Wentz Weekly Insights

Stocks Experience Weakness & Q4 Earnings Preview

In another shortened trading week (due to the National Day of Mourning for former President Jimmy Carter), stocks ran into weakness again with the S&P 500 down for the fourth week of the past five. The downside was pretty broad with mega caps seeing downside, mostly from Nvidia (-6%) and Tesla (-4%), despite the Consumer Electronic Show taking place last week. While there were no groundbreaking announcements, there were many updates on the AI and robotics space.

But the big story over the past several weeks has been the uptick in bond yields, particularly on the longer end of the yield curve (longer term bonds, or bonds with longer maturities). The 30-year treasury yield rose 14 basis points to 4.95% and touched 5.00% at one point on Friday, the 10-year yield rose 17 basis points to 4.77%, both the highest since October 2023. In fact, if you exclude the two-week period when yields rose at or just above 5.00% in October 2023, yields are the highest in nearly 20 years.

With higher rates comes lower bond prices, so far this year long dated bonds are down almost 3%. With data showing progress on bringing inflation down has stalled, the labor market remaining strong, and consumer spending growth is solid, the thought is there is no need to continue easing financial conditions (lowering interest rates) and the economy can handle the higher rates.

Much of Treasuries move last week came Friday after the December labor report was released in the morning. The Department of Labor said the economy saw 256,000 new payrolls in the month, much stronger than the average of 140,000 over the prior six months. There was the expectation the unemployment rate would steadily increase late 2024 and through 2025, but the opposite happen in December with the unemployment rate falling from 4.2% to 4.1%. Wage growth has been more even, rising 0.3% in the month and up 3.9% from a year earlier.

The Fed has two mandates: full employment and stable inflation. We will get an update on the second half of that mandate (inflation) in the week ahead with the consumer price index. That and the start to fourth quarter earnings will be the highlights this week.

On the earnings side, the first companies to report will be some of the world’s largest banks like JPMorgan, Citigroup, Bank of America, and Wells Fargo. These should provide a glimpse of consumers’ and businesses demand for debt given the recent uptick in rates.

For the fourth quarter, analysts are expecting earnings to grow 11.7%, which would be the highest growth in company profits since Q4 2021. But that is down from the 14% growth in profits that was expected three months earlier.

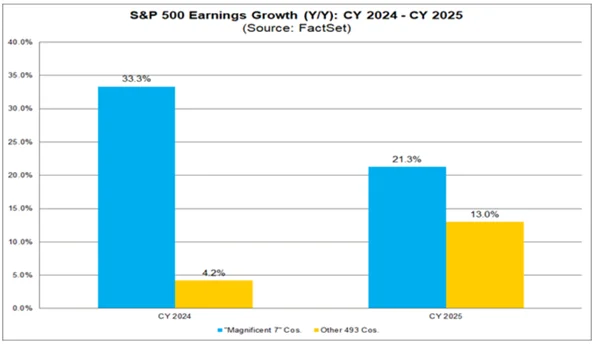

For all of 2024, earnings are expected to have increased 9.5%, above the 10-year average of 8.0%. However, earnings growth was very concentrated. For example, the Magnificent 7 companies (Apple, Microsoft, Nvidia, Alphabet, Amazon, Meta, Tesla) will report earnings growth of around 33%, a very strong growth rate. Meanwhile, the other 493 companies in the S&P 500 will report earnings growth of about 4.2%, well below the average. Another interesting fact, if Nvidia’s earnings were included from the Mag 7, the earnings growth of the other six would be mid-single digits instead of 33%.

This year earnings growth is expected to broaden out somewhat and we believe that is one thing that is needed for market momentum to continue. Earnings for the Magnificent 7 is expected to grow 21%, lower than last year’s 33%, but earnings for the other 493 companies are expected to grow 13%, according to FactSet, accelerating from the 3.8% in 2024 (see chart below – blue bar is earnings growth rate of the Mag 7, yellow bar is earnings growth rate of S&P 500 excluding the Mag 7).

