Wentz Weekly Insights

Markets Mixed as Rate Cut Expectations and AI Concerns Collide

US stocks saw another mixed week with the average stock slightly lower while big tech and Magnificent 7 names were slightly higher, leading to a 0.10% gain for the S&P 500. After the large decline two Fridays ago, the downside continued Monday through Wednesday. But the week ended strong – the S&P 500 gained 1.67% Thursday and Friday as sentiment improved after additional economic data was released, most of it that would support more rate cuts in 2026 versus less.

The major themes lately have been around the economic data and Fed rate cuts as well as increasing worries about AI when it comes to capital expenditures, profitability/payoff, and supply concerns. The AI trade remained very volatile last week with Oracle remaining in the headlines. This time a report called out stalled negotiations between Oracle and its largest data center partner Blue Owl after Blue Owl reportedly would not back Oracle’s new $10 billion data center project in Michigan.

Oracle later said the project remains on track and chose Related Digital as its development partner and Blue Owl would not be involved. Oracle has recently been in the headlines due to its massive AI related spending, raising debt for its projects, and the spike in the cost of insurance on its debt (suggesting investors are increasingly worried).

Sentiment quickly changed after a blowout earnings report from memory chip maker Micron, whose shares rose over 10% on the week. The company is benefiting from higher prices in its memory chips from a continued supply-demand imbalance and the substantial demand for its high bandwidth memory chips that are used for GPUs/AI/data centers.

There was also news from OpenAI that it is in talks with Amazon, where Amazon will invest $10 billion in OpenAI (valuing the company at $500 billion) and a pledge where OpenAI will use Amazon’s custom Trainium chips in effort to reduce its reliance on Nvidia’s chips.

The notable data that came out last week was relating to the Fed’s two mandates – stable inflation and full employment. First came the jobs report on Tuesday – the DOL said in November there were 64,000 new nonfarm payrolls added (data that was delayed due to the government shutdown). While this was an improvement from October’s decline, it was lower than the 12-month average of 77,750.

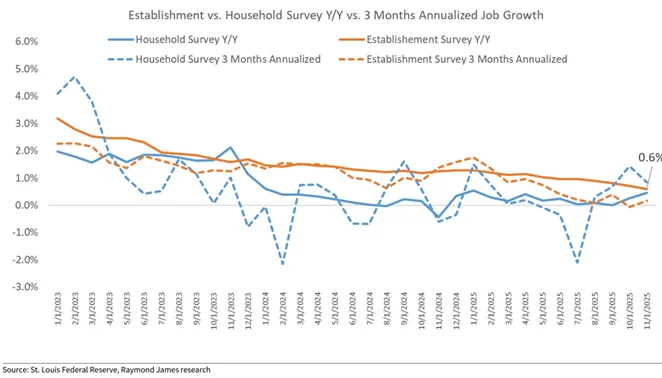

The story in the labor market has been the steady decline in new job growth – over the past 12 months there were 933,000 new payrolls, but this is well below the 2,012,000 added the same period a year ago. The chart from Raymond James below helps illustrate this. The DOL collects data from surveys to establishments (the orange line – this is the headline payroll number we see every month) as well as households (the blue line – this is where we get the unemployment rate and comes from survey given to households on if they’re considered employed or not).

The unemployment rate increased to 4.6%, the highest since 2021. This was due to the household survey showing 228,000 more people considered themselves unemployed (for a total of 7.831 million), which was only partially offset by a 96,000 increase in those considered employed.

We will also note, much of the decline in payrolls this year has come from government where federal payrolls have dropped for the tenth straight month due to the Trump Administration’s efforts to trim the government. Federal payrolls fell 168,000 over the past two months and a total of 271,000 since January.

While the data has been mixed between the two surveys, the message is the same and that is the jobs market is stable where employers in general are no longer hiring but not firing either.

Inflation data came next and was the real catalysts for the strong rally to close the week. The consumer price index for November increased 0.2% with the annual change at 2.7%, both lower than expected with the annual rate the lowest since early 2021.

However it is difficult to take much from this report because October’s inflation report was not published due to the government shutdown, so many month-over-month figures were not available. Many analysts/economists have talked about the flaws in this months inflation report due to the missing data in October. Services inflation remained high though, the index for services prices is still at a 3.5% annual rate.

We expect the Fed to look past this month’s data due to the government shutdown impacts. We expect continued volatility around data and the Fed to undertake one more “insurance” rate cut in 2026 versus the market odds of two rate cuts.

This week will be much more quiet; there are no corporate events to note (no earnings or investor/shareholder events) and economic data will be light. Markets will close at 1:00pm on Wednesday and be closed Thursday to observe Christmas Day.

We hope everyone gets to spend quality time with family and loved ones and wish everyone a very Merry Christmas!

