Wentz Weekly Insights

Market Sentiment Shifts Back to Positive After Stronger Economic Data

From the S&P 500’s year-to-date highs on July 16 to the bottom of the recent drawdown August 5, the index fell 8.5% with investors starting to believe a bigger correction was in the works amid economic slowdown concerns. However, since then, the index has increased 7.1% and it seems markets have moved on like the drawdown never happen. Last week the index increased 3.93% and the Nasdaq broke a four-week losing streak with a 5.29% gain making it the best weekly gain for both indexes since November 2023. Technology was a big standout, rising 7.5%, particularly Nvidia and its 19% weekly gain.

There was no single factor that caused the reversal, but was mostly from improved sentiment around a “soft landing” – a term that describes an economy that avoids a recession and continues to grow despite a central bank that tightens monetary policy (raises interest rates and reduces liquidity). That sentiment gained traction this past week with the release of key economic data reports including the latest inflation data and retail sales.

The latest consumer price index, which typically provides our first look on the prior month inflation rate, came it just about as close to expectations as it could get. The index rose 0.2% in the month, coming after a 0.1% decline from the prior two months combined, and slowing to a 2.9% 12-month change, down from 3.0% in June. Commodity prices falling 1.9% over the past year have been a big contributor to inflation coming down. The other thing is the most important – services inflation excluding housing was unchanged in July and up 4.6% over the past year, decelerating from the 4.8% rate in June. Also of note, vehicle prices continue to move lower with used car prices down 11% over the past year and new car prices down 1%.

An inflation report that came in exactly as expected likely seals the deal for the rate cut cycle to begin at the Fed’s next meeting September 18th. Market pricing is currently giving it a 100% chance of a rate cut, with a 23% chance the Fed will cut 50 basis points (a change in rates is typically done in 25 basis points, 0.25%, increments). Two weeks ago, after the disappointing labor market data, market odds for a 50 bps rate cut were over 60%, reflecting markets increasing worry of a recession or hard landing scenario (when the economy is slowing more than expected. Cutting rates faster would be seen as providing more support to the economy).

We are beginning to see a broader shift in the tone of Fed policymakers as well. This past week we saw Atlanta Fed President Raphael Bostic and St. Louis Fed President Alberto Musalem provide more of a dovish tone, supporting rate cuts sooner. Bostic said in a speech the Fed needs to shift its thinking to be more mindful of the employment mandate (seeing maximum employment), suggesting concerns of the labor market, while Musalem said the time is near for rate cuts.

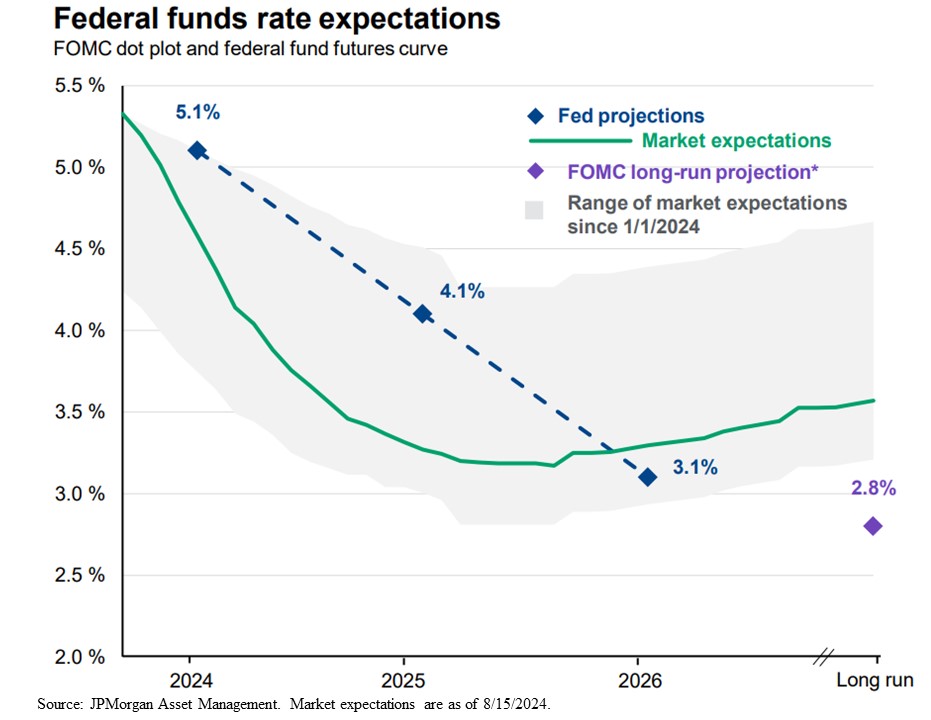

JPMorgan chart of the week, seen below, is a great illustration of the expectations for the future path of interest rates. The green line shows the markets’ consensus expectation for where the rate will be over the next two years and long-run (compared to its current rate of 5.4%). The grey shaded area indicates the range of the market expectations since the beginning of this year. As you can see, the market has adjusted its expectations of rate cuts many times this year, and the range has been fairly wide, illustrating the level of uncertainty and mixed opinions. Finally, the blue line is where the Fed projects interest rates will be at the end of each year.