Week in Review:

Stocks had a difficult week gaining momentum as Treasury yields continued to move higher. One of the big stories was the upward movement in yields over stalling inflation progress and a tight labor market. The yield on the 2-year Treasury yield rose 10 basis points to 4.39% while the 10-year Treasury yield gained 17 basis points to 4.77%. The yield on the 30-year Treasury was just below 5.00%. In the equity market small caps underperformed followed by tech. The major US indexes finished as follows: Dow -1.86%, S&P 500 -1.94%, Nasdaq -2.34%, Russell 2000 -3.49%. Bitcoin fell with the markets with a 3.5% decline on the week. The dollar continued its strength with a 0.6% rise, the sixth consecutive weekly increase and the highest since November 2022, while gold increased 2.3%. Meanwhile, oil rose another 3.5% for the highest level since early October.

Recent Economic Data

- Employment Report: The December employment report showed that there was an addition of 256,000 payrolls in the month, gaining pace after averaging 141,000 the prior six months. The most gains were seen in retail, health and education, and government, with job losses in manufacturing and trade. The prior two months saw a net revision 8,000 less jobs than previously estimated, a relatively muted revision compared to the last couple years. To the household survey – the labor force grew 243,000, the number of people employed grew a very solid 478,000, while the number unemployed fell 235,000. The household survey saw very good jobs data and resulted in the unemployment rate falling from 4.2% to 4.1% and the underemployment rate (the U-6 rate) falling from 7.7% to 7.5%. Finally, wages grew as expected, seeing a 0.3% monthly increase, and are 3.9% higher from a year ago, a slower pace than the 4.0% annual increase in November.

- ADP Payrolls: ADP’s payroll data shows there were 122,000 payrolls added in the month of December, slightly below the expectation of about 135,000. Most gains were seen in the largest size employers and in the health care sector and leisure and hospitality sectors.

- Jobless Claims: The number of jobless claims as of the week ended January 4 was 201,000, another 10,000 decline to the lowest level in almost a year. The four-week average was down 10k to 213,000. The number of continuing claims was 1.867 million, up 33,000 from the prior week with the four-week average down slightly to 1.866 million.

- ISM Non-Manufacturing Index: The ISM services index was 54.1 for December, a solid increase of 2 points in the month and better than expected. Several things to note from the report include an uptick in new orders, a slight decline in employment, while the prices index was the highest of all components and increased to the highest level since January, with the prices paid index at the highest in 22 months. Of the 18 major industries, 14 of them reported growth in the month. A lot of commentary from survey respondents highlighted tariff uncertainty under the new administration.

- Factory Orders: Factory orders fell by 0.4% in November which followed a 0.5% increase from October. The decline was driven by a 3.0% drop in transportation order, which is by far the most volatile category due to the high costs of airplanes. Orders for non-durable goods rose 0.4%. The core component, shipments of nondefense capital goods excluding aircraft, rose 0.3% after a 0.4% increase the month prior.

- International Trade: The latest data on international trade shows the US trade deficit widened by $4.6 billion, or 6.2%, to $78.2 billion in November. The larger deficit was due to a 3.4%, or $11.6 billion, increase in imports (totaling $351.6 billion in November), which was only partially offset by a 2.7%, or $7.1 billion, increase in exports (to a total of $273.4 billion in the month). Through the first 11 month of 2024, the trade deficit was $94 billion larger than the same period from 2023. The volume of trade, reflecting cross border activity, has increased 8.2% over the past year, signaling strong demand.

Company News

- Nvidia & AMD: Nvidia and AMD each revealed their new graphic chips at last week’s Consumer Electronic Show, with AMD also unveiling a new CPU. Nvidia said its new line of AI accelerators is in full production and will be used by all the major cloud service providers and a number of PC makers.

- Disney & Fubo: Disney and Fubo said they will merge Disney’s Hulu+ Live TV with Fubo’s business to create a new streaming service. Disney will hold a 70% controlling stake in the combined business and the new venture will operate under the Fubo name. The merger will include a new carriage agreement where Fubo will create a new sports and broadcasting service that will feature Disney’s sports networks like ESPN.

- United Airlines & SpaceX: United Airlines said it will begin testing Starlink’s (a unit of SpaceX) internet service on its planes beginning next month and expects to have the service in all its planes by the end of this year.

- Getty Images & Shutterstock: Getty Images will combine with Shutterstock to create a visual content company valued at $3.7 billion. Getty shareholders will own 54.7% of the combined company while Shutterstock shareholders will own 45.3%. The companies say the combination is expected to create increased capacity for product investment and innovation.

