Wentz Weekly Insights

Impressive First Half Tech Driven Rally

|

|

Recent Economic Data

- Home prices in the US, according to the monthly Case-Shiller home price index, recorded a 0.5% monthly increase in April with all 20 major metro markets reporting a monthly increase and 12 of those seeing the monthly increase accelerate. This was the third consecutive monthly gain after seven straight months of declines. However, prices are now down 0.2% over the past year, slipping into negative after a 0.7% annual increase in March. The West continues to be the weakest region with Seattle and San Francisco seeing the largest annual declines, down 11.1% and 12.4% respectively, while the Southeast and now some of the Midwest/Northeast are the best regions with Miami +5.2% and Chicago +4.1% leading the way with annual increases. Cleveland fourth out of the 20 cities with a 2.9% y/y gain in home prices after posting a strong 2.3% monthly increase in April.

- Sales of new homes unexpectedly jumped 12.2% in May for the third consecutive monthly increase to a seasonally adjusted annualized rate of 763,000 for the highest sales pace since February 2022. The pace is 20.0% above the level from a year ago and up 41% from the low in July. The median price of a new home sold rose 3.5% to $416,300 in the month and is down 7.6% from a year ago and down 16% from the peak late 2022, which has helped sales somewhat. At the end of the month there were 428,000 new homes for sale, relatively unchanged from the prior month with 6.7 months supply at the current sales pace. However, making matters worse for the housing market, particularly new homes, is the number of new homes sold but not yet started made up most the increase in new home sales with a 78% jump. Keep in mind that new home sales are based on signed contracts, so reflects activity in May, as opposed to existing home sales which reflects closings.

- New orders for manufactured durable goods increased 1.7% in May for the third consecutive monthly increase, and although transportation orders were up 3.9%, orders excluding transportation still increased 0.6%. The aircraft category is the volatile one and orders of aircraft were up 32.5% in the month. Shipments of durable goods increased 1.7% as well, after a small decline in April, with transportation leading the increase. The more important reading for the business investment component of GDP, shipments of nondefense capital goods excluding aircraft, rose 0.2% in the month after a 0.4% increase in April.

- Economic growth was stronger than initially thought in the first quarter, with GDP growth being revised up to a 2.0% annualized rate in the quarter in the “third” estimate of GDP based on more complete source data, up from 1.3% in the previous estimate. The better than expected growth was due to upward revisions in exports and consumer spending which was offset by a downward revision to nonresidential fixed investment and government spending. Consumer spending rose 4.2% annualized in the quarter, up from the first estimate of 3.7%.

- The number of jobless claims filed the week ended June 24 was 239,000, down 26k from the prior week with the four-week average moving up again to 257,500. The number of continuing claims was 1.742 million, down 19k in the week, with the four-week average at 1.757 million.

- The Conference Board’s consumer confidence index was 109.7 in June, up 7 points in the month for the highest level since January 2022. The present situations index was 155.3, up in the month and the best since July 2021, while the expectations index was 79.3 for the best since December 2022 and while it increased it is still at a low level that suggest consumers are anticipating a recession.

- The final June Consumer sentiment survey showed an index level of 64.4, up from 63.9 in mid month survey and the second best reading of the year. The current conditions index was 69.0 up from 68.0 in the mid-month reading, also the second best of the year. The expectations index was 61.5 up from 61.3. The expectations on one-year ahead inflation was 3.3%, unchanged from the mid-month survey and remaining the lowest since March 2021.

- Money supply in the US economy grew by $131 billion, or 0.6%, in May for the first monthly increase in nine months. Money supply is still down $860 billion, or 4.0%, since last May and down 4.1% from the peak July 2022. While a 4% decline may appear small, the pace of the decline is the fastest in history. Of course, money supply is still up 35% from pre-pandemic levels, one of the main reasons inflation remains an issue.

- Personal income and outlays data:

- Personal income rose 0.4% in the May, picking up from the 0.3% increase in April and in line with expectations. The important wages and salaries component rose 0.5%, higher than the 0.4% increase from April. Compared to a year ago incomes are up 5.3% with wages and salaries up just 3.5%. Wages/salary growth has accelerated in recent months so this will be something to keep an eye on.

- Consumer spending rose 0.1% in May, slightly lower than the 0.2% expected with April’s increase not as strong as previously expected after revisions – rising 0.6% in April versus 0.8% in the initial estimate. The weak spending in May was due to a 0.6% decline in spending on goods, but offset by another strong 0.4% increase in spending on services. Compared to a year ago, spending is up 8.4% with goods spending up 3.7% and services spending up 9.8%.

- The savings rate increased slightly to 4.6% from 4.3% but still remains below the longer-term average of 7.5%.

