Wentz Weekly Insights

Stocks Higher But Strength Has Become Very Narrow Again

Despite the disappointing economic data from two weeks ago, investors resumed the risk-on approach last week with volatility falling 26% (measured by the VIX – the volatility index) and risk assets performing the best. The Nasdaq outperformed the other major US indexes with a 3.87% gain while the S&P 500 gained 2.43% and the equally weighted S&P 500 underperformed significantly with just a 0.84% gain.

The gains came despite the latest tariff rates going into effect on Thursday. The new tariffs pushed the effective tariff rate to 18.6%, the highest level since 1933, according to the Budget Lab at Yale. There were also several more announcements including a 100% tariff on semiconductors, unless companies commit to manufacturing in the US, and plans for pharmaceutical tariffs of up to 250%.

The Budget Lab at Yale notes the price level from all 2025 tariffs is estimated to rise by 1.8% in the short-run, equivalent to an average per household income loss of $2,400 in 2025. It estimates the effect to US GDP could be as high as 0.5% in 2025-2026, and 0.4% persistently after, equivalent to $125 billion annually.

On the flip side, tariffs are achieving two of the three goals – raising revenue and reducing trade imbalances. JPMorgan notes since April the Treasury has collected record revenue with a April, May, and June revenue total of $64 billion, about 2.6x higher than a year ago. In addition, the goods trade deficit was narrowed by around 10% to $265 billion with the US’s largest trading partners like China, the European Union, Canada, and the UK seeing the largest reduction in the trade deficit.

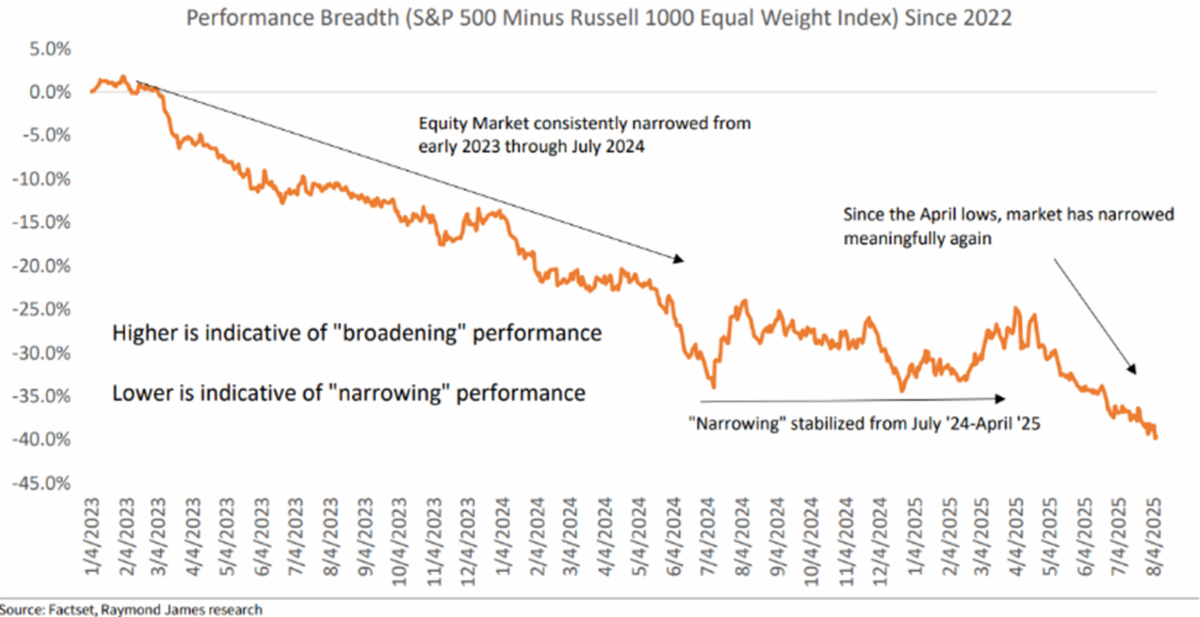

As mentioned, the gains last week were driven by riskier assets like growth stocks, more specifically technology and communication services, with performance very narrow. In fact, that has been the case since the market low of the year after the Liberation Day announcement in early April.

