Wentz Weekly Insights

Stocks Higher Last Week But Choppiness Expected This Week

Please note the weekly newsletter will be taking a week off, we will be back February 2.

It was another strong week for small caps as the rotation that began at the start of the year gained momentum last week. The Russell 2000 small cap index gained 2.04%, outperforming the S&P 500 by almost 3% while the S&P 500 equal weight index outperformed the cap weighted index by over 1%. There was a little weakness in big tech, led by Meta and Amazon with no specific reasoning despite semiconductors performing quite well.

There are a lot of moving pieces in the market recently. First off, the markets were hoping to get some clarity on the Trump tariff case, deciding whether the tariffs Trump imposed were legal or not, but the decision was not made and we will have to wait until at least its next decision day which could be as early as this week.

Separately, the Federal Reserve’s independence has been called into questions recently. Fed Chairman released a video saying he was issued a grand jury subpoena relating to the costs of remodeling the Federal Reserve building, increasing concerns on whether the Fed can maintain its independence. In it, Powell accused Trump of using his position to push lower interest rates. The concerns somewhat eased after seeing support for Powell from a list of past central bank leaders, US Senators (including many Republicans), even confusion inside the Trump Administration, while Trump said later in the week he has no plans to fire Powell.

Meanwhile, earnings season kicked off last week with some of the largest banks being the first to report. Financial results were decent but failed to meet the high expectations that markets expected. For example, JPMorgan was down on lower investment banking revenue, Bank of America was down on a lower net interest income guidance, Wells Fargo was down on a miss in net interest income despite stronger credit quality trends, and Citigroup was slightly lower despite a small beat on its financials.

Banks and credit card issuers were under further pressure after Trump called for a 10% cap on credit card interest rates for at least one year. This will require an act from Congress, something that appears to be gaining traction, but will likely not happen. Payment network companies like Visa and Mastercard were some of the hardest hit after Trump also called for support for the Credit Card Competition Act which is a proposed legislation aimed to increase competition in the credit card payment processing market, specifically how credit card transactions are routed and the “swipe” fees that merchants pay.

On the data side, the inflation reports (consumer price index and produce price index) were more of a non-event. Consumer inflation and producer inflation were both at or just near expectations. Consumer inflation increased 0.3% in December and was up 2.7% over the past year while core inflation was 2.7%, all the same increase as November. Inflation on the services side is still elevated though, rising 3.4% over the past year.

Markets will likely be on a weak start this week after news headlines over the weekend were dominated by Trump’s social media post where he said Denmark and other European countries will face a 10% tariff starting February 1, which will be increased to 25% in June, if there is no deal made for the US to purchase Greenland. European nations have even moved troops and ships to the island country to deter any threat, signifying the heightened tensions this has brought. We expect this to bring on a lot more uncertainty and expect a move higher volatility as a result.

This week the annual World Economic Forum takes place in Davos. The most anticipated event will be Trump’s interview scheduled Wednesday where he will be asked many questions around his recent announcements. We will also see several economic data reports, the most significant coming from the first estimate of fourth quarter GDP, as well as the next wave of earnings reports, highlighted by Netflix’s report on Tuesday.

Recent Economic Data

- Consumer Price Index: Consumer inflation, according to the consumer price index, increased 0.3% as expected in December with prices up 2.7% over the past year, matching November’s increase. Food prices increased 0.7% in the month, the largest monthly gain in almost 3 years, while energy prices increased 0.3%, with gasoline/oil falling and other energy like utilities rising. Excluding these two volatile categories, core consumer prices increased 0.3%, slightly below the 0.3% expected. Shelter prices rose 0.4%, transportation was up 0.5%, medical care was up 0.4%, new vehicles flat while used vehicle prices fell 1.1%, and apparel rose 0.6%. Core prices are up 2.6% over the past year, matching the pace from November. We have seen a large increase in prices around energy services like utilities which are up 10.8%. Finally, services prices excluding shelter were up 0.2% in the month and 3.4% over the past year, still slightly elevated.

- Producer Price Index (Delayed): The producer price index for November, delayed by a month, increased 0.2%, slightly lower than the 0.3% increase expected and the 0.3% that was seen in October. Food input prices were unchanged while energy prices surged 4.6% in the month. Excluding these two categories, producer prices for final demand goods increased 0.2% while prices for final demand services were unchanged. Producer prices are up 3.0% from a year ago, but up 3.5% excluding food, energy, and trade services, a big acceleration from 2.9% in October.

- Retail Sales (Delayed): Monthly retail sales were strong yet again in November, rising a better than expected 0.6% in the month with $735.9 billion in sales. All but one of the 13 major categories were higher in the month, with furniture stores declining, down 0.1%. The strongest sales growth was seen in sporting goods/hobby stores up 1.9%, followed by miscellaneous stores up 1.7%, gasoline sales up 1.4%, building materials up 1.3%, and vehicles up 1.0%. Excluding vehicles and gas, sales were up 0.4%. Retail sales have increased 3.3% over the past year, and after accounting for the 2.7% increase in inflation are up 0.6%.

