Wentz Weekly Insights

Busy Week Sends Stocks Lower, Now Election Time

In a week that was full of key economic data and the busiest week for third quarter earnings, US stocks ended up mostly lower with bond yields rising. It was the second consecutive week of declines for the S&P 500, which dropped 1.37%, while the Nasdaq fell 1.50% and snapped a seven week winning streak.

Meanwhile, bond yields moved higher, continuing the upward trend that began after a hotter than expected inflation report several weeks ago and has continued since. There are also worries about the rising debt level and increasing interest cost on US debt, something that has received more scrutiny as we get closer to the election. This is despite several labor market reports from last week that painted a slowing economic picture.

One of the bigger reasons for equity market weakness last week was from big tech. Some of the largest companies in the world reported financial results including Alphabet, Microsoft, Meta, Amazon, and Apple. A key theme for the first three (Alphabet, Microsoft, and Meta) is the massive bets on artificial intelligence and if that will pay off with larger revenues. Those three companies reported better than expected sales and profits, but concerns about capital expenditures are increasing.

The numbers are staggering, with Alphabet (Google parent company) spending $13 billion in the quarter, up from $8 billion in last year’s third quarter, Meta spending at $9.2 billion, up from $6.8 billion last year, and Microsoft’s spending up $14.9 billion, up from $9.9 billion last year. A big chunk of the spending is going to the data center chips that power artificial intelligence, which is why chipmaker Nvidia has been such a large beneficiary.

For Meta, its losses in Reality Labs is growing. That division contains its virtual reality, augmented reality, and its metaverse products. It lost $4.4 billion in the quarter, increasing 18% from last year. It also said it expects spending to be significantly higher in 2025, worrying investors about higher costs. For Apple, its iPhone sales were better than expected but the stock was down because its guidance was lower than estimates with investors becoming worried its new AI software, Apple Intelligence, will not be enough to cause an upgrade cycle and boost demand. Amazon was positive after beating expectations with solid guidance due to strength in Amazon Web Services, its highly profitable cloud computing division.

Later in the week there was a higher hope of a quicker pace of rate cuts. This was due to the disappointing labor market data. A slower labor market could mean a weakening economy, which would cause the Fed to increase the pace of rate cuts.

First, on Tuesday, the job openings and labor turnover survey showed there were 7.4 million job openings the last day of September. This was below expectations, down from August, and a new 3 ½ year low. It was just two years ago that job openings peaked at an all-time high of 12.2 million. At that time there were 2.2 job openings for every unemployed person. Today that number has fallen to 1.1 and below the long-term average.

Then, the DOL labor report on Friday showed that just 12,000 jobs were added in October, well below the average of 158,000 over the past year and the smallest number of monthly job gains since December 2020. Moreover, the DOL said they overstated job growth by 102,000 in August and September, revising the two months lower.

The household survey was weak as well – the number of people employed fell 368,000 while the number of people unemployed increased 150,000. The unemployment rate however remained at 4.1% as it found 220,000 people left the labor force.

Wages continue to rise faster than inflation too – the average wage increased 0.4% in the month and are up 4.0% from a year ago, both more than expected.

After the report, stocks and Treasury yields initially moved lower, however both reversed shortly after the open. The reason may be due to a special statement made in the labor report where the DOL said its survey responses were lower than average and the data may be impacted from the two hurricanes as well as the effects of the Boeing worker strike.

Whether it was an excuse for the weak data or a preview of things to come is yet to be seen. We cannot make a trend with a single month of data, but overall the labor market is apparently slowing. This more than likely inks in another rate cut at the Fed’s next meeting this Wednesday. Investors are pricing in a 98% chance of a rate cut, but the next meeting is more uncertain, with investors now pricing in a 80% chance of another cut, up from roughly 65% prior to the labor data.

Investors will look to fine tune those odds after Chairman Powell’s press conference shortly after the policy announcement Wednesday afternoon. There is likely to be many questions on the recent labor market data, stubborn inflation, and pace of future rate cuts.

But that is not the only big event in focus this week. The other is the more obvious one – the US election. All focus is on the Presidential race, where currently odds are a toss up or a slight Trump advantage. Just as important is the race for Congress. The Republicans currently are the favorites to end with a slight majority in the Senate, while the House is more of a toss up.

