Wentz Weekly Insights

Economic Data Deteriorates with Retail Sales Declining to End 2022

Recent Economic Data

- The Empire State Manufacturing survey index fell to -32.9 in the January survey, the fifth worst reading in the series history, and down from -11.2 in December, indicating manufacturing activity in the New York region declined at a much faster pace in the month. The report says new orders and shipments “declined substantially” while inventories built and delivery times held steady. Employment growth came to a halt while input prices “slowed considerably.”

- The Philly Fed manufacturing survey index was -8.9 for January, indicating continued declines in activity in the manufacturing sector in the Philly region for the seventh decline of the past eight months. Firms noted overall activity, new orders, and shipments declined at a slower pace in the month. Prices continue to increase with the index remaining elevated. Feelings about growth over the next six months was very mixed.

- The producer price index fell a much more than expected 0.5% in December, coming after a 0.3% increase in November. Over the past 12 months, producer prices are up 6.2%, a sharp deceleration from 7.4% the 12 months ended November and lower than expected. Energy prices fell 7.9% while food fell 1.2%. Prices for final demand goods was 1.6% lower, but prices for final demand services still rose 0.1%. Core producer prices, which exclude food, energy, and trade services rose 0.1% in the month and are 4.6% higher over the past 12 months, down from 4.9% in November.

- Monthly retail sales for December fell 1.1%, a little more than the 0.8% decline expected, showing consumers slowed their spending the last month of the year and holiday shopping season – it actually appears that consumers started their holiday shopping early, with strong sales in October and most of November. Gasoline sales contributed a lot to the decline due to a 4.6% decline as prices dropped, while vehicle sales fell 1.2%. Excluding these two more volatile categories, retail sales were still down 0.7%, more than the 0.1% drop expected. Only two of the eleven core categories saw a monthly increase (building materials up 0.3% and sporting goods/hobby/musical up 0.1%) while the largest declines were in furniture down 2.5%, online sales down 1.1%, and bars and restaurants down 0.9%. Sales are 6.0% higher from a year earlier, matching November’s 12 month rate, and up 7.2% for core sales.

- Industrial production, covering manufacturing, mining, and electric/gas utilities, fell 0.7% in December versus the 0.1% decline expected. Most of this was due to a 1.3% decline in manufacturing output, which was widespread throughout the sector, which follows a weak November where output fell 1.1%. Utilities offset manufacturing weakness, rising 3.8% in the month getting a boost from the cold month. Capacity utilization, which measures sustainable potential output, was 78.8%, a sharp drop from 79.4% in November – anything over 80 typically brings bottlenecks.

- The number of construction starts on new homes was 1.382 million on an annualized basis in December, down 1.4% from November levels and down 21.8% from the level a year prior. Looking at the details, there was strong growth in starts on single family homes – rebounding 11% in the month (however still down 25% from a year earlier as home builders slow the pace of new home builds due to the slowing housing market and high cancellation rates). Starts on multi-family units fell 19% in the month, offsetting gains from single-family homes, but down 16% over the past year. For all of calendar year 2022, there were 1.553 million housing units started. Permits to build new homes fell 1.6% in December to a seasonally adjusted annualized rate of 1.330 million. This is 30% lower than the level a year earlier. For the calendar year 2022 there were 1.649 million housing units authorized by building permits.

- Sales of existing homes fell 1.5% in December, to an annualized pace of 4.02 million, to close out 2022 with the eleventh consecutive month of declines as affordability becomes a bigger issue. This was a 34% decline from the 6.09 million pace in December 2021 and represented the slowest sales pace in over 10 years. Total inventory of existing homes fell another 13% in the month to 970,000 units, its fifth consecutive decline, now sitting at 2.9 month supply at the current sales pace, an improvement over the year, but due almost entirely from the decline in the pace of sales. The median price of an existing home continues to increase despite the slower sales pace, up 2.3% in the month to $358,800 with prices rising in all regions. Despite the slowdown, sellers are still selling houses quickly – 57% of homes were sold in less than a month, with the average existing home on the market for 26 days, up from 24 days in November and 19 days in December 2021. First time home buyers are making up a larger chunk of existing home buyers, now at 31% of sales, up from 28% in November.

- For the week ended January 14, there were 190,000 unemployment claims filed with states, a decline of 15k from the week prior with the four-week average lower again now at 206,000. Continuing claims were 1.647 million, a small increase of 17k, with the four-week average down slightly to 1.634 million.

- The 30-year prime mortgage rate fell to 6.15% last week, the lowest since September and falling from the high of 7.08% in November, according to the mortgage survey from Freddie Mac.

Company News

- After completing its strategic review of its international business, Whirlpool said it will combine its European appliance business with Turkish appliance maker Arcelik to form a new entity which it will maintain 25% ownership, along with selling its Middle East and Africa business to Arcelik. The new entity will have combined sales of over €6 billion. With the news, Whirlpool said its North American division saw a significant one-time supply chain disruption with one supplier that will negatively impact sales, production, and EBIT.

- High profile layoffs continue – Microsoft says it will lay off 10,000 employees, approx. 5% of its employees, and would take a $1.2 billion charge as a result. It will still hire in key strategic areas. Separately, Google said it would lay off roughly 12,000 employees, equal to about 6% of its staff.

