Wentz Weekly Insights

Big Tech Momentum Continues As Solid Earnings Propel Stocks Higher, But Gains Were Narrow Again

The S&P 500 ended the week higher again, for the third straight week and again new record highs, although the divided market intensified. While the S&P 500 gained 0.71% for the week, the equally weighted S&P 500 underperformed significantly with a 1.74% decline. The gains were driven by big tech after solid earnings reports and continued AI optimism. Technology and consumer discretionary were both up almost 3% while the other nine sectors were up minimally or lower by as much as 4%.

The Treasury market saw yields higher across the curve last week – the 2-year Treasury yield was up 8 basis points to 3.58% while the 10-year Treasury yield, which is basically the benchmark or reference rate for borrowing rates for consumers and businesses like mortgages and credit cards, was up 6 basis points to 4.08%. Just about all the increase in yields came after the Fed meeting Wednesday which indicted a rate cut at the next meeting in December is far from certain.

The Federal Reserve’s policy making committee decided to cut rates another quarter percent last week, as was expected, bringing the overnight borrowing rate for banks to 4.00% (now down from 5.50% before this rate cut cycle began 14 months ago). The policy statement noted the lack of economic data recently from the government shutdown, but indicators suggest a moderate pace of economic growth, slowing job gains, and inflation that has moved higher since the beginning of the year.

The markets were more focused on what will happen going forward. The first question Powell was asked in the Q&A was regarding policy at the next meeting where Powell said a “further reduction in interest rates in the December meeting is not a foregone conclusion.” He added the decision on what to do in December depends on the data and how it affects the outlook and balance of risks.

The immediate reaction in markets was a rise in yields and a drop in stocks. In addition, the futures market showed a lower chance of a rate cut in December – odds for a cut fell from 85% to 65%. In addition, futures markets are pricing in 0.70% worth or rate cuts in 2026, down from 0.86% prior to the meeting.

The other dominating theme has been earnings report and artificial intelligence. We have seen a series of announcements on deals/partnerships between companies related to AI over the past several weeks. It was more of the same last week, for example Nvidia is partnering with Nokia to build out infrastructure, AMD is partnering with the Energy Department to build a supercomputer, and Qualcomm announced it will build an in-house AI chip.

Earnings helped move stocks higher and it was several of the mega cap tech stocks that drove index returns. Alphabet (+8.2%), Amazon (+8.9%), and Apple (+2.9%) were clear winners with Apple eclipsing the $4 trillion market capitalization level for the first time (as did Microsoft).

Apple was higher on better earnings driven by higher margins, but the bigger story was its forecast on iPhone sales where it said demand is strong, driven by a return to growth in China. Amazon was higher from better than expected earnings and sales with the key detail being its cloud division experiencing an acceleration in growth to 20%, the strongest since 2022, driven by “strong demand in AI and core infrastructure.” Alphabet was higher from reporting better results driven by Search, YouTube, and cloud with it noting that AI is driving an expansion in Search and improved monetization.

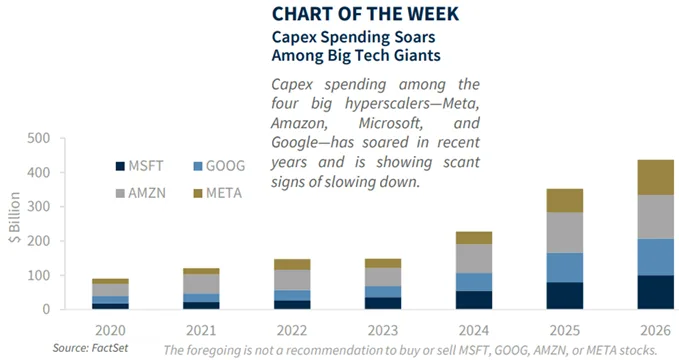

On the other hand, Meta (-12.2%) was the big underperformer for the week, and to a lesser degree Microsoft (-1.1%). Meta, parent company of Facebook, saw much better results than expected but the concern was it raising its spending forecast and saying next year will see “notably larger” capital expenditures as it continue to build out its data center infrastructure. The reason for the drop in Microsoft was similar – it reported strong financial results that were better than expected, but its forecast was mixed and its commentary noted rising capital expenditures due to capacity constraints, which may accelerate next year.

