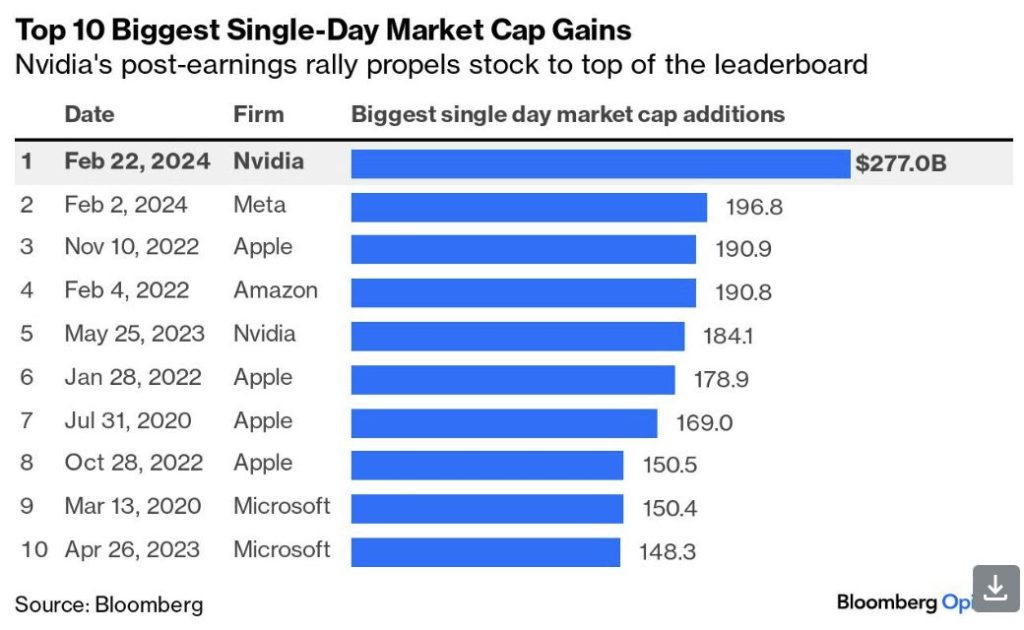

All eyes were on Nvidia’s fourth quarter financial results that were released after the market close on Wednesday. Its results were enough to drive the stock to a new record high after a 16% increase Thursday and a $2 trillion market cap, along with giving the market confidence the momentum behind artificial intelligence (AI) can continue to drive stock prices higher.

The S&P 500 rose for the 15th time out of the past 17 weeks after a 1.7% increase last week, driven by Nvidia’s 9% weekly gain and gains in the other ‘Magnificent 7’ stocks. Meanwhile, in the Treasury market yields moved to three-month highs over Fed comments that it may take more months of data to gain greater confidence inflation is coming down, after hotter than expected inflation readings two weeks ago.

Nvidia’s expectations heading into the quarterly results were very high, which explains why the stock saw some volatility heading into the release with a 7% decline the two days prior to. It reported revenues of $22.1 billion in the quarter, $1.55 billion more than Wall Street had expected, reflecting growth of 265% from the year ago quarter. Its net income was $12.8 billion, about $1.4 billion more than expected. Nvidia’s graphic chips that power AI fall under its data center segment. Revenue in that segment the same quarter a year ago was $3.62 billion. In its last quarter that grew to $18.4 billion, generating a majority of the company’s overall sales.

More importantly, investors were looking for what the company was projecting for the upcoming year. For the next three months the company said it is forecasting its revenues would grow to $24 billion, well ahead of analyst’s estimates of $22 billion. This better than expected forecast for the current quarter was one of the main reasons the stock rose to new highs. To reflect just how substantial the growth has been and its impact on the overall markets, Nvidia’s earnings growth made up 31% of the whole growth in S&P 500 earnings in the last quarter.

Beside the financials, management commentary on the conference call helped push the stock higher. Jensen Huang, co-founder and CEO of Nvidia, said “accelerated computing and generative AI have hit the tipping point. Demand is surging worldwide across companies, industries and nations.” Companies across the globe are using Nvidia’s chips, which crunch an immense amount of data used for AI models, to power their AI services, from chatbots to creating text and graphics based on single prompts, according to Bloomberg.

Huang said demand for its newest products will continue to outpace supply in the year ahead and demand is not showing any signs of slowing. He said the new investment cycle of generative AI represents a market opportunity in the “hundreds of billions.”

While the enthusiasm in AI has generated much of the chatter recently, outside of AI markets are still focused on the economy and the Fed. This week we will see more inflation data for January, the Fed’s favorite inflation reading – the PCE price index. The report comes out Thursday morning where economists have increased estimates slightly after the hotter than expected consumer price index data released two weeks ago.

Since that report, markets have pushed out the expectations on when rate cuts would begin, along with how many rate cuts we would see in 2024. Fed policymakers have tempered the market expectations on rate cuts as well. Many public comments over the past two weeks have reiterated the need for the Fed to see more months of data that provide it greater confidence that inflation is moving back to its 2% target before they find it necessary to cut rates. Several policymakers gave a reminder that there are risks in cutting rates too soon, which could reignite inflation, while keeping rates too high for too long could slow demand enough to cause a recession.

At either rate, the data this week should paint a more clear picture for January. The report includes data on the consumer, with personal income and consumer spending. Outside of a wave of economic data, earnings season rolls on with many smaller cap tech companies and several notable retailers reporting quarterly results.