- Jobless Claims: The number of jobless claims the week ended January 10 was 198,000, a decline of 9,000 from the week prior with the four-week average down 6,500 to 205,000, back down to the lowest level since January 2024. The number of continuing claims fell 19,000 to 1.884 million with the four-week average unchanged at 1.889 million. After trending higher for several months last year and reaching the highest since 2021, jobless claims have since moved lower to a 2-year low.

- New Home Sales (Delayed): The number of new home sales in October was 737,000 on a seasonally adjusted annualized basis, down 0.1% from September’s level but a recovery of 18.7% from a year ago. Outside of September this was the highest number of new home sales since early 2022. Supply of new homes has improved over the past few years, hitting the highest level since 2007 in June, is down slightly since then, but still 1.7% higher over the past year to 488,000 homes. The median sales price spiked during the pandemic to an all-time high of $442,600 in mid-2022 but is down to $410,000 in October as the housing market has cooled, falling 8.0% over the past year. However, this could also be due to the fact the median square footage of a new home is 6.3% smaller than those a year ago, so lower prices may be due in part to smaller new homes.

- Existing Home Sales: The number of existing homes sold in December was at a seasonally adjusted annualized rate of 4.350 million, a 5.1% increase in the month for the fourth consecutive monthly increase and the strongest sales rate since 2023. Sales are up 1.4% from a year ago. Existing home sales are based on closings, so this reflects homes sold from October and November, but rates are at basically the same level now as they were then. Supply of existing homes was a big story – the number of homes on the market is up 3.5% over the past year to 1.180 million, but down from around 1.500 million last summer, with just 3.3 months supply on the market. This is quite lean compared to 5.5 months supply the NAR says reflects a balanced market. The average home was on the market for 39 days, up from 35 days a year ago with sales more robust at the higher end of the market.

- Philly Fed Manufacturing Index: The Philly Fed manufacturing index was 12.6 for January, an improvement from -8.8 in December. About 23% of firms reported increases, 11% reported decreases, and 63% reported no change in current manufacturing activity. Employment remains positive but moved lower in the month with 70% of firms reporting no change. Firms continue to report overall price increases, but the index was the lowest since June, still a little elevated though.

- Empire State Manufacturing Index: The Empire State manufacturing index was 7.7 for January, improving from -3.7 in December. There was an increase in new orders and shipments and firms are more optimistic about the outlook with the index for future conditions at 30.3 with half the firms expecting improving conditions over the next 12 months. The index for employment was negative for the lowest reading in 2 years while the prices paid index was unchanged but still remains elevated at 42.8.

Company News

- Meta: Facebook parent company Meta said it is cutting at least 10% of its metaverse staff to shift its resources to artificial intelligence, according to the New York Times. Most of the cuts will reportedly be in the Reality Labs division that develops virtual reality headsets, rather than its augmented reality division that develops things like glasses and wristbands, and currently employs about 15,000 people. Meta said the decision to cut some of the VR jobs reflect lower demand for its VR headsets. In a separate report by Bloomberg, Meta is in talks to partner with eyeglass company Luxottica to double production of its AI-enabled Ray-Ban smart eyeglasses.

- UnitedHealth: Shares of UnitedHealth moved lower after the Wall Street Journal reported a Senate committee investigation found the company’s practices used aggressive tactics to collect higher paying diagnoses for its Medicare Advantage members. It said the company turned risk adjustment into a business which was not the initial intent. Separately, the company reaffirmed its 2025 forecasts of at least $16.25 earnings per share.

- Allegiant Travel: Budget airline Allegiant Travel said it has agreed to acquire budget airline Sun Country Airlines in a cash and stock deal valued at $1.5 billion, a roughly 30% premium to where shares traded prior to the announcement. Sun Country will receive $4.10 in cash plus 0.1557 shares of Allegiant for each share of Sun Country owned.

- Apple: Apple said it has chosen Google’s AI model Gemini to run its next version of Siri after a thorough evaluation saying its technology will provide the most capable foundation for Apple Foundation Models.

- Warner Bros. Discovery: Bloomberg reported Netflix is working on revising its terms for its proposed takeover of Warner Bros. Discovery by considering making it an all-cash offer, an effort to speed up the sales process and to fend off Paramount Skydance and its proposed acquisition.

- Taiwan Semiconductor Manufacturing: TSM shares were higher after it reported earnings that its revenues grew 26% with a 35% increase in its net income. In addition, The Information reported the company is telling its customers that they are unable to give them as much capacity as they need due to sharp demand, saying they cannot make AI chips fast enough.

