Wentz Weekly Insights

Economic Growth Remained Strong in Q1

In a busy week full of earnings, stocks were able to break a three week losing streak with the S&P 500 rising 2.67% and NASDAQ outperforming with a 4.23% gain after Microsoft and Alphabet (Google) posted much better results than expected. It was the best week for stocks since November. Treasuries saw less volatility and moved in a small range with the 2-year Treasury yield unchanged at 5.00% while the 10-year yield rose 4 basis points to 4.67%. Foreign exchange received more attention, particularly the Japanese yen after it weakened to 155.60 per dollar, the weakest in over 30 years.

Alphabet saw a 12% gain after its earnings release from reporting better than expected results with growth accelerating in its Search, YouTube, as well as cloud businesses. Investors also liked the fact AI contributed to growth in its cloud segment. In addition, it announced a dividend for the first time ever, equaling a 0.5% yield, and a new $70 billion share buyback program. With the increase in shares Friday, the company passed the $2 trillion market capitalization level.

On the same day, Microsoft shares rose about 2% after it beat already elevated expectations by a solid margin with revenue in its key Azure (cloud) business accelerating to a 31% year-over-year increase. Similar to Alphabet, the company said the AI impact was larger in the quarter compared to the prior, leading investors to believe the massive investment in AI looks like it will pay off. Microsoft’s market cap rose back to $3 trillion after the report.

Outside of earnings, the big story was about two economic data reports – the personal income and outlays data that included inflation readings for March as well as the first estimate of first quarter GDP.

Personal income rose 0.5% as expected in March with a 0.7% increase in wages driving most the increase. Consumer spending continues to be very strong, rising another 0.9% in March, almost double the growth expected. Spending on services remains hot, rising 7.7% over the past year with spending on goods rising a slower, but still solid, 4.6%.

The PCE price index, which the Fed puts the most weight on, rose just as much as expected with a 0.3% increase, but the change from a year ago in core prices (which exclude food and energy prices) rose a slightly higher than expected 2.8%. This is still too high for the Fed and something we expect Chairman Powell to talk about after the FOMC meeting this week.

GDP was a surprise to the downside, but comes after estimates have steadily increased through the quarter. GDP (gross domestic product), one of the most common figures in measuring economic growth, rose at an annualized rate of 1.6% in the first three months of the year. This was lower than the 2.4% expected (and lower than the 3.5% some at the higher end were expecting) and is the slowest growth pace in two years.

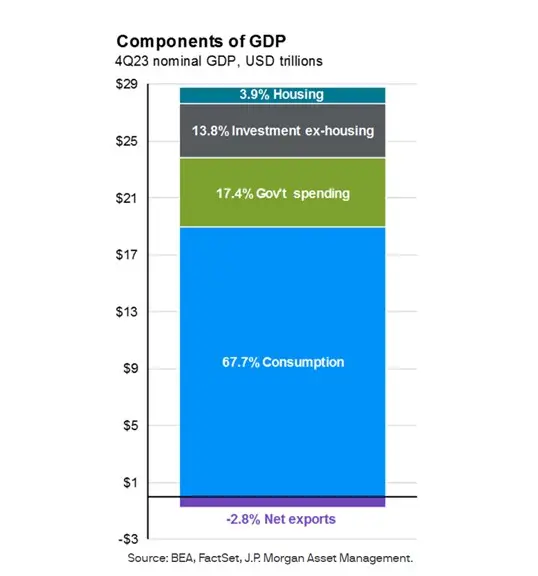

However, the most important component, consumer spending, was very strong – increasing 2.5% in the quarter. GDP is made up of several components including consumer spending (making up roughly 70% of the overall number), business and residential investments, government spending, net exports, and inventory growth, as illustrated in the chart below (based on Q4 2023 numbers).

Consumer spending’s 2.5% growth contributed 1.7% to the GDP number, driving most of the growth in the quarter. Residential investment, basically home building, rose 13.9% and contributed 0.5% to GDP. Business investment increased 2.9% and contributed 0.4% to GDP. Government spending, which along with consumer spending has been a massive growth driver to the US economy, increased 1.2% and contributed 0.2% to GDP.

The negatives were inventory adjustments and net exports. The growth in inventories was slower and contributed a negative 0.4% to GDP. Exports rose 0.9% but imports rose 7.2%, leading to a negative 0.9% contribution to GDP. Despite the headline 1.6% growth coming in below expectations, we view the number as quite strong due to the important components of consumer spending and fixed investments.

