Wentz Weekly Insights

Labor Market Stability Lifts Stocks Despite Rising Geopolitical Tensions

The first full week of 2026 was a positive one with stocks rallying in what was a week full of geopolitical headlines and some key economic data. The tech sector was mixed after starting the week stronger from many companies unveiling new products at the annual Consumer Electronic Show. But the clear winner last week was small caps with the Russell 2000 rising 4.62% to a new high (the Dow and S&P 500 hit new all-time highs as well).

There was no specific reason for small caps outperformance, but a rotation in the markets did benefit non-tech and value areas of the market. Several factors likely helping small caps include expectations for support from the One Big Beautiful Bill Act (extended tax cuts and other tax reform), forecasts for stronger earnings growth, and stability in the labor market.

On the latter, that was the biggest non-political headline of the week with Friday’s Department of Labor monthly employment figures. Data from the establishment survey showed US employers added 50,000 payrolls in December which was right in line with expectations. However, October and November saw a downward revision of 76,000 payrolls, meaning the December report saw a net job decline of 26,000.

For 2025, employers added 584,000 new jobs, averaging 49,000 per month. While this is positive, it is a stark decline from the 2.0 million added, and the 168,000 monthly average, in 2024.

Employers appear to be in a low hire, low fire mode. Outside of the two most recent recessions, 2025 saw the lowest pace of monthly job gains since 2003. There could be several factors playing a role – higher costs from the past five yeas of higher than average inflation, uncertainty over Trump’s tariffs, the sharp decline in immigration could be making it harder for employers to find workers, businesses may be waiting to see if AI can handle tasks that employees would or AI is already taking over tasks requiring less employees, and Americans seem to be staying at their jobs longer, a reversal from the pandemic era when job switches were very common.

Government hiring is also making an impact on the headline payroll figures, mostly due to Trump’s efforts to streamline the government and cut unnecessary positions. The government saw a decline of 200,000 jobs in 2025, nearly a 10% decline in the government workforce, the largest decline of any sector/industry, and the largest annual decline with data going back to 1990.

The household survey, which asks Americans directly about their labor market status (versus the establishment survey which asks businesses about their hiring/firing), was more positive – its data showed the unemployment rate declined to 4.4% in December. This was because those considering themselves employed increased 232,000 while the number of people considered unemployed declined 278,000.

There are now 0.91 job openings per unemployed person, a sharp decline from over 2.0 much of the past four years (mostly pandemic related labor shortages). This compares with the historical average of around 1.2 job openings per unemployed person.

Even with a decelerating labor market, economic activity remains resilient and continues to expand. After seeing a much better than expected 4.3% growth (annualized) in the third quarter, GDP (gross domestic product) is expected to post a 5.4% increase in the fourth quarter, according to the Atlanta Fed GDPNow Model. This is up from the 2.7% estimate just a week ago.

The notable increase is mostly due to the trade data received last week. The trade deficit in October fell to its lowest level since 2001 (excluding a brief period during the Financial Crisis in 2009). The monthly deficit in October was $29.4 billion, meaning the US imported $29.4 billion more than what it exported. This is a sharp reversal from the $136 billion monthly deficit the US experienced in March 2025 as businesses rushed to import ahead of potential tariffs.

The deficit made such an impact to GDP because GDP measures domestic production and in October exports increased at a faster pace than imports, therefore contributing more to GDP.

Due to the data, the market implied chance of a cut at the Fed’s next meeting January 28th fell to just 5% over the course of the week, from around 20%, while the expectation for two rate cuts by the end of the year dropped.

Meanwhile, geopolitical news has been very fluid since the start of the new year. There is the situation with Venezuela, Trump’s comments and threats regarding Greenland, Trump talking about possible action in Mexico, Cuba, and other South American territories, along with China and Taiwan and Japan tensions, and the ongoing Russia/Ukraine war. Despite the situation in Washington and related geopolitics, the market reaction has been muted.

The market has so far only responded to whether the news could impact growth or inflation. Even the volatility index was unchanged last week, remaining near the lowest levels of the past 12 months at 14.50.

The stable, though decelerating, labor market is keeping markets in check, but more importantly, earnings estimates have consistently moved higher the past couple years. The next several weeks will be key in determining if this can continue. Earnings season kicks off this week with some of the big banks before getting into the center of earnings season the last week of January with the bulk of the S&P 500 reporting.

Also on the calendar this week is several key economic indicators including the next consumer inflation report Tuesday, several housing indicators, and retail sales for our first glimpse of consumer spending for December.

Finally, beside geopolitics, the Federal Reserve will be in focus as well as markets are on track to open the week lower. This comes after Fed Chairman Powell said the DOJ has served the Fed with grand jury subpoenas, and in a video released Sunday said it was part of Trump’s pressure and intimidation to lower interest rates, leading to questions about if the Fed can maintain its credibility.

