Wentz Weekly Insights

Job Growth Overstated, Inflation As Expected, Rate Cuts Ahead

US stocks were higher last week with growth stocks, particularly technology and anything related to artificial intelligence, outperforming. However, breadth was weak again – while the cap weighted S&P 500 rose 1.59%, the equally weighted S&P 500 rose just 0.28%. Meanwhile, volatility remained low – the volatility index (VIX) fell almost 3% and remains in the mid-teens range. Driving markets higher last week was the higher expectation for rate cuts this year along with encouraging financial results from Oracle that boosted the technology sector 3.1% for the week.

Markets are now fully pricing in a rate cut at this week’s Federal Reserve policy meeting with the possibility for a jumbo rate cut still on the table. Recent economic data has provided policymakers more evidence of normalizing inflation and a slowing labor market.

The latest consumer inflation report was released last week that showed inflation remained in check, although still slightly above the longer-term target of 2%. The consumer price index increased 0.4% in August, compared with the 0.2% increase in July. Food and energy prices, up 0.5% and 0.7% respectively, drove a good amount of the increase. Excluding these two volatile categories, the core index increased 0.3% as expected.

The annual consumer inflation rate was 2.9% in August and the annual rate for the core index was 3.1%, the same 12-month change as in July. The good news is inflation in the services sector appears to be closer to normalizing. The index on service prices excluding shelter was up just 0.1% in August and up 4.0% over the past year with the index up an annualized rate of 3.2% over the past three months.

Prices on goods were very mixed, with categories like apparel, furniture, tools, and appliances seeing moderate increases while things like electronics saw prices decline in August. It is yet to be seen what impact tariffs will have on inflation, with the data very mixed so far this year, but we think it will ultimately take much more time to tell. Markets celebrated this data with the S&P 500 up 0.85% and Russell 2000 up 1.83% after the data release.

The Bureau of Labor Statistics’ annual revision to nonfarm payrolls was in focus as well. Last year the BLS made a massive downward revision to job growth, causing concern the labor market was slowing more than expected, so this report was closely followed this year. The BLS makes annual revisions to previously reported payroll growth figures to account for more comprehensive and reliable data like from the Quarterly Census of Employment and Wages, which uses things like unemployment insurance tax records and actual birth and death rates versus estimates.

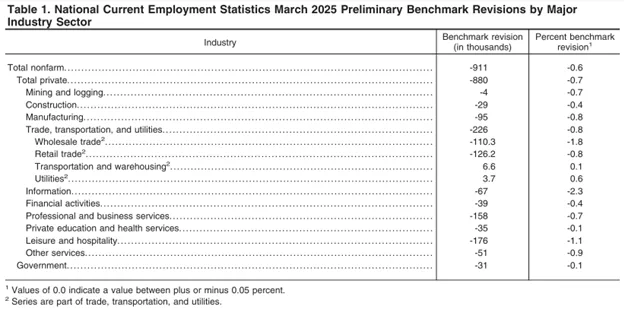

The BLS revised payroll growth down by 911,000. This means instead of the US economy creating 1.8 million jobs from the April 2024 to March 2025 period as was initially reported, payroll growth was actually 847,000 over that 12 month period. Monthly job growth averaged 70,000 over that period, down from the initial reports of 147,000. The chart below shows the revisions made among each industry sector. Rosenberg Research notes the past three year initial monthly job numbers have been overstated by more than 2 million and Bank of America noted the downward revision indicates the labor market had essentially stalled in Q1, before the trade uncertainty hit markets.

This, combined with no surprise in the inflation data, not only moved the rate cut odds to 100% for this week’s meeting, but increased the odds for three rate cuts this year (in the three remaining meetings) to about 80%, double what it was prior to the new data. By the end of next year, markets are betting the Fed will have cut rates six times, or by 1.50% from 4.25% to 2.75%.

The other big talking point last week revolved around artificial intelligence after Oracle reported its quarterly financial results. The stock finished the week up 25.5%, rising as much as 40% at one point, after announcing an AI-driven $317 billion increase in its backlogs after signing four contracts with three large customers during the quarter and hinted at a pipeline of additional high-profile deals. A report said OpenAI (one of the largest pure-play AI companies) was one of the contracts where Oracle will provide it with computing power in a $300 billion five-year deal.

