Wentz Weekly Insights

Jobs Report Strengthens Case For Rate Cut, Small Caps Rally

For the most part, stocks were higher last week with another rotation where riskier assets outperformed, like small caps, while value investments underperformed. The small cap index, the Russell 3000, rose 1.04% while the Dow index, which is more heavily weighted to value companies, fell 0.32%. The Nasdaq rose over 1% as well, but that was due to several mega cap tech names like Alphabet/Google and Apple seeing big gains after a favorable antitrust ruling (see company news section below). However, the average stock didn’t perform so well – the equally weighted S&P 500 index fell slightly.

Meanwhile, the bond market had a solid week with many bond indices now up mid- to upper-single digits this year. Treasury bond yields fell across the curve last week which put upward pressure on prices (bond yields/rates and bond prices move in opposite directions, when bond yields fall the price of the bond typically increases). The 10-year Treasury yield, usually an indication of investors expectations of economic growth, at 4.08% has moved to its lowest level since last October.

The expectation for rate cuts has increased steadily the past several weeks and after last week the market is now pricing in a near 100% chance for a rate cut at the Fed meeting taking place next week. Even more, the market has begun to price in higher odds for a jumbo rate cut (a 50 basis point, or 0.50%, cut in rates instead of 25 basis points) at just over 10% as of Friday.

The lower bond yields and higher expectations for rate cuts came after more evidence of a slowing labor market, as was seen in last week’s economic data, which was the most followed event for investors in the holiday shortened week.

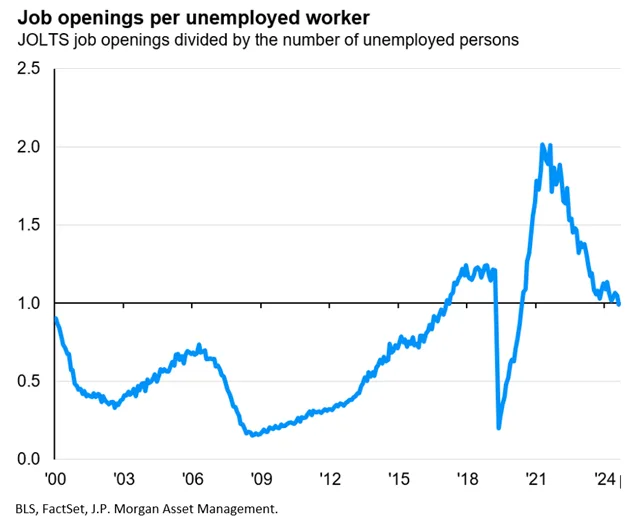

The first was a report on the number of job openings in the economy from the job openings and labor turnover survey (JOLTS). There were 7.181 million job openings on the last day of July, falling from June and down about 323,000 from a year ago. Job openings have come down substantially since recording an all-time high of 12.1 million in early 2022 and are now near its pre-pandemic 2017-2019 average.

The next was ADP’s monthly data on payrolls where it said it saw 54,000 new payrolls added in August, which was lower than economists’ estimates and was a slowdown from 106,000 the month prior. Year-to-date, the average monthly payroll additions is 80,375, much lower than 2024’s average of 144,333.

Then there was the most followed labor market report – the employment report from the Department of Labor. This report includes data from an establishment survey as well as a household survey. The establishment survey’s, which measures jobs, most important figure is nonfarm payrolls, which in August increased 22,000. This was well below the 75,000 increase that was expected. The average monthly increase in payrolls through the first eight months this year is 74,750, less than half the monthly average of 167,667 in 2024.

On the other hand the household survey, which measures people and captures self-employed individuals, saw the number of people employed increased 288,000. Numbers here are often very volatile due to the small sample size of people surveyed. But the number of people employed has increased nearly 2 million in the past year. This could be due to the massive revision seen in January (where 2.234 million additional people were considered employed) but to a lesser degree could be due to people getting multiple jobs.

The number of people unemployed however increased 148,000 in the month and is higher by 313,000 over the past year. As JPMorgan noted in their chart of the week, illustrated below, the labor market is eroding, but only slowly. The job openings-to-unemployed worker ratio fell to 0.99 in July, the first time since April 2021 there has not been at least one job available for each unemployed worker. Also to note, the number still remains above 2015-2019 pre-pandemic average.

in addition, the unemployment rate increased from 4.2% to 4.3% for the highest since late 2021.