The other big data release was July retail sales that increased 1.0%, much more than the 0.3% expected and a big bounce from the 0.2% decline in June. This was the largest monthly increase since January 2023. The increase in spending was broad based too, 10 of the 13 major retail categories saw an increase. However, the trend has been mixed – sales over the past year are up just 2.7%, and if adjusted for inflation, are down 0.2%.

That turns us to this week where the key event will be the Jackson Hole Economic Symposium hosted by the Kansas City Fed. Global central bank leaders will convene in Jackson Hole to discuss monetary policy issues and the speech of the week will come from Fed Chairman Powell on Friday morning. This symposium is one of the largest of the year and is where previous Fed officials have announcement major policy changes/announcements. While the Fed will not cut rates during this event, it will be closely followed for the Fed’s thoughts on economic growth, inflation, employment, and the path of interest rates.

Volatility spiked two weeks ago, seeing its third largest spike in history, but has since seen its quickest decline on record and back close to the levels it was at prior to the quick equity pullback. The volatility is likely not done however – with Fed cuts incoming, a big election coming up, and mixed pictures on the economy, the uncertainty remains high.

Recent Economic Data

-

Consumer Price Index: The latest inflation data for July came in just about as close to expectations as you can get. The consumer price index increased 0.2% in July. This comes after no change and a 0.1% decline the prior two months. The 12-month change was at 2.9%, a slowdown from 3.0% in June. Energy prices were flat in the month, up just 1.1% over the past year, while food prices rose 0.2%, and up 2.2% over the past year. Commodity prices saw a sizeable decline and over the past year have helped overall inflation move lower with a 1.9% decline from a year ago. In addition, new and used car prices continue to decline, falling 0.2% and 2.3% in the month, respectively, with used car prices down 11% over the past year. Now the “sticky” categories – shelter prices rose another 0.4% in July, a pickup from 0.2% in June, and up 5.1% over the past year, while transportation prices rose 0.4% (despite another big decline in airfares) after two consecutive months of declines. Perhaps the biggest positive is services prices excluding shelter were unchanged in the month and up 4.6% over the past year, decelerating from the 4.8% rate in June.

-

Producer Price Index: The producer price index increased 0.1% in July, slightly less than the 0.2% increase expected. Producer prices are up 2.2% over the past year, a deceleration from 2.7% in June. Energy prices saw a big jump of 1.9% in July while food rose 0.6%. However, prices of final demand services fell 0.2% which offset the larger 0.6% gain in final demand goods. Within services, trade fell 1.3% while transportation/warehousing rose 0.4%.

-

Retail Sales: Retail sales in July were much better than expected and sales growth was pretty broad based. Retail sales increased 1.0% in July, a bounce after a 0.2% decline in June, and above the 0.3% increase expected. Of the 13 major retail categories, 10 of them saw an increase in the month with only miscellaneous stores, sporting goods/hobby stores, and clothing seeing a decline. The largest increase was in vehicle sales which grew 3.6%. Excluding vehicles and gas, sales were up 0.4%, still better than 0.3% expected. Other categories with solid sales growth were electronics up 1.6%, building supplies/garden equipment up 0.9% and food/beverage up 0.9%. Sales are up 2.7% from a year ago (up 3.4% excluding vehicles and gas), which is now struggling to keep up with inflation.

-

Jobless Claims: The number of jobless claims the week ended August 10 was 227,000, a decrease of 7k from the prior week with the four-week average at 234,000. The number of continuing claims was 1.864 million, down 7k from the prior week. The four-week average was 1.862 million.

-

Empire State Manufacturing Index: The Empire State Manufacturing index was -4.7 for August, near the level of -6.0 it was in July and indicating conditions that continue to decline but not as much as last month. The report noted a decline in new orders and a steady flow of shipments. It also noted employment continued to be weak with the average workweek dropping sharply.

-

Philly Fed Manufacturing Index: The Philly Fed manufacturing index was -7.0 for August, down from a positive 5.8 indicating manufacturing conditions in the Philly region have weakened once again in the past month. The survey noted general activity, new orders, and shipments all declined with overall prices increasing, but near their long run averages. However, a positive was firms expect growth over the next six months.

