Wentz Weekly Insights

Stocks Lower In Busy Week of Earnings, Fed Meeting, and Data – Capped Off By Soft Jobs Data Friday

It was a down week for stocks, one that erased the prior two weeks of gains after the S&P 500 lost 2.36%. In fact it was the worst performing week since the week of Liberation Day, when Trump first announced the reciprocal tariff rates in early April. Breadth was bad as well – the equally-weighted S&P 500 underperformed the cap weighted index again with a loss of 3.29%. This was mostly due to several of the mega cap tech stocks having positive week driven by solid earnings reports.

It was the busiest week of the quarter, and one of the busiest of the year, with over 40% of the S&P 500 reporting quarterly financial results, a FOMC Fed meeting, a big wave of important economic data, and a trade deadline.

Earnings were largely mixed, as has been the case so far this quarter. The big theme, which was the case for most of 2024, was the significant earnings beats by the largest companies in the world, with pockets of weakness from all others. Microsoft, Apple, Meta/Facebook, and Amazon (four of the “Magnificent 7” companies, the other being Nvidia, Alphabet/Google, and Tesla) all had much better than expected financial results for the second quarter.

Microsoft’s focus was on Azure, its cloud computing segment, which saw its revenue growth accelerate to 39%, or 5% more than expected. It also had a better forecast than was expected with an indication its AI investments will pay off. Meta reported much strong results than expected too, with its sales growth accelerating to 22%. It saw better engagement as well as advertising pricing and said AI provided a tailwind for both. Microsoft rose as much as 8% while Meta was up as much as 13% after earnings.

However, Apple fell 2.5% and Amazon fell 8.5% despite their financial results coming in better than expectations. Apple had solid growth in its important iPhone segment, and outperformance in China (best growth in two years), however there have been worries on how and if Apple Intelligence will be a driver of iPhone sales and the quarter provided no confirmation it will. Amazon had solid results but its high growth Amazon Web Services cloud computing segment saw 17.5% growth which was only in line with expectations and underwhelmed investors, particularly as Microsoft and Google’s cloud segments did so well.

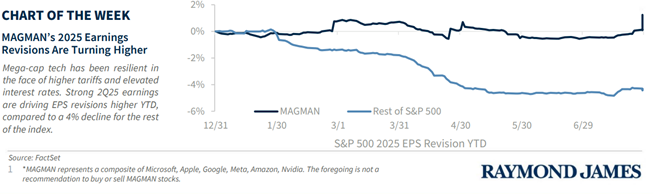

Meanwhile, the remainder of companies have seen mixed results and a handful of bigger disappointments with some suspending forward guidance due to economic uncertainty, most of them citing tariff uncertainty. As Raymond James notes in the chart below, the Mag 7 companies have seen earnings for the full year 2025 revised higher, while the other 493 companies in the S&P 500 have seen earnings revised lower by over 4% (note that MAGMAN stands for Microsoft, Apple, Google/Alphabet, Meta/Facebook, Amazon, and Nvidia).

The Federal Reserve drove some volatility Wednesday after its meeting concluded with no change in interest rates. The bigger news was two of the Committee’s 12 voters voting to cut rates and Chairman Powell’s pushback against cutting rates at the next meeting in September. The two dissents were the most since 1993, signifying how the Fed has become more divided recently. In Powell’s press conference remarks, he emphasized the decision on when to cut rates will be dependent on the incoming data.

After the meeting, the odds of a rate cut at the Fed’s next meeting moved from around 70% to around 40%. The two dissenters said on Friday their support for a cut was due to the possibility of a slowing labor market and believe tariffs will only cause a one-time price increase (rather than create more persistent inflation).

If the Fed interest rate decision was based on the labor market data that was released last week, we would have most likely seen a rate cut. The monthly labor report showed 73,000 new payrolls were added in July, however revisions have been a major issue since the pandemic. The revisions in August disclosed the Department of Labor overstated job growth by 258,000 the past two months – May saw 19,000 new jobs (down from 144,000) while June saw 14,000 new jobs (down from 147,000).

Revisions are common because the initial data is based on incomplete information (mostly from partial survey responses as not all surveys are submitted by the deadline) and more accurate data becomes available over time. However, the employment report has seen larger revisions since the pandemic compared to prior to the pandemic.

The soft data had several consequences; it caused a broad-based market selloff with stocks down 1.60% Friday, increased the market odds of a rate cut in September to 90% (up from 40%), and resulted in the firing of the Bureau of Labor Statistics commissioner Erika McEntarfer by President Trump after accusing her of “faking the jobs numbers” and for inaccuracies.

Some positive news revolved around trade with about two-thirds of the US’s 18 largest trading partners having already agreed to a trade deal, and countries that have not heard from the US would have received trade letters on Friday (August 1) with their tariff rate, according to Karoline Leavitt, the White House Press Secretary.