Week in Review:

Volatility subsided more last week after a late week rally from better than expected economic data. However it was still a mixed week for the major indices, which finished as follows: Nasdaq +0.48%, S&P 500 +0.10%, Dow -0.67%, and Russell 2000 -0.86%. The fixed income market/bonds were mostly higher as yields fell across the curve. Both the 2-year and 10-year Treasury bonds fell 4 basis points to 3.49% and 4.14%, respectively. The dollar index rose 0.20% while gold gained 1.43% to another new record high. Bitcoin remained volatile and fell 2.40%. Oil fell to the lowest level since early 2021 on Tuesday before it saw four straight increases, however still finished the week down 1.36%.

Recent Economic Data

- Employment Situation (Delayed): The labor market report for November, which was delayed by two weeks, showed the US economy added 64,000 payrolls, improving from the 105,000 lost in October, and compared to the 12-month average increase of 77,750. However, payroll growth has steadily decelerated with total payrolls added over the past 12 months at 933,000, much less than the 2,012,000 added the same period last year. Meanwhile, the unemployment rate increased to 4.6%, the highest since September 2021. The reason was (in the household data) even though the number of people who said they were employed increased by 96,000, the number unemployed increased by 228,000 to 7.831 million for the highest level since August 2021. The average wage increase has also steadily decelerated, with wages up just 0.1% in the month and 3.5% over the past year, slowing from 3.8% in October.

- Consumer Price Index: The consumer price index increased 0.2% in November, slightly lower than the 0.3% increase expected, and compared to the 0.3% increase in September (October data was not reported or collected due to the government shutdown). There is not much data on the month-over-month change due to the October report not being published, so most of the data is year-over-year and is as follows. The index was 2.7% higher from a year ago for the slowest annual pace of inflation since early 2021. Food prices are up 2.6% while energy prices are up 4.2%, driven by higher oil prices (up 11.3%). Excluding food and energy core prices were up 2.6%. New vehicle prices are up 0.6% while used vehicle prices are up 3.6%. Shleter, by far the largest component of inflation, was up 3.0%. Finally, the index on services excluding shelter prices were up 3.5% over the past year.

- Retail Sales (Delayed): Monthly retail sales for October (delayed) at $732.6 billion were unchanged compared September, versus the expectation of a 0.2% increase. Vehicle sales declined 1.6%, likely due to the expiration of the $7,500 tax credit from buying an EV, while gasoline sales declined 0.8% due to lower gas prices. Excluding these two often volatile categories, retail sales increased a stronger 0.5%. Of the other 11 major categories, 8 of them saw an increase in sales, led by a 2.3% increase in furniture, 1.9% increase in sporting goods/hobbies stores, and 1.8% increase in online sales, while 3 saw a decline, including building material stores, health/personal care stores, and restaurants and bars. Compared to a year ago retail sales are up 3.5%, or 4.2% excluding vehicles/gas, with real retail sales (which takes into account inflation) up 0.7%.

- Empire State Manufacturing Index: The Empire State Manufacturing Index was -3.9 for December, weakening from the 18.7 in November. Indicators suggest activity edged lower in the month while employment and price increases continue to rise. A welcoming sign was firms feel better about the future with the index about future business conditions at 35.7, the highest since January.

- Philly Fed Manufacturing Index: The Philly Fed Manufacturing Index was -10.2 for December, falling further into contraction territory from the -1.7 November. The report noted new orders and shipments increased slightly, but most of the future indicators in the survey remained soft. Employment improved somewhat while price increases remained elevated but did improve from November.

- Housing Market Index: The housing market index, an index on homebuilder sentiment, was 39 for December, higher for the third straight month and up from 32 over that period which was near an all-time low. The index on present sales was 42, up from 34 over the past three months, the index on expected sales over the next six months was 52, improving only slightly, while the index on traffic of prospective buyers was 26, unchanged from November but up from a near record low of 20 just four months ago.

- Housing Starts & Permits: Delayed

- Existing Home Sales: The number of existing homes sold in November was at a seasonally adjusted annual rate of 4.130 million, 0.5% above October’s pace but 1.0% below the rate from November 2024. The number of existing homes for sale saw substantial improvement over the past year, up 7.5% from a year ago, however in the past several months the increase has stalled, with November’s supply down 5.9% at 1.43 million homes. The median sales price increased 1.2% from a year ago to $409,200.

- Jobless Claims: The number of jobless claims the week ended December 13 was 224,000, a decrease of 13,000 from the prior week, bringing the four-week average only slightly higher to 217,500. The number of continuing claims was 1.897 million, up 67,000 from the prior week, with the four-week average down 14,000 to 1.902 million.

Company News

- Alphabet: Google is reportedly testing real estate listings directly in its search results, according to real estate tech strategist Mike DelPrete. The report included screenshots of “for sale” listings inserted into Google search results in limited markets, which appear to be tests and only seen on mobile. Shares of Zillow fell 8.5% as a result.

- Ford: Ford announced a series of actions as part of its Ford+ plan, including a strategic pivot in its EV business due to lackluster demand and as a result will take a $19.5 billion write down of its EV division, with a majority of that occurring in Q4. Part of the strategy includes shifting its focus to higher return opportunities including adding trucks and vans to its US manufacturing and a new battery energy storage business (to capitalize on energy needs from data centers and infrastructure). With the update, Ford increased its full year EBIT guidance.

