Wentz Weekly Insights

Stocks Fall As Fed Signals Less Rate Cuts In 2025

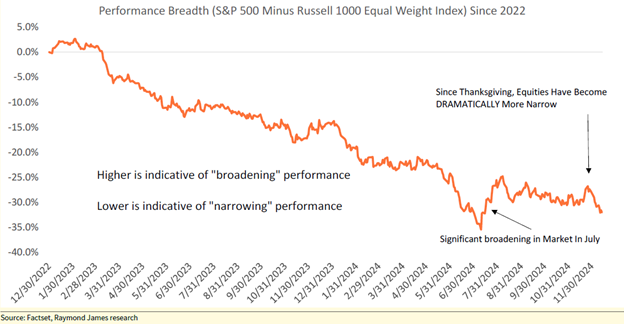

Stocks had a down week, driven by Wednesday which was the second worst day of the year as the S&P 500 fell almost 3%. The big event was the FOMC meeting where the Fed cut interest rates again. But that was not what sent stocks lower – it was the fact the Fed sees less rate cuts in 2025 that what it previously projected three months ago. The other big market story was disappointing breadth in stocks.

Stocks have seen negative breadth, looking at the number of stocks positive each day compared to the number of stocks negative, for 13 consecutive days through Wednesday, which was the longest streak since data began going back to 1978. In addition, the Dow was down for 10 straight days through Wednesday, the longest losing streak since 1974, the year of the Watergate Scandal.

The S&P 500 fared better and the Nasdaq even better. The reason is the largest companies in the indexes have been the best performing (stocks like Apple, Amazon, Alphabet, Meta, Tesla, Nvidia, and Microsoft). The remainder of the index has substantially underperformed over the past couple weeks. The progress we have seen since the election, where the rally in stocks broadened out to small caps and the rest of the market, was just about erased over this recent period. The percent of S&P 500 members above their 50-day moving average has fallen to around 40%, the lowest since the pullback in August. The reading was at 85% as recent as late September and has lost 40% since then, despite the S&P 500 index gaining over 5% over the same period.

The chart below is a great visual of the pattern we have experienced since the beginning of 2023. The line indicates the performance difference of the S&P 500 and the Russell 1000 equal weight index (an index of the top 1000 stocks that all carry the same weighting). A declining line indicates performance that is narrowing – that is several stocks driving performance. When the line is sloping up it indicates a broadening of performance – that is where most stocks participate in the upside versus just a few. You can see a small move upward in October/November this year, then a dramatic turn lower.

The big event for the week was the Fed meeting that concluded with a rate cut, the third consecutive cut. The meeting concludes with the release of the policy statement which was basically unchanged from the prior meeting. The only change was including the wording “the extent and timing of” when considering additional rate changes. When asked about this in the press conference, Chairman Powell said it was to suggest the slower pace of rate cuts moving forward. Also important to note, there was one dissent by Cleveland Fed president who voted to keep rates unchanged.

As is the case every other Fed meeting, once every quarter, this meeting also provided an update to the Summary of Economic Projections (SEP), a summary of where all Fed members see policy rates, economic growth, unemployment, and inflation over the next several years. This caught the most attention – the Fed projected just two rate cuts in 2025 versus its prior projection of four cuts. In addition, inflation and economic growth projections moved higher while unemployment projections moved lower.

Powell said the decision to cut was a close call but he believed the right thing to do. It is clear that the risks to inflation are to the upside, and it is clear most policymakers incorporated Trump policy into their projections and decision making (stronger growth which may lead to higher inflation for longer). Powell said the current rate is still restrictive (higher than the “neutral” rate). He said the slower pace next year reflects the “higher inflation readings we have had this year and the expectations inflation will be higher” and because risks and uncertainty around inflation will be higher. For further cuts the Fed wants further progress on inflation and continued strength in the labor market.

We are in a period now of greater uncertainty on Fed policy – due to both the uncertainty on which direction the data is heading as well as the uncertainty on where the neutral interest rate is. The neutral rate is the rate that neither restricts economic growth nor supports/stimulates economic growth. The fact of less rate cuts and higher uncertainty on policy is what led to stocks seeing their second worst day of the year and Treasury yields spiking.

Now markets enter what is typically the strongest part of the year, referred to as the Santa Claus rally. This is the last five trading days of the year and first two of the following year. As Raymond James notes, historically the S&P 500 has been up 0.5% on average and has been positive 75% of the time over the previous 20 years. This week is very quiet with several economic data releases, no corporate or earnings events, and no Fed or political items to note.

Recent Economic Data

- Retail sales: Retail sales were once again stronger than expected – sales increased 0.7% in November versus the 0.5% increase expected. In addition, October’s 0.4% increase was revised up to a 0.5% increase. However, much of the monthly gain could be attributed to a larger increase in vehicle sales which rose 2.6%. Excluding vehicles, retail sales increased 0.2% which was half the expectation. Of the 13 major retail categories, 7 of them saw an increase in sales in the month, led by vehicles, online stores, sporting goods/hobby stores, while declines were led by miscellaneous stores and restaurants/bars. From a year ago, retail sales are up 3.8%, while core sales excluding vehicles/gasoline are up 3.9%, versus the 2.7% increase in inflation, meaning real retail sales (inflation adjusted) are up 1.2%.