The report was enough to push the stock into the top 10 largest US companies measured by market cap, with the company at one point within reach of the $1 trillion mark. Combining this with remarks from Nvidia that demand from hyperscalers and oversea customers remaining robust was enough to keep the momentum going and push the technology sector up 3% for the week.

With the earnings and economic calendar lighter this week, investors will be super focused on the Fed meeting Wednesday and its policy decision. Like the market odds, we see a quarter point cut to interest rates, which is well priced into markets. There is a smaller chance for a larger rate cut, which may not be taken well for markets. A larger rate cut may signal that the Fed sees deeper issues to the economy and may cause additional worries for investors. We think the Fed will signal consistent rate cuts through 2026, but stress patience and that it will continue to react to the incoming economic data.

Week In Review:

Stocks were higher last week with an outperformance in growth and technology while market breadth was weak as the equally weighted index underperformed by 1.3%. Volatility remained low with the VIX (volatility index) down 2.77%. The four major stock indices finished as follows: Nasdaq +2.03%, S&P 500 +1.59%, Dow +0.95%, and Russell 2000 +0.25%. Treasuries were mixed – the 2-year Treasury yield bounced off its lowest level since last September, up 4 basis points to 3.56% while the 10-year yield fell one basis point to 4.07%. The dollar index fell 0.22% while gold keeps pushing new all-time highs, rising 1.00% last week. Bitcoin rallied with risk assets, up 4.93%. Meanwhile, oil rose 1.33% despite the OPEC agreement to increase production.

Recent Economic Data

- Consumer Price Index: Inflation ticked up slightly with the headline number a little more than expected but all other major figures in line with expectations. The consumer price index increased 0.4% in August versus economists’ estimates of 0.3%, compares to the 0.2% increase July, and was the largest monthly increase since January. Food prices increased 0.5% while energy prices increased 0.7%, both the largest increase in several months. Excluding these two categories, which make up 20% of the index, the core index increased 0.3% as expected. New vehicle prices rose 0.3%, used vehicles rose 1.0%, apparel saw a 0.5% increase, medical care commodities down 0.3%, medical services down 0.1%, transportation costs up 1.0%, while shelter prices, the largest category, rose 0.4%. Compared to a year ago the headline index accelerated to 2.9% in August, up from 2.7% in July, with the core index up 3.1%, the same annual change as in July. Price increases in services have really cooled the last several months, up 0.1% in August and up 4.0% over the past year.

- Producer Price Index: Inflation at the producer level in August was muted and helped move stocks higher Wednesday morning. The producer price index declined 0.1% in the month, well below the expected 0.3% increase, but comes after an outsized 0.7% increase from July. It wasn’t just the volatile categories that drove the decline, with food prices up 0.1% and energy prices down 0.4%, the core index which excludes these two categories declined 0.1% as well. Prices for final demand goods were up 0.1% while prices for final demand services were down 0.2% driven by a 1.7% decline in trade services (trade services refer to the margins that wholesalers earn when they sell goods, not necessarily the selling prices of said goods). Producer prices are up 2.6% over the past year with the core index up 2.8%.

- Jobless Claims: Unemployment claims moved to the highest level since late 2021. The number of jobless claims filed the week ended September 6 was 263,000, up 27,000 from the week prior. The four-week average increased 9,750 to 240,500. The number of continuing claims was 1.939 million, unchanged from the prior week with the four-week average relatively unchanged at 1.946 million.

- Consumer Sentiment: The consumer sentiment index was 55.4 for September, falling three points from the August survey and about 3 points lower than what was expected. The current conditions index was 61.2, relatively unchanged from August, while the expectations index fell four points to 51.8. The expectation for inflation over the next 12 months was steady, although elevated, at 4.8%, while the longer-run 5-year ahead inflation expectation moved up for the second straight month to 3.9%.