While one month of reports is not enough to tell the full story, this has been the trend this year – less job openings and less hiring. The good news is the labor market is still growing and claims for unemployment benefits have not seen a meaningful increase and have remained in a tight range.

Now the big question is do we see a more aggressive 50 basis point rate cut. If that is the case, we believe it may be welcomed at first, but after digesting the move we see a higher likelihood markets pullback. If the Fed decides to make a larger rate cut, it means it sees the need to move faster on policy and if it is moving faster on policy there must be a reason. The typical reason is because the economy is slowing quicker than initially thought, warranting a faster pace of reducing interest rates.

We don’t think this will happen though, just several weeks ago it was a toss up on whether the Fed would even consider cutting rates. A jumbo cut would spook markets and investors, and we don’t think that is something Fed Chair Powell wants to do. However, this Thursday’s inflation report (the consumer price index) could change that narrative.

Week In Review:

Stocks got off to a solid start to the holiday shortened week, hitting new record highs Thursday before pulling back Friday after the jobs report and ending the week slightly higher. Volatility started the week high then fell to the lowest level of the week on Friday before the employment report, but ultimately finishing the week down 1.2%. The four major US stock indices finished as follows: Nasdaq +1.14%, Russell 2000 +1.04%, S&P 500 +0.33%, and Dow -0.32%. The bond market had a solid week as bond yields fell – the 2-year Treasury yield fell 11 basis points to 3.52% while the 10-year Treasury yield fell 15 basis points to 4.08%. The dollar index was unchanged for the week while gold hit yet another record high with a 4.02% increase. Bitcoin rose 2.07%. Oil fell 3.34% after reports said OPEC was considering another increase to oil production.

Recent Economic Data

- Employment Situation: The monthly employment survey showed 22,000 new payrolls were added in August, less than the 75,000 new payrolls that were expected and lower than the bottom end of the estimated range of 59,000-110,000. The revisions to the prior two months was not as severe as last month’s report – June saw a downward revision of 27,000 jobs to -13,000 while July saw a upward revision of 6,000 jobs to 79,000 for a net decline of 21,000 (versus the July report that saw a net revision of -258,000). Many industries saw job losses, with the rise in jobs driven by a 46,000 increase in education and health services jobs. On the other hand, the household survey showed the labor force increased by 436,000 people with the number of people employed increasing 288,000, while the number of people unemployed increased 148,000. The number of people unemployed has increased 313,000 over the past 12 months, driving the unemployment rate one point higher to 4.3%. The underemployment rate (the U-6 rate) increased to 8.1%, up from 7.9% last month. The average wage increased 0.3%, matching last month’s increase and matching expectations, up 3.7% from a year ago, slowing from the 3.9% increase last month.

- Job Openings and Labor Turnover Survey: The number of job openings the last business day of July was 7.181 million, back to the post-pandemic lows, down slightly from 7.357 million from June and down about 323k from a year ago. Since last summer job openings have leveled out at the low-mid 7 million range after being at a record high of 12.13 million shortly after the pandemic. The number of hires was 5.308 million and has trended in a tight range of about 5.3-5.6 million. The number of separations was down slightly in the month to 5.289 million with quits also down slightly to 3.208 million and down about 200k from a year ago, indicating employees may be less confident in finding a better or higher paying job.

- ADP Payrolls: ADP said it saw 54,000 new payrolls in August, a slower pace than economists had expected and slowing from the 106,000 new payrolls seen in July. Trade/transportation, manufacturing, and health services saw a small decline in payrolls while leisure and hospitality drove much of the gains followed by construction.

- Jobless Claims: The number of jobless claims the week ended August 30 was 237,000, an increase of 8,000 from the week prior which brings the 4-week average up slightly to 231,000. The number of continuing claims was down slightly to 1.940 million with the four-week average falling slightly to 1.947 million.

- PMI Manufacturing Index: The PMI manufacturing index was 53.0 for August, rising back above the breakeven point of 50 from its reading of 49.8 in July, suggesting manufacturing activity expanded slightly in August. The report said a surge in production and solid new orders in the month drove the strongest improvement in manufacturing performance since May 2022, which was linked to higher sales and building of inventories. A boost in confidence drove more hiring but the report also said tariffs caused a steep rise in input costs and drove up selling prices even more.

- ISM Manufacturing Index: The ISM manufacturing index was 48.7 in August, up from 48.0 in July, however still indicating a small contraction in manufacturing activity in the month. One of the biggest positives was new orders grew in the month, the reason for the 0.7 point increase in the headline number, but that did not lead to an increase in production or employment yet. The prices index remained elevated but down one point in the month.

