Wentz Weekly Insights

“Risk Management” Rate Cut

It was another positive week for stocks, the third in a row, with the S&P 500 ending the week at another record high. Not only was it the S&P 500 though, the Nasdaq and Dow indices hit a new high and the small cap oriented Russell 2000 did as well. It was the first high for the small cap index since November 2021, its third longest streak. Despite this, breadth remains somewhat weak – the equally weighted S&P 500 index underperformed by over 1%. It was technology that drove most of the upside again, with the sector up 2.1% last week.

The big story last week was the Federal Reserve’s policy meeting, its decision, the summary of economic projections, and Chairman Powell’s post-meeting press conference. As was expected, the Fed voted to cut interest rates by 25 basis points (0.25%), the first time this year, and suggested there would be more rate cuts ahead. The market was fully pricing in a 25 basis point cut, but more recently began pricing in higher chance of a 50 basis point rate cut.

Powell said that there “wasn’t widespread support at all” for a larger 50 basis point rate cut, saying the Fed has done large rate cuts and hikes like that before and that those tend to be made when they feel policy is out of place and needs to move quickly to a new place.

The decision to cut rates came from a “shift in the balance of risks” according to Powell. The Fed has a dual mandate of maximum employment and stable inflation and Powell indicated it was seeing additional downside risk to its employment mandate and it put more weight on that. He highlighted growing concerns about the jobs market like rising minority and youth unemployment, a declining labor force participation, and a lower hiring rate, which he said could exacerbate unemployment if layoffs increase.

There were several indications that this is the first of a series of rate cuts. The policy statement added verbiage that job gains have slowed and unemployment has “edged up,” adding that the balance of risks have shifted. Powell’s commentary was a lot about risk management, calling the cut last week an insurance rate cut and one that usually comes in consecutive meetings.

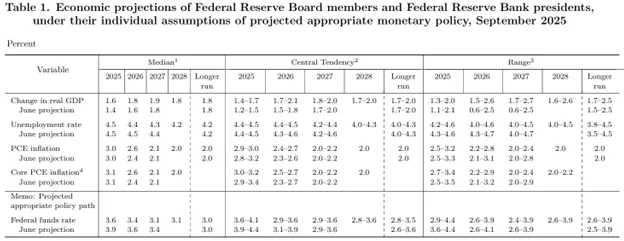

There was also the summary of economic projections (SEP – see the chart from the Federal Reserve below), a statement where each Fed policymaker writes down their projections on things like interest rates, unemployment, inflation, and economic growth. The average projection for where interest rates will be at the end of the year moved from a total of two rate cuts at the previous meeting, to three rate cuts at last weeks. However, there is a wider range of views by Fed members, with one member calling for an additional 1.50% of rate cuts this year. Powell attributed the divergence to the unusual and challenging nature of the economic environment.

The market reaction was mixed, with stocks moving sharply up and down while Powell spoke, but ultimately ended the day mixed. Since the meeting, markets haven’t adjusted rate cut expectations much, but the odds of over two additional rate cuts is increasing and if we see more disappointing jobs data, we would expect more rate cuts.

It is expected to be quieter this week, the next big event on the calendar is Friday’s personal income and outlays data that includes the PCE price index (the Fed’s preferred inflation reading). Markets will also be following the number of Fed members speaking publicly this week. Investors will be looking for if they provide more context on the pace of rate cuts ahead.

Recent Economic Data

- Retail Sales: US consumer spending remains robust – Retail sales increased 0.6% in August, double the increase that was expected, with July’s increase revised up to +0.6% from 0.5%. Of the 13 major categories, 9 of them saw an increase in the month. Vehicle and gasoline sales were both up 0.5% in the month. Excluding these two categories, which could sway the index due to the higher dollar amount spent on each, retail sales were up a strong 0.7%. Over the past year retail sales excluding vehicles and gas are up 5.4% with real sales (inflation adjusted) up 2.5%. Seeing the largest monthly increase in sales were online sales, clothing stores, sporting goods/hobby stores, and bars and restaurants. The categories seeing a drop in sales in August were miscellaneous stores, general merchandise stores, furnishing stores, and personal care stores.

- Housing Market Index: The housing market index, an index on homebuilder confidence, was 32 for September, unchanged from August and remaining near the lowest level ever (a value below 50 means more builders see conditions as poor than good). The index of present sales remains very weak at 34, unchanged from August. The index of expected sales over the next six months has been much better, at 45 in the month it has steadily improved this year. Like the present sales index, the traffic of prospective buyers index fell one point to 21, near the lowest level this cycle.

