Wentz Weekly Insights

Markets See Big Rotation Favoring Small Caps Following Latest Inflation Data

Last week started pretty quiet, continuing the quietness from the holiday shortened week the week prior. However, that all quickly change on Thursday as a result of the latest inflation data from the consumer price index. Going into Thursday, the S&P 500 and Russell 2000 were both higher by 1.2% with the S&P 500 seeing a seven day win streak and its 37th record close of the year. Over the next two days (Thursday and Friday) the S&P 500 fell 0.3% while the Russell outperformed, rising 4.7%. In fact, as Bespoke noted, in terms of performance, Thursday saw the widest spread between the S&P 500 and the Russell 2000 in 23 years.

By the end of the week it was a massive outperformance for small caps with the Russell 2000 rising 6.00% compared to the 0.87% gain for the S&P 500. A basket of the ‘Magnificent 7’ saw a decline of 1.95% for the week, driving most the underperformance in the index.

The Treasury yield curve saw a steepening with Treasury prices moving higher. The monetary policy sensitive 2-year Treasury yield saw a drop of 15 basis points for the week, most of that coming Thursday, and finished at 4.46% for the lowest in almost a year. The 10-year yield fell 10 bps to 4.19% for its lowest since December.

The move was a result of an inflation report investors have been looking for. June’s consumer price index saw its first decline since May 2020, decreasing 0.1%. The expectations was for a 0.1% increase and comes after seeing no change in the index in May. This makes it two straight inflation reports that have come in lower than expected, coming after seeing inflation higher than anticipated the prior four months and puts the Fed back on path to gaining greater confidence inflation is returning to its 2% annual target.

Details of the report were encouraging as well. Although most the decline came from a 2% drop in energy prices, and 3.8% drop in gas prices, the core index only rose 0.1% as shelter prices rose just 0.2% for the smallest monthly increase since late 2021. New and used car prices fell 0.2% and 1.5% respectively, and transportation prices, which have been one of the hottest categories seeing the highest inflation this year, saw a 0.5% decline due to another large drop in airfares.

In addition, the subindex of service prices excluding housing was unchanged for the second consecutive month. This index is still 4.8% higher from a year ago but that has steadily decelerated, falling from 5.0% in May.

The welcoming data caused another repricing in rate cut expectations which in turn created a strong rally in smaller size stocks and the fixed income market with yields falling across the board. Expectations for a rate cut moved close to 15% for the Fed’s meeting in two weeks, with the odds for a cut at the following meeting in September all but certain. This repricing will likely continue to provide fuel for smaller cap stocks.

From an earnings standpoint, several big banks were the first to report second quarter results on Friday, with results underwhelming – there was positive in investment banking due to higher M&A activity, but larger loan loss provisions (cash set aside for potentially bad loans), slow loan growth, and guidance for weaker net interest income and higher expenses. Meanwhile, PepsiCo had lower organic growth and cautious guidance while Delta provided disappointing Q3 guidance amid lower fares but said summer travel demand remains strong.

Earnings are expected to have grown 8.9% in the second quarter with sales increasing 4.8%. Expectations are high this earnings seasons, particularly the high bar on AI related companies. We expect investors to punish stocks with any earnings misses or disappointing forecasts with such a high bar.

This week will see a continued focus on banks and about 10% of S&P 500 companies set to report before seeing a pickup in activity next week and the week after. The most important data this week is the retail sales report on Tuesday morning where economists expect a slight decline in June. Monday is the start to the Republican National Convention where we will see Trump’s pick for Vice President. There will also be talk on the assassination attempt on President Trump and how it changes his election odds. A Trump win and GOP sweep would be viewed as market positive due to the probabilities of an extension to the 2017 Trump tax cuts, strong trade focus, and deregulation.

Recent Economic Data

-

Consumer Price Index: The consumer price index showed consumer inflation declined in June for the first time since May 2020. The index fell 0.1% in June, this was against the expectations for an increase of 0.1%, and comes after the index saw no change in May, so the last two months consumer prices have declined. However, the decline was mostly due to a 2.0% drop in energy price (3.8% decline in gas prices) in June. Food at home (groceries) rose 0.1% while food away from home (restaurants) rose 0.4%. Excluding these two volatile categories, the “core” index rose 0.1%, again still slightly lower than the 0.2% increase expected and the slowest monthly increase since August 2021. Within core categories, there was a decline in commodities (outside of energy) of 0.1%, a 0.2% decline in new car prices, 1.5% decline in used car prices and one of the hottest categories over the past year, transportation, saw a 0.5% decline (due to a 5% decline in airfares). Car prices have actually been a big factor in lower prices over the past year – prices of new cars down 1% and prices of used cars down 10% over the past year. Categories seeing higher prices were apparel, medical care, and shelter. One of the important subindex is looking at services prices excluding housing, which is unchanged for the second consecutive month and up 4.8% from a year ago, slowing from the 5.0% 12-month pace in May.

