Wentz Weekly Insights

Second Quarter Earnings Trending Lower & FOMC Meeting Preview

Recent Economic Data

- Sales at retail and food services for June rose a seasonally adjusted 0.2% to $689.5 billion, lower than a 0.5% increase that was expected and slowing from May’s 0.5% pace. At the same time, retail sales over the past three months was up 1.5% from the same three months in 2022, and since the data does not adjust for inflation of 3.0%, real retail sales are down 1.2%. For the month, seven of the thirteen major retail categories saw an increase in the month, led by miscellaneous store sales growing 2.0%, online sales growing 1.9%, furniture sales up 1.4%, and electronics/appliances up 1.1%. Declines were led by gasoline sales down 1.4%, building materials down 1.2%, sporting goods/hobby store sales down 1.0%, and grocery store sales down 0.7%. Overall sales excluding the volatile vehicle and gasoline categories were 0.3% higher in June and 3.9% higher from a year ago, growing 0.9% after adjusting for 3.0% inflation. Online sales and restaurant/bars continue to see the fastest annual growth.

- Home builder sentiment, according to the housing market index, rose in July with the index at 56 (anything above 50 is positive), up one point, for the seventh consecutive month of increases and the highest since June 2022. Lack of supply in the re-sale market is driving demand for new home build but higher rates, higher costs, and supply issues continue to pressure the market for new home builds. Current sales conditions was up 1 point to 62 while sales expectations were down 2 points to 60 as mortgage rates rose over the past month. Buyer traffic was up 3 points to 40 for the highest level since June 2022.

- The number of housing starts in June was at a seasonally adjusted annualized rate of 1.434 million, down 8% from May’s pace and about 8% below the pace from June a year ago, but right in line with the average through the first six months of the year. Single-family home starts fell 7% to 935k while multi-family units fell 11.6% to 482k. Meanwhile, the number of permits submitted to build a new home fell 3.7% in June to an annualized rate of 1.440 million, also in line with 2023’s average, and is 15.3% below the pace a year earlier. Permits for single family homes rose while multifamily homes fell. At the same time, home builders cannot keep up with the demand – there are still 281k new homes authorized for build but where construction has not yet started and the number of homes currently under construction remain near the highest on record at 1.682 million (annualized).

- The number of existing homes sold in June fell 3.3% in the month to a seasonally adjusted annualized rate of 4.160 million, and matching other June housing reports that home sales pulled back in June after a strong month in May. The sales pace was down from 5.130 million a year ago (down 19%). As has been the story since the outbreak of the pandemic, supply of homes is very thin with inventory of just 1.08 million units, down 13.6% from last year, with unsold inventory sitting at 3.1 month supply at the current sales pace, as the NAR Chief Economist says “the market could easily absorb a doubling of inventory.” But no one wants to list their house to move to a new one with a mortgage rate of over 7% when they are locked in below 4%. The median price of an existing home sold was $410,200 in June, down just 0.9% from the record high a year ago. One-third of homes sold went above the listing price.

- With the pullback in Treasury yields, mortgage rates fell according to Freddie Mac’s latest mortgage survey. It indicated the average prime 30-year mortgage rate was 6.78%, down 18 bps from the prior week of 6.96% which was the highest since last November.

- The Empire State Manufacturing survey index was 1.1 in July, indicating growth in manufacturing activity in the month was barely positive but also above expectations of a small decline, and has grown for two consecutive months now. New orders and shipments grew slightly while manufacturers continue to work down inventories. Input and selling prices are still rising but at a more moderate pace. Expectations over capital spending continues to be weak.

- Manufacturing conditions in the Philly region in July contracted again at roughly the same pace as June according to the Philly Fed manufacturing survey index. The index was a worse than expected -13.5 for July. Indicators for general conditions and new orders remain negative, shipments turned negative and declined, employment was relatively unchanged, prices paid were below the long-run average but prices received increased, but one bright spot was future indicators improved with more widespread expectations for growth in the future.

- Industrial production in June declined 0.5%, the largest decline since the end of 2022, and less than the no change that was expected. Manufacturing output fell 0.3% while mining fell 0.2% and utilities fell 2.6%. Capacity utilization was 78.9%, a disappointment versus the 79.5% expected and is 0.8% below its longer-run average.

- The number of unemployment claims for the week ended July 15 was 228,000, the lowest in two months, a decline of 9k from the prior week and the four-week average at 237,500 (down 9k). Continuing claims were 1.754 million, up 33k from the prior week and moving up for the second consecutive week after a steady downtrend since April, with the four-week average at 1.732 million.

Company News

- In effort to still have the deal go through, Microsoft and Activision have agreed to move the deadline to close the $69 billion deal to October 18 (from the initial closing date of July 18) after last second pause to the appeal process by UK regulators. Meanwhile, the FTC withdrew its lawsuit to block the acquisition. Separately, Microsoft reached new highs after saying its AI tools for its Office suite will cost $30/month, higher than what analysts were projecting, further increasing the potential of AI-related revenues.

- AT&T (and Verizon to a lesser extent) saw shares fall last week after a WSJ report went into detail how an 18 month investigation found tests have shown thousands of AT&T’s cable network are covered in dangerous amounts of lead. The company later responded that it will perform tests at locations where it has lead sheathed cables. It said the lead cables make up just a small part of its network (less than 10% of its total copper footprint). The company will report quarterly results this week and it will closely followed what the company says the impact could be on future financial results.

