Wentz Weekly Insights

Banks Deliver Strong Start to Q2 Earnings

US stocks moved higher last week driven again by higher beta names as the risk-on rally continued. Tech outperformed, helped by a further de-escalation of trade tensions with China focused more on semiconductors. This helped drive a 4.5% gain for Nvidia for the week, pushing its market cap higher by approximately $180 billion (now sitting with a market capitalization of $4.210 trillion). Outside of tech, upside was more muted with sectors like energy, healthcare, materials, and consumer staples all lower. While the S&P 500 and Nasdaq ended higher, the Dow and equally weighted S&P 500 ended lower.

The big news for technology and more specifically semiconductors was Tuesday when Nvidia said it received approval from the White House that it can resume selling its H20 AI chips to China. Recall when the trade/tariff situation was escalating back in April, the US already had restrictions on Nvidia’s most advanced chips, but Nvidia developed these less advance H20 chips specifically for China which the US later banned as well.

Nvidia said in its most recent quarterly earnings results that the restriction caused it to write down $4.5 billion in the first quarter leading to a $2.5 billion loss in China sales. It also said it would see a $8 billion quarterly impact going forward from the lost business from the export restrictions. It was a massive relief for the large chipmaker that controls an estimated roughly 80% of the market for advanced AI chips and drove shares 4.5% higher for the week and made technology the best performing sector for the week.

Near the beginning of the week there were a lot of tariff headlines as well with concerns about trade with Mexico and the European Union after Trump said each would be hit with 30% tariffs starting August 1. The EU responded quickly threatening retaliation but quickly took that back in effort to begin talks but did release a list of goods from the US it would target with tariffs of its own if the US moves forward with the 30% tariff rate.

There was more positive news later in the week after Trump said a deal had been made with Indonesia to bring its tariff down to 19% from 32% and a deal with India was “close”.

The economic data was more mixed. The most anticipated report was the consumer price index that increased 0.3% as was expected. The data had a little bit of something for both sides of the inflation argument (inflation is still too high or inflation is coming back down to a “normal” level). While the number was as expected, it has accelerated in the most recent month.

The annual rate moved up to 2.7% in June, from 2.4% in May with the annual core rate (which excludes food and energy) up 2.9% compared to 2.8% in May. Services inflation has steadily moved lower, albeit at a slow pace – the index on services inflation (non-goods) was up 0.4% in June and still up 3.8% over the past year, but up just 3.6% the past three months annualized. Goods inflation is what is moving a little higher lately, and something that concerns those that believe tariffs will cause a spike in inflation. We still need multiple more months to see the full effects to confirm either way.

The retail sales data was much better and harder for either side to argue. Sales growth of 0.6% in June was better than expected and bounced back after a 0.9% decline in May. It wasn’t just driven by the two volatile categories – gasoline and vehicles – most categories (11 of the 13) saw growing sales in the month.

Finally, banks kicked off earnings season with a solid start. Banks had high expectations heading into their earnings because of the recent stock gains, and exceeded those expectations thanks to strong trading revenue (thanks to the market volatility from April May and June) and better investment banking activity (thanks to the pickup in merger and acquisition activity).

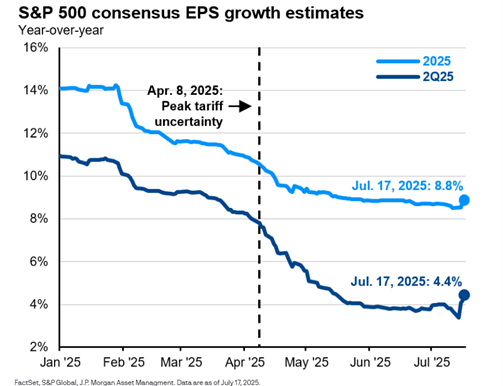

At the beginning of the year, analysts had expected earnings for the second quarter (the quarter companies are currently reporting on) to grow about 11%. Three months later when the quarter started that expectation moved down to about 8.5%, and as of last week that expectation is 4.4% as seen in the chart below (it was just 3.5% prior to the bank earnings). While expectations typically move lower, this was a much larger margin that typical. The reason most likely comes down to tariffs and the uncertainty on what effect they will have on businesses.

The bar is lower for companies, but the uncertainty remains. Most of the tariffs haven’t even started yet, the next big day is August 1 when Trump said most tariffs would begin to be collected, so the uncertainty will extend beyond just the second quarter.

This week the focus will be on earnings as another approximately 100 S&P 500 companies report while the economic calendar will be lighter of data releases.

Week in Review:

It was another risk-on week last week with the S&P 500 and Nasdaq indexes hitting fresh record highs, driven by another solid week for the largest company in the world Nvidia (up 4.5%). The four major US indices finished as follows: Nasdaq +1.51%, S&P 500 +0.59%, Russell 2000 +0.23%, and Dow -0.07%. The Treasury market saw little movement with a slight curve steepening as the 2-year yield fell 3 basis points to 3.88% while the 10-year yield rose 1 basis point to 4.42%, and 30-year yield remained right around 5.00%. Equity market volatility was muted with the VIX (volatility index) unchanged on the week. The dollar index rose 0.64% and gold was flat. Bitcoin rose with risky assets but it was less than one percent. Meanwhile, oil fell 1.62%.

