Wentz Weekly Insights

Momentum Continues with Earnings, Politics, and Fedspeak All Highlights

Last week saw stocks move higher again, ending less than 1% off record highs. There was not any clear underperforming part of the market, but a clear outperformance was seen in small caps that helped the equally weighted S&P 500 index (where each stock carries an equal weighting) outperform the cap weighted index (where larger companies carry a higher weighting) by almost 1%. Big tech/mega caps were mixed on the week. The Treasury market was mixed as well with shorter term yields slightly higher and longer term yields slightly lower.

It was a week that saw a bigger focus on earnings results, Fed speak, and politics. The main event for the week was earning results from the largest company in the world Nvidia. Its financials were much better than expected, as has been the case for the past several years, driven by the strong demand in its data center chips, more specifically its advanced chips that power everything artificial intelligence related. The stock was initially lower after providing a forecast for the next three months that was only ‘slightly’ better than what estimates were.

One of the bigger questions going into the quarter was the demand for its new, faster, and more powerful chips, called Blackwell, and the supply of those chips which the company said demand is expected to far outpace supply through its fiscal year 2026. Despite starting the day lower, shares ended up finishing higher after management noted substantial demand for Blackwell.

The other focus from the earnings perspective was on the retail sector, which was mostly positive. The main headline was earnings from Target versus Walmart where trends were in the opposite. Walmart stock rose over 7% while Target fell nearly 20%. Walmart reported solid financial results and gave upbeat comments on the consumer. Target’s results missed expectations due to a number of reasons including weaker spending in higher margin discretionary items, higher inventory levels, and cost controls.

Other solid results in the retail sector came from TJX, Ross Stores, and GAP, all of which ended higher.

It was a busier week of Fed speak with many Fed policymakers giving public remarks on monetary policy, but the overall message has remained the same – stressing patience in policy easing, and the pace of rate cuts should slow as we approach inflation target and terminal rate. The odds of a rate cut in December (the Fed’s last meeting of the year) is close to a toss up, a big change from a 75% chance about a week ago. In addition, the odds for cuts in 2025 has been cut in half to two rate cuts, down from the expectation of four cuts just a month ago.

Finally, politics has been a big discussion the past two weeks with Trump announcing a number of cabinet nominations. The one most impactful for markets is Treasury Secretary in which hedge fund manager Scott Bessent was nominated. Markets see Bessent as a more moderate pick and as a fiscal hawk (more controlled budget, less spending). The initial thoughts see him taking a less extreme approach on some of Trump’s views, including tariffs and higher deficit spending.

Another big impact on markets comes from the Securities and Exchange Commission (SEC) where the current Chair Gary Gensler said he would step down once Trump takes office. Gensler’s agenda during his tenure included more transparency, reducing systematic risks and conflicts of interest, as well as the battle on cryptocurrency where he took a hard stance that securities laws apply to cryptocurrencies. With his resignation announcement, Bitcoin (and other cryptocurrencies) reach new record highs, with Bitcoin up 50% since the election. The gains come not only from SEC changes, but Trump’s friendly view on crypto and one of his campaign discussion points around possibily creating a Bitcoin strategic reserve.

Investors come back this week to a holiday shortened week with markets closed Thursday and open half day Friday. Highlights this week will be a wave of retailer earnings Tuesday before things settle down Wednesday in what is expected to be a quiet day.

Week in Review:

It was another strong week for stocks with big tech mixed and an outperformance of the equally weighted S&P 500 over the cap weighted index. The major indices finished as follows: Russell 2000 +4.46%, Dow +1.93%, Nasdaq +1.73%, and S&P 500 +1.68% (and the equally weighted S&P 500 index +2.54%). The fixed income market was mixed with the Treasury curve flattening somewhat – the 2-year Treasury yield rose 5 basis points to 4.38% while the 10-year yield fell 3 basis points to 4.41%. The dollar continues its strong run higher with the dollar index rising another 0.81% last week for its eighth straight week of gains, the longest since last September. Gold increased 5.5% after three straight weekly declines. Bitcoin’s incredible run continues, rising another 8.7% last week and up 43% since the election. Oil gained 6.3%.

Recent Economic Data

- Housing Market Index: The housing market index, which is a measure of homebuilder sentiment, improved for the third consecutive month after reaching the lowest level in August since mid-2023. The index was 46, up 3 points from October and the best level since April suggesting slightly more confidence on the housing market for home builders. The present sales index rose 2 points to 49, up 5 from the year’s low, the expected sales over the next six months rose 7 points to a strong 67, up from a low of 47, while the index for traffic of prospective buyers rose 3 points to 32, up from a low of 25, although remains pretty low.