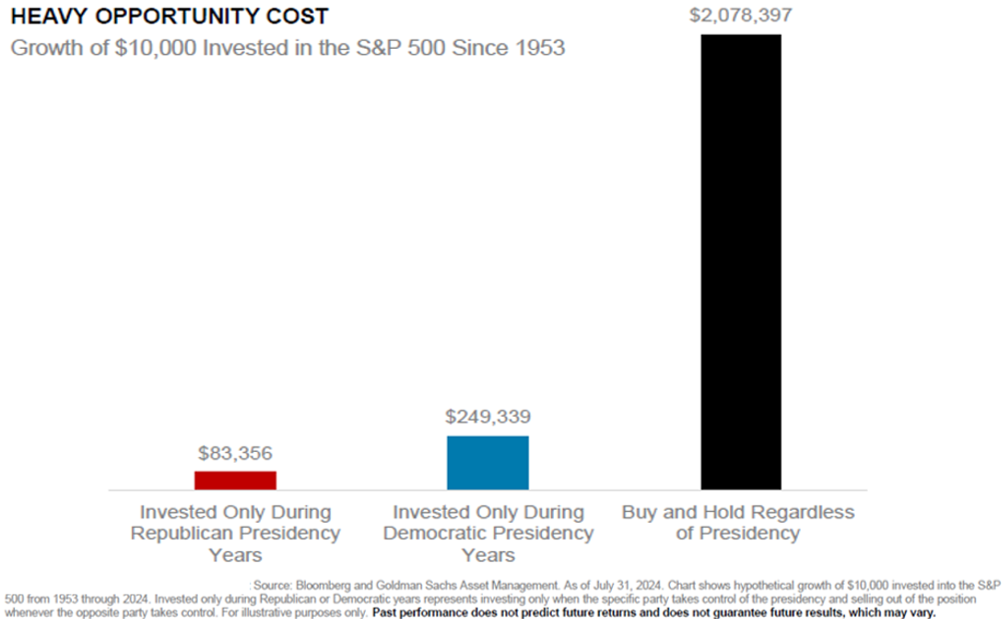

At any rate, as history has shown, making investment decisions based on who is in the White House turns out to be a bad idea. The more logical strategy is to keep your long-term investment objectives in mind and avoid making emotional decisions based on which party controls Washington.

The chart below helps illustrate this – the red bar is $10,000 invested in the S&P 500 since 1953 during only Republican Presidencies, the blue bar is $10,000 invested in only Democratic presidencies, while the black bar is $10,000 invested when buying and holding regardless of presidency. The current value of that $10,000 for the red bar is $83,356, the blue bar is $249,339, while the black bar is $2,078,397.

Week in Review:

Stocks were mostly lower last week with downside driven by weakness in Big Tech and Real Estate. The major US stock indices finished as follows: Russell 2000 +0.10%, Dow -0.15%, S&P 500 -1.37%, and Nasdaq -1.50%. Treasury yields were higher across the curve, sending bonds lower. The 2-year Treasury yield rose 10 basis points to 4.22% while the 10-year yield rose 15 basis points to 4.40% for the highest since July. The volatility in oil continued due to geopolitical concerns in the Middle East, falling early in the week before rising the end of the week but ultimately settling down 3.2%. The dollar index was unchanged, gold fell 0.2% from all-time high levels, while Bitcoin gained 4.3%.

Recent Economic Data

- Third Quarter GDP: The first look at third quarter GDP shows the economy grew at a 2.8% annualized rate in the quarter, a little lower than the 3.0% expected and down from 3.0% in Q2. But the most important component of GDP, consumer spending, remains quiet strong and resilient. Consumer spending increased a better than expected 3.7% which is the strongest since Q1 2023 and contributed 2.5% to the GDP number. Spending on goods increased 6.0% while spending on services increased 2.6% (remember these are annualized numbers). Next is government spending, which has been driving a lot of growth since the pandemic, with a 5.0% increase in the quarter and contributing 0.9% to GDP. Business fixed investments were strong, rising 3.3% due to a boost in equipment spending (mostly semiconductor equipment) and contributed 0.5% to GDP. Residential investment (new home building) was weak, declining 5.1% and contributed a negative 0.2% to GDP. Exports rose 8.9% while imports rose 11.2%, with net exports contributing a negative 0.6% to GDP. Finally, inventory stocking slowed, which contracted 0.2% from GDP.