- Consumer Credit: The total credit outstanding by consumers increased $16 billion in July, or by an annual rate of 3.8%, to a total amount of $5,060.1 billion. Revolving credit (like credit cards) increased $10.5 billion, or an annualized rate of 9.7%, while nonrevolving credit (like mortgages, auto and student loans) increased $5.4 billion, or a 1.8% annualized rate.

- Employment Preliminary Benchmark Revisions: The Current Employment Statistics (CES) national benchmark revision to the payroll figures was released for the April 2024 to March 2025 period and showed payroll growth was overstated by 911,000, the largest downward revision going back 25 years. The average monthly payroll growth over that 12 month period was 147,000, but after the revisions was just 70,000. Economists were expecting a downward revision to payrolls, but this was a much larger number than expected. The revision is basically a recalibration of previously reported numbers based on more comprehensive and reliable data like from the Quarterly Census of Employment and Wages, which uses things like unemployment insurance tax records and actual birth and death rates versus estimates. The table below is from the news release that shows which industry sectors saw the largest downward revisions, with transportation and warehousing and utilities sectors the only two seeing an upward revision.

Company News

- Nebius: Data infrastructure provider Nebius shares were up after it said it will provide Microsoft with GPU infrastructure capacity in a deal worth $17.4 billion over a five-year term, highlighting the continued surge in demand for high-performance computing for artificial intelligence. The deal could be worth another $2 billion if Microsoft takes the option of acquiring additional capacity under the deal.

- OpenAI: OpenAI, maker of ChatGPT, made headlines early last week after The Information reported it is seeing a massive ramp in its cash burn after the company raised its forecast for cash burn through 2029 to $115 billion, up from $80 billion, including spending $1.5 billion more this year than previously expected (to $8 billion). In a separate report, The Information reported Microsoft is set to partially replace some of its AI technology with Anthropic, moving away from OpenAI. Microsoft has been a massive investor in OpenAI since its breakthrough, while Amazon is a big backer of Anthropic.

- Alibaba/Baidu/Nvidia: The Information is reporting sources have told them that Chinese large tech companies Alibaba and Baidu are now using chips designed internally to train their AI models which it says have partially displaced Nvidia’s chips. The sources say Alibaba’s in house chips are at least as effective as Nvidia’s H20 chips, which are the most advanced chips Nvidia is licensed to sell to China.

- Oracle: Shares of Oracle surged around 35% after it reported its quarterly earnings that were mixed. However, the bigger news was it recording a massive increase in its backlog of $317 billion with cloud RPO (remaining performance obligations, contracted revenue it has not received yet) growing 500% after seeing four contracts with three different customers into fiscal year 2030. The Wall Street Journal reported the same day OpenAI signed a massive $300 billion deal to provide data center capacity to Oracle.

- UnitedHealth: UnitedHealth shares moved higher after it reaffirmed its earnings outlook again and gave a favorable update on its Medicare Star Ratings performance, saying 78% of its members could be enrolled in Medicare Advantage plans rated four stars or higher for the 2027 plan year. The CMS rewards healthcare plans with four or more stars with annual bonus payments with a higher percentage seeing higher bonuses.

- Apple: Apple held its product event Tuesday where it unveiled three new iPhone products; the iPhone17, iPhone 17 Pro & Pro Max, and the iPhone Air, a new ultra-slim iPhone that replaces the “plus” line. The iPhone17 starts at $799, the Pro at $1,099, the Pro Max at $1,199, and the Air at $999. It also announced three new watch models, new AirPods, and a new operating system iOS 26 that will launch in mid-September.

- Delta Airlines: Delta Airlines tightened the range of its revenue growth guidance, expecting revenue to grow 2-4% versus its initial forecast of 0-4% growth. It said there has been improving demand trends but said it still sees challenges in Transatlantic routes, which may be driving the weakness in shares.

- Warner Bros. Discovery: Shares of Warner Bros. Discovery jumped over 30% after a report by the WSJ said Paramount Skydance is preparing a cash bid for the entire company, including its cable networks and movie studios. The report added Paramount may be making the bid before the planned split of Warner Bros. in attempt to pre-empt a possible bidding war for the streaming unit that could possibly include the mega cap companies like Amazon and Apple. Recall in June Warner Bros. Discovery said it would split into two companies, one with a focus on streaming the other focusing on television networks.