-

Producer Price Index: The producer price index rose 0.2% in June, slightly more than the 0.1% increase expected. Prices for final demand goods declined 0.5% due to a 0.3% decline in food prices and a 2.6% decline in energy prices. Prices of final demand services is what drove most the upside in producer inflation, where the index rose 0.6%. If food and energy is excluded, the overall index increased 0.4%, double the expectations. The index is up 2.6% from a year ago, accelerating from 2.4% in May, with the core index up 3.0%, accelerating from 2.6% in May.

-

Jobless Claims: The number of unemployment claims filed the week ended July 6 was 222,000, a decrease of 17k from the prior week, which was the highest in the past 12 months. The four-week average was 233,500, down 5k from the prior week. The number of continuing claims was 1.852 million, down 4k from the prior week which was the highest since November 2021, with the four-week average up 10k to 1.840 million.

-

Consumer Sentiment: The preliminary July Consumer sentiment survey came in with an index level of 66.0, down from 68.2 from June and the weakest level since November, indicating consumers’ are feeling less optimistic on the economy. The current conditions index was 64.1, down from 65.9 last month and the weakest since December 2022. The expectations index was 67.2, down from 69.6 last month and the lowest reading since November. Expectations for inflation over the next 12 months was 2.9%, dropping from 3.0% last month for the lowest of the year while longer-term inflation expectations were at 2.9%. The report noted “with the election, consumers perceived substantial uncertainty in the trajectory of the economy, though there is little evidence that the first presidential debate altered their economic views.”

-

Mortgage Rates: The average 30-year prime mortgage rate was 6.89% for this week’s Freddie Mac survey. That is a 6 basis point decline from last week and now down from this year’s high of 7.22% but still above the low of the year, which was the first week of the year, of 6.62%.

Company News

-

Nike’s Struggles: Nike was highlighted in a Financial Times articles on its struggles in its turnaround to grow sales again. Meanwhile Bloomberg reported the company rehired a retired key senior executive, Tom Peddie, to fix relationships with retailers and help its declining sales.

-

Energy Sector Weakness: Oil stocks saw some downward pressure to start last week after warnings from several large oil producers/refiners. BP warned it would see a writedown on the value of a plant in Germany of up to $2 billion and warned of weakness in results due to “significantly lower” refining margins and results from oil trading. Meanwhile, Exxon Mobil implied its Q2 EPS guidance will be below consensus estimates due to a drop in refining profits from lower margins across the industry.

-

Next in the Weight Loss Drug Race: Pfizer said it is proceeding with the development of its own once daily weight loss drug after encouraging data from an ongoing study, attempting to capitalize on the massive and quickly growing market. Last month it said it was testing three weight loss drugs, one which will have a different mechanism from the current on-the-market weight loss drugs (like Ozempic and Wegovy).

-

Apple’s Optimism: Bloomberg reported Apple plans to ship at least 90 million iPhone 16s before the end of the year, equaling a 11% increase from last year’s iPhone 15 shipments. Apple is hoping its AI driven software, called Apple Intelligence, will drive an upgrade cycle and lead to higher demand. Giving more confidence to this report is the multiple reports the past couple weeks that Apple has asked its suppliers to boost shipments in the second half 2024. In a separate report, Bloomberg said its Vision Pro headset is not expected to see a pickup in sales until it releases a cheaper version next year. It added sales of the product are facing a 75% decline in the current quarter and are not expected to cross 500k unit sales this year.

-

Tesla’s Robotaxis: Tesla shares were down 8.5% Thursday after, in addition to the mega cap selloff, a Bloomberg report was released saying the company may be delaying its robotaxi event that was scheduled for August 8 because it needs more time to build the autonomous vehicle prototypes.

Other News:

-

Powell’s Comments: In Fed Chairman Jerome Powell’s testimony to Congress, he said data from first quarter did not support the greater confidence the Fed needs to cut rates but said higher rates and restrictive policy is helping put downward pressure on inflation, adding recent months inflation readings have shown modest progress. He also said labor market conditions have “cooled considerably” and the economy is no longer an “overheated economy” and is mostly back to where it was prior to the pandemic. This means the Fed faces a two sided risk and he indicated that is one of the Fed’s bigger focuses – if moving too quickly (loosen policy/cut rates too soon) it could undermine the progress on inflation, or moving too slowly (not cutting rates soon enough) it could hurt economic activity.