- Personal Income & Outlays: All in all, the data was relatively in line with expectations:

- Personal incomes rose 0.3% in September, slightly below the 0.4% increase expected and slightly higher than 0.2% increase from August. The wages and salaries category of incomes, which is the largest, increased 0.5% in the month, higher than recent trend. Incomes are up 5.5% from a year ago with wages and salaries up a larger 6.4%.

- Personal outlays (consumer spending) increased 0.5% in September, slightly more than expected and rising from the August rate, signaling continued consumer resiliency. In fact it was the strongest month since March. Outlays are up 5.1% from a year ago. Spending growth was equally driven by a 0.5% increase in both goods and services.

- The personal savings rate was 4.6% in September, back to the lowest level since December and has remained below its 10-year average of around 7.5% since the pandemic period when Americans were locked up at home unable to spend.

- The PCE price index, another key read on inflation, increased 0.2% in the month and is up 2.1% from a year ago – the monthly rate ticked higher while the annual rate decelerated slightly. The core PCE price index (excludes food/energy) increased 0.3% and is up 2.7% from a year ago – a monthly rate that ticked higher as well, but the annual rate that remained unchanged.

- Job Openings & Labor Turnover Survey: The number of job openings as of the last day in September fell to 7.443 million, down from 7.861 million from August and a new 3 ½ year low and also below expectations of 8.0 million. Since the peak of 12.2 million in 2022, job openings have declined 4.74 million. At its peak, there were 2.2 job openings for every unemployed person, which has fallen to 1.1 in September. In addition, there were 5.196 million separations in the month (on an annual basis) with 3.071 million of those being quits, a level that has steadily declined, indicating workers less likely to switch jobs or finding it harder to find a better job.

- Jobless Claims: The number of jobless claims the week ended October 26 was 216,000, falling 12k from the prior week with the four-week average at 236,500, down just slightly. This could be due to the numbers normalizing after recent worker strikes and hurricane related impacts. The number of continuing claims was 1.862 million, down 26k from the prior week with the four-week average at 1.869 million up about 11k from the prior week.

- ADP Payrolls: The ADP payroll data for October showed a much stronger number of payroll gains than expected with 233,000 in the month, the most in 15 months, above the 115,000 estimate, higher than 159,000 from last month, and well above the recent trend.

- Employment Report: According to the Department of Labor, payrolls grew by just 12,000 in October, well below the 100,000 increase expected and the smallest number of job gains since the decline in December 2020. The report has a special statement on the hurricane related impact of the data, saying there were lower survey response rates, but the DOL is unable to quantify the net effect on the change in payroll numbers, wages, and hours worked, etc. The only industry with notable growth was education/health services and government. A big issue has been revisions to prior months’ data and that was the case again in this past month. August payrolls gains were revised down 81k to now 78,000, while September payrolls were revised down 31k to 223,000. The household survey showed weakness as well – the number of people employed fell 368,000 while the number of people unemployed increased 150,000. With that, the unemployment rate remained at 4.1% due to 220,000 people supposedly leaving the labor force (and no longer counted in the labor force). The U-6 rate, or the underemployment rate, remained at 7.7%. The average wage grew 0.4% in the month, again hotter than expected, and is up 4.0% from a year ago, matching September’s pace.

- Employment Cost Index: The employment cost index, an important quarterly read on compensation costs for employers which the Fed also puts a high weighting on when assessing inflationary pressures, increased 0.8% in the third quarter. This is the smallest quarterly increase since Q2 2021 and was slightly below the expected 0.9% increase for the quarter. The 0.8% increase was due to a 0.8% rise in both wages and salaries as well as benefit costs. The change over the past 12 months was 3.9%, falling from 4.1% in Q2.

- S&P Case-Shiller Home Price Index: The Case-Shiller home price index showed home prices increased 0.3% in August, in line with expectations. The index showed home prices are up 4.2% over the past year, decelerating from the 4.8% annual gain in July with the report noting home price increases are “beginning to show signs of strain” as home prices have decelerated for six straight months. The highest annual increases were more mixed, with New York region seeing the highest increase of 8.1%, followed by 7.3% in Las Vegas. The slowest home price gains were seen in Denver (up 0.7%) and Portland (up 0.8%). Cleveland region was near the top regions at 6.9%.