Bank of America released a note last week saying just 10 stocks in the S&P 500 have made up over 80% of the S&P 500’s 33% gain since Liberation Day (the 10 stocks include the Magnificent 7 stocks of Nvidia, Microsoft, Meta, Tesla, Alphabet, Amazon, and Apple, as well as Palantir, the largest gain of 127%, Broadcom, and Oracle).

In addition, concentration in the market continues to grow – asset management firm Apollo Global Management notes Nvidia now holds the largest individual stock weighting in the S&P 500 index since the records began in 1981. However, the trend is not just limited to Nvidia. It adds that the Magnificent 7 companies now account for a combined 33.9% weighting in the S&P 500 and if you broaden it out to the top 20 largest names in the index, they make up nearly half of the index’s weighting at 48.5%.

While the large companies have been big drivers of market gains since 2022, the shift to a small group of companies leaves the index more exposed to sector-specific swings like technology.

The chart below from Raymond James illustrates the narrowness of the markets since the beginning of 2023. A declining line represents a more narrow market while a upward sloping lines represents a broader market performance. After a brief approximately one-year period (roughly June 2024 to April 2025) where markets broadened somewhat, stocks are back to having a very narrow performance. It could be a function of AI spending (dominated by the top companies) or a concern over the broader economy (because the average stock not doing as well).

Either way, there are many reasons to be both bullish and bearish. Bulls argue a more dovish Fed with rate cuts on the horizon, tariff negotiations progressing, tariff exceptions, deregulation push from Trump Administration, strong high-profile earnings and better than expected revision trends, AI secular growth theme, pickup in merger & acquisition activity, lower oil prices, and falling inflation.

Bears argue labor market slowdown, tariff impacts on inflation being delayed, both creating a stagflation type environment, underwhelming earnings outside of technology, narrowing of market performance, upward pressure on Treasury yields (higher government debt), mixed and increasingly bifurcated consumer, increasing division among Fed members, and inconsistency and concerns of inaccurate economic data.

August to mid-October is the seasonally softest period of the year historically (the last 30 years August and September were on average the worst months of the year, per Raymond James) and combined with overbought conditions and an overvalued market, and stocks rising nearly 35% over the past three months since Liberation Day, we expect markets to stall or even a small pullback in stocks over the short-term.

Week in Review:

Stocks had a positive week, reversing the declines from the week prior, with riskier assets and growth stocks outperforming. After spiking two weeks ago, volatility fell 25% with the volatility index (VIX) back down to mid-teens level. The four major US indexes finished as follows: Nasdaq +3.87%, S&P 500 +2.43%, Russell 2000 +2.38%, and Dow 1.35%. After a big drop in Treasury yields two weeks ago from higher rate cut expectations, yields increased slightly last week – the 2-year Treasury yield rose 7 basis points to 3.77% while the 10-year yield rose 6 basis points to 4.29%. The dollar index fell 0.97% while gold rose 2.73%. Bitcoin rose 2.97% back near record highs. Meanwhile, oil fell 5.12% driven by the OPEC announcement of increasing oil production.

Recent Economic Data

- Trade Deficit: Both trade activity and the US trade deficit fell in June. The trade deficit, after spiking in the first quarter as businesses imports surged to get ahead of any potential tariffs, has declined dramatically since April and down another 16% in June to a deficit of $60.2 billion. The smaller deficit was due to imports declining $12.8 billion, or 3.7%, and partially offset by a 1.3 billion, or 0.5%, decline in exports. However, year-to-date the deficit is still 38% higher than the same period a year ago. Trade activity, the total amount of cross border trade between the US and its partners, is up $4.169 billion, or 0.7%, from a year ago, slowing considerably since the beginning of the year.