- Now what markets were focusing on was the PCE price index which rose 0.1% in the month as expected and coming off a 0.4% increase from April. The core PCE price index rose 0.3%, slightly lower than the 0.4% expected and after a 0.4% increase from April. Compared to a year ago the price index was up 3.8% as expected with core prices up 4.6%, down slightly from 4.7% in April. Markets welcomed the data with stocks moving higher after the report with the inflation reading decelerating.

Company News

- A report by the WSJ last week said the White House is preparing new restrictions on AI chip exports to China as well as restricting leasing of cloud services to Chinese AI companies. The restrictions could be implemented as soon as next month, possibly following Janet Yellen’s visit to China to avoid conflict during her visit. The potential restrictions come amid concerns China could use the advanced AI chips to produce malicious computer code, advanced weapons development, or chemical weapons.

- Microsoft said, in a memo that was dated June 7, 2022 that was just released, that its CEO Satya Nadella said the company’s 2030 target would be revenues of $500 billion which would help the company deliver in excess of 10% annual returns to shareholders over that timeframe. For comparison purposes, Microsoft’s revenue in 2022 was $198.27 billion.

- Chinese internet company Baidu claimed its AI chatbot “Ernie” beat ChatGPT on several metrics. The chatbot has been featuring ‘plugings’ including enabling Baidu Search to generate real time and more precise information, and a plugin to enable long text summary and Q&A.

- Lordstown Motors has filed for Chapter 11 bankruptcy this morning and is also suing Foxconn for its “fraud and willful failure to live up to its commercial and financial commitments” to Lordstown which it says led to material damage and its future prospects. Lordstown and Foxconn had a partnership where Lordstown would divest its manufacturing plant in Eastern Ohio to Foxconn and form and joint venture with the company. Lordstown has started the process of finding a purchaser for its Endurance EV truck and related assets.

- Cloud service provider Snowflake said it entered into a partnership with Nvidia where it would build generative AI apps in Snowflake’s data cloud which would allow its customers to build AI models using their own data by integrating Nvidia’s cloud framework into Snowflake’s data cloud.

- Shares of Delta Airlines moved up last week during its investor day event after it provided an update to its financial metrics including reaffirming revenue and earnings for the current quarter, while increasing full year EPS forecast to the high end of the $5-$6 range it previously provided and guides free cash flows of $4 billion for next year. It continued to talk about the secular growth trends and the “constructive industry backdrop with structural demand tailwinds and multi-year supply constraints.”

- General Mills reported mixed quarterly results, but its organic sales growth of 5% missed the estimates of 6.9% and volumes were down 6%. It forecasted organic sales growth of 3%-4% and EPS that is in line with consensus estimates for the current quarter. On the conference call the CEO said the company is not seeing disinflation yet despite hearing a lot of commentary that it will happen soon, adding that current inflation is being driven by labor costs inflating. He went on to say the company expects to raise prices again this year due to persistent inflation.

- Visa said it has agreed to acquire Pismo, a fintech firm that provides a cloud based payment and banking platform, for $1 billion in cash. Visa said the acquisition will position it to provide core banking and issuer processing capabilities for financial institutions and fintech clients through the cloud.

Other News

- All 23 banks passed the capital requirements under the Fed’s annual stress tests. The stress test runs a scenario on banks’ capital levels if they were to see $541 billion in estimated losses in a hypothetical scenario of a severe global recession. Banks can now start announcing new buybacks and updated dividend payouts.

- The Supreme Court was busy announcing major decisions last week – siding with a business owner who refused to do business with a same sex couple, striking down affirmative action in college admissions, and denying President Biden’s plan to cancel billions in student loan debt. The latter will have a massive economic impact as the plan would have wiped over $400 billion in debt from borrowers for over 40 million Americans. The court decided in a 6-3 vote that while the Education Secretary has authority to modify the terms of student aid programs, it cancellation plan exceeded its authority. Payments on student loans are expected to begin again later this year after the three-year long pandemic-related forbearance ends. The average monthly student loan payment is around $350 with about 40 million Americans holding student loan debt. The repayment comes at a crucial time where the economy is slowing, inflation remains high, and consumers have built debt levels to the highest on record.

- At the annual World Economic Forum meeting, China’s Premier said China was still on track to reach its growth target of 5% for this year and sees second half 2023 growth stronger than the first half. Recently China has seen weakening economic data that resulted in analysts downgrading its growth forecast.

- In another step toward reviving relations with China, Janet Yellen will reportedly visit the mainland this week. Yellen initially had a China trip scheduled earlier this year but that was canceled after the US shot down the Chinese spy balloon. Yellen’s visit will come several weeks after Secretary of State Antony Blinken trip to China, which he said was constructive.

- Central Bank headlines – Global central bank leaders spoke on a panel at a central bank forum in Portugal last week. Some highlights are below:

- European Central Bank leader Christine Lagarde said the central bank has raised rates aggressively but still has a lot of ground to cover. It will remain data dependent but anticipates another rate increase at its next meeting in July.