Recent Economic Data

-

Consumer Price Index: After decelerating to start the year, the consumer price index has reaccelerated with a 0.3% increase in June which was expected while the annual rate ticked up to 2.7%, up from 2.4% in May and slightly more than expected. Food prices increased 0.3% while energy prices increased 0.9% which wasn’t due to one specific subcategory, but big increases in oil, electricity, and other utility prices. Excluding food and energy, inflation was 0.2% in the month, up from 0.1% in May, and up 2.9% over the past year, accelerating from 2.8% in May. New and used car prices fell in the month while all other major subcategories saw increases including a 0.2% increase in shelter (where price increases were the hottest but have cooled substantially over the past year). Inflation on services, excluding shelter, rose 0.4% in June, is still up 3.8% over the past year, and up 3.6% over the past three months annualized.

-

Producer Price Index: Inflation at the producer level was flat in June, lower than the expected increase of 0.2%, however the prior month saw an upward revision from 0.1% to 0.3%. Inflation in final demand goods was 0.3% in the month driven by a 0.6% increase in energy prices, with core producer prices up 0.3%. The lower inflation was driven by a drop in prices in transportation/warehousing along with no change in trade inflation. Over the past year, the producer price index is up 2.3%, down from 2.7% the prior month.

-

Retail Sales: After a weak May (declining 0.9%), June retail sales bounced back with a monthly increase of 0.6%, which was above the expected 0.1% increase. Of the 13 retail categories, only 2 of them saw a decline in sales in June, a big improvement from May when 7 categories saw a decline. Gasoline sales were flat while vehicle sales saw an increase of 1.2%. Excluding these two more volatile categories, retail sales increased a stronger 0.6%, higher than the 0.3% expected. Stronger sales were in miscellaneous stores, apparel stores, building materials/gardening, with weakness in furniture and electronics and appliances. Retail sales are up 3.9% over the past year, with core sales up 4.1% (up 1.4% when adjusting for inflation).

-

Empire State Manufacturing Index: The Empire State Manufacturing index was 5.5 for July, moving back to positive territory for the first time since February indicating a slight increase in manufacturing activity in the New York area after a -16.0 from June. Orders and shipments grew which indicated a possible rebound in demand, although still slow, while workforce expanded and input prices and selling prices accelerated.

-

Philly Fed Manufacturing Index: The Philly Fed Manufacturing index was 15.9 for July, also an improvement from -4.0 in June indicating a resumption of growth in manufacturing in the Philly region. General activity was positive with new orders seeing a solid increase, shipments rising, both the strongest since February, with employment rebounding. However, the index on input costs and selling prices saw big increases.

-

Industrial Production: Industrial production in the US increased 0.3% in June, a little better than the 0.1% increase expected and improved after a slight decline in May. Manufacturing saw a 0.1% increase, utilities saw a 2.8% increase (very weather dependent), while mining saw a decline of 0.3%. Capacity utilization has been relatively stable the past several months, at 77.6% in June and growing 1.5% over the past year.

-

Housing Market Index: The housing market index, which is an index on homebuilder confidence, has dropped to very low levels the past several months and remained there in the July survey. The index level was 33, only an improvement from 32 in June, continuing to suggest sluggish conditions for homebuilders. The index on present sales ticked up one point to 36, the index on expected sales the next six months rose 3 points to 43, while the index on traffic of prospective buyers fell 1 point to 20.

-

Housing Starts & Permits: The number of housing starts and permits were relatively unchanged in June. The number of housing starts was at a seasonally adjusted annualized rate of 1.321 million, 4.6% above May’s pace and 0.5% below last June. The number of permits for new home builds was up just 0.2% in June to 1.397 million, but 4.4% below the level from a year ago. The number of completed homes has slowed significantly, down 15% in May and down 24% over the past year to 1.314 million. At the same time, the number of homes currently under construction has been on a downtrend as well, dropping 0.4% in June and down 13.4% over the past year.

-

Jobless Claims: The number of jobless claims the week ended July 12 was 221,000, a decline of 7,000 from the prior week, with the four-week average up slightly to 228,000. The number of continuing claims increased slightly to 1.956 million with the four-week average up about 5k to 1.957 for a new four year high.

Company News

- Nvidia: Shares of Nvidia moved higher again last week after it said in a statement the US government has given it assurance its licenses will be granted to resume sales of its H20 GPUs to China. The H20 chips are one of Nvidia’s more advanced AI chips that was developed specifically for China to bypass other US export restrictions, but were restricted from being exported back in April. The company added it intends to resume shipments to China soon. It was later reported by Reuters that the resumption of H20 exports was tied to the US/China deal to increase shipments of rare earth minerals to the US.