- Procter & Gamble’s fourth quarter eanrings report gained attention last week after it reported mixed results. Better results were driven by a 10% increase in prices, however this was offset by a 6% decline in volumes, which was worse than the 2% decline in volumes that was expected, leading to demand concerns.

Other News

- The Treasury said the U.S. government reached its statutory debt limit of $31.38 trillion late last week and Treasury Secretary Janet Yellen told Congress the extraordinary measures it would take to avoid a default on its debt. Congress will need to pass legislation to increase the debt limit, which will prove to be a difficult task due to the split Washington – Republicans controlling the House while Democrats control the Senate. It makes it more difficult Republicans, so far in the new House, have been in disagreeance, apparent by their inability to select a Speaker to the House, until the 15th round of voting. Analysts are estimating these extraordinary measures would last until about mid-year until the government would default on its debt.

- JPMorgan CEO Jamie Dimon said he believes rates are “probably going to go higher than 5%” because there is too much underlying inflation that won’t go away quickly. He says the recent slowdown in inflation we have seen is due to temporary factors like the slowdown in China from Covid restrictions and lower oil prices. Separately, JPMorgan strategists warned the markets are not accurately pricing in the possibility of a recession

- In global news, the Bank of Japan concluded its policy meeting last week with no changes to policy, coming after a hawkish surprise at its last meeting to increase the range it would allow the 10 year government bond to fluctuate (up to 0.50% from 0.25%), so there was a little speculation of another surprise especially as inflation moves higher. It did say it will continue large scale purchases of Japanese government bonds to maintain its yield curve control and did not back down from this. The government bond initially moved lower but then moved back to the 0.50% cap suggesting the BoJ will need to keep buying billions in bonds to keep the cap in place.

- China said its economic growth was just 3% in 2022, missing its target of 5.5% and growing at the slowest pace since 1976 as it dealt with numerous lockdowns/restrictions and continued issues in the property sector.

- Recent Fed Speak (policymakers go into a quiet period starting after Friday as the next FOMC meeting approaches):

- Boston Fed President Collins said rates need to continue to rise even though we are seeing slower demand in rate sensitive sectors, expects rates to rise just above 5% and hold there “for some time.” Supports a 25 bps increase at the next meeting.

- Fed Vice Chair Brainard supports the view of keeping policy restrictive for some time and a slower pace of increases now will enable the Fed to assess data as rates continue to move to a “sufficiently restrictive level”. Laid out a scenario where the Fed lowers demand enough to make inflation come down without a significant loss of employment and said she does not see the economy on track for a 1970’s type inflationary environment.

- NY Fed President Williams said higher rates are starting to bring prices lower but it is showing at different speeds, especially non-energy services which are moving lower at a “far slower pace” due to the continued imbalance between supply and demand. With these imbalances, its clear monetary policy still has work to do, meaning ongoing rate increases, according to Williams.

- Philly’s Fed president Harker said 25 bp increases ongoing are more appropriate until rates rise to slightly above 5%, saying he supports moving slowly now and not overreacting. Says the economy is slowing but not in a recession because the labor markets “are simply too hot”.

Did You Know…?

- The Treasury said the U.S. government reached its statutory debt limit of $31.38 trillion late last week and Treasury Secretary Janet Yellen told Congress the extraordinary measures it would take to avoid a default on its debt. Congress will need to pass legislation to increase the debt limit, which will prove to be a difficult task due to the split Washington – Republicans controlling the House while Democrats control the Senate. It makes it more difficult Republicans, so far in the new House, have been in disagreeance, apparent by their inability to select a Speaker to the House, until the 15th round of voting. Analysts are estimating these extraordinary measures would last until about mid-year until the government would default on its debt.

- JPMorgan CEO Jamie Dimon said he believes rates are “probably going to go higher than 5%” because there is too much underlying inflation that won’t go away quickly. He says the recent slowdown in inflation we have seen is due to temporary factors like the slowdown in China from Covid restrictions and lower oil prices. Separately, JPMorgan strategists warned the markets are not accurately pricing in the possibility of a recession

- In global news, the Bank of Japan concluded its policy meeting last week with no changes to policy, coming after a hawkish surprise at its last meeting to increase the range it would allow the 10 year government bond to fluctuate (up to 0.50% from 0.25%), so there was a little speculation of another surprise especially as inflation moves higher. It did say it will continue large scale purchases of Japanese government bonds to maintain its yield curve control and did not back down from this. The government bond initially moved lower but then moved back to the 0.50% cap suggesting the BoJ will need to keep buying billions in bonds to keep the cap in place.

- China said its economic growth was just 3% in 2022, missing its target of 5.5% and growing at the slowest pace since 1976 as it dealt with numerous lockdowns/restrictions and continued issues in the property sector.

- Recent Fed Speak (policymakers go into a quiet period starting after Friday as the next FOMC meeting approaches):

- Boston Fed President Collins said rates need to continue to rise even though we are seeing slower demand in rate sensitive sectors, expects rates to rise just above 5% and hold there “for some time.” Supports a 25 bps increase at the next meeting.