It will be another big week this week as investors look for another 35% of S&P 500 companies to report quarterly results, including mega caps like Apple and Amazon, as well as important economic data. The focus will be on the jobs market with the employment report Friday as well as the employment cost index, which is followed for early hints on inflation trends (the thought is employment costs higher would lead to higher costs for businesses and cause higher prices).

But perhaps the biggest event will be the Fed’s FOMC meeting and policy announcement Wednesday at 2:00pm, with Chairman Powell’s press conference to follow. Markets will look for any discussion on the path of rates after significantly repricing for less rate cuts since the beginning of the year. This week could set the tone for markets for the next several months.

Recent Economic Data

- Personal income & outlays:

- Personal incomes rose 0.5% in March, right in line with expectations. The important wages and salaries category of wages, the largest source of income by far, rose 0.7% in March and is now up 6.4% from a year ago, with real wage growth about 3.5% (wage growth minus inflation). After taxes, consumers’ disposable income rose 0.5% and is up 5.7% from last year.

- Consumer spending remained quite strong in March with a 0.9% increase in the month with consumer spending up 7.1% from a year ago. There was a strong bounce in spending on goods, which rose 1.3%, while services spending remained strong with a 0.6% increase. Over the past year spending on goods has increased 4.6% while spending on services has increased 7.7%.

- The result was another decline in the personal savings rate which stood at 3.2% in March, an extremely low reading, last seen a couple months right after the pandemic when the economy reopened and compares to the 10-year pre-pandemic average of about 7.5%.

- The PCE price index rose 0.3% in the month as expected, while core price also rose 0.3% as expected. The 12-month change in the PCE index was 2.7%, slightly higher than expected and increasing from 2.5% in February, while core prices are up 2.8%, also slightly more than expected and matching February’s rate.

- New Home Sales: Sales of new homes rose 8.8% in March to a seasonally adjusted annual rate of 693,000, and is about 8% above the rate from March 2023. The data is pretty volatile and revisions are sometime large, as was the case for February that had a downward revision to 637k home sales, which made the increase in March look better. Nonetheless, it was the strongest sales rate since September and appears new home sales have been recovering as there continues to be a major lack of supply with existing homes (people do not want to list their homes and give up their low mortgage rates they locked in). Home builders have quickly caught up with demand with inventory of new homes steadily improving, now at 477k, the highest inventory of new homes since the housing boom in the mid-2000s (for comparison purposes, supply pre-pandemic was around 330k).

- Durable Goods Orders: Sales of durable goods rose a strong 2.6%, but as is usual this was mostly related to transportation, more specifically aircraft where orders rose 30.6% (still recovering from a 63% decline 2 months ago). Orders of durable goods excluding transportation rose 0.2% as expected. The more important category, shipments of nondefense core capital goods excluding aircraft, rose 0.2% and is a slight positive for GDP.

- Jobless Claims: Jobless claims fell another 5,000 to 207,000 for the week ended April 20, bringing the four-week average 1k lower to 213,250. The number of continuing claims was 1.781 million, falling 15k from the prior week with the four-week average at 1.794 million, a small decline from the week prior. As mentioned last week, jobless claims have trended in this very low range since September, and only going above 250,000 three times (all last summer) since 2021.

- Money Supply: The money supply in the US (which includes cash on hand, deposits at banks, money market balances) rose $92.6 billion in March, or about 0.45% a relatively sizeable monthly increase, but down about 0.3% from a year ago. The massive increase in money supply, up 35% since pre-pandemic, is one of the reasons many believe we have an inflation problem. But the 4.1% decline from the all-time high April 2022 is also a reason some see an economic slowdown coming. The rise, and now the decline, are both the highest since the Great Depression.

- Mortgage Rates: Mortgage rates have been on a steady rise higher since the beginning of the year after falling in the fourth quarter last year – the prime 30-year rate was 7.17% last week, according to the Freddie Mac survey, which is 7 basis points higher than the prior week. The rate started the year at 6.61%, but is still below this cycle high of 7.79% from October.

Company News

- Express Bankruptcy: Express filed for Chapter 11 bankruptcy protection. The filing will allow it to facilitate a sale of a majority of its stores and operations which is in discussion to be sold to a consortium led by private equity group WHP Global (who owns brands like Toys R Us, Babies R Us, and Joseph Abboud).

- Blocked Deal: The Federal Trade Commission filed a lawsuit to block Tapestry’s (brands like Coach, Kate Spade) $8.5 billion acquisition of Capri (brands like Versace, Michael Kors), claiming the merger would eliminate competition between the popular luxury brands while employees would lose benefits and more favorable workplace conditions.