- Housing Starts: The number of housing starts in October was 1.311 million (on a seasonally adjusted annualized pace) which is 3.1% below September and down 4.0% from a year ago. The number of permits for new home builds was at an annualized rate of 1.416 million, down 0.6% from September and 7.7% below the pace the same month a year earlier. The number of completed homes, at 1.614 million (again, an annualized pace and seasonally adjusted) remains near the highest since the housing boom in mid-2000s, however that should slow as new home builds remains and new permits remain near the lowest since pre-pandemic.

- Existing Home Sales: The number of existing home sales increased 3.4% in October to a seasonally adjusted annualized pace of 3.96 million. The sales rate was up 2.9% from the same month a year ago, the first annual increase for existing home sales in over three years (July 2021, when the sales rate was 6.070 million). Supply continues to improve as the number of existing homes on the market rises 0.7% in the month to 1.370 million units, 19% higher from last year’s level of 1.15 million. Prices continue to increase though, up another 4.0% in October from a year ago to $407,200. The unfortunate part is first time home buyers remain a small portion of existing home sales due mostly to affordability, making up 27% of all transactions, much lower than the historical average of 40%.

- Mortgage Rates: Mortgage rates are creeping back up to the 7% level – the latest Freddie Mac mortgage survey showed the average prime 30 year mortgage rate increased another six basis points last week to 6.84%, rising from the late summer low of 6.08%, however still below the cycle peak of nearly 8% last October.

- Jobless Claims: The number of unemployment claims filed the week ended November 16 was 213,000, a decline of 6k from the prior week. The four-week average fell about 4k to 217,750. The number of continuing claims increased 36k to 1.908 million, a new three year high. The four-week average rose 5k to 1.879 million.

- Philly Fed Manufacturing Index: The Philly Fed manufacturing index came in at -5.5 for November which was a decline from 10.3 in October and below expectations, suggesting manufacturing conditions in the Philly region went back to contracting after a quick expansion. This was the complete opposite of the Empire State report that showed a strong expansion in activity. The Philly report noted 18% of firms saw increase in activity in the month (down from 24%), 23% saw a decrease, while 58% saw no change.

Company News

- DOJ Pushing For Google Breakup: The Department of Justice, in its ongoing antitrust case against Alphabet, is planning to ask a federal judge to force the company to sell off its Chrome browser and require measures on AI and its Android operating system, including breaking Android from its other products like search and Google Play app store, according to a Bloomberg report. This comes after the judge recently ruled in August that Google has illegally monopolized the search market. Several days after this report, Bloomberg reported that part of the DOJ’s antitrust investigation may require the company to unwind its investment in generative AI startup Anthropic.

- OpenAI Web Browser: Separately, The Information is reporting OpenAI is considering launching its own web browser that would be combined with its chatbot ChatGPT in a direct challenge to Google’s Chrome. The report says OpenAI has been discussing the idea with website and app developers and has hired two employees who were previously with Google and worked on developing Chrome.

- Super Micro Computer’s Super Week: Super Micro shares were up 80% last week after it announced it has appointed an independent auditor and submitted a plan to the Nasdaq to remain compliant in order to remain listed on the exchange, as well as saying it believes it will be able to complete its annual report.

- Comcast Splitting: Comcast confirmed it will move forward with its plan to spinoff its NBCUniversal portfolio of cable TV networks into a newly created separate public company, coming a month after Comcast said it was evaluating a spinoff of its cable assets. The spinoff will be a tax-free event and take about a year to complete. The separate company will include networks such as MSNBC, CNBC, E!, Golf Channel, and USA, but the streaming service Peacock and Bravo will remain part of the parent company.

- iPhone Sales Struggle in China: Counterpoint Research said Apple saw a double-digit decline in iPhone sales in China’s two week “Single’s Day” shopping event, seeing increasing pressure and losing market share from what it said was an “abnormally high number” of competitors. There have been increasing concerns around demand of Apple products in China as well as increasing competition.

- McValue Menu: McDonald’s said it is launching a “McValue” platform in 2025 that will include the $5 meal deal, app only offers, localized food/drink deals, and a new buy one, add one for $1 offers which will allow customers to mix and match their own items. This comes after recent success of its value deal.