- Factory Orders: Orders for manufactured goods, also known as factory orders, declined by 1.3% in July as was expected, following a 4.8% decline from the month prior. The reason for the two large declines comes down to transportation orders, more specifically aircraft orders which declined 32.7% in the month, following a 52.7% decline in June (which came after a 231% increase in May). Excluding transportation, orders were up 0.6%. Shipments of manufactured goods have been strong in the past several months, increasing 0.9% in the month with shipments excluding transportation goods up 0.6%.

- Construction Spending: Construction spending continued its downward trend in July, with the amount of spending on construction down 0.1% in the month, declining 8 of the past 9 months, down 2.8% from a year ago, and down 3.4% from its peak May 2024. Spending on residential construction improved 0.1% in the month, but still down 5.1% over the past year, while spending on nonresidential declined 0.2% in the month and down 1.1% over the past year.

- International Trade Balance: After spiking to record high deficits in the spring months then falling dramatically at the beginning of summer, the US trade deficit has leveled out and appears to have returned to pre-tariff levels. The trade deficit was $78.3 billion in July, up $19.2 billion compared to June. The monthly deficit was $67 billion at the beginning of the year, increased to $138 billion in March as US businesses imports surged to get ahead of tariffs, then shrunk to $60 billion in April. The wider deficit in July was due to a 5.9%, or $20.0 billion, increase in imports, slightly offset by a 0.3%, or $0.8 billion, increase in exports. Trade activity is up $18.4 billion over the past year, or 3.0%.

Company News

- Kraft Heinz: Kraft Heinz said it has approved a plan to split the company into two independent publicly traded companies via a tax-free spinoff which would allow it to simplify operations, improve performance, and let each independent company have greater strategic and operational focus. One company will focus on sauces, spreads, seasonings, and shelf meals with brands like Heinz, Kraft Mac & Cheese, etc, while the other company will focus on grocery brands like Oscar Mayer, Lunchables, and Kraft Singles. Warren Buffet, the largest shareholder with a 27.5% stake, said he was disappointed with the decision to split and that shareholders did not get to vote on it.

- Amazon: Amazon said it will change its policy to restrict Prime free shipping to household members only starting next month, ending its Prime Invitee feature. It will be replacing the feature with Amazon Family which offers free shipping and membership benefits to another adult, up to four teens, and four profiles for children in the household.

- Separately, Shares of Amazon moved higher after a SemiAnalysis report said Amazon is currently building three new data center campuses for the private AI startup company Anthropic. The data centers are expected to use mostly Amazon’s new in house AI chips which it calls Trainium. The report adds the data centers will hold nearly one million Trainium chips, the largest number of non-Nvidia chips in a data center. Trainium chips are not as powerful as Nvidia’s most advanced AI chips, but the report adds Anthropic was involved in the design of the Trainium chips, making the chips more customized to what Anthropic needs for its AI models.

- Alphabet (Google): In a major decision for the company, a judge ruled Alphabet will not be required to sell off its Chrome web browser and will still be able to make payments for distribution and placement of its products, sending its shares higher as it avoided a worst case scenario. However, the judge did prohibit Google from paying to be the exclusive search engine on devices and browsers and ordered it to share its vast amount of data with rivals to improve competition. The decisions come a year after the judge said the company illegally monopolized the Search market for more than a decade.

- PepsiCo: Shares of PepsiCo rose after it was reported activist investor Elliott Management has built a $4 billion stake in the company, its largest position ever, and is planning an activist campaign. In a letter to PepsiCo’s board, the investor is pushing the company to refranchise its bottling business and make other changes to help boost its valuation after saying the company has experienced “poor financial results, sharp stock price underperformance, and a highly dislocated valuation”. The Wall Street Journal reported Pepsi, which was once rivaled with Coke, has dropped to the fourth in terms of sales volume, behind Coke, Dr. Pepper, and Sprite.

- Nvidia: Reuters reported Chinese tech companies still have high interest and still want to buy Nvidia’s AI chips despite China’s efforts to discourage the purchase of them. Several companies have asked for reassurance that their orders of Nvidia’s H20 chips (the AI chips from Nvidia that just regained approval to sell to China) are still being processed. Separately, Nvidia denied reports that ramping up H20 chip production has caused it to see lower supply of its most advanced Blackwell chips.