- Fed Vice Chair Brainard supports the view of keeping policy restrictive for some time and a slower pace of increases now will enable the Fed to assess data as rates continue to move to a “sufficiently restrictive level”. Laid out a scenario where the Fed lowers demand enough to make inflation come down without a significant loss of employment and said she does not see the economy on track for a 1970’s type inflationary environment.

- NY Fed President Williams said higher rates are starting to bring prices lower but it is showing at different speeds, especially non-energy services which are moving lower at a “far slower pace” due to the continued imbalance between supply and demand. With these imbalances, its clear monetary policy still has work to do, meaning ongoing rate increases, according to Williams.

- Philly’s Fed president Harker said 25 bp increases ongoing are more appropriate until rates rise to slightly above 5%, saying he supports moving slowly now and not overreacting. Says the economy is slowing but not in a recession because the labor markets “are simply too hot”.

WFG News

Updates on 2022 Tax Documents

Secure Act 2.0 – Important Retirement Account Changes

- The Required Minimum Distribution (RMD) age was increased to 73 this year and is scheduled to increase to 75 by the year 2033.

- The penalty for a missed RMD is reduced to 25% (from 50% currently).

- Starting in 2025, all new 401k plans must have automatic enrollment. New employees will be automatically enrolled at a 3% contribution rate and automatically increase by 1% each year until the contribution rate is 10%, unless employees opt out.

- Emergency savings accounts will be established within a 401k to allow people to save $2,500 annually in an emergency savings account

- Employers can now do their employer match in Roth contributions if they like. The plan would need to have Roth option available.

- Starting in 2023, SIMPLE and SEP plans can allow contributions on a Roth basis

- After 2025, if your income is over $145,000 – your catch up contribution must be made as Roth

- Employers now have the ability to recognize payments made on student loans as elective deferrals, and therefor match on those payments to a retirement plan to assist those people paying on loans to save, effective in 2024.

- Retirement plan lost and found is being created on DOL website for those people who may have old 401k accounts

- Financial hardships – Employees will now self-certify if they qualify for a financial hardship to take a permissible withdrawal

- For those ages 60-63, the catch-up contribution limit is raised to $10,000 or 50% higher than the regular catch up amount, whichever is higher, effective for 2025.

- A 50% tax credit for administrative costs incurred by new businesses is increased to 100% for small businesses (less than 50 employees).

- Special Rules on 529’s – Beneficiaries of 529 accounts have the options to rollover these balances tax free to a Roth IRA as long as the 529 account has been opened for 15 years. These rollovers are subject to Roth contribution limits annually.

Economic & Market Outlook Meeting

The Week Ahead

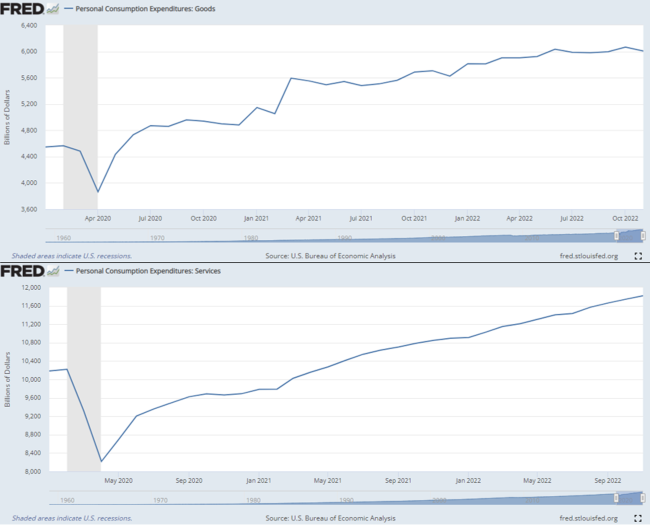

It will be a much busier week on the earnings calendar, while the economic calendar will include key reports on the economy and consumer. Nearly 20% of S&P 500 companies will be reporting their quarterly results this week. Highlights for the week include Baker Hughes on Monday, 3M, Johnson & Johnson, Verizon, General Electric, Microsoft on Tuesday, Tesla, AT&T, Boeing, IBM on Wednesday, American Airlines, Comcast, Dow, Intel, Visa on Thursday, and Chevron and American Express on Friday. The two key reports on the economic calendar will be the first estimate on fourth quarter GDP on Thursday morning and the personal income and spending report on Friday. On GDP, economists are expecting the economy grew at a 2.7% annualized rate in the quarter, still good but another slowdown from the prior quarter. On Friday, income is expected to have increased 0.2% in December while spending is expected to have declined 0.1%, which would follow a disappointing retail sales report. On the other hand, the Fed’s preferred measure of inflation, the core personal consumption expenditure price index, is expected to have increased 0.3% in the month and 4.4% from a year ago, a slowdown from 4.7% the month prior. Elsewhere, durable goods orders, unemployment claims, and new home sales for December are released Thursday, and the week is wrapped up with the pending home sales index and the January consumer sentiment survey. We will see a break from Fed speak as policymakers go into a quiet period before next week’s FOMC policy meeting.