- Goldman Sachs: Goldman Sachs said it is looking at opportunities in the prediction markets, one of the fastest growing ways to bet on real-world events (such as who will win the next presidential election). Its CEO said the market is super interesting and he has met with executives at the two largest prediction market companies.

- Credit Card Issuers/Payment Processors: Credit card issuers were some of the worst hit stocks the beginning of last week after Trump called for a 10% cap on credit card interest rates for at least one year. Payment network companies like Visa and Mastercard were also lower after Trump called for support for the Credit Card Competition Act which is a proposed legislation aimed to increase competition in the credit card payment processing market, specifically how credit card transactions are routed and the “swipe” fees that merchants pay.

Other News:

- Home Building: The Wall Street Journal reported the Trump Administration, according to FHFA Director Bill Pulte, is looking at targeting home builders over their stock buybacks, and instead help lower home prices by building more homes. Pulte implied there could be penalties for those that engage in buybacks or don’t help in the administration’s efforts to lower housing costs.

- Tariff Legality Decision: The Supreme Court did not announce its ruling on the Trump tariff case last Wednesday, delaying the decision for at least another week. The Supreme Court has not said when it will issue its next opinions but could schedule more this Tuesday or Wednesday when the justices are in session again, according to Bloomberg.

- Tariffs: The Trump Administration said it struck a new trade deal with Taiwan which would include new terms with the world’s largest semiconductor manufacturer Taiwan Semiconductor (TSM). The new deal includes Taiwan investing at least $250 billion, backed by the government, in semiconductors, energy, and AI production in the US and in return the US will lower tariffs on Taiwan to 15%, down from 20%. It also includes TSM building five new manufacturing sites in Arizona. Separately, Trump said he will impose 25% tariffs on goods from any country doing business with Iran.

- The Great Healthcare Plan: Trump rolled out a framework of a health care plan that the administration says will lower drug prices and insurance premiums, calling it “The Great Healthcare Plan.” The plan includes codifying the deals that were recently made with drugmakers to cut certain prescription drugs as part of Trump’s “most favored nation” policy, including the use of a new direct to consumer platform Trump Rx, and send money for health insurance coverage directly to Americans rather than giving insurance companies taxpayer funded subsidy payments. It would also increase accountability of insurance companies, including increased transparency, and fund a cost sharing reduction program which would reduce many Obamacare plan premiums.

- Fed Speak:

- St Louis Fed president Musalem said there is little reason to cut rates further and he sees current rates “right around neutral,’ adding that it is inadvisable to put policy in an accommodative/stimulate stance.

- Philly fed president Paulson said she feels cautiously optimistic on inflation (to keep moving lower) and said she still sees more room for rate cuts.

- Atlanta’s Bostic said he still sees the need to keep policy a little restrictive and let things play out because inflation, despite making some progress, hasn’t been at target for many, many years now. He said the labor markets have weakened but that does not mean the labor markets are weak, noting the 4.4% unemployment rate (historically low).

- Minneapolis’ Kashkari said the economy remains resilient and the elevated borrowing costs are not limiting growth as much as he expected, mostly due to a solid consumer and the AI boom. He noted the labor market is moving sideways, not seeing widespread layoffs, and inflation is still too high and that may mean less rate cuts needed this year.

- Kansas City’s Schmid, one of the officials voting against rate cuts, said he has not changed his mind on rates and inflation. He said he is reluctant to cut rates further until there are more convincing signs inflation is heading in the right direction, adding there is no room to be complacent, and that cutting rates would do more harm to the inflation side of the Fed’s mandate than benefit on the employment side.

Did You Know…?

Artificial Intelligence Productivity Reviews Mixed:

While artificial intelligence is taking over many tasks for workers, studies and surveys show humans are still spending a great amount of time fixing its mistakes, as reported by Axios. A report by software company Workday showed 85% of respondents said AI saved them 1-7 hours a week, however 37% of that time they saved is used on what they call rework – where workers have to correct errors from AI, verify output, and rewrite content. On the other hand only 14% said they get outcomes from AI that are consistently positive. The most frequent users of AI are the ones spending the most time reviewing and correcting its outcome. Workday noted typically the more a new technology is used the more efficient it becomes, but with AI the more proficient the user gets, the more they understand ways the new technology can go wrong. While artificial intelligence is still in the early stages, for example the chatbot ChatGPT that sparked the whole AI interest was released just three years ago, there have been several other studies that call out its lack of productivity gains, including MIT and Harvard Business Review.