- Factory Orders: New orders for manufactured goods (factory orders) decreased 4.8% (or $30.9 billion) in June for one of the largest declines in years, however this is after a 8.3% increase the month prior. As is almost always the case, the volatility in orders stems from aircraft orders, which declined 52% after a 231% increase the prior month. On the other hand, shipments of manufactured goods rose 0.5% in June after a 0.2% increase the month prior and up 0.4% excluding transportation.

- ISM Services Index: The ISM services index was 50.1 for July, just barely above the 50 breakeven level. It was about 1.5 points lower than expected and down from 50.8 in June. New orders fell another point to 50.3, nearing the breakeven level. The employment index dropped from 47.2 to 46.4, the weakest since March. Meanwhile, the prices paid index rose to 69.9, up 2.5 points from the prior month, for the highest level since October 2022, signifying a bigger increase in prices in the services sector. Eleven sectors reported growth, one more than in June.

- Productivity and Costs: US worker productivity increased 2.4% on an annualized basis in the second quarter, better than the 1.9% increase expected and bounces back after a disappointing 1.8% decline in productivity in the first quarter. Productivity is so important because it is one of the main drivers of longer-term economic growth. Productivity is a function of output growth minus the increase in the number of hours worked. Output increased 3.7% in the quarter while the number of hours worked increased 1.3% (hence the 2.4% increase in productivity). On the other hand, unit labor costs increased 1.6% annualized in the quarter which reflected a 4.0% increase in compensation minus the 2.4% increase in productivity. Unit labor costs in Q2 slowed considerably from the 6.9% increase in Q1. When comparing to a year ago, productivity was up 1.3% while labor costs were up 2.6%.

- Jobless Claims: The number of jobless claims the week ended August 2 was 226,000, an increase of 7,000 from the prior week. The four-week average decreased slightly to 220,750. The number of continuing claims increased 38,000 to 1.974 million, a new 4 year high. The four-week average rose 5,000 to 1.952 million.

Company News

- Walt Disney: Disney said its ESPN segment will acquire key NFL assets including NFL Network, NFL RedZone, and NFL Fantasy in exchange for the league receiving a 10% equity stake in ESPN. Disney’s motivation was to strengthen its content on its direct streaming platforms. Disney is also launching its ESPN direct-to-consumer streaming service starting August 21. In a separate deal, Disney announced it has signed a deal to have exclusive rights to high profile and two day wrestling events with the WWE, with the WSJ reporting the deal is worth $1.6 billion.

- Apple: Apple gained about 6% last Wednesday after Bloomberg reported it has made a commitment with the Trump Administration on a new $100 billion investment that includes a new manufacturing program, which will bring more of its supply chain to the US, with a focus on critical components. Recall Apple has recently faced threats of having to pay tariffs on iPhones not made in the US, and the move was likely to avoid such tariffs. Later, Trump confirmed Apple would be exempt from the 100% tariff on semiconductors.

- Intel: Trump called for the resignation of Intel CEO Lip-Bu Tan, coming after US Senator Tom Cotton sent a letter to Intel’s board asking about the CEO’s relations with Chinese companies and a criminal case on his former company.

Other News:

- Trump CNBC Phone Call: In an interview with CNBC early in the week, President Trump defended the firing of the Bureau of Labor Statistics due to the large revisions on the labor market numbers, when talking about how the jobs numbers would make it more likely for rate cuts he said he “wanted it a year ago” and that it was too late. Regarding trade, Trump said tariffs on semiconductors will be announced soon and tariffs on pharmaceuticals will jump to 150% within the next year and a half. He also thinks he will raise the tariff on India substantially due to them continuing to buy Russian oil.

- OPEC Raises Oil Production Targets: In its monthly meeting last Sunday, OPEC agreed to another output increase beginning in September by another 547,000 barrels/day, which will complete the unwinding of its 2.2 million output cut that was made back in 2023.