- Ford said it will be lowering the price of its F-150 Lightning trucks, its line of electric pickup trucks. It said its assembly plan in Michigan is in the final stage of upgrades that will allow it to scale production and along with improved battery raw material costs and cuts in other costs will help it lower the sales price. The upgraded assembly plant will be able to run at a 150,000 production rate once completed.

- Apple saw a brief spike in shares last Wednesday after a report from Bloomberg said the company has made a major effort over the past several months, in a way playing “catch up”, to work on an artificial intelligence project that could compete with some of the leaders like OpenAI’s ChatGPT and Google’s Bard. It had been working on a ChatGPT like product since late 2022 but the report says it picked up its efforts over the past several months. It has been working on building its own framework, known as “Ajax,” to create large language models that would rival ChatGPT and Bard. However, the report notes the company does not have a clear strategy for releasing the new technology to consumers.

- A lowered outlook from Taiwan Semiconductor, the largest global foundry (the manufacturer of chips) had chip stocks lower late last week. It sees revenues declining 10% versus the previous forecast of a low single digit decline while reducing its capital spending plans (usually indicates lower demand). AI chips are driving a ton growth in the space, but it appears semiconductors outside of AI are still in the downcycle.

Other News

- China said its economy grew, as measured by GDP, by 6.3% in the second quarter compared to Q2 2022, a pickup from 4.5% growth rate in the first quarter but one percent below the estimates of 7.3%. This led to more speculation China would step in to provide further support for its economy that is growing below expectations over the past year since it ended its Covid lockdowns.

- The Federal Trade Commission (FTC) and Department of Justice released an update on antitrust/merger guidelines, not explicitly saying it but targets more of the technology and Private equity sectors. The Financial Times is reporting regulators can consider an entire series of acquisitions when evaluating individual deals that form part of the series, and a buyers “history and current or future strategic incentives” when evaluating deals.

- The Biden Administration’s plan on restricting China investments is said to narrowly target advanced technologies and new investments that will focus on chips, artificial intelligence, and quantum computing, but will not be implemented until next year, according to the latest from Bloomberg. The administration is hoping to release a final proposal by the end of August and will come via an executive order. This follows up from a recent report two weeks ago that the US was preparing to take steps to prevent China from accessing chips needed to advance its technology in AI and advanced computing to prevent it from creating advanced weapons or producing malicious computer code.

Did You Know…?

Rejections Rising

Potentially More Bad Loans, Lower Profits

The Week Ahead

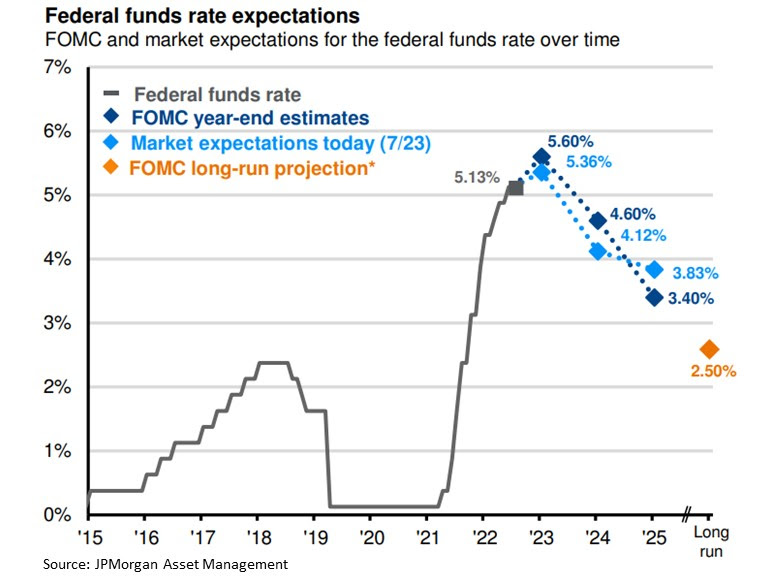

This week will be one of the busiest of the quarter. The two main events are the FOMC July meeting and policy decision along with a large number of companies reporting quarterly earnings results, including several of the largest companies in the world. The Federal Reserve’s policy setting committee meets this week with an announcement on Wednesday at 2:00pm where the overwhelming consensus is for another 25 basis point rate hike, but markets will react more to what Powell says of future policy and how tough the message is on inflation. The European Central Bank and Bank of Japan hold their respective policy meetings as well. Meanwhile, nearly 35% of S&P 500 companies will be reporting second quarter financial results this week with notable reports coming from Microsoft, Alphabet, GM, GE, Visa, Texas Instruments on Tuesday; Meta, Boeing, Chipotle, AT&T on Wednesday; Intel, Mastercard, McDonald’s, Comcast, AbbVie on Thursday, and Exxon Mobil, Chevron, and Procter & Gamble on Friday. The economic calendar has several notable, possibly market moving, reports as well. The big two will be the personal income and outlays report Friday that includes consumer spending, wages, and inflation (the Fed’s preferred measure) figures with spending and the PCE price index expected to tick slightly higher in the month. On Thursday the first read on second quarter GDP is released where economists are currently expecting a 1.5% annualized growth in the quarter. Elsewhere, on Tuesday the Case-Shiller home price index and consumer confidence are released, then on Wednesday we will see home sales data for June, then the pending home sales index, durable goods orders, trade data, and jobless claims on Thursday, and ending the week with the employment cost index for Q2 and consumer sentiment on Friday.