WFG News

Upcoming Events:

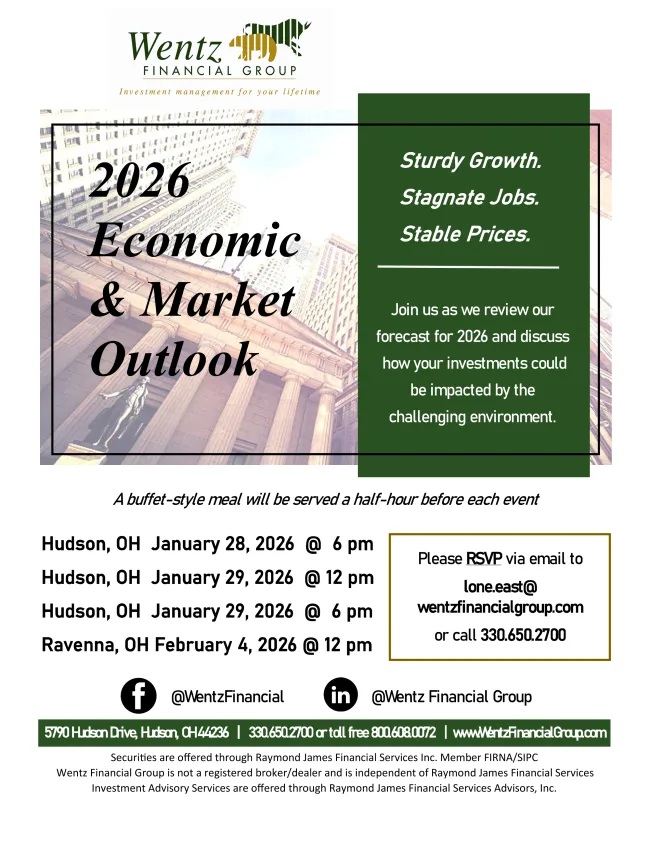

See the flyers below for our upcoming events. In late January, we will host our 2026 Economic and Market Outlook meeting, where we will review key developments from 2025 and share our outlook for how we see 2026 shaping up.

In March, we will welcome a Social Security Specialist who will provide an overview of how Social Security works and discuss key strategies to help maximize your benefits.

Click the links below to RSVP today!

WFG Investment Classes:

Interested in learning more about investing and how the markets work? Wentz Financial Group holds various Investment Basics classes throughout the year. Contact us for details!

Reminder – 2026 Contribution Limits Increased:

- 401k, 403b, and 457 plans: The contribution limit increases $1,000 to $24,500. Catch up contributions, for those over the age of 50, increases $500 to $8,000. The “Super catch-up”, for those aged 60-63, remains at $11,250.

- Another important rule to note that goes into effect next year – For those age 50 and over that make more than $150,000, any catch up contribution must be made as a post-tax Roth contribution (rather than a traditional pre-tax contribution).

- IRAs (Traditional IRA and Roth IRA): The contribution limit increases $500 to $7,500. The catch up contribution, for those over the age of 50, increases $100 to $1,100.

- Simple IRAs: The contribution limit increases $500 to $17,500. Catch up contributions, for those over the age of 50, increases $500 to $4,000. The “Super catch-up”, for those aged 60-63, remains at $5,250.

The Week Ahead

It will be a shorter week with markets closed Monday for Martin Luther King, Jr. Day. However it will still be a busy week with many headlines expected. First, the annual World Economic Forum kicks off in Davos, Switzerland, with many looking forward to the interview scheduled on Wednesday, which is timely considering the threats around Greenland. We will hear from many executives as well from some of the largest companies in the world. Staying on the political side, government shutdown concerns may pick back up with Congress needing to pass nine more appropriations bills by the January 30th shutdown deadline. Earnings season picks up pace this week as we start hearing from larger companies while next week is the busiest of the quarter with a bulk of the S&P 500 reporting and most of the Magnificent seven companies. Notable companies reporting quarterly financials this week include 3M, Fastenal, Netflix, United Airlines, Johnson & Johnson, Halliburton, Charles Schwab, Procter & Gamble, GE Aerospace, Abbott Labs, Intel, Capital One, Alcoa, and CSX. Notable earnings next week include UnitedHealth, GM, UPS, Boeing, Microsoft, Tesla, Apple, IBM, AT&T, SoFi, and Chevron. This week has several economic data reports scheduled, several of them delayed from several months ago. The first is construction spending from October, then the personal income and spending report for November which will include the PCE price index (a widely followed inflation reading). Other normal scheduled releases include jobless claims, consumer sentiment, and the first revision on fourth quarter GDP. The latest consensus estimate sees GDP growing 4.3% annualized in the quarter. Next week includes durable goods orders (delayed from November), consumer confidence index, jobless claims, November trade deficit, factory order (delayed from November), and the producer price index (delayed from November). This week it will be quiet from a Fed standpoint with no Fed speak as policymakers are in a quiet period ahead of the next FOMC meeting January 30. Current futures pricing is showing just 5% odds the Fed cuts rates, the other 95% odds on no rate cut.