’s $25 billion pending acquisition of Albertsons, ruling in favor of the Federal Trade Commission (FTC) that each “engage in substantial head-to-head competition and the proposed merger would remove that competition” and it would lead to “unilateral competitive effects and is presumptively unlawful.” After the news, Kroger said it would resume share buybacks with a new $7.5 billion stock buyback program.

- Hershey & Mondelez: Shares of Hershey were up about 11% to start the week after a report was released that Mondelez has approached the company and was exploring a potential acquisition. Hershey’s controlling shareholder, the Hershey Trust (the charitable organization that controls most the voting shares), later rejected the offer as too low. Mondelez previously attempted a buyout in 2016 that was rejected by Hershey due to Hershey Trust siding against the transaction. Later in the week Mondelez announced a new $9 billion stock buyback program.

- Omnicom & Interpublic: Omnicom has agreed to acquire Interpublic in what will form the largest advertising company in the world. It will purchase Interpublic in an all-stock transaction where Interpublic shareholders will receive 0.344 shares of Omnicom for each share of Interpublic owned. Omnicom shareholders will own about 61% of the combined company and Interpublic shareholders will own about 39%. The company expects to generate annual cost synergies of $750 million.

- Walgreens: Shares of Walgreens spiked about 20% yesterday after the WSJ reported the company is in talks for a buyout from private equity firm Sycamore Partners. It adds a deal could be announced early next year and after the deal Sycamore would likely sell off pieces of Walgreens.

- Super Micro Computer: Super Micro Computer stock continues its wild ride, this time down nearly 10% yesterday despite the CEO saying to Reuters he was confident shares would not be delisted from the Nasdaq. Earlier in the week the company filed and was approved an extension.

- Apple & Broadcom: According to a report from The Information, Apple is working with Broadcom on developing its first in-house serve chip, codenamed Baltra, which will be designed exclusively for AI. It added the chip could be ready for mass production by 2026. Separately, Apple released an update to its operating system, iOS 18.2, which will add features to its AI Apple Intelligence as well as integrate ChatGPT into devices.

- Affirm: Shares of buy now, pay later provider Affirm moved higher late last week after it said it agreed to sell up to $4 billion of consumer installment loans to private credit group Sixth Street, its largest capital commitment to date. The deal will provide Affirm additional funding with the ability to extend nearly $20 billion in additional loans over the next three years.

- Apollo Global & Workday: S&P Dow Jones Indices announced it is adding Apollo Global Management and Workday to the S&P 500 index which will replace Qorvo and Amentum Holdings. The two latter companies will enter the S&P SmallCap 600 index.

.

Other News:

- China’s Plans to Boost Growth:Ahead of its Central Economic Work Conference, China pledged in Politburo readout to implement more proactive fiscal measures, including measures to stabilize the property market, and a moderately looser monetary policy next year in attempt to support economic growth, with a focus on expanding domestic demand and stimulating consumption. Following its conference, its top officials pledged to raise the fiscal deficit target next year to help “lift consumption aggressively.” Many market participants were disappointed, however. Despite the promise to take measures to boost growth, it fell short of providing specific details.

- Central Bank News:

- The Swiss National Bank cut its policy rate by a larger than expected 50 basis points, bringing its key rate to 0.5%. It was the fourth consecutive rate cut and brings the rate to the lowest in two years. The larger than expected cut comes from worries over its stronger currency, the Swiss franc, and lower inflation. The central bank also cited the move as a way to “preempt” risks from the eurozone economy due to US policy with its new administration and political woes in France and Germany.

- The European Central Bank cut interest rates another 25 basis points, to 3.00% for the fourth cut of the year. It said it sees inflation at 2% in 2025 and to settle there, but expects a slower economic recovery than previously thought.

- The Bank of Canada delivered another jumbo rate cut – cutting its key policy rate by another 50 basis points to 3.25%, now seeing 1.75% of rate cuts over the past several months. After aggressive cuts this year, in this meeting the central bank removed verbiage that it is expecting to continue cutting rates, instead saying the need for additional rates will be evaluated “one decision at a time.”

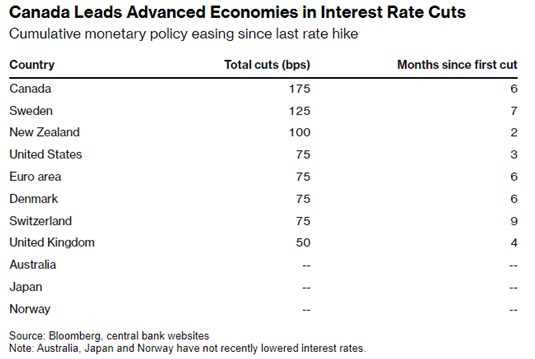

- The chart below from Bloomberg shows the amount of policy easing by several advanced economies around the world.

Did You Know…?