- Housing Starts & Permits: The number of housing units where construction started in August was 1.307 million on a seasonally adjusted annualized basis, a big disappointment with an 8.5% drop from the pace in July. This was 6.0% below the rate from a year ago and just near the lowest level of this cycle (since the pandemic). The number of permits to build a new home was 1.312 million on an annualized basis, down 3.7% from July and down 11.1% from a year ago. The number of new housing units completed saw a sharp jump, up 8.4% in the month, while the number of units under construction was down slightly in the month and down 13% from a year ago, which is not a welcoming figure given the high need for housing.

- Empire State Manufacturing Index: The Empire State Manufacturing index was -8.7 for September, dropping back into negative territory after being at 11.9 in August, indicating declining manufacturing activity in the New York area. The report noted the new orders and shipments index saw their lowest level since April 2024, pointing to significant declines in new orders and shipments. Employment was unchanged while the prices paid index fell to 46.1, a sign input price increases slowed, but remain elevated.

- Industrial Production: Industrial production increased 0.1% in August, slightly above the consensus estimate and bounces back after a 0.4% decline from July. The slight increase was due to a 0.2% increase in manufacturing output, a 0.9% increase in mining, offset by a 2.0% drop in utilities. Capacity utilization has been pretty consistent this year, remaining unchanged at 77.4% in August.

- Jobless Claims: The number of jobless claims the week ended September 13 was 231,000, a decrease of 33,000 from the prior week with the four-week average down slightly to 240,000. The number of continuing claims was 1.920 million, a decrease of 7,000 from the previous week with its four-week average down 10,250 to 1.933 million.

Company News

- Live Nation: Bloomberg is reporting the FTC (Federal Trade Commission) is investigating Ticketmaster (a company of Live Nation) to see if the company is taking enough steps to keep bots from illegally reselling tickets on its platform with a focus on the if it is doing enough to prevent automated ticket resales, per recently passed legislation. The report adds the FTC is looking at whether the company has a financial interest in allowing resellers to get around its rules on ticket limits. It was later reported the FTC and seven states have sued Live Nation for deceptive pricing and profiting off resales.

- Nvidia: China antitrust regulators are investigating Nvidia after they said Nvidia breached antitrust laws when it acquired Israel tech company Mellanox Technologies in 2020, saying certain conditions were not met when China initially approved the purchase. Separately, a Reuters report said Nvidia’s new chip it developed for China, the RTX6000X, has seen tepid demand and some tech companies have opted to not place orders. The report adds the new chip is seen as expensive for what it does, with those that have tested it said its performance is weaker than the RTX5090.The next day, the Financial Times reported the Cyberspace Administration of China has banned the country’s largest tech firms from buying Nvidia’s chips, telling companies to end their testing and orders of the chips.

- Intel: Nvidia announced it will invest $5 billion in Intel and collaborate to jointly develop custom CPUs that will be easily integrated into Nvidia’s chips and other equipment for data center and PC products.

- Alphabet: Last week, Google’s parent company Alphabet made headlines after its stock rose above the $3 trillion market cap level, becoming the 4th company to do so. The recent rally gained steam after a judge ruled it would not be forced to sell its Search browser.

- Tesla: Tesla shares were higher after a new SEC filing showed Elon Musk bought $1 billion worth of shares.

- TikTok: The White House said the deadline for TikTok to sell itself or face a US ban was extended from September 17 to December 16. Treasury Secretary Bessent said China and the US have agreed on a “framework.” A Fox Business report said China will allow the new TikTok owners to re-write the algorithm, a big part of any deal for the new company. Existing users would be asked to move to a new standalone app that is run on a reengineered algorithm and new content recommendations. Also, CNBC reported a deal is expected to close in the next 30 to 45 days. The report added Oracle will maintain their cloud deal under a new agreement, responsible for storing the data.

Other News:

- Semi-Annual Reporting: Trump suggested in a post that public companies should only have to report financial results on a semi-annual basis, allowing companies to “save money and allow managers to focus on properly running their companies.” Trump made similar remarks during his first term. Then on Friday the chairman of the Securities and Exchange Commission (SEC) said the agency will propose the rule change. If it is approved it would be up to each company if they want to switch to semi-annual reporting or remain quarterly.

- New Fed Governor: Trump’s nomination for the vacant Fed Governor spot Stephen Miran was confirmed by the Senate late Monday, just in time to participate in the Fed policy meeting. He is expected to be a key voice pushing for rate cuts.

The Week Ahead

It will be a light week of earnings again, but a good amount of economic data and a handful of Federal Reserve speakers. The notable companies reporting quarterly earnings results include Micron, AutoZone, Cintas, Costco, and Accenture. The main economic data report comes Friday with the personal income and outlays data which includes the PCE price index. The price index is estimated to have increased 0.3% in the month with core prices up 2.9% over the past year. Other data includes new home sales, existing home sales, durable goods orders, the third revision on second quarter GDP, jobless claims, and consumer sentiment. Markets will also be paying close attention to what each Fed member has to say this week after seeing the rate cut from last week.