- Personal income and outlays:

- Personal income increased 0.3% in November, slightly less than the 0.4% increase expected and comes after a strong 0.7% increase in October. Incomes are up 7.6% from a year ago. Wage and salaries were up 0.6% in the month and up 5.5% from a year ago. Consumers’ disposable income was up 0.3% in the month and is up a strong 7.2% from a year ago. Government benefit payments accelerated with a 8.6% annual increase, and outside of the pandemic period due to stimulus payments, is the highest in over 10 years.

- Consumer spending increased 0.4% in the month, slightly lower than the 0.5% expected, with October’s 0.4% increase revised down to 0.3%. Spending on goods was solid in the month with a 0.8% increase, while spending on services was a little weaker with a 0.2% increase. However, over the past year spending on goods is up only 1.5% while services spending is up 9.5% as has been the case since coming out of the pandemic.

- The PCE price index, which is the inflation reading that receives the most weight, increased 0.1%, lighter than the 0.2% increase expected. The index is up 2.4% over the past year, slightly lower than expected but up from the prior month and the highest annual rate since July. This is a reason why the Fed is projecting less rate cuts in 2025 than previously expected, because inflation is trending in the wrong direction lately. The core PCE index was the same, rising 0.1% in the month and up 2.8% over the past year, both 0.1% lower than expected but the highest rate in several months.

- Empire State Manufacturing Index: The Empire State Manufacturing index was 0.2 for December, indicating manufacturing conditions in the NY region barely grew in the month. The index is a significant drop from 31.2 from November but that now appears to be a short term surge that happen just one month. The report noted a modest increase in new orders, small decline in employment, and input and selling prices that increased moderately.

- Philly Fed Manufacturing Index: The Philly Fed Manufacturing index was -16.4 for December, the lowest since April 2023, indicating manufacturing activity contracted at a faster pace in the month compared to the -5.5 reading from November. New orders and shipments declined, employment increased but at a much slower pace, while prices continue to increase, with the price index near the highest level since late-2022. The report noted 33% of firms reported decreases in activity (up from 23% last month), only 16% reported an increase, and the other 47% reported no change.

- Industrial Production: Industrial production declined 0.1% in November, versus the expectation of a 0.3% increase, and comes after a 0.4% decline from October. The decline was due mostly to a 1.3% decline in utilities and a 0.9% decline in mining, offset somewhat by a 0.2% increase in manufacturing. Capacity utilization, how much output a plant maintains versus its maximum level, was 76.8%, a big miss against expectations and the lightest since April 2021.

- Housing Market Index: The housing market index, an index of homebuilder sentiment, was 46 for December, unchanged from the month prior and ending the year at the best level since early spring. The report noted homebuilders have expressed concerns that high interest rates, elevated construction costs, and lack of buildable lots will continue to be headwinds. The index of the present situation was 48, unchanged from last month, the index of expected sales the next six months improved to 66, up from 63 last month, while the index of traffic of prospective homebuyers fell to 31, down one point from last month.

- Housing Starts & Permits: The housing starts report continues its streak of disappointments, with the number of housing starts falling 1.8% in November to a seasonally adjusted annualized rate of 1.289 million. This is a 14.6% decline from the pace November 2023. The number of new housing units authorized by permits was much better, potentially hinting at a rebound in starts, with permits rising 6.1% in November to an annualized rate of 1.505 million, however still slightly lower from a year ago. Another interesting point, the number of housing units authorized but no yet started construction has steadily risen this year, whether it’s a sign of lack of labor, supplies, or demand. On the other hand the number of housing units under construction has declined significantly over the past year to 1.434 million (annualized) from 1.683 million last year.

- Existing Home Sales: Existing home sales saw a small increase in November, rising to a seasonally adjusted annualized sales rate of 4.150 million, a 4.8% increase from a last month and 6.1% from a year ago. Recall existing home sales are based on closings, so these number reflect contracts that were signed in September and October when rates fell to the year’s low. Inventory continues to improve with 1.33 million existing homes on the market, up 17.7% from last year. The average existing home sold for $406,100, up 4.7% from a year ago. the number of first time homebuyers made up 30% of home purchases, up from last month but still lower from a year ago. About 18% of sales were sold above the listing price and all cash sales remain high.

- Mortgage Rates: After falling for three weeks, according to the weekly Freddie Mac mortgage survey the average prime 30-year mortgage rate increased 12 basis points last week to 6.72%. It is up 64 basis points from the year’s low back in September. A separate survey showed mortgage rates shot up after the Fed meeting Wednesday with the average rate up 21 basis points to 7.12%.

- Q3 GDP: The third (and final) revision to third quarter GDP had growth better than previously expected with the economy growing at a 3.1% annualized pace in the quarter, up from 2.8% in the first two estimates. The update to GDP reflected upward revisions to exports and consumer spending, which was partially offset by downward revisions in inventory growth and imports.