The amount these companies are spending on artificial intelligence is remarkable and the chart below helps illustrate that. Microsoft is expected to spend near $100 billion, Amazon is expected to spend over $100 billion, Alphabet said it expects to spend $92 billion, and Meta said it expects to spend $71 billion on capex in 2025. For the three month period that just ended, the four companies reported they spent around $80 billion on capex, nearly a 90% increase from last year.

The other big news was the US and China agreeing to a trade truce following President Trump’s meeting with China’s President Xi. Trump said China has agreed to postpone export controls on rare earth minerals for at least one year and in return the US will cut the fentanyl related tariffs from 20% to 10%. This brings the average tariff rate on Chinese imports down to around 47%. China also agreed to purchase a large quantity of soybeans and other farm products from the US. While many items remain unresolved, this avoids a worst case scenario when it comes to China and trade.

Moving forward, markets will remain focused on earnings with another approximately 25% of the S&P 500 reporting quarterly results this week. Meanwhile, we remain in a vacuum when it comes to economic data with the government still in a shutdown, preventing government related economic data from being released.

Week in Review:

Stocks were very mixed last week with a strong outperformance in technology while the average stock was down for the week as the equally weighted S&P 500 fell 1.74% as the volatility index rose 6.5% to 17.44. The four US stock indices finished as follows: Nasdaq +2.24%, Dow +0.75%, S&P 500 +0.71%, and Russell 2000 -1.36%. Treasuries moved lower due to a rise in yields after the Fed meeting indicated a lower chance of rate cuts than the market expected. The 2-year yield rose 8 basis points to 3.58% while the 10-year yield rose 6 basis points to 4.08%. The dollar index increased 0.86% while gold fell 3.31% from record highs. Bitcoin fell 1.33%. Oil fell 0.85% over the expectations of another oil production increase by OPEC.

Recent Economic Data

- GDP: Delayed

- Personal Income & Spending: Delayed

- Employment Cost Index: Delayed

- Jobless Claims: Delayed

- Durable Goods Orders: Delayed

- Money Supply: The money supply, or the amount of money in circulation which includes cash, deposits at banks and money market balances, spiked during the pandemic from government stimulus which led to inflation, pulled back slightly late 2022 and early 2023 which led to a brief economic slowdown, and has since resumed its growth with a $104 billion, or 0.5%, increase in September. Money supply is up $955 billion, or 4.5%, over the past year, still slightly lower than its average annual increase from the 2010’s.

- Case Shiller Home Price Index: Home prices are beginning to show more widespread signs of declines across the US. The Case Shiller home price index showed home prices on average in the US declined 0.3% in August with 19 of the 20 metro areas tracked seeing a decline in the month. On a seasonally adjusted basis, home prices were up 0.2%. Over the past year, home prices are up just 1.5% for the slowest annual gain in over two years, and in real terms (after adjusting for the 3.0% rate of inflation) home prices are down 1.5%. The regions that experienced sharp pandemic-era gains, like the South and West are seeing price declines with Tampa, Phoenix, and Miami seeing the largest declines between -1.7% and -3.3%, while more affordable metro areas with stable economies are holding up better like the Midwest and some of the Northeast as metro areas like New York City, Chicago and Cleveland are seeing the largest home price increases between 4.7% and 6.1%.

- Consumer Confidence: The Consumer Confidence index was 94.6 for October, down one point from September for the third straight monthly decline and the lowest since the tariff Liberation Day related lows in April and May. The present situations index improved 1.8 points to 129.3 while the expectations index fell 2.9 points to 71.5, remaining below a key level of 80 that historically signals a recession ahead. The report noted consumers were a bit more pessimistic about future job availability and future business conditions.