- The Bank of England President Andrew Bailer said the UK economy has turned out to be much more resilient, which is a good thing, and that combined with stronger data on the labor market and inflation caused it to raise rates a higher than expected 50 basis points at its recent meeting.

- Fed Chairman Jerome Powell said policy has not been restrictive for very long and believes there is more restriction coming and a very strong labor market will allow the Fed to maintain this restrictive stance. Data over the last quarter has shown stronger than expected growth, higher than expected inflation, and a tighter labor market. The decision to not raise rates last month instead of 25 bps was a “continuation” of its process of slowing down tightening. He does not rule out two consecutive rate increases. Powell added he does not see core inflation coming down to 2% until 2025.

- Powell later spoke at a banking conference in Madrid where he said most FOMC officials see rates rising at least two more times. Regarding the economic and activity he said the labor market remains “very tight” and payroll gains have been robust, consumer spending picked up this year, and the housing market has turned up recently. These are things that point to a strong economy and market still seem to be discounting the chances of more rate increases.

- Bank of Japan, the only major global central bank to not tighten policy during this period, Governor Kazuo Ueda said the reason is, even though inflation is 3% and slightly higher than its target, core inflation is lower and more importantly wage growth is still only 2% and has not shown signs of increasing.

Did You Know…?

Three Trillion Club

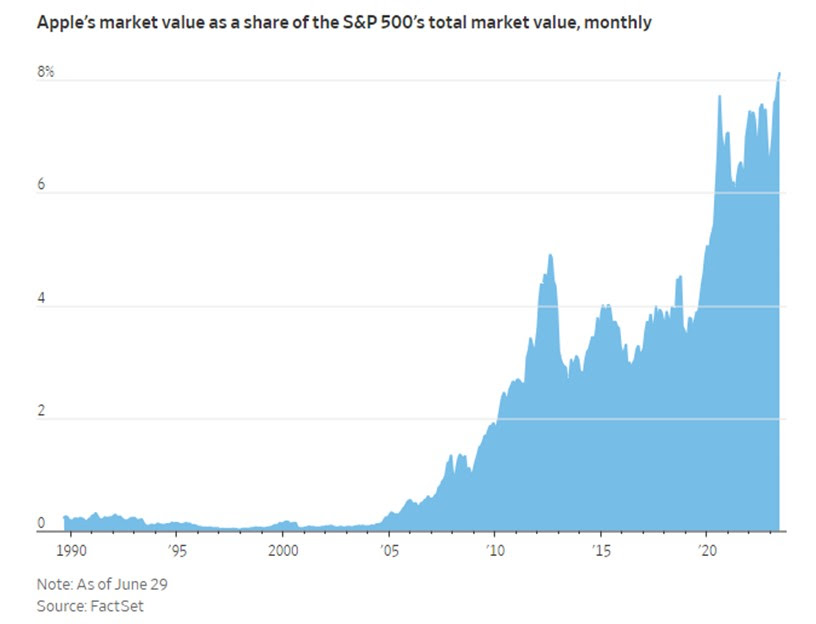

The most valuable company in the world, Apple, became the first company to reach a market capitalization of $3 trillion, closing Friday at $193.97 per share. Apple began in 1976 as a computer company and took 42 years to become the first $1 trillion company in 2018, then only an additional two years to reach $2 trillion in 2020. The market cap fell back down to roughly $2.04 trillion as of the beginning of 2023 but has gained nearly 50% so far this year. As seen in the chart below, Apple makes up approximately 8% of the S&P 500’s roughly $37.2 trillion market cap.

First Half in the Books

The Week Ahead

Although it will be a holiday shortened week, there will be many economic data reports to digest for investors. Markets are open for half day on Monday before being closed on Tuesday for Independence Day. The calendar will include several notable data points on the labor market including the highlight of the week which will be the employment report for June on Friday. Economists and analysts are expecting another 213,000 jobs were added in the month with wages ticking down to a 4.2% annual increase. Other labor market data releases include the job opening and labor turnover survey, the ADP employment report, and jobless claims all on Thursday morning. Several reports on the manufacturing sector come out as well – the PMI and ISM manufacturing survey indexes are out Monday and factory orders on Tuesday. Elsewhere, on Monday we will see construction spending data for May, June motor vehicle sales on Wednesday, and then trade data and the ISM services survey index on Thursday. The FOMC meeting minutes from the committee’s June meeting come out Wednesday afternoon. After holding a meeting over the weekend, OPEC will hold its official production meeting on Wednesday and Thursday. Action on the earnings calendar is muted with no notable companies reporting results before things pick up over the next several weeks with next week being the unofficial start to second quarter earnings season.