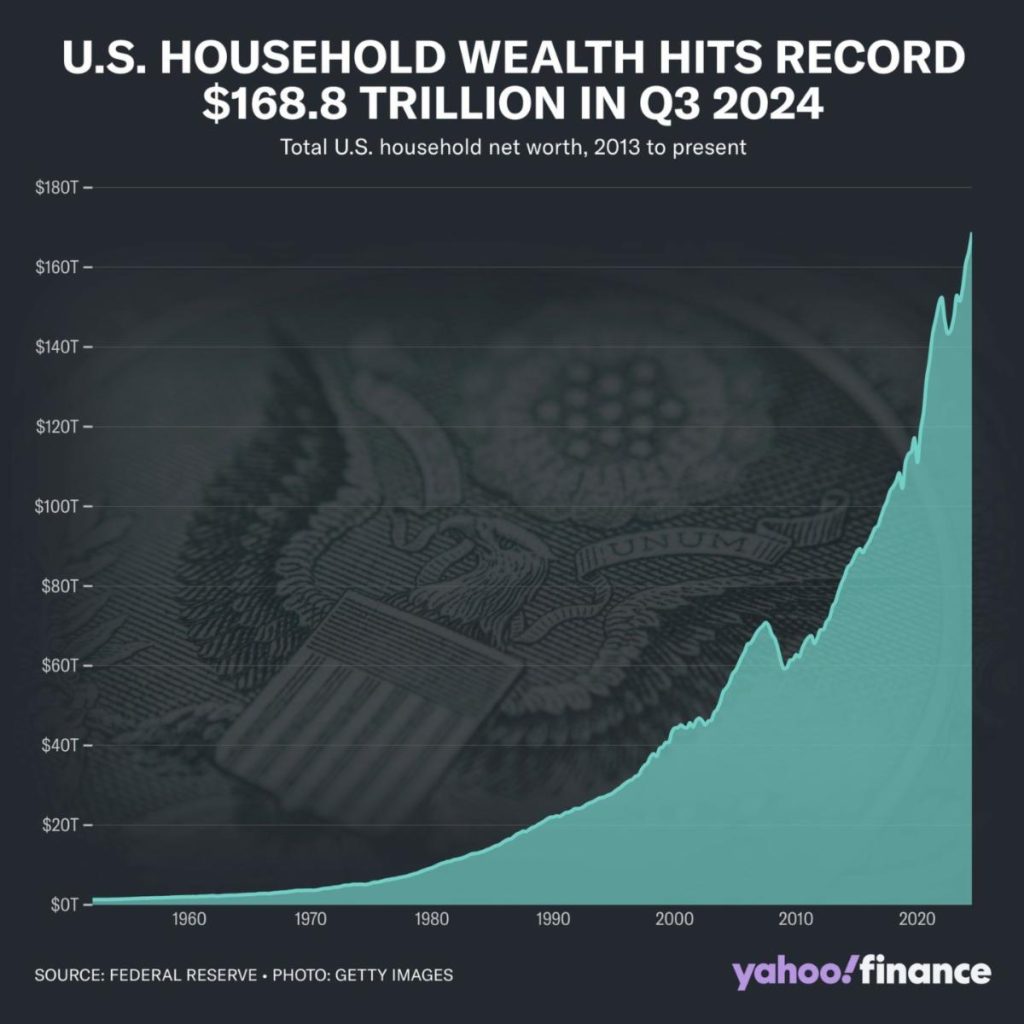

Household Net Worth

US household net worth increased for the eighth consecutive quarters to a new record high of $168.8 trillion—up $4.8 trillion, or 2.9% from the prior quarter, and an 11% increase over the last year. This was in large part driven by investors benefiting from a stock-market rally in the 3rd quarter, in anticipation of interest-rate cuts from the Fed and a return to the White House for former President Donald Trump. The surge in the equity market allowed assets tied to the market to increase ~$4 trillion vs. the prior quarter and now make up a record high relative to total asset ownership. Rising net worth should continue to support consumer spending over the next 12 months.

WFG News

WFG Closed December 24 & 25

Please note that Wentz Financial Group will be closed Tuesday December 24th and Wednesday December 25th. We will be back open Thursday morning the 26th

The Week Ahead

The FOMC meeting on Tuesday and Wednesday, with the monetary policy decision on Wednesday at 2:00pm, will be the main event on the calendar for the week ahead. After last week’s consumer inflation report being in line with expectations, investors have priced in a nearly 100% probability the Fed will cut interest rates 25 basis points. As usual, Powell comments at the press conference will carry a lot of weight for markets as investors look ahead to policy for 2025. On that point, the FOMC will also release its Summary of Economic Projections (SEP) which provides all policymakers projections on where they see inflation, economic growth, unemployment, and interest rates over the short and medium-term. The Bank of England and Bank of Japan will release policy decision as well, and after recent events, markets no longer fully expect a rate hike from the Bank of Japan policy committee. The economic calendar is a busy one with a focus on retail sales, the Fed’s preferred inflation measure, and an update on the housing market. Retail sales are expected to have seen another strong month with a 0.5% increase in November while inflation is expected to have seen a 0.2% increase. Other data releases include the Empire State manufacturing index, Philly Fed manufacturing index, industrial production, personal income and outlays, housing market index, housing starts and permits, existing home sales, the final revision on third quarter GDP, jobless claims, and consumer sentiment. The corporate and earnings calendar is light, with notable earnings reports from only several including Micron, General Mills, Nike, and FedEx. Expect to hear things about government funding too, with Congress facing a deadline of Friday to pass another bill to keep it funded. Finally, before a holiday shortened week next week, markets will see high volume to close the week Friday due to with four major index options expiring, referred to as quadruple witching.