- More Boeing 737 Issues: Business Insider reported the Federal Aviation Administration is reviewing Boeing 737 MAX engine to address safety concerns after two bird strike incidents last year. The FAA may require pilots to change takeoff procedures until Boeing finds a permanent solution, which it says could delay certifications of the newer models.

Other News:

- Credit Spreads at New Lows: Credit spreads for investment grade bonds (how much a corporate bond is paying over the Treasury of equal maturity) are at 78 basis points, the lowest level since 1998, according to Bloomberg. High yield spread are around 265 basis points, the lowest since 2007. The aggressive spreads are beginning to cause more talks of bubble signs in the fixed income market.

- Geopolitical Tensions Heat Up: Geopolitical tensions were heightened after Ukraine fired long range missiles that were supplied by the US on an ammo depot in Russia, a first in the Russia/Ukraine war. This comes a couple days after Biden approved the use of the weapons after North Korea sent thousands of troops to Russia near the Ukraine border where Russia is planning to claim additional territory. As a result of the missile strikes, Putin signed a decree that revised Russia’s nuclear doctrine to broaden the basis on which Russia could use nuclear weapons.

- Self-Driving Vehicles A Priority: Companies involved with self-driving vehicle technology, including Tesla, saw gains yesterday after a report said members of the Trump transition team have told its advisers to make a federal framework for self-driving vehicles one of the Department of top priorities, according to a Bloomberg report. The report added Trump is looking to staff the department with leaders who will develop the framework, though little details on the framework are known. It also says mass adoption of self-driving cars will likely require a broad act by Congress, but the Department of Transportation will likely be able to create narrower rules.

- Bank of Japan: The Bank of Japan governor signaled the central bank plans to raise interest rates gradually if the economy continues to evolve as expected, but gave no specific timeline on the increases. He added that risks, including those outside Japan, will be monitored and could change its stance due to the impact on Japan’s economic activity. Recall the BoJ raised rates for the first time in July to 0.25%, ended its zero interest rate policy.

Did You Know…?

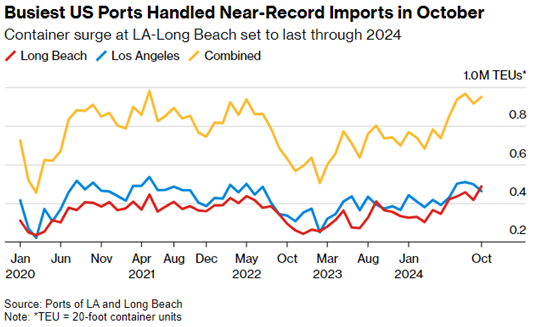

U.S. Port Activity at A High

The busiest port complex in the US reported almost record level of imports in the latest month of data, according to Bloomberg. This is a result of businesses importing and stocking inventory ahead of potential tariff increases, to avoid labor-related shipping disruptions, and to get in front of the holiday shopping period. The executive of the Port of Los Angeles said the port handled 905,000 container units in October, a 25% increase over last October’s numbers, and is the first time the port has handled over 900,000 containers for four months in a row. That four month period processed more cargo than the peak period of 2021, which was a record year after the pandemic disruptions. The chart below shows the number of 20-foot container equivalent units (TEUs) that were handled by the two LA ports. The LA ports account for roughly one-third of all US container imports, and have seen their all-time busiest peak season, which began earlier and is lasting longer than typical.

WFG News

WFG Closed November 29

Please note that Wentz Financial Group will be closed Friday November 29th (Black Friday). We will be back open Monday morning.

The Week Ahead

Market will be closed Thursday for Thanksgiving and reopen Friday for a half day – closing at 1:00 pm. Market’s focus this week will be on another wave of earnings from the retail sector as well as several economic data reports such as the personal income and spending report that includes the PCE price index, the Fed’s preferred inflation reading. The index is expected to have increased 0.3% in the month and 2.3% from a year ago, accelerating from the 2.1% annual increase from September. Other data releases come from the housing sector like the Case Shiller home price index and new home sales, as well as other data releases like consumer confidence, durable goods orders, the second estimate on third quarter GDP, jobless claims, and money supply. On the earnings calendar, retailers reporting quarterly financial results this week include Kohl’s, Best Buy, Macy’s, Dick’s Sporting Goods, Burlington, and Urban Outfitters, with other results coming from Zoom Video, Dell, CrowdStrike, Workday, Autodesk, and HP. On the political side, it will be quiet in Washington with Congress not in session until next week, but we may continue to hear additional cabinet nominations by President Trump. Finally, on Tuesday, the Fed will release the minutes from its most recent FOMC meeting.