-

New NBA TV Deal: The NBA reached a deal with major broadcast partners in a 11 year deal valued at $76 billion. The contract includes longtime broadcast partner TNT and ESPN with the additions of NBC and Amazon. The new package would feature national NBA telecasts almost every day of the week. Amazon is expected to show regular season games mainly on Friday and Saturday nights, while NBC would broadcast mostly on Tuesdays with its streaming service Peacock showing exclusive games on Mondays. Disney’s ESPN would reduce its regular season games, expected to be cut to 80 from about 100, but retain its rights to broadcast the NBA Finals.

Did You Know…?

Airport Passenger Volume Hits New High:

The Transportation Security Administration (TSA) said that on Sunday it screened 3,013,413 passengers, the first time ever that TSA saw throughput of over 3 million in a single day. The Secretary of Homeland Security said TSA checked 35 passengers every second on Sunday and added the record breaking travel is expected to continue through summer. The previous record was 2.996 million that was set on June 23. Last year’s Sunday after the Fourth of July saw throughput of 2,644,639, an increase of 14%. TSA said it has seen eight of its ten busiest days on record this year alone.

Consumer Credit Grows:

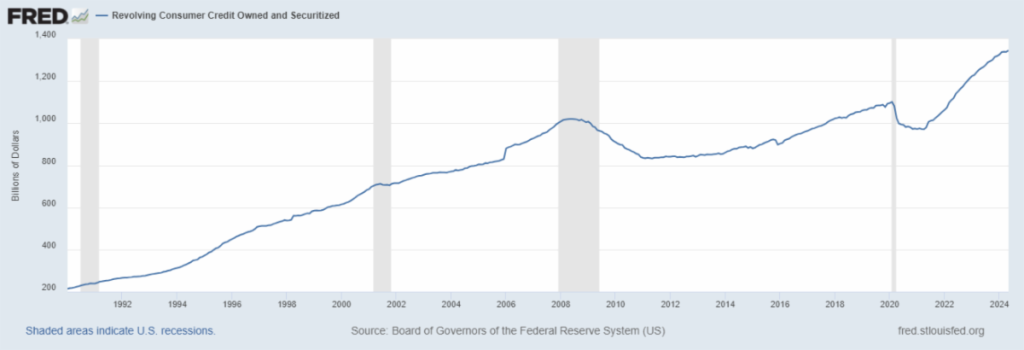

Consumer credit increased by $11.3 billion in May, equal to an annualized rate of 2.7%, to a new high of $5.06 trillion. Revolving credit like credit cards rose $7 billion, or an annualized rate of 6.3%, while non-revolving credit like mortgages, car loans, etc, rose $4.4 billion or an annualized rate of 1.4%. Revolving credit is now $374 billion, or 39% above the low levels of the pandemic in April 2021, however, just 22% above pre-pandemic levels from February 2020 which is about a 6% annualized pace, so compared to pre-pandemic is not too crazy of growth – however still closely followed as a large increase (especially tied to higher interest rates) could lead to stress on consumers budgets. The chart below shows the trend in revolving credit since 1990. The grey shaded periods indicate recessions and you will notice revolving credit declines in recessionary periods as consumers slow/stop spending. You may also notice the large increase after the pandemic recession in 2020.

The Week Ahead

Earnings seasons ramps up this week with around 10% of S&P 500 companies set to report with focus remaining on the financial sector. Notable earnings releases will come from Goldman Sachs, BlackRock, Bank of America, Morgan Stanley, PNC, US Bancorp, American Express, as well as many others from other sectors including UnitedHealth, Johnson & Johnson, United Airlines, Halliburton, and Netflix. Mid-month economic data reports get into several housing reports and retail sales. Current consensus estimates see retail sales for June declining at a 0.2% rate, mostly due to lower gasoline sales (lower prices), and up a small 0.1% excluding gas. Housing data will come from the housing market index and housing starts and permits. There are a couple manufacturing updates including the Empire State and Philly Fed Manufacturing indexes (surveys), and industrial production, and of course weekly jobless claims on Thursday. On the Fed side, we will hear from more policymakers during public appearances, including Jerome Powell’s discussion with the Chairman of the Economic Club of Washington DC on Monday. Across the Atlantic, the European Central Bank will meet Thursday to make its monetary policy decision. The expectations are for no changes in policy, after it cut rates in its prior meeting in June. On the political side, there will be a lot of talk on how the weekend assassination attempt on former President Trump will affect his election odds and the market implications, as well as the start to the Republican National Convention on Monday and with focus on Trump’s Vice President decision.