Wentz Weekly Insights

2024 Recap: US Stocks Rise Over 20% For Second Straight Year

It was another quiet week in markets with trading volume below the average of 2024. US stocks were mostly lower for the week, as the S&P 500 fell 0.48%, with some weakness in big tech driving most the downside. The equal weighted S&P 500 outperformed the cap weighted S&P 500 thanks to an outperformance in small caps where the Russell 2000 index gained 1.06% for the week.

Despite a disappointing performance during this year’s Santa Claus Rally period, the year ended Tuesday with a second straight year of at least 20% gains for stocks with stocks seeing the best two year stretch since 1997-1998! Since the beginning of 2023, the S&P 500 is up 53% over the two year period. In 2024, the S&P 500 hit a new all-time closing high 57 separate times, the most since 1928 according to JPMorgan.

While the S&P 500 gained 23.3% in 2024, the average stock did not do nearly as well. The equally weighted S&P 500 index, which is where all 500 companies carry an equal weight (versus the S&P 500 where larger companies carry a higher weight), was up just 11.1% in 2024, less than half the cap weighted index performance.

As we have touched on several times in 2024, the reason was the top seven stocks (Apple, Nvidia, Microsoft, Alphabet, Amazon, Meta, and Tesla) gained an average of 60.4% with Nvidia the winner, gaining 171.2%. Of the 23.3% gain in the S&P 500, 13% of that came from just these seven names (a pattern that has occurred for two years now). While we still believe there is upside in these names, we believe markets will begin to broaden out and the other 493 companies will begin to see better performance going forward.

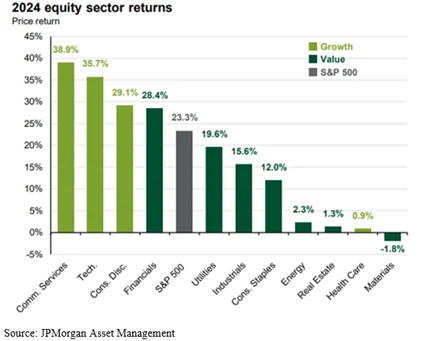

From a sector perspective, communication services, technology, and consumer discretionary were the top three sectors for the second straight year. The chart below shows how the 11 sectors finished the year.

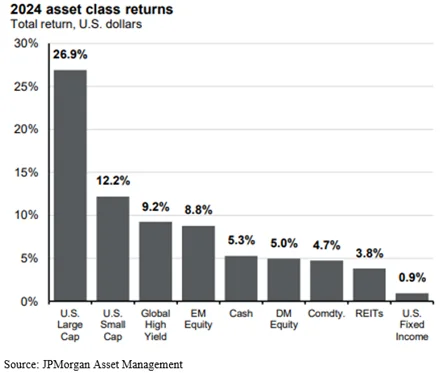

Globally, as seen below, one of the better areas of the market was global high yield bonds which benefited from central banks around the world cutting interest rates and lower default rates. Emerging market stocks had a positive year with hopes for growth returning to China from fiscal and monetary support, along with solid gains in Taiwan (tech related) and India (economic growth related). International developed markets struggled somewhat, rising 5.0% due to weaker and uneven economic growth in Eurozone economies, offset by market strength in Japan. Commodities were positive but lower returns due to weaker global demand outlooks. Fixed income was very mixed, with longer dated bonds negative and shorter dated bonds positive, but the overall index was only slightly positive. Finally, due to higher interest rates, cash returned 5.3%.

The reason for the strong growth in stocks has been the bounce in company profits. After basically no change in 2023, the earnings picture was better in 2024 with earnings across S&P 500 companies expected to increase 9.5% (pending fourth quarter results, we will see these numbers over the next several weeks), which is better than the 10-year average of 8% growth. Calendar year 2025 is setting up to be better, with current consensus estimates seeing a growth of 14%, which is why we remain cautiously positive.

Week in Review:

Stocks were lower for the week with the exception of small caps. The major US indices finished as follows: Russell 2000 +1.06%, S&P 500 -0.48, Nasdaq -0.51%, and Dow -0.60%. Treasuries were up slightly with yields moving a little lower – the 2-year Treasury yield fell 4 basis points to 4.29% while the 10-year yield fell 3 basis points to 4.60%. The dollar saw strength with the dollar index gaining 0.88% with gold also up 0.8%. Bitcoin gained 4.2% but is still several percent below its high. Oil was higher by 4.7% despite more oversupply worries.

Recent Economic Data

- Case Shiller Home Price Index: Home prices across the US showed the recent strong gains since the pandemic have faded with home prices declining another 0.2% in October, according to the S&P Case Shiller home price index. However, after seasonal adjustments the index was up 0.3% as expected. Compared to a year ago home prices are up 3.6%, a deceleration from the 3.9% annual rate in September. New York is the new leader with the fastest annual change in home prices at 7.3%, followed by other Midwest cities like Chicago (+6.2%) and Cleveland +5.8%. Cities with the smallest annual increase were Tampa and Denver at +0.4%, Dallas at 0.8%, and Phoenix at 1.2%.

- Jobless Claims: The number of jobless claims the week ended December 28 was 211,000, falling 9,000 from the week prior for the lowest level since April. The four-week average was down 4k to 223,250. The number of continuing claims fell 52,000 to 1.844 million with the four-week average down slightly to 1.871 million.

- PMI Manufacturing Index: The US PMI manufacturing index was 49.4 for December, up from the mid-month read of 48.3, however the sixth straight month under 50 which indicates contraction in manufacturing activity. The report noted a bigger decline in new orders and production as customers scaled back purchasing activity. Input cost inflation “accelerated sharply” which prompted an increase in selling prices, while employment improved.