- Expansion of Investments in Retirement Plan: Bloomberg said Trump is expected to sign an executive order this morning allowing private equity, cryptocurrency, and other alternative investments in 401ks. The executive order will direct the Department of Labor, in coordination with the SEC, Treasury, and other federal regulators, to re-evaluate guidance on alternative investments in retirement plans. The order also intends to ease plan administrators’ concerns about liability in added these types of investments to plans.

- Trade/Tariffs:

- It is reported the holdup in any trade deal with China revolves around its supply/exports of rare earth minerals. The Wall Street Journal reported US defense manufacturers are running into delays and soaring costs as China continues to tighten its export restrictions on critical minerals including rare earths and specialty metals. The WSJ reported some restrictions were eased are recent trade negotiations, but China continues to limit shipments of minerals it deems defense-sensitive. It has disrupted production for things like drone motors to missile guidance components.

- Trump said pharmaceutical tariffs will start low then be raised to 150% then 250% after one or one and a half years.

- Trump announced via an executive order India will see an increase in its tariffs by an additional 25% (on top of the 25% Trump announced two weeks ago) to punish it for continuing to buy petroleum products from Russia. He says India is not only buying oil for consumption but also buying to resell it on the open market for big profits. A Reuters report said India has indicated it will continue to buy oil from Russia despite the threats from Trump, with another source saying they are long term purchase contracts and it is not feasible to halt purchases.

- Trump said he plans to impose a 100% tariff on imports of all semiconductors with exemptions for companies that manufacture or commit to manufacturing in the US. Taiwan Semiconductor, the world’s largest manufacturer, will supposedly be exempt from the tariff.

- Bank of England: The Bank of England voted to cut rates by 0.25% at last week’s policy meeting, in a 5-4 vote, for the 5thtime this rate cut cycle as its economy continues to deal with low growth, persistent inflation and rising unemployment, typical indicators of stagflation. The BoE also cited weak business confidence (driven by Trump tariffs), consumer spending under pressure, slowing wage growth and rising job cuts.

- Fed Talk: After the recent disappointing labor market report, we have heard more Fed policymakers voicing support for interest rate cuts soon.

- Minneapolis Fed President Kashkari said the economy is cooling enough to warrant a response from the Fed “in the near term” and sees two rate cuts as appropriate this year.

- St Louis Fed President Musalem said he sees risks to both sides of the Fed’s stable inflation and maximum employment mandates. He sees downside risk to the labor market as both labor demand and supply are slowing and upside risks to inflation as tariffs are starting increase prices. As a result he said the Fed must take a balanced approach, which is why he supported holding rates at the recent Fed meeting.

- Search for the Next Fed Chairman:Bloomberg News reported current Federal Reserve Governor Christopher Waller is emerging as a top pick to be the Fed’s next chair as Trump and the administration continue its search. The report says Trump and his advisers are impressed with Waller’s way of willing to move on policy based on forecasting rather than current data, along with his knowledge of the Fed system. Current Chairman, Jerome Powell, term ends May 2026.

WFG News

Economic & Market Outlook Meeting:

Please note that due to unforeseen circumstances, we had to make the decision to postpone our Economic and Market Outlook meetings indefinitely. We will send along updates as they become available.

The Week Ahead

The main event this week is the next inflation release with the consumer price index coming out Tuesday morning. Consensus estimates see a 0.2% increase in the index, 0.3% increase in the core index, with the annual core rate moving up to 3.0%. The other big data release this week is retail sales on Friday morning – economists are expecting sales to have remained strong in July with a 0.5% increase in sales (0.3% excluding vehicles). Other data releases include the producer price index, import and export prices, the Empire State manufacturing index, the Philly Fed manufacturing index, industrial production, and consumer sentiment. We are past the peak of earnings season, but there are still several notable companies scheduled to report quarterly results including Oklo, CoreWeave, Deere, Cisco, Applied Materials, and Alibaba. We will see a handful of Fed speeches, which will be more in focus after Tuesday’s inflation data. Finally, in geopolitics, on Friday all eyes will be on the scheduled meeting between President Trump and Russian President Putin as Trump pushes for Russia to come to a peace agreement with Ukraine.