Three of the largest trading partners have not made deals yet though – Mexico, who was just granted a 90 day extension to the start of tariffs, China, who also received a tariff extension, and Canada, who saw tariffs raised due to its support of a Palestine state. It was also announced that the new tariff duties will begin to be collected August 7, giving a final week for potential deals.

This week market moving activity slows a little with no notable economic data, quiet on the Fed and political front, but we will see another wave of earnings reports and may see trade/tariff news. As we saw Thursday and Friday, with stocks rising 25% since the Liberation Day selloff in April and in overvalued and overbought territory, they are more vulnerable for a pullback.

Week in Review:

Stocks ended the week lower with mega cap tech holding up much better and the average stock underperforming. The equally weighted S&P 500 underperformed the cap weighted index by almost 1%. The major US indices finished as follows: Nasdaq -2.17%, S&P 500 -2.36%, Dow -2.92%, and Russell 2000 -4.17%. Stock volatility increased with the VIX up 36% for the week. The fixed income market rallied as yields fell across the curve, more so on the short end – the 2-year Treasury yield fell 24 basis points for the week after a 30 basis point drop Friday to 3.70%, while the 10-year yield fell 16 basis points to 4.23%. The dollar index rose 1.54% after the more hawkish Fed meeting while gold rose 0.41%. Bitcoin fell 3.67% as investors were more risk-off. Meanwhile, oil rose 3.33% over concerns of additional Russia sanctions.

Recent Economic Data

- Employment Report: The Department of Labor establishment survey showed 73,000 new payrolls were added in the month of July, a little below expectations of around 110,000. The biggest disappointment in the data is that the last two months saw a combined negative revision of 258,000 jobs – May saw its job gains revised down 125,000 to just 19,000, while June saw its job gains revised down 133,000 to just 14,000. The average monthly job gain the last three months is just 35,333. Goods producing jobs, like construction and manufacturing saw a 13k decline in jobs while service producing jobs were positive – however, if it weren’t for the 79k increase in education and health services jobs, we would’ve seen jobs decline in July. The household data showed there were 260,000 less people employed in the month while those considered unemployed increased 221,000, while the labor force shrunk 38,000. The result was an unemployment rate that ticked back up to 4.2% after briefly falling to 4.1%. The average wage was up 0.3% as expected, and up 3.9% over the past year, up a little more than expected.

- Job Openings and Labor Turnover Survey: The number of job openings the last day of June was 7.437 million, down 275k compared to May and basically unchanged from a year ago. Job openings have flattened out in the mid 7 million range since the beginning of last year, which is near the pre-pandemic trend. The number of hires dropped to 5.204 million, also relatively unchanged from a year ago. Meanwhile, the number of separations was 5.060 million, unchanged from a year ago with the number of quits steadily dropping, down 142k from a year ago to 3.142 million.

- ADP Payrolls: ADP’s payroll data showed 104,000 new payrolls in July, slightly more than expected, after a decline of 23,000 in June. Payroll gains were seen in all employer sizes and just about all industries except education and health services.

- Jobless Claims: The number of unemployment claims the week ended July 26 was 218,000, a slight increase from the prior week, with the four-week average down 3.5k to 224,500. The number of continuing claims was unchanged at 1.946 million, with the four-week average moving down slightly to 1.949 million.

- Employment Cost Index: The employment cost index increased 0.9% in the second quarter (over April, May, and June), a little higher than the 0.8% expected. This index is followed closely for signs of rising labor costs and inflation. The increase was due to a 1.0% increase in wages and salaries and a 0.7% increase in benefit costs. Both those figures have flattened out in the last several quarters after peaking in mid-2022. Over the past year, the employment cost index has increased 3.6% from a 3.6% increase in wages and salaries and 3.5% increase in benefits.

- GDP: Second quarter GDP grew at an annualized rate of 3.0% according to the first GDP estimate, more than the 2.5% growth rate expected and bouncing back after a 0.5% decline from the first quarter which was purely trade related (a surge in imports as businesses acted to get ahead of tariffs). Consumer spending, which makes up 70% of GDP, grew 1.4% and contributed 1.0% to GDP. Spending on goods was up 2.2% while spending on services was up 1.1%. Government spending has really slowed down, after a 0.6% decline in Q1 it increased only 0.4% in Q2, contributing 0.08% to GDP. Business investments grew 0.4% while residential investments fell 4.6%, subtracting a combined 0.2% from GDP. Inventory growth slowed as businesses worked down supply after building it in Q1, with the change in inventory subtracting 3.2% from GDP. Finally, imports fell 30.3% (after growing 38% last quarter) while exports fell 1.8%, combining the two (net exports) contributed 5.0% to GDP.

- Personal Income & Outlays: Incomes rose more than expected, consumer spending increased less than expected while consumer inflation was in line with expectations.

- The data showed income rