Wentz Weekly Insights

Markets Rotate as Fading AI Sentiment Sends Stocks Lower

The major US stock indices saw mixed performance last week. The best way to describe the week was a continued unwind of the recent momentum, particularly in higher-beta areas of the market like technology, AI-related stocks, meme stocks, and crypto, and a rotation into value and defensive sectors. For the week, the S&P 500 and equally weighted S&P 500 were basically unchanged.

Markets had a decent start to the week with the Nasdaq rising 2.3% Monday on optimism over earnings growth and the AI trade. The AI theme stayed in the headlines the beginning of the week after AMD (maker of CPUs and GPUs, some of which power AI data centers) held its first investor day event in three years and had strong growth targets for the next 3-5 years. It said it expects annual revenue growth of at least 35% over that period and expects earnings of over $20 per share (up from the estimated $4/share this year). It also said it sees the addressable market for AI data centers to surpass $1 trillion by 2030 which was double its recent view.

However, the strength in AI and tech stocks faded later in the week. Recent headlines highlight the rising concerns around the AI theme – particularly stretched valuations and increasing talk of a potential bubble following the sharp run up in share prices.

Comments from the CEO of Palantir also hit sentiment after he warned the cost of building some AI technology may not be worth the value it delivers, coming at a time where investors are increasingly questioning whether the industry’s massive spending will continue to generate meaningful returns.

These comments relate to one of the biggest issues emerging in the sector that is the pace of capital spending required to support AI initiatives and how it is looking more unsustainable. An increasing number of large tech companies are turning to the debt markets to finance their capital expenditures required to pursue their AI ambitions, raising questions about leverage, return on capital, and the overall long-term sustainability of this spending.

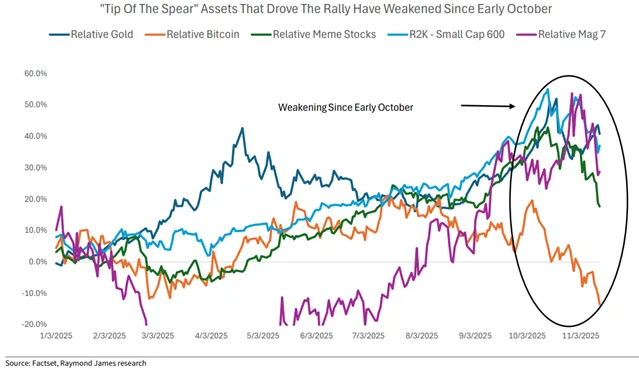

The result was a slight decline for the Nasdaq last week, but as Goldman Sachs notes, a basket of high beta momentum stocks ended Thursday lower by 6.4%, the biggest pullback since the DeepSeek worries the beginning of the year. Furthermore, FactSet reported Morgan Stanley’s Quantitative & Derivatives Strategies team said the long portion of its long/short momentum basket is now down 19% since peaking October 15. The chart below from Raymond James shows how the year-to-date winners have pulled back since early October.

On the other hand, year-to-date underperforming sectors like Healthcare, Materials, and Consumer Staples performed the best last week. These are the top sectors since the market peaked late-October, while the year-to-date winners like technology and consumer discretionary are the bottom sectors since then.

Outside of the market rotation, the other headlines were around the end of the government shutdown after Trump signed a stopgap spending bill late Wednesday. The Senate’s bill was passed after gaining support from several moderate Democrat despite the bill not including an extension to healthcare subsidies the party was pushing for. In return, most Republicans promised to address the healthcare issue in December. The bill keeps the government funded through January 30 and some agencies funded through the fiscal year (September 30).

With the longest shutdown in the government’s history, at 43 days, investors are going to be gauging what impact it will have on the broader economy. A lack of government activity – like furloughed workers and disruptions to travel – will weigh on activity for the fourth quarter, but we believe most of the activity will be realized over the next several months and activity will shift into the first quarter 2026 as government spending resumes and workers receive backpay.

A note from JPMorgan shows its estimates for GDP (economic growth) in Q4 was 1.0% prior to the shutdown but was revised to a 0.5% decline, while initial Q1 2026 growth estimates of 1.2% were revised upward to 3.4%.

The reopening of the government also means the economic data reports that were delayed will begin to roll out. We have no certainty on what data will be released when, but the administration has already stated we may not see some reports, like the October labor data, due to the shutdown.

The most anticipated delayed data with a release date is the September jobs data which is scheduled to be released Thursday (versus the initial date of October 3). Economists are estimating 50,000 jobs were added in the month.

As we mentioned, with market valuations currently in the 99th percentile over the past 20 years markets may be vulnerable to pullbacks, add onto this the influx of economic data could create additional volatility. The data will be closely monitored by Fed officials, as we expect the December rate-cut decision to hinge on the incoming figures over the next several weeks, a decision which currently has 50/50 odds by futures markets.

Recent Economic Data

- Consumer Price Index: Delayed

- Producer Price Index: Delayed

- Retail Sales: Delayed

- Jobless Claims: Delayed

Company News

- OpenAI: Business Insider reported OpenAI is talking internally about potentially moving into consumer health apps in effort to move beyond its generative AI chatbot ChatGPT. The products under discussion include a generative AI personal health assistant and a health data aggregator.

- Apple: Reuters reported, citing Counterpoint Research, said iPhone sales in China increased 22% compared to a year ago in the first month of each phones launch, despite the broader market weakening. A majority of the increase in iPhone sales (80%) were from the new model, suggesting higher demand than recent launches. Separately, the Information reported Apple will not release the next version of the iPhone Air in the fall 2026 as was initially planned, amid weaker sales than expected. The iPhone Air, which launched this year, was a thinner and lighter alternative to the flagship iPhone, but came with trade-offs like a shorter battery life and a downgrade in camera features.

- StubHub: Shares of StubHub fell over 20% after the company reported its first earnings results as a public company, with mixed results, however the issue is the company said it is not giving guidance for the current quarter since it is hard to predict consumer demand because of timing of when tickets go on sale.

- AMD: AMD gained after it hosted its first analyst day in three years and said it sees the addressable market for AI data centers reaching $1 trillion by 2030, double its prior view, and provided its expectation of accelerating growth. It provided longer-term growth targets, expecting annual revenue growth of 35% over the next 3-5 years and earnings of over $20+ per share.

- Under Armour: Under Armour said the company and NBA star Stephen Curry have planned to separate the Curry Brand from Under Armour. The company said it will incur an additional $95 million in restructuring costs (contract terminations, incremental asset impairments, and employee severance and benefit costs) due to the separation. Under Armour said it will develop new basketball products in replace of the brand.

Other News:

- Government Funding Bill: The Senate passed a bill mid-week, and House later that night with President Trump signing it Wednesday evening, that would end the government shutdown as several moderate Democrats voted away from party lines with the bill passing 60-40 (8 Democrats voted for). The deal would keep the government funded through January 30 and some agencies funded through the fiscal year (September 30), however the deal does not include Democrats demands of renewing the expiring Affordable Care Act subsidies. Moderate Democrats agreed to support the bill after Republicans promised they would vote by the end of the year to extend the insurance subsidies.

- Data Delays: National Economic Council director Kevin Hassett said the October jobs report (was originally scheduled for release November 7) will not include the household survey portion of the report, which is what is used to calculate the unemployment rate, and will only include establishment survey data, which is the data that comes from businesses and gives us the payroll numbers (the main headline number, i.e. job gains/losses in the month). We will still see the September jobs report as that survey was taken prior to the shutdown, however the data still needs to be put together and analyzed.

- Credit Cards and Merchants Reach Settlement: Visa and Mastercard reached a settlement over a 20-year long legal battle with merchants over “swipe” or interchange fees, which are the fees merchants pay to the credit card companies when the customer uses the card. The settlement gives merchants the flexibility to reject certain higher cost credit cards, like those that carry high rewards, rather than being forced to accept all credit cards. The cards will be grouped into categories, like standard cards, premium cards, and commercial cards, and merchants have the ability to decide which to accept. The settlement also cuts and caps the processing fees for merchants.

- Tariff Dividend: Over the weekend Trump brought back the idea of giving all Americans, except high income households, a $2,000 “dividend” that would be funded from tariff revenue. Bessent later said the proposed tariff dividend could come in a lot of forms but might be in the way of new or expanded tax cuts rather than direct cash payments.

- 50-Year Mortgages: The Director of the Federal Housing Finance Agency (FHFA) said the Trump Administration is exploring ways to introduce 50-year mortgages.

- Fed Speak: Many Fed members spoke last week and the overall message is slightly more hawkish with most cautious on additional rate cuts due to upside risks to inflation and the recent lack of economic data. The futures market now has about a 50/50 chance of a rate cut at the Fed’s next meeting in December, down from 70% the week prior.

- Monday Fed Governor Musalem struck a hawkish tone, urging caution as he anticipates a strong economic rebound in 1Q26. San Francisco Fed Governor Daly warned against keeping rates too high amid a weakening job market and cooling wage growth.

- Boston’s Susan Collins said she has a high bar for additional rate cuts in the near term without the usual economic data and due to upside risks to inflation. Atlanta’s Bostic said he sees little to suggest price pressures will dissipate before the end of next year and he sees data showing businesses plan to continue raising prices.

- Cleveland Fed President Hammock said with monetary policy is difficult right now because both sides of the mandate (stable inflation and maximum employment) are challenged and because of that policy needs to stay “somewhat restrictive”. She thinks current policy is “barely restrictive” and has a higher neutral rate than most other Fed members.

- Minneapolis President Kashkari said he did not support a rate cut at the last meeting, because the anecdotal evidence and data implied resilience in economic activity more than he expected, and is undecided on what to support at the upcoming meeting but said data has suggested more of the same for the economy.

Did You Know…?

Auto Loan Issues

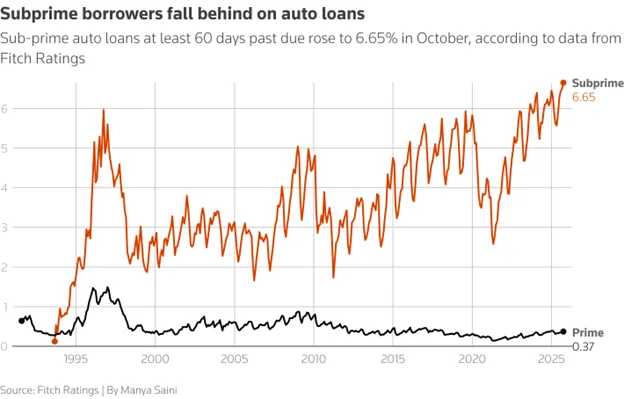

More Americans are falling being on their auto loans, according to new data by Fitch Ratings. The rating agency said the share of subprime borrowers at least 60 days behind on their auto loans rose to 6.7%, which Fitch says is the highest on record going back to 1990. Subprime refers to lending to customers with lower credit scores or limited credit history, and those that are considered higher risk. For comparison, and as the chart below from Fitch shows, during the Financial Crisis the peak was around 5.0%. In addition, many car buyers, even those not subprime borrowers, are responding to higher prices and interest rates by stretching their auto loans to longer terms, often to 72 or 84 months, which lowers the monthly payment slightly, but increases the total interest paid and heightens risk and negative equity. Edmunds reported a record high 19.1% of new car buyers committed to a monthly payment of $1,000 or more and a record 22.4% of all new car loans had terms of 84 or more months. Adding to that, car buyers are financing a record $42,400 of their purchase, whereas the average down payment of $6,433 has declined 2% from last year. Together, these trends suggest mounting stress in auto financing.

WFG News

Thanksgiving Weekend Office Hours

Please note that our offices will be closed Thursday November 27 and Friday November 28 for the Thanksgiving holiday.

IRS Announces 2026 Contribution Limits:

- 401k, 403b, and 457 plans: The contribution limit increases $1,000 to $24,500. Catch up contributions, for those over the age of 50, increases $500 to $8,000. The “Super catch-up”, for those aged 60-63, remains at $11,250.

- Another important rule to note that goes into effect next year – For those age 50 and over that make more than $150,000, any catch up contribution must be made as a post-tax Roth contribution (rather than a traditional pre-tax contribution).

- IRAs (Traditional IRA and Roth IRA): The contribution limit increases $500 to $7,500. The catch up contribution, for those over the age of 50, increases $100 to $1,100.

- Simple IRAs: The contribution limit increases $500 to $17,500. Catch up contributions, for those over the age of 50, increases $500 to $4,000. The “Super catch-up”, for those aged 60-63, remains at $5,250.

Medicare Open Enrollment

Medicare open enrollment period runs from October 15 to December 7 each year and during this period, individuals are able to make changes to their current Medicare coverage. Individuals on Medicare should receive an Annual Notice of Change and/or Evidence of Coverage for Medicare Advantage or Part D plan. This is a good time to review coverage, as medical needs, benefits, and premiums may have changed over the year. During this time here are some things to consider:

- Will your primary doctor still accept you Medicare Advantage Plan?

- Have your medical needs changed? Different plans offer different benefits and different costs

- Are there comparable, lower cost plans available? Don’t forget to consider out-of-pocket costs when comparing options

- Are you medications still on your plan’s list of covered medications?

The Week Ahead

With the government now reopened, we will begin to see some of the recently delayed economic data reports start to be released, however it is still uncertain if and when all the delayed reports will be released. What we know so far is the September jobs report will be released Thursday, but October’s is uncertain. The DOL conducted the September jobs survey already (to businesses but not households – so we will not see the unemployment rate) and just needs to compile the results, however the October survey was never done. Other delayed reports we know will be released this week include construction spending (August), factory orders (August), and the trade balance (August). Regularly scheduled data this week includes the Empire State manufacturing index, the Philly Fed manufacturing index, industrial production, import and export prices, housing market index, housing starts and permits, existing home sales, jobless claims, and consumer sentiment. After a quiet week in earnings, the number of companies reporting picks up pace this week with the next wave coming mostly from retailers. Notable retailers reporting include Home Depot, Lowe’s, Target, TJX, Walmart, Ross Stores, Gap, and some tech companies like Klarna, Palo Alto, Veeva, and Intuit. And of course, the other notable report comes from the world’s most valuable company, Nvidia, who reports earnings on Wednesday.