-

Housing Starts & Permits: The number of housing starts fell 6.8% in July to a seasonally adjusted annualized rate of 1.238 million, the lowest since the Covid drop April 2020, and down 16.0% from the number of starts 12 months earlier. The number of building permits was 1.396 million, down 4.0% from last month and down 7.0% from a year ago. Not good data considering the issue we are seeing with the shortage of housing supply.

-

Housing Market Index: The housing market index, an index of home builder sentiment, fell even further in August, with the index at 39, dropping 2 points from July for the lowest reading since December indicated a housing market that continues to struggle. The index for present sales fell 2 points to 44 for the lowest since December, the index for expected sales over the next six months actually rose 1 point to 49 as the expectation for interest rate cuts increase, while the index for traffic of prospective buyers fell 2 points to 25, also the lowest since December. Some of these readings are very depressed levels.

-

Consumer Sentiment: The consumer sentiment index was 67.8 for August, slightly better than the 67 expected and an improvement from 66.4 last month. The current conditions index was 60.9, 3 points lower than expected and the lowest since December 2022, likely a result of the market drawdown in the beginning of the month and weakening jobs data. The expectations index was 72.1, better than the 68.5 expected and the best since April. The expectation for inflation over the next 12 months was 2.9% matching July’s expectation and the longer-run inflation expectation was 3.0%, unchanged from July.

Company News

-

Disney’s Parks Investment: Disney unveiled new theme park projects as part of its previously announced $60 billion capital improvement plan over the next 10 years. The plan, unveiled at the company’s biennial D23 fan club convention, includes a new theme park attraction devoted to movie villains at Magic Kingdom, roughly the same size as the Star Wars themed space, an upgrade to Frontierland including a Cars-themed area, a new attraction based on Monsters Inc in Hollywood Studios, several new attractions at the Avengers themed area at Disneyland, and a new attraction devoted to the film Coco. Construction is expected to begin over the next five years. In addition it is planning for four new cruise ships.

-

Candy/Snack Merger: Mars (owner of candy brands like M&Ms, Skittles, etc) has made it official and agreed to acquire Kellanova (spinoff from Kellogg – is the snack brands from what was Kellogg, like Cheezits, Poptarts, etc) for $30 billion in an all cash deal, which is about a 33% premium to where shares traded prior to the first report two weeks ago.

-

Google’s Possible Breakup: The Department of Justice is reportedly considering a move to break up Google after it ruled the company has monopolized the search market. It would be the DOJ’s first attempt to breakup a company since its failed attempt to break up Microsoft 22 years ago. The most likely forced divestures would be the Android operating system and its Chrome web browser. If it does not force a split of the company, it would consider forcing Google to share more data with competitors and other requirements to prevent it from having an unfair advantage.

Other News:

- Kamala Harris’ Economic Plan: At a rally in North Caroline, Kamala Harris laid out her economic agenda which called for a list of progressive proposals. The plan includes a tax credit of $6,000 for families during the first year of the child’s life along with bringing back the expanded tax credit from 2021 and expanding the earned income tax credit. She is also proposing giving $25,000 to prospective homebuyers, allowing those that are first time homebuyers with a two-year record of timely rent payments to qualify. The plan also calls for the development of 3 million new housing units by giving construction tax incentives and a $40 billion fund dedicated to helping local governments build/preserve affordable housing units.

Did You Know…?

Paris Summer Olympics Big Audience

The Paris Summer Olympics ended up being a hit for NBCUniversal, owned by Comcast. The network drew a daily average of 31.6 million viewers over the 14-day Prime Time period. That viewership is up 77% from the 17.8 million average from the Tokyo 2021 Summer Olympics. NBCUniversal has rights to the Olympics through 2032.

The Week Ahead

Markets biggest focus this week will be on the Federal Reserve and central banks toward the latter half of the week as the Kansas City Fed hosts its annual Jackson Hole Economic Symposium. This is a multi-day conference of central bank leaders around the world to discuss key topics regarding monetary policy and has been one of the longest running central bank conferences around the world. In the past, this is where major policy changes have been announced. The main event is Fed Chairman Powell’s speech on Friday where investors will look for any hints on a rate cut in September. The economic calendar is lighter of data releases this week, but still includes key housing data like existing home sales and new home sales, as well as jobless claims and the release of the FOMC’s last meeting minutes. On the earnings front, we are basically past earnings season but there are still key software companies and many more retailers set to report their quarterly results. Notable companies releasing earnings results this week include Palo Alto Networks, Snowflake, Zoom Video, Synopsys, Baidu, Workday, Intuit, Lowe’s, Target, Macy’s, TJX, Peloton, and BJ’s Wholesale Club. On the political side, the Democratic Party begins its Democratic National Convention that runs all week and will kick off Monday with a keynote address by President Biden on Monday evening.