Week in Review:

The first full week of trading for the new year was a positive one for US stocks – the S&P 500, Dow, and Russell 2000 all hit new all-time highs as a rotation favored smaller cap and cyclical names most. The four major US indices finished as follows: Russell 2000 +4.62%, Dow +2.32%, Nasdaq +1.88%, and S&P 500 +1.57%. Treasury markets were mixed with the curve flattening somewhat – the 2-year Treasury yield rose 5 basis points to 3.54% while the 10-year yield fell 2 basis points to 4.18%. The dollar index increased 0.72% while gold gained 4.08% to yet another new high. Bitcoin was relatively unchanged. Oil gained 3.14% despite the expectations of more Venezuelan crude hitting the markets.

Recent Economic Data

- Employment Report: The December employment report, the first normal data collection since the government shutdown, showed US businesses hired 50,000 new employees, right in line with expectations, with most job gains seen in bars/restaurants, health care, and social assistance. Government added 13,000 jobs, meaning the private sector added only 37,00 jobs, and excluding non-core jobs like those in leisure and hospitality, jobs gains were negative. In addition, revisions were to the downside – October saw a downward revision of 68,000 to a loss of 173,000 while November saw a downward revision to 8,000 to a gain of 64,000. Separately, the household data was much more positive – even though the labor force declined by 46,000, the number of people employed increased 232,000 while the number of people considering themselves unemployed fell by 278,000 (to 7.503 million). This change, more employed and less unemployed, resulted in a 0.1% decline in the unemployment rate to 4.4%. The average wage increased 0.3% in the month (bringing the average annual salary to $77,002), and is up 3.8% from a year ago, accelerating from 3.6% last month. For 2025, payroll employment rose by 584,000, an average monthly gain of 49,000, a sharp decline from the 2.0 million increase in 2024 that averaged 168,000 per month.

- ADP Payrolls: ADP’s payroll data shows it saw an increase of 41,000 private payrolls in December, relatively in line with the consensus estimate and coming after four declines out of the past six months. From a year ago, private payrolls are up just 614,000, averaging 51,200 per month over that period, the slowest growth since coming out of the pandemic early 2021. The report said small businesses drove most of the year-end hiring while large employers were basically unchanged.

- Job Openings and Labor Turnover Survey: The number of job openings the last day of November was 7.146 million, a decline of 303,000 from the prior month for the second lowest level since the pandemic in 2020 and trending at pre-pandemic levels. The number of job openings per unemployed person is at .91 (there are .91 job openings for every unemployed person), a stark difference from a 2.0 ratio we saw much of the past four years (for reference a balanced market is typically around 1.2). The number of separations in November was 5.080 million, relatively unchanged.

- Jobless Claims: The number of jobless claims the week ended January 3 was 208,000, up 8,000 from the prior week with the four-week average down about 7k to 211,750. The number of continuing claims was 1.914 million, up 56,000 from the prior week. The four-week average was 1.892 million, up slightly from the prior week.

- US Productivity (Delayed): US worker productivity, a key figure that drives longer-term economic growth, saw strong growth in the third quarter, with productivity rising at an annual rate of 4.9% in the quarter, higher than the 3.6% increase expected and accelerating from the 4.1% annual pace in Q2. The rise in productivity was due to a 5.4% increase in output minus the 0.5% increase in the hours worked. Unit labor costs decreased 1.9% in the quarter (also annualized), reflecting a 2.9% increase in compensation less the 4.9% increase in productivity. It appears the surge in AI investment may be having a positive impact on productivity.

- ISM Services Index: The ISM non-manufacturing (services) index was 54.4 for December, a 2 point improvement from November and better than expected for the highest index level of the year. For the first time since February, all four of the subindexes (business activity like new orders, supplier deliveries, prices, and inventories) were in positive territory. Of the 18 major industries, 11 of them reported growth in the month while 5 reported contraction in activity.

- ISM Manufacturing Index: The ISM manufacturing index was 47.9 for December for the lowest reading of 2025, falling from 48.2 in November indicating manufacturing conditions in December remained weak and in contraction territory (an index level below 50) for the tenth consecutive month. The lower index level was due to a pullback in production and inventories. Of the 17 manufacturing industries only two of them saw growth in December while the other 15 reported contraction.

- Trade Balance (Delayed): The monthly trade deficit has made substantial progress since the beginning of the year when tariffs caused a surge in imports and a record high trade deficit. In October, the trade deficit was $29.4 billion, the lowest level going back to a brief period after the Financial Crisis in 2009, and before that the lowest since 2001. The shrinking deficit is happening as exports increase while imports decrease – in October exports increased 2.6%, or $7.8 billion, while imports declined 3.2%, or $11.0 billion. Year-to-date the trade deficit is still large though, rising 7.7%, or $56.0 billion, from the same period last year. The October deficit will be another large positive for GDP as a shrinking deficit increases GDP (a rise in exports compared to imports).