- Consumer Confidence Index: The Conference Board’s Consumer Confidence index was 108.7 for October, much better than the 99.5 expected and the best since January. The present situations index was 138.0, up from 124.3 for the best since May while the expectations index was 89.1 versus 81.7 last month and the best since December 2021.

- Mortgage Rates: Mortgage rates have took a somewhat dramatic swing higher over the past month after reaching a two year low around the end of September. Last week the prime 30-year mortgage rate was 6.72%, up another 18 basis points over the week and up 64 basis points from a month ago.

Company News

- Super Micro Computers Audit Issues: Shares of Super Micro Computers was one of the worst performers last week, losing 45% after it disclosed in a regulatory filing its auditor Ernst & Young has resigned as its accounting firm. Ernst & Young said it was due to information that recently came to its attention that had led it to question the company’s integrity and ethical values in connection with an accounting review. This comes several weeks after Super Micro had delayed its annual filings over internal controls and a couple weeks after the Department of Justice launched a probe into Super Micro that it violated accounting rules.

- Boeing Capital Raise and Worker Strike: After recent reports Boeing was exploring ways to raise capital, the company announced it will raise over $21 billion by offering 112.5 million shares of common stock as well as preferred stock. It said the proceeds will be used for general corporate purposes, including repayment of debt, additional working capital, capital expenditures, and funding/investments in its subsidiaries. Separately, late in the week a deal was made between Boeing and its labor union, ending a weeks long strike that was draining cash from the company that caused it to issue $21 billion in new stock and cut 17,000 jobs. The new contract agreement includes a 38% wage increase over four years. Many union members were pushing for Boeing to bring back its pension, but that is not included in the deal, instead Boeing will increase 401k contributions.

- Apple Intelligence: Apple said its new update is available and will include its highly anticipated Apple Intelligence with its iOS 18.1 update. It also announced its new version of its Mac desktop that uses its new M4 chip, helping it introduce its AI in its device. The new desktop is up to 1.7x faster than the previous Mac chips.

- Comcast Considering Spinoff: Comcast said it is considering spinning off its cable networks (such as NBC, MSNBC, CNBC, the Golf channel, etc) into a separate company to shareholders. This would not include its streaming service Peacock or its broadcast.

- Google Search Competition: Google saw a move lower last week after OpenAI (creator of ChatGPT) said it is adding new search features to its ChatGPT. Users can search something and get a fast response with links to relevant web sources. Separately, Meta (parent company to Facebook) is reportedly working on a search engine for users that utilize its AI chatbot. These are seen as a direct competitor to Google’s Search feature.

- Ford Pausing F-150 EV Production: Ford said it will pause production of its signature EV pickup, the F-150 Lightning, through the end of the year due to weak EV demand. Sales of the F-150 Lightning have increased this year, but have fallen well short of the company’s expectations.

- Dow Index Shakeup: Late on Friday, S&P Dow Jones Indices said it will be adding Nvidia and Sherwin-Williams to the Dow Jones Industrial Index which will replace Intel and Dow. The change will take effect before the open November 8. Dow Jones said the changes were made to “ensure a more representative exposure to the semiconductors industry and the materials sector.”

Other News:

- Treasury Refunding Announcement: The Treasury announced its borrowing plans for the fourth quarter 2024, saying it expects to borrow $546 billion, down $19 billion from its July estimate and would leave the Treasury with a cash balance of about $700 billion. It also said it expects to borrow $823 billion in the first quarter 2025, which would be a first quarter record. Thoughts on the borrowing plans were mixed with some analysts calling for a larger cut to Q4 borrowing and others expecting an increase due to seasonal reasons. It also announced refunding plans for the quarter which offered no surprises, saying it plans to offer $125 billion in securities with $8.6 billion in new cash. It said it continues to expect to hold its auction sizes steady, as it has said the prior couple quarters, so no big surprises for the Treasury markets. There were concerns it may raise offerings to boost its cash supply ahead of the next debt ceiling the beginning of 2025.

- Crude Oil Volatility: Crude oil fell at the beginning of the week by over 6%, its biggest daily drop in 2 years, from Israel strikes on Iran that were more limited than expected. There were worries the strikes would target Iranian oil facilities, with the strikes instead targeting military sites. Then, later in the week, oil moved higher after reports said Iran is preparing a retaliatory attack on Israel in the coming days from Iraqi territory using a large number of drones and ballistic missiles, citing Israeli intelligence.