- Jobless Claims: The number of jobless claims the week ended December 14 was 220,000, a decrease of 22,000 from the prior week, with the four-week average up slightly to 224,250. The number of continuing claims declined 5k to 1.874 million with the four-week average down slightly to 1.880 million.

Company News

- Pfizer: Pfizer shares are higher this morning after it reaffirmed its 2024 guidance and provided a 2025 forecast that was slightly ahead of consensus estimates.

- Novo Nordisk: Drugmaker Novo Nordisk shares fell around 20% Friday after saying its weight loss drug under trial fell short of expectations.

- PBM Weakness: Certain stocks in the health care sectors, specifically pharmacy benefit managers (who negotiate with drugmakers and pharmacies on behalf of insurers), have fallen significantly since the election and more so over the past couple days. This comes after Trump said he would be targeting the PBMs and that they are making way too much, saying “we are going to knock out the middleman.”

- Apple: A report from the WSJ is saying Apple is planning major design changes including thinner and foldable iPhones that would be cheaper than the Pro models, with Apple planning to incorporate a more simple camera system to lower the costs. It has been working on several different designs, including having a display on the outside when the device is unfolded, but the sources say an inward display has been preferred. Apple was planning for a 2026 release, but technical issues may push it to 2027.

- Nucor & US Steel: The steel sector is seeing recent weakness due to dampened optimism from skepticism the US Steel/Nippon Steel deal will be blocked. In addition, Nucor said its earnings will be lower than it previously thought due to reduced volumes and lower average selling prices. Separately, US Steel said later in the week its earnings will be much lower than expected due to a more difficult pricing environment and higher costs related to one of its projects.

- Honda & Nissan: Honda and Nissan are reportedly in merger talks as both struggle to advance their EV efforts, according to Nikkei. A separate report by Reuters says the companies are talking about setting up a holding company which would allow them to share more resources. Neither company confirmed merger talks but did say in the release they have been exploring possibilities for future collaboration to leverage each other’s strengths.

Other News:

- Softbank’s Massive Investment: CEO of the tech-oriented investment holding company Softbank, Masayoshi Son, met with Trump last week and following the meeting said the company would commit $100 billion in investments to the US over the next four years, while aiming to create 100,000 jobs related to AI and infrastructure.

- Government Funding Bill: Congress initially reached a bipartisan stopgap spending bill that would extend the government funding deadline to March 14 (past last Friday’s deadline) in a bill that would include $100 billion in emergency aid and several other items like limiting US investments in China, extending health programs that are expiring, and funds to support farmers. However, Trump voiced his opposition to the bill, calling for a more streamlined version that keeps disaster and farm aid, but excludes other “Democratic giveaways.” It took until the final hours before the government shutdown deadline that Congress agreed on a new bill that still included disaster relief and farm support, and keeps the government funded through March 14.

- Stock Trade Ban: President Biden said he would endorse a ban on stock trading by Congress members, saying “I don’t know how you look your constituents in the eye and know because the job they gave you, it gave you the inside track to make more money.”

- Central Bank News:

- The Bank of Japan left its benchmark rate unchanged, with expectations mixed on a small increase or no change, the latter of which was increasingly priced in as of late. Comments from its Governor indicated the central bank is open to waiting longer to raise rates for the third time this cycle, something that sent its currency, the yen, lower. He said it needs more data on Japan’s wages and the impact from Trump policy before committing to a rate hike.

- After implementing two rate cuts this year, the Bank of England said in its last policy meeting of the year it would keep its benchmark rate unchanged at 4.75% and, similar to the Fed, signaled slower/more gradual rate cuts in 2025 as concerns over stagflation (slow/no growth combined with higher inflation) rise. Markets are giving the highest probability for two rate cuts for 2025, down from four cuts just days ago.

- Other central bank meetings included the Norges Bank leaving rates unchanged, and Sweden’s Riksbank lowering its policy rate 25 basis points.

Did You Know…?

AI Chip Demand:

Microsoft is buying twice as many AI chips from Nvidia as its biggest rivals (recall these run about $40,000 per chip), according to a report from the Financial Times, citing tech consultancy firm Omdia. It estimates Microsoft has bought 485,000 of Nvidia’s Hopper chips, more than double the 224,000 chips that the next biggest buyer has bought, which was Meta. This is followed by Amazon with 196,000 and Google with 169,000 Hopper chips. It added that it estimates tech companies have spent nearly $230 billion on servers this year, which was led by $31 billion from Microsoft and $26 billion by Amazon. These same tech companies are also buying AI chips from AMD (its MI300 chips), led by Meta’s purchase of 173,000 of its MI300 chips.

WFG News

WFG Closed December 24 & 25

Please note that Wentz Financial Group will be closed Tuesday December 24th and Wednesday December 25th. We will be back open Thursday morning the 26th.

The Week Ahead

This week will be a short and quiet one with markets closed early on Tuesday at 1:00 pm and closed all day Wednesday. The corporate calendar is very quiet with no company earnings reports and no other notable corporate events. The economic calendar is also light on releases – the only notable data points include consumer confidence, durable goods orders, new home sales, and jobless claims. The political and Fed calendar is quiet as well.