- Apple’s iPhone Sales Slump: A new report from Bloomberg said Apple’s recent sales slump continued in the latest quarter, saying iPhone sales in China declined 19% in the quarter, citing data from Counterpoint Research. This would mark the worst performance for the iPhone in China since the pandemic. Its market share in China’s smartphone market reportedly declined to 15.7%, down from 19.7% a year ago.

- Apple’s Vision Pro: A TF International Security analyst says that Apple has cut its forecast for its Vision Pro units that it expects to ship, now expecting to ship between 400,000 – 450,000 units in 2024, down from its prior forecast of between 700,000 – 800,000, with the analyst citing recent checks. In addition, it expects Vision Pro shipments will decline in 2025 from 2024 levels and not having a new model in 2025.

- Cleveland Cliff’s Interest in US Steel: Bloomberg reported that Cleveland Cliff’s CEO is still interested in purchasing U.S. Steel, who has agreed to be acquired by Japanese Nippon Steel but is undergoing an national security review with the deal in jeopardy. The CEO said he is willing to buy the whole company if the US blocks Nippon Steel’s purchase, but the bigger interest is on the union-represented assets.

Other News:

- Airlines’ New Rule: A Department of Transportation rule was implemented that will require airlines to give passengers a full refund for cancelled, delayed, or changed flights that meet certain criteria. This includes flights that are 3+ hours delayed (6+ for international), or for flights that have changed connections/airports, and includes refunds on checked bags if the bags are delayed at least 12 hours.

- Japanese Yen: Global currencies have received more attention this year due to the increase in volatility. The Japanese yen has been on a continued slide versus the dollar and other global currencies and just hit its weakest level in over 34 years. The exchange rate was 155.60 yen per dollar as of Friday. The massive weakening of its currency picked up pace when the Fed started raising rates in 2022 while Japan kept its interest rates at 0% where they are still at today. There have been several reports recently that Japan will intervene to support its currency. The currency slid further after the Bank of Japan held its policy meeting and made no changes to policy early Friday.

- 24/7 Trading: The New York Stock Exchange is reportedly gauging interest for 24/7 trading. It has started polling market participants and the interest and implications for moving to an exchange that trades 24/7. The report by the Financial Times adds it is one of many surveys the exchange does so does not mean it is considering the move. This comes shortly after 24 Exchange had applied to be the first 24 hour exchange to the SEC, which is backed by Steven Cohen’s hedge fund, Point72.

- Funding for Ukraine & A Possible TikTok Ban: The Senate ended up passing, and the President signed, the House $95 billion foreign aid package that provides billions in aid to Ukraine, Israel, and Taiwan. The package also includes a bill that would force TikTok to sells itself or face a ban in the U.S. After the package was signed, ByteDance, the owner of TikTok, said it would prefer to shut down TikTok operations in the U.S. over being forced to sell itself.

WFG News

Estate Planning Seminar

May 7, 2024 @ 6:00 pm

Join us on May 7 as we welcome James Contini, Lawyer and Director of Krugliak, Wilkins, Griffiths & Dougherty Co., L.P.A. as he discusses the important need for Estate Planning and effective ways to plan for your future.

See flyer below for details.

The Week Ahead

It will be a very busy week, full of earnings reports, Fed updates, and economic data. This week is the busiest for first quarter earnings season with nearly 35% of S&P 500 companies set to report their quarterly results this week including mega cap companies like Apple and Amazon. Other notable earnings releases will come from Sofi, Paramount, Coca-Cola, AMD, McDonald’s, PayPal, CVS, Qualcomm, Pfizer, Mastercard, MGM, and Monster Beverage. Economic data turns to the labor market with updates for April with ADP’s payroll data and the job opening and labor turnover survey on Wednesday, jobless claims on Thursday, and the employment report on Friday. Current consensus estimates see a gain of 230,000 jobs for April, which would be a slowdown from March but still reflects strong gains. Another important release is the quarterly employment cost index, which is closely followed for signs of inflation. Other data releases this week include the Case Shiller home price index, consumer confidence, the ISM and PMI manufacturing surveys, construction spending, trade data, productivity and costs, factory orders, and the ISM services index. The Treasury refunding announcement will take place Wednesday where the Treasury will announce its funding needs for the next two quarters, which has been closely followed the past year or so due to the rapidly increasing funding needs. The other major event is the FOMC meeting where the Fed is expected to keep rates unchanged, but markets will focus on forward guidance for any clues on when to expect rate cuts and by how much.