- Housing Starts & Permits (Delayed): Homebuilding in October, which was delayed a couple months from the shutdown, continued to struggle. The number of housing starts in October was at a seasonally adjusted annualized rate of 1.246 million, a decline of 4.6% from the prior month, down 7.8% from a year ago, and the lowest level of new housing since 2019. However, all of the decline was due to a drop in multi-family housing, down 22%, while single-family new home build increased 5.4%. Meanwhile, building permits were at an annualized rate of 1.412 million, relatively unchanged from September and only 1% lower from a year earlier.

- Consumer Sentiment: The index on Consumer Sentiment, according to the University of Michigan’s monthly survey, was 54.0 for January, rising slightly from December for a four-month high, although still hovering near record lows. The index on current conditions rose 2 points to 52.4 while the index on expectations improved somewhat to 55.0. Concerns around unemployment have increased with two-third of those surveyed expecting unemployment to rise in the year ahead. Inflation over the next year is expected to increase 4.2%, holding steady from last month’s expectation, while the next five years inflation expectations ticked up to 3.4% from 3.2%.

Company News

- JPMorgan: The Wall Street Journal was the first to report JP Morgan has reached a deal to take over the Apple credit card program from Goldman Sachs, becoming the new issuer of Apple’s credit cards, one of the largest cobranded programs in the world with around $20 billion in balances. The deal benefits both – giving JPMorgan a loyal base of Apple customers who it can pitch its products and services to, and Apple a partner to help it sell and finance more of its products.

- Novo Nordisk: Novo Nordisk recently announced it received FDA approval for its pill version of its weight loss treatment Wegovy, the first pill version to receive approval, and yesterday said cash-paying customers will be able to purchase the treatment for $149/month.

- Alaska Airlines: Alaska Airlines said it agreed to buy 110 Boeing planes for its largest airplane order in its history, which extends its delivery pipeline of new planes to 2035. The orders will help Alaska’s long-haul ambitions from Seattle including service to at least 12 international destinations by 2030.

- Nvidia: Nvidia’s CFO spoke at the CES, and recall late last year Nvidia said it saw revenue of $500 billion for 2026, and when questioned on this figure the CFO said more has occurred since it gave that forecast in terms of new orders and “that $500 billion has definitely gotten larger.” Separately, The Information reported China told some of its tech companies to halt orders of Nvidia H200 chips (that the US just approved for export) while it makes its decision on whether to allow the chips to be sold in its country. Then, a Bloomberg report said China is moving toward partially allowing the H200 chips and is preparing to approve some imports as soon as this quarter, but it will restrict its access across military, government agencies, and critical infrastructure.

Other News:

- Trump Pressures Defense Industry: President Trump called for the US military budget to increase to $1.5 trillion in 2027, up from $1 trillion in the current budget. He also said he will not allow defense companies to issue dividends or buy back their own stock until they increase investments in production and research and development, saying defense firms are not building military equipment fast enough and are not maintaining it properly. Bloomberg reported, citing a Jefferies report, defense firms spent nearly $50 billion on dividends and share buybacks in 2023 and 2024, compared to about $39 billion they spend on research and development and capex.

- Home Buying: President Trump is pushing for the US to ban large institutional investors from buying more single-family homes, arguing that corporate ownership has helped push housing cost higher and further out of reach for far too many Americans, especially younger ones. Shares of companies that own and rent out single family homes, like Invitation Homes, Opendoor, and Blackstone, were down as a result. Separately, Trump called on the government-backed mortgage finance companies Fannie Mae and Freddie Mac to buy $200 billion in mortgage bonds, an effort by Trump to address the sharp rise in the cost of buying a home, adding it was also because they are “flush with cash.”

- ACA Subsidies: The House passed legislation that would extend the Affordable Care Act health care subsidies for another 3 years (they expired on Jan 1), however it is expected to be rejected by the Senate. It is reported a bipartisan group of Senators are working on a separate legislation that would extend the subsidies, but with more limitations.

- Venezuela: After the capture of Venezuela President Nicolas Maduro, Trump said the US would run the country in the near term. When it relates to oil, Trump said Venezuelan authorities will turn over between 30 and 50 million barrels of oil to the US which will be sold at market price, where Trump said the money will be controlled by himself to ensure it benefits the people of Venezuela and the US.

Did You Know…?

Auto Sales & Car Prices:

Sales of new cars in the US increased 2% in 2025 to 16.2 million units, well ahead of the 15.7 million units expected and the best year of auto sales since 2019. Carmakers with the biggest increase include Toyota and Hyundai’s 8% increase, while American automakers like Ford increased 6% for its best year since 2019, GM increased 5.5%, while Stellantis’ sales declined 3.0%.