Other News:

- Tariffs: Trump is pressuring the European Union to put massive tariffs on China and India and keep them in place until they stop purchasing Russian oil, as a way to put additional pressure on Putin to end the Ukraine war. Also, US Commerce Secretary Harold Lutnick said a trade deal with India will not happen until the country stops its purchases of oil from Russia.

- Israel Targeted Strike on Qatar: Oil and gold prices moved higher after Israel launched drone strikes on Qatar’s capital of Doha, targeting leaders it said were directly responsible of the attacks on Israel from October 2023.

- Trump Targets Prescription Drug Ads: President Trump signed a memorandum aimed at tightening down on direct-to-consumer prescription drug advertising. The memorandum instructs the Health and Human Services Secretary to ensure transparency and accuracy in all ads and aims to increase the risk related information in the ads, as well as directing the FDA Commissioner to ensure ads are truthful and not misleading and enforce existing standards.

- Federal Reserve Governors: A federal judge blocked Trump’s attempt to remove Federal Reserve Governor Lisa Cook from her position. Trump quickly asked an appeals court to reverse the judge’s order. Separately, the Senate is on track to confirm Fed Governor nominee Stephen Miran as early as Monday. Confirming Miran by Monday would allow him to participate in the Fed’s meeting the begins next Tuesday.

Did You Know…?

World’s Wealthiest Person:

Elon Musk is no longer the wealthiest person in the world. After Oracle’s massive 36% increase last Wednesday, Larry Ellison, co-founder of the company, overtook that title after seeing his net worth increase $101 billion due to the stock increase, according to the Bloomberg Billionaires Index. His net worth stood at $393 billion, above Elon Musk’s $385 billion. In addition, Oracle jumped to the top 10 list when it comes to the most valuable companies in the US. Its market cap jumped to nearly $1 trillion after Wednesday’s increase.

Concentrated Markets:

Bank of America released a note saying just 10 stocks in the S&P 500 have made up over 80% of the S&P 500 30% gain since Liberation Day in early April. The stocks include all Magnificent 7 stocks (Nvidia, Microsoft, Apple, Amazon, Alphabet, Meta, and Tesla) as well as other large cap tech companies Palantir, Oracle, and Broadcom. Concentration in the S&P 500 index, which is weighted by market cap so a larger company will carry more weight in the index, has received a lot of attention lately. Apollo Global Management said Nvidia now has the largest weighting in the S&P 500 ever, since data began in 1981, making up nearly 8% of the index. In addition, the Magnificent 7 stocks make up 33.9% of the index weighting, while the largest 20 stocks make up 48.5% of the index.

WFG News

Investment 101 Class

Interested in learning more about the basics of investing and how the markets work? Join us in our next Investment 101 class on September 18 at 4:00pm!

This is a great opportunity to learn in a small setting about key financial principals, like risk and return, liquidity, inflation, diversification, growth versus income, time value of money, account types, and how your money can work harder for you!

The Week Ahead

All eyes will be on the Federal Reserve this week with its meeting taking place Tuesday and Wednesday and a policy decision coming Wednesday at 2:00. The question is whether policymakers agree to cut interest rates 25 basis points or elect for a larger 50 basis point cut. This meeting will also include the summary of economic projections – material the market looks at to gain a better idea of how the Fed sees the economy playing out the next several years. Investors will also be looking at what the Fed says about future interest rates and whether it sees more after the weaker labor market data recently. Other central banks around the globe will hold policy meetings as well, with policy decisions coming from the Bank of Canada, The Bank of England, the Bank of Japan, and the Norges Bank. The big report on the economic calendar will be retail sales on Tuesday morning. Consumer spending is expected to have remained strong in August with economists forecasting a 0.4% increase in retail sales (excluding vehicles). Other data comes from manufacturing with the Empire State and Philly Fed manufacturing indexes, industrial production, then other reports like the housing market index, housing starts and permits, and jobless claims. The earnings calendar is in the most quiet stretch of the quarter, with the only notable quarterly reports coming from General Mills, Darden Restaurants, FedEx, and Lennar.