- OpenAI: The Financial Times reported OpenAI is preparing to produce its own AI chip next year in partnership with Broadcom. OpenAI plans to use the chip internally rather than making it available and selling to external customers. Recall a report from earlier this year said OpenAI was planning to lower its reliance on Nvidia by developing its own chip.

- Texas Instruments: Shares of Texas Instruments moved lower after its CFO said at a conference that the recovery in semiconductor demand is not coming back as quickly as some have anticipated or as quickly as has happened in the past. A recovery has been seen in four of its five end markets but the recovery in automotive remains the exception, with the company citing macro uncertainty.

- Starbucks: Reuters reported Starbucks has received bids for its China business that values it as high as $5 billion, which is below the value that was estimated by some when Starbucks first announced it was taking bids, and compares to Starbucks total market cap of about $99 billion. It added Starbucks is not committed to selling its China business.

- Kenvue: In an exclusive report, the Wall Street Journal said Secretary of the Department of Health Robert F Kennedy Jr is planning to announce pregnant women’s use of over-the-counter pain medication is potentially linked to autism in a new report. Tylenol is a major pain reliever brand made by Kenvue. The report is expected to be a review of existing research but takes a measured approach and will list the possible causes for autism and discusses what is known and what is unknown.

Other News:

- Tariffs Deemed Illegal, Appealed by Trump: The US Court of Appeals upheld the decision of a lower court ruling that Trump overstepped his authority by imposing certain tariffs (mainly the reciprocal tariffs), saying Trump using the trade deficit as a national emergency was not a justification to impose tariffs. The court will not block the tariffs until October 14 which gives the administration time to appeal the decision with the Supreme Court. Treasury Secretary Bessent said the administration is preparing a plan B in case the Supreme Court upholds the ruling.

- Tariffs and Inflation: A Yale University’s The Budget Lab research study said between 61% and 80% of new tariffs from 2025 have been passed to consumer prices for core goods as of June. It said this falls near the same levels as prior studies it had (examining prior cases of tariffs and consumer price effects).

- Make Housing Affordable: Bessent said in a Reuters interview that the administration is planning new measures in the coming weeks to address high housing costs, including new ways to simplify permitting and to encourage standardization to boost new housing construction to increase housing supply. Bessent also said Trump may declare a national housing emergency this fall to address the issue.

- Fed Governor Lisa Cook: The Department of Justice opened a criminal investigation into Federal Reserve Governor Lisa Cook over allegations of mortgage fraud after referrals were made by Federal Housing Finance Agency Director Bill Pulte, according to the Wall Street Journal. North Carolina Senator Thom Tillis, who is a member of the Senate Banking Committee, said a replacement for Federal Reserve Governor Lisa Cook will not be considered until the legal status is determined in court. Tillis added that Trump’s move to fire Cook is to create divide in the Fed and he is against it on that basis. Any Fed nominee would need unanimous support on the committee before moving to the Senate for full consideration.

- OPEC Production Increase: The oil producing group OPEC (Organization of the Petroleum Exporting Countries) decided to increase its oil production quotas by 137,000 barrels per day next month, increasing production for multiple months in a row now, but at a smaller increment than the prior months. Oil was down over 3% last week as it was becoming clear that was the expectation. However, prices are moving a little lower early Monday morning after Saudi Arabia said it was cutting the price for its main markets in Asia next month, which may be a sign it sees worsening demand, according to Bloomberg.

WFG News

Investment 101 Class

Interested in learning more about the basics of investing and how the markets work? Join us in our next Investment 101 class on September 18 at 4:00pm!

This is a great opportunity to learn in a small setting about key financial principals, like risk and return, liquidity, inflation, diversification, growth versus income, time value of money, account types, and how your money can work harder for you!

The Week Ahead

Markets have a full week ahead but any market moving events will be limited. The main event is the release of the latest inflation data for August which will come out Thursday. The consumer price index is expected to show an increase of 0.3% in the month for both headline consumer prices and core prices, with the annual core change at 3.1%. Other data on the economic calendar includes the producer price index, jobless claims, consumer credit, and consumer sentiment. There will also be the annual revision to jobs growth for the April 2024 to March 2025 period on Tuesday, which may come with large revisions. We are in a quieter period of the quarter for earnings with very few quarterly reports scheduled for this week, but the most notable companies that are reporting include Oracle, Adobe, Kroger, GameStop, and Chewy