- Uber: Uber said it will enter into an accelerated share buyback program to repurchase $1.5 billion of its stock as part of its previously announced plan to buy back $7 billion worth of stock. It also said it has entered a strategic partnership with Nvidia which will accelerate the development of AI powered autonomous driving, leveraging Uber’s massive data from millions of its daily trips along with Nvidia’s advanced AI platforms.

- Meta: Meta said in a video blog by CEO Mark Zuckerberg that it would be ending its third-party fact checking system in the US, and instead will move to a “community notes” system to avoid frequent and unnecessary censorship on posts, similar to what X has.

- Exxon Mobil: Exxon Mobil released a statement warning of downside risks to Q4 earnings from softer than expected upstream and chemicals segment performance.

- Quantum Computing: Quantum Computing stocks saw a big decline after Nvidia CEO Jensen Huang said in a presentation at CES that the technology’s usefulness is still decades away.

Other News:

- Canadian PM Trudeau Resigns: Canadian Prime Minister Justin Trudeau, who has held office since 2015, said last week he will resign as Prime Minister and as the leader of the Liberal Party. Trudeau has been facing declining support from the opposition party, his own caucus, as well as the public, with polls have indicated a loss to the Conservative Party in the next election. He said he will remain as PM until the party selects a new leader and Parliament will be suspended until March 24 which will provide the minority party time to find a new leader.

- Trump’s Tariff Plan: A Washington Post report said Trump could dial back his plans on aggressive tariffs, instead focusing on critical imports. Trump shot back, saying the Washington Post was fake news and that the report was wrong. Trump previously called for universal tariffs as high as 10% or 20% on everything imported to the US. A separate report said Trump is considering declaring a national economic emergency to make way for a broad set of tariffs which would provide legal cover to support tariffs.

- The Biggest Bill in American History: Republicans are planning to roll all priorities of Trump administration into one bill, calling it the biggest bill in American history. The bill could include things like tax cuts, spending cuts, border security, immigration reform, and a deal to extend the debt ceiling. House Speaker Johnson has said he wants to pass the bill by late May in a worst case scenario.

- Foreign Investment in the US: President elect Trump announced $20 billion in foreign investment with Emirati billionaire Hussain Sajwani pledging at least that amount, to build new data centers in the US. Sajwani implied the Republicans win in the election spurred him to commit to the investment.

WFG News

2025 Economic & Market Outlook Meeting

Wednesday January 22 – 6:00 pm – WFG Auditorium in Hudson, OH

Thursday January 23 – 12:00 pm – WFG Auditorium in Hudson, OH

Thursday January 23 – 6:00 pm – WFG Auditorium in Hudson, OH

Tuesday January 28 – 12:00 pm – Ravenna Office Downstairs Banquet Hall

Wentz Financial Group will be holding its semi-annual Economic and Market Outlook Seminars on the dates above. Join us as we recap a positive 2024, explain how we got to where we are today, as well as give our expectation and forecast on the economic and market environment and how that will affect portfolios in another challenging year ahead. We will have four seminar times. Please RSVP by responding to this email or by calling the office at 330-650-2700. Seat are limited for each event and will be on a first come first served basis. A buffet style meal will be served approximately 30 minutes before each event.

The Week Ahead

After three consecutive shortened trading weeks, this week markets will see a full week of trading. Highlights will include the next round of inflation data and the beginning of fourth quarter earnings season. The consumer price index comes out Wednesday morning with estimates seeing a 0.3% monthly increase in the index for December and inflation at 2.9% over the past year, accelerating from November’s rate. Other data includes retail sales for the last month of the holiday shopping period, December, released Thursday morning where economists expect another solid increase of 0.5%. Other data releases include the producer price index, the Empire State Manufacturing index, Philly Fed Manufacturing index, industrial production, jobless claims, housing market index, and housing starts and permits. The earnings season kicks off with some of the big banks later in the week. Notable companies reporting include JPMorgan, Citigroup, Wells Fargo, Goldman Sachs, BlackRock, Bank of America, PNC, and others like Taiwan Semiconductor, United Health Group, and JB Hunt. There are several larger brokerage conferences taking place as well including the ICR Conference (a focus on consumer brands) and the JPMorgan Healthcare Conference. Outside of that, there will be a number of Fed officials making public appearances before the quiet period begins this weekend.