The average price for a new vehicle was $47,104, up 1.5% or $715 in 2025, according to JD Power. Meanwhile, like housing, affordability has made buying a new vehicle more difficult. The average monthly car payments for a new vehicle just hit a new record high, rising to $772/month, with those seeing a monthly payment of over $1,000 spiking. The average amount financed was at a new high of $43,759. It was just 10 years earlier that the average amount financed was $28,769 while the typical monthly payment was $491.

WFG News

Upcoming Events:

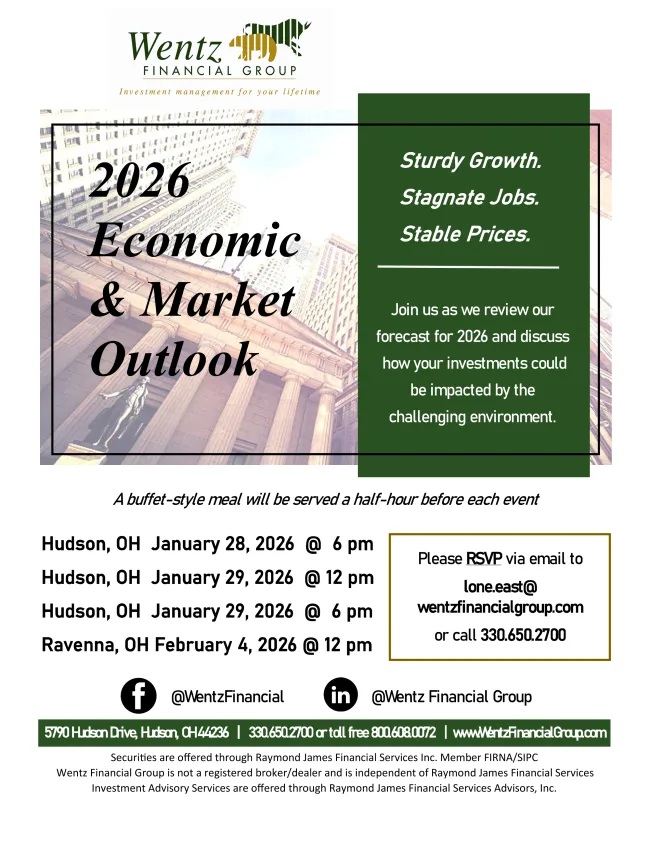

See the flyers below for our upcoming events. In late January, we will host our 2026 Economic and Market Outlook meeting, where we will review key developments from 2025 and share our outlook for how we see 2026 shaping up.

In March, we will welcome a Social Security Specialist who will provide an overview of how Social Security works and discuss key strategies to help maximize your benefits.

Click the links below to RSVP today!

WFG Investment Classes:

Interested in learning more about investing and how the markets work? Wentz Financial Group holds various Investment Basics classes throughout the year. Contact us for details!

Reminder – 2026 Contribution Limits Increased:

- 401k, 403b, and 457 plans: The contribution limit increases $1,000 to $24,500. Catch up contributions, for those over the age of 50, increases $500 to $8,000. The “Super catch-up”, for those aged 60-63, remains at $11,250.

- Another important rule to note that goes into effect next year – For those age 50 and over that make more than $150,000, any catch up contribution must be made as a post-tax Roth contribution (rather than a traditional pre-tax contribution).

- IRAs (Traditional IRA and Roth IRA): The contribution limit increases $500 to $7,500. The catch up contribution, for those over the age of 50, increases $100 to $1,100.

- Simple IRAs: The contribution limit increases $500 to $17,500. Catch up contributions, for those over the age of 50, increases $500 to $4,000. The “Super catch-up”, for those aged 60-63, remains at $5,250.

The Week Ahead

The earnings calendar picks up this week with the unofficial start to fourth quarter earnings season. As usual, the highlight the first week of earnings season is several of the big banks – we will see quarterly financial results from JPMorgan, Citigroup, Bank of America, Wells Fargo, Goldman Sachs, PNC, Morgan Stanley, and BlackRock, with other notable results from Delta Airlines, JB Hunt, and Taiwan Semiconductor. On the economic calendar, there are several notable data reports but the biggest will be the consumer price index released Tuesday morning. Other notable reports include the producer price index, existing home sales, new home sales, and retail sales. The consensus estimate sees another solid month in retail sales for December with retail sales rising 0.5%. Other less followed reports include jobless claims, the Philly Fed manufacturing index, the Empire State manufacturing index, industrial production, and the housing market index. Earnings and economic data are not the only things on investor minds though, politics and geopolitics will be top of mind with the situations around Venezuela and Greenland, along with several announcements from Trump on some of him next priorities. The Federal Reserve will also receive more attention after Chairman Powell said the DOJ has served the Federal Reserve with grand jury subpoenas.