- Trade Desk: Shares of the Trade Desk were higher last week after it was announced S&P Dow Jones will add the stock to the S&P 500 index, replacing ANSYS after its acquisition by Synopsys.

- Amazon: Amazon said its July 8 to July 11 Prime Day event was its biggest ever, but did not disclose actual figures. Adobe Analytics reported shoppers spent $24.1 billion in online transactions during the event period, marking 30% growth over last year and exceeding the expected growth of 28%. It also said it received a boost in traffic driven by generative AI products, with traffic from this source up 3,300% from last year. Although it was a big increase it was a fraction of other sources, including from paid searches where traffic grew 5.6% and drove 29% of sales, and social media influencers which grew 15% and generated 20% of sales, according to Adobe Analytics.

- Couche-Tard: The Canadian convenience store company and parent company to the Circle K chain Couche-Tard had previously offered to acquire 7-Eleven parent company from Japan Seven and i Holdings for $47 billion, but withdrew its offer citing “persistent lack of good faith engagement” by Seven & i. It added that there hasn’t been any “sincere or constructive engagement from Seven & i that would facilitate the advancement of any proposal.”

Other News:

- Private Market Investments In 401k Plans: The Wall Street Journal reported President Trump is expected to sign an executive order that would help make private-market investments more available in US retirement plans like 401(k) plans. The order would instruct the Department of Labor and SEC (Securities and Exchange Commission) to provide guidance to employers and plan administrators on including private assets in 401(k) plans. The article adds in theory retirement plans can already add investments to private funds, but companies are concerned they would be sued by employees over higher fees associated with private market investments, and it is believed the executive action would make them more comfortable.

- Fed Chairman Powell: A media report last week said President Trump, when holding a meeting with a group of Republicans regarding the crypto legislation that failed to pass, asked the group whether or not he should fire Fed Chairman Jerome Powell after giving them a draft letter of his firing, which the group gave approval. Bloomberg News reported Trump was likely to fire Powell soon, citing a White House official, confirming multiple recent reports that Trump was considering the move. Markets immediately dropped along with the dollar and Treasury yields. However, Trump very quickly responded, saying firing Powell is “highly unlikely” unless its for fraud.

- US/China Trade: Bloomberg reported Trump is dialing down his tone with China when it comes to trade and instead is now focusing on purchase deals similar to his first term (like China purchase x amount of US goods). In recent meetings with staff, officials said Trump is often the least hawkish voice and have said Trump has expressed personal admiration for Chinese President Xi. In addition, Trump is preparing to delay the August 12 deadline when US tariffs on Chinese imports are scheduled to go back to 145%.

- Trade/Tariffs:

- Trump posted on his social media last Saturday that he sent letters to the European Union and Mexico telling each they will see a 30% tariff on all exports to the US starting August 1, saying if they open their closed trading market, eliminate tariff and non-tariff policies and trade barriers, “we will, perhaps, consider an adjustment to this letter.”

- The EU responded quickly calling the new tariffs a disruption to essential transatlantic supply chains and vowed to retaliate on Monday. However, it later said it would hold off on retaliating and said it is time for negotiations but would postpone its retaliation tariffs until August 1 if no deal is made. It later released a list of goods worth $84 billion (including Boeing aircraft, cars, bourbon, and other industrial and agricultural goods) that it is prepared to hit with tariffs.

- Meanwhile, Mexico said they are engaging in discussions with the US.

- Trump announced a trade agreement with Indonesia on Tuesday after previously threatening a 32% tariff. The deal reduces the tariff to 19% with Indonesia agreeing to remove all duties on American imports and purchase at least $19 billion of US goods including aircraft.

- Trump said he is planning to put “a little over 10%” tariffs on goods from 100 or so smaller countries including African and Caribbean nations, with Commerce Secretary Lutnick clarifying these tariffs would apply to countries the US does relatively modest trade with and have a minimal impact on Trump’s overall goal of improving the trade balance.

- Trump said “we’re very unhappy with Russia” adding the US will impose “very severe” tariffs of 100% if there is no deal in 50 days, referring to a ceasefire agreement between Ukraine and Russia.

The Week Ahead

This week the focus will most likely be on earnings with over 20% of S&P 500 companies reporting their quarterly financial results this week, the second most for a week before next week’s number really ramps up. We will see companies from all sectors and the first megacaps including Alphabet and Tesla. Other notable results will come from Verizon, AT&T, Cleveland Cliffs, Coca-Cola, GM, Lockheed Martin, Capital One, Texas Instruments, Hasbro, IBM, Chipotle, Dow, Union Pacific, Honeywell, Service Now, Intel, and HCA Healthcare. The economic calendar is light with several housing reports including existing home sales and new home sales. Other data will come from money supply, jobless claims, and durable goods orders. Fed Chairman Jerome Powell will talk publicly Tuesday morning at a Capital Framework for Large Banks Conference in D.C.