Company News

- Nvidia: Nvidia said it is investing $1 billion in the network infrastructure and cellphone company Nokia (at $6.01/share in newly issued shares) to accelerate the development of Nokia’s software to run on Nvidia’s architecture in effort to be the front runners in AI-powered networking, as well as exploring other opportunities to incorporate Nokia’s technologies in Nvidia’s future AI infrastructure architecture. Nvidia shares got another boost Wednesday after Trump said he may speak with China’s President Xi about Nvidia’s Blackwell chips (its most advanced, creating speculation he will remove export restrictions). This moved the company’s market capitalization over the $5 trillion mark, the first company to ever receive such valuation.

- Microsoft: Shares of Microsoft shares were higher and eclipsed the $4 trillion market cap level for the first time after it agreed to a restructuring of OpenAI that took nearly a year to negotiate where Microsoft will receive a 27% ownership stake, worth about $135 billion. This removes a key headwind for both companies and clears the way for OpenAI to become a for-profit company. As part of the agreement, Microsoft will have access to OpenAI’s AI technology through 2032 and will continue to be entitled to receive 20% of OpenAI’s revenue.

- Qualcomm: Shares of Qualcomm were up double digits last Monday after it said it is entering the AI accelerator market by unveiling its in-house AI chips which use its own neural processing units (NPUs) technology and are set to compete with Nvidia and AMD. The company generates most of its business from handsets (mobile phones) and this is an avenue it is taking in attempt to diversify its revenue stream.

- AMD: Shares of AMD moved higher after the company said it has agreed to a partnership with the Department of Energy valued at $1 billion to developing supercomputers. The DoE is creating the supercomputers to deal with large scientific issues like nuclear power and cancer treatments, which it believes will help get “massively faster progress” on these areas.

- Skyworks/Qorvo: Skyworks said it has agreed to merge with RF chipmaker Qorvo in a transaction valued at $22 billion. Under the agreement, Qorvo shareholders will receive $32.50 in cash and .96 shares of Skyworks for each share of Qorvo owned. After the completion of the deal, Skyworks shareholders will own 63% of the combined company while Qorvo shareholders will own 37%.

- Netflix: Netflix said it approved a 10-for-1 stock split “to reset the market price of the stock to a range that will be more accessible to employees who participate in the company’s stock option program.” The split will occur at the close of trading on November 14. Separately, Reuters reported Netflix is actively exploring a bid for Warner Bros. Discovery and has hired an investment bank to evaluate a prospective offer for the company.

Other News:

- FOMC Meeting: The Federal Open Market Committee decided it was appropriate to cut interest rates another 25 basis points, bringing the top end of its range to 4.00%. There were two dissents – Miran wanted a 50 basis point cut and Kansas City’s Schmid wanted no change.

- Policy Statement: The changes in the policy statement noted the lack of data recently available but said indicators suggest a moderate pace of economic growth, job gains that have slowed with inflation moving up since earlier in the year. In addition to rate cuts, the Fed will end its reduction of the balance sheet (referred to in the markets as quantitative tightening) on December 1 in order to keep the appropriate amount of reserves in the financial system. Any mortgage backed securities that are maturating, instead of rolling off the balance sheet, the Fed will reinvest into T-bills (short term government debt) to “normalize” its balance sheet.

- Press Conference: Markets were initially higher after the rate cut announcement but reversed course after the first Q&A question in Powell’s press conference about the what the Fed is thinking for its next meeting in December where Powell said a rate cut is “far from a foregone conclusion.” Markets were giving a 85% chance of a rate cut in December, but that has since fallen to around 65%. There were two bigger comments on the Fed’s mandate (which include stable inflation and maximum employment) throughout his commentary: Inflation is higher than target, but expected to come down and the Fed does not see further weakening in the labor market. This may indicate less future rate cuts than what the markets are expecting which may be attributing to stocks move lower.

- Trump’s Asia Tour: President Trump made an Asia tour last week with one of the first stops in Southeast Asia where he made deals on tariff relief to countries like Thailand, Vietnam, Cambodia, and Malysia in return for lower barriers on US goods. These deals were considered important to the US due to the US reducing its reliance on China. There was also a framework agreement made between Trump and Japan’s PM Sanae Takichi, calling for a “new golden age” for its relationship and to strengthen the collaboration on critical minerals and rare earths, while agreeing to 15% tariffs on Japanese exports to the US.