Did You Know…?

The New #1

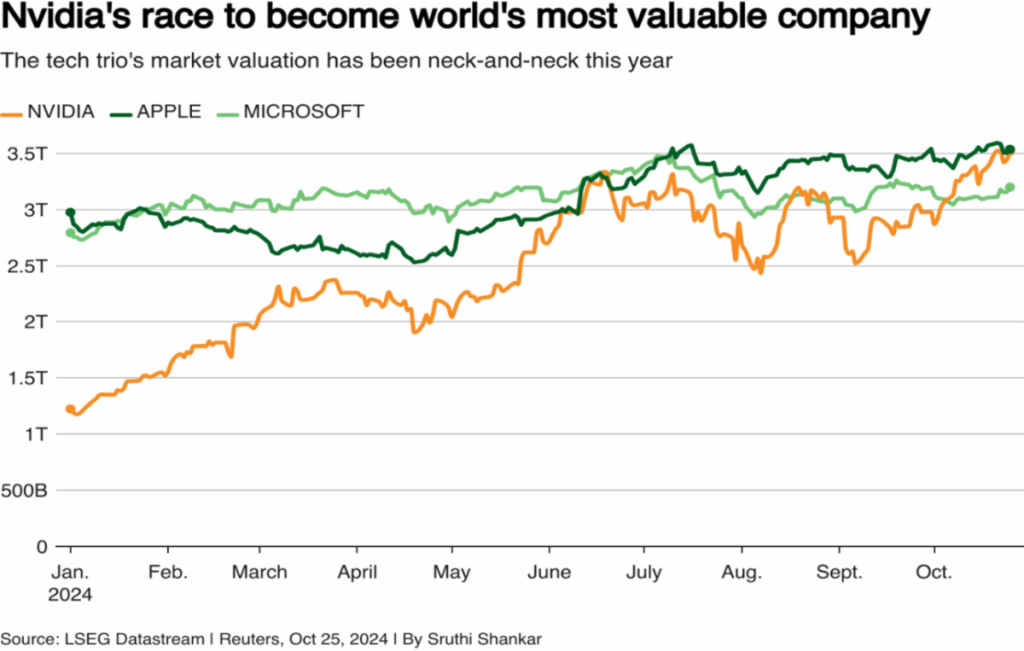

After a strong move higher in October, Nvidia kicked Apple as the world’s most valuable company late last week. Nvidia’s market capitalization (which is taken by multiplying the company’s shares outstanding by the stock price) surpassed $3.53 trillion while Apple’s was right around $3.52 trillion. In 2024, three companies, Nvidia, Microsoft, and Apple, have been trading the spot as the world’s most valuable company. Nvidia dominates the chipmaking market, specifically the chips that are used in all artificial intelligence applications. Source: Reuters

WFG News

SAMPLE TEXT. DELETE THIS AND THE SEPERATOR BlOCK BELOW IF UNUSED.

The Week Ahead

There will be two key and closely followed events this week – the US election and the Fed’s FOMC meeting. Election Day is Tuesday and is not important for just the race for the White House, but also for Congress with the majority for the House and Senate up for grabs. The Fed meeting begins Tuesday with its policy announcement coming Wednesday at 2:00. The Fed is widely expected to move forward with another rate cut, this time just 25 basis points (after a 50 bps cut in September). There will be a big focus on Chairman Powell’s press conference after the meeting and what is said about the pace of future rate cuts. Though these two events will take the spotlight, there will still be many smaller headlines on earnings reports. This week another 20% of the S&P 500 is scheduled to report third quarter financial results. Notable companies reporting include Palantir, Cleveland Cliff’s, Wynn, Goodyear Tires on Monday, Super Micro Computers on Tuesday, CVS, Celsius, Arm Holdings, Qualcomm on Wednesday, Datadog, The Trade Desk, Block, Affirm, Airbnb, Warner Bros. Discovery, Halliburton on Thursday and Sony on Friday. On the economic data side of the calendar, not many key reports, but less high profile data releases like vehicle sales, factory sales, trade data, the ISM services index, productivity & costs, jobless claims, and consumer sentiment.