- Amazon: The Information reported Amazon is in preliminary discussions to invest $10 billion in OpenAI that would value OpenAI at $500 billion. The investment would involve OpenAI using Amazon’s Trainium AI chips that it has developed inhouse. The partnership would reduce OpenAI’s reliance on Nvidia’s GPUs (where it currently gets its AI chips). It added that since Amazon’s Trainium chips are cheaper and use less energy, it is looking for customers that want to save costs (over other GPUs/chips like those from Nvidia).

- Lululemon: Lululemon shares were higher after activist investor Elliott Management took an over $1 billion stake in the company and said it will push for leadership changes. In addition, the company said it will expand its international presence by adding six new markets.

- Oracle: Shares of Oracle were lower again last week (continued overspending and debt concerns) after a report said its $10 billion data center in Michigan is in limbo after funding talks have stalled with its private capital partner Blue Owl, who has helped finance many of its other projects. The report said concerns were raised about Oracle’s infrastructure strategy, its rising debt levels, and its stricter leasing and stricter debt terms from lenders. Oracle later said its development partner/builder Related Digital has chosen an alternate equity partner instead of Blue Owl and denied the claims it was about the concerns raised above

Other News:

- Extended Trading Hours: Reuters reported Nasdaq has filed documents with the SEC to launch trading of stocks outside the normal hours, with the company planning to start this in the second half of 2026. The plan includes extending trading hours from the current 16 hours per day (which includes pre-market trading, regular trading hours, and post-market trading) to 23 hours Monday through Friday. The planned 23/5 schedule would include a day session from 4am – 8pm and a night session from 9pm – 4am (which would be considered trades for the following day). The one hour break would be for clearing of trades, maintenance, and testing. Critics say the almost nonstop trading could worsen some issues that face the equity markets today including thin liquidity, sharp price swings, and a more “gamified” trading environment, according to CNBC.

- Fed Talk:

- NY Fed President Williams said he sees the downside risks to employment rising and upside risks to inflation moderating, and despite these uncertainties the US economy has been resilient and expected to grow faster next year.

- Fed Governor Waller (who President Trump has interviewed for the Fed Chairman job) said the US is close to zero jobs growth, despite recent monthly reports showing gains averaging 77,000, and said he thinks these numbers will be revised lower. Due to this along with his confidence inflation is receding and his estimate that the neutral rate is lower (around 2.5%-3.0%), he is pushing for more rate cuts early next year.

- Atlanta’s Bostic said he believes the elevated level of inflation is still the most pressing risk and believes continuing rate cuts will move the rate into accommodative/stimulus mode and would risk exacerbating inflation and inflation expectations, adding that this could hurt the Fed’s credibility.

- Atlanta Fed president Bostic said inflation still worries him, more so than unemployment, and he still believes it is likely inflation will remain above the 2% target and as a result prefers to keep interest rates elevated. He said monetary policy addresses cyclical changes but not structural changes so his Atlanta Fed staff is studying whether the current labor market weakness is a cyclical issues (due to the business cycle) or is related to structural changes.

- Global Central Bank News:

- The Bank of England voted, in a 5-4 vote, to lower interest rates to 3.75%, the fourth rate cut this year and 5th of the cycle, due to continued progress on inflation, weak employment growth and a slack in activity. The 4 dissents voted to keep rates unchanged.

- The European Central Bank held its rates unchanged as expected for the 4th straight meeting. It upgraded its economic growth projections, driven by domestic demand, and sees inflation falling to 1.9% next years.

- The Bank of Japan raised its benchmark interest rate to 0.75% in a unanimous decision, as was expected, and to the highest level since 1995, while signaling additional rate cuts ahead. Officials said data shows solid wage growth momentum and receding risks from US tariffs. Officials also suggested the neutral interest rate is somewhere between 1% and 2.5% but said its difficult to judge precisely, which to us suggests there are additional rate hikes on the horizon.

WFG News

Office Hours:

Please note Wentz Financial Group offices will be closed Wednesday and Thursday this week, we will return on Friday the 26th. Next week the offices will be closed Thursday January 1 for New Year’s Day.

WFG Investment Classes:

Interested in learning more about investing and how the markets work? Wentz Financial Group holds various Investment Basics classes throughout the year. Contact us for details!

The Week Ahead

The calendar lightens up as we enter the holiday period and markets will be closed early at 1:00 pm on Christmas Eve and all day Thursday for Christmas Day. The corporate calendar is the quietest it will be all year with no notable earnings scheduled and no shareholder or investor events. There are several economic data releases to take note of however. Tuesday morning we will see the first estimate of third quarter GDP, something that has been delayed for almost two months, with the consensus estimating third quarter growth was 3.2% (annualized). Durable goods orders, industrial production, new home sales, money supply. jobless claims, and consumer confidence are all released this week as well.