- US & China Trade Truce: President Trump held a face-to-face meeting with China’s President Xi in South Korea where they reportedly agreed to the framework that was laid out by Bessent earlier in the week, as was expected. The two sides agreed to extend the tariffs truce, roll back export controls and ease trade barriers – Trump said China will buy a “tremendous scale” of agricultural products from the US (mostly soybeans) while China’s rare earth export restrictions will be suspended for one year. In return, US will cut China’s fentanyl related tariffs in half to 10% and halt a rule targeting blacklisted firms’ subsidiaries. Trump said both sides will review the agreement annually. He added they talked Nvidia chips but China needs to talk with Nvidia and nothing was clear about removing export curbs. Bessent later said China will buy 12 metric tons of soybeans for the current season and increase to 25 million metric tons the next three years (it averaged 19 metric tons the prior 5 years).

- Nuclear Weapons Tests: Trump directed the Pentagon to begin testing nuclear weapons just before the meeting with China’s Xi, which would be the first in 33 years, due to “other countries testing programs” and that the US needs to do so on an equal basis. The Energy Secretary later said the testing will not include nuclear explosions.

- Fed Speak: Dallas’ Fed President Lori Logan (a non-voter on the FOMC this year) said the current economic outlook did not call for cutting interest rates and she finds it difficult to cut rates again in December. She said the labor market is now balanced but cooling while inflation has remained too high. She added the Fed has mitigated further labor market weakness with previous rate cuts.

- OPEC: The Organization of the Petroleum Exporting Countries (OPEC) agreed at its meeting over the weekend to another modest increase in oil production next month but will take a pause on increasing production in the first quarter. Beginning in December, OPEC will increase productions another 137,000 barrels/day, matching the increases it made the prior two months. The decision to pause came from the fact January to March is normally a period of weaker demand from seasonal factors. Some also agreed to a pause due to an expected supply glut building next year. Crude oil fell 1% last week and is down only slightly as of early Monday morning. The International Energy Agency estimates 2026 will see an oversupply of oil by about 3.3 million bbl/day.

Did You Know…?

Medicare Open Enrollment

Medicare open enrollment period runs from October 15 to December 7 each year and during this period, individuals are able to make changes to their current Medicare coverage. Individuals on Medicare should receive an Annual Notice of Change and/or Evidence of Coverage for Medicare Advantage or Part D plan. This is a good time to review coverage, as medical needs, benefits, and premiums may have changed over the year. During this time here are some things to consider:

- Will your primary doctor still accept you Medicare Advantage Plan?

- Have your medical needs changed? Different plans offer different benefits and different costs

- Are there comparable, lower cost plans available? Don’t forget to consider out-of-pocket costs when comparing options

- Are you medications still on your plan’s list of covered medications?

The Week Ahead

It is expected to be less busy of a week compared to last week, but there is still a big wave of earnings reports coming this week with about 25% of the S&P 500 index scheduled to report their quarterly financial results. Notable companies reporting earnings this week include Palantir, Shopify, Uber, AMD, Super Micro Computer, Pinterest, Robinhood, AppLovin, Qualcomm, Arm Holdings, Snap, Figma, Datadog, The Trade Desk, Airbnb, DraftKings, Goodyear, Pfizer, McDonald’s, AMC, and Warner Bros. Discovery. The week also has a solid amount of economic data releases scheduled, however many of these are expected to be delayed due to the continued shutdown, including key labor market data. The highlights would be the labor report on Friday where consensus estimates 32,000 jobs were added in October. Other labor market data includes the job openings and labor turnover survey, ADP’s payroll data, jobless claims, and productivity & costs. Outside of that other reports include the PMI and ISM manufacturing indexes, factory orders, construction spending, trade balance, the ISM services index, and consumer sentiment. Politics will be on the mind of a lot with the government shutdown going into its sixth week and this week will turn into the longest shutdown ever if Congress does not agree to a short-term funding package. In addition, the Supreme Court will hear arguments on Wednesday in the case that challenges the legality of Trump’s tariffs. Fedspeak is also scheduled this week with many Fed officials scheduled to make public appearances.