- Construction Spending: Construction spending was unchanged in December with residential construction spending up 0.1% in the month and nonresidential spend down 0.1%. Over the past year construction spending has seen a big slowdown, rising 3.0% over the past year, which is down from the 10.0% annual increase from 6 months earlier. Over the past year residential spending is up 3.2% while nonresidential is up 2.8%.

Company News

- Tesla: Tesla said it had delivered 495,570 vehicles in the fourth quarter, short of the consensus estimates of 507,000, while saying it produced 459,445 vehicles. It saw a total of 1.79 million vehicles delivered in 2024, 1% drop from 1.81 million from 2023 for its first ever annual decline, and missing its forecast from the beginning of the year.

- US Steel: Shares of US Steel rose Tuesday after a report said Nippon Steel, who is under agreement to purchase the company pending US approval, has proposed allowing the government to veto any reduction in US Steel’s production capacity. It was several days ago that the Committee on Foreign Investment in the US warned the deal could lead to a decline in domestic steel production and could pose a national security risk, so the move by Nippon was seen as a last ditch effort to save the deal. Then, early Friday morning, Biden officially blocked the deal, sending shares lower.

- Apple: Apple is offering a discount, which it rarely does, of up to 500 yuan (equal to about $70 USD) on its latest iPhone models in China in a four-day promotional period, according to its China website. It has faced increased competition in China where it has significantly lost market share to domestic smartphone makers like Huawei.

- Microsoft: Microsoft said via a blog post by President Brad Smith that it will spend $80 billion in 2025 “to build out AI-enabled datacenters to train AI models and deploy AI and cloud-based applications around the world,” with more than half that spending occurring in the US.

Other News:

- US Debt Ceiling: The US debt ceiling was reinstated Wednesday so the government cannot borrow any more funds, forcing the Treasury to spend down its cash balance, until Congress passes another bill to suspend the debt ceiling.

- Treasury Department Hacked: The Treasury Department said it had experienced a major incident where a state-sponsored Chinese hacker was able to tap into computers of Treasury employees through access of third party software. Congress was notified on December 8th regarding the breach via a letter written to a couple Senators and said the information accessed included unclassified documents.

- China’s Growth: China President Xi Jinping said that China’s economy, measured by its GDP, is expected to have grown 5% in 2024, on track to meet its official target. He said the economy was stable and progressing amid stability with risks in key areas addressed while employment and inflation were steady. It is expected to release its 2025 growth target next month, which is expected to be similar to 2024. In addition, its Ministry of Civil Affairs is pushing local governments to provide more financial relief to those in need into the new year, a similar call that was made in September.

- PBoC Preparing For Rate Cuts: China’s central bank (People’s Bank of China) said “at an appropriate time” it will likely cut banks’ reserve requirement ratio and interest rates from the current level of 1.5% and said it would shift its focus toward the “role of interest rate adjustments” and away from loan growth, a move that aligns it more with developed central banks like the Fed and European Central Bank. It was early December that the political address from China noted making a shift to loose monetary policy.

- Record US oil Production: US oil production hit a new record high in October amid an increase in demand. Energy Information Administration data shows oil production increased about 2% in October compared to the month prior, or 260,000 barrels per day (bbl/day) to reach a new all time high of 12.460 million bbl/day. For 2024, oil production growth is expected to be 300,000 to 400,000 bbl/day more than in 2023. Oil demand in October saw a surprisingly large increase, up 700,000 bbl/day in the month to 21.010 million bbl/day, the highest demand since August 2019.

WFG News

Markets Closed January 9

Please also note markets will be closed on Thursday January 9th in observance of a national day of mourning for former President Jimmy Carter. It has been a long standing American tradition where financial institutions close following the death of a president

2025 Economic & Market Outlook Meeting

Wednesday January 22 – 6:00 pm – WFG Auditorium in Hudson, OH

Thursday January 23 – 12:00 pm – WFG Auditorium in Hudson, OH

Thursday January 23 – 6:00 pm – WFG Auditorium in Hudson, OH

Tuesday January 28 – 12:00 pm – Ravenna Office Downstairs Banquet Hall

Wentz Financial Group will be holding its semi-annual Economic and Market Outlook Seminars on the dates above. Join us as we recap a positive 2024, explain how we got to where we are today, as well as give our expectation and forecast on the economic and market environment and how that will affect portfolios in another challenging year ahead. We will have four seminar times. Please RSVP by responding to this email or by calling the office at 330-650-2700. Seat are limited for each event and will be on a first come first served basis. A buffet style meal will be served approximately 30 minutes before each event.

The Week Ahead

Markets will see a shortened trading week for the third consecutive week. Thursday is a National Day of Mourning in honor of former President Jimmy Carter with the stock market closed. The highlight for the week will be the Consumer Electronic Show (CES) and the monthly labor market reports. CES is one of the largest technology trade shows that kicks off today (Monday) and typically includes new product announcements and keynote speeches by notable people. All eyes will be on artificial intelligence and its advancements. The main economic event is the release of the December employment report on Friday where the current consensus estimates 160,000 new jobs were added in the month with no change in the unemployment rate. Other data on the labor market include the job openings and labor turnover survey, ADP’s payroll numbers, and jobless claims, with other data releases including factory orders, trade deficit, the ISM services index, and the consumer sentiment survey. The earnings calendar remains quiet before picking up pace next week with the start of Q4 earnings season. The only notable companies to report this week are Constellation Brands, Delta, and Walgreens. The 119th Congress convened last Friday and will begin its term this week with counting the electoral votes to certify the Presidential election. Elsewhere, Friday the Supreme Cort will hear arguments in the case for banning TikTok, something which Trump asked to be delayed beyond its current January 19th implementation date. Finally, there will be several Fed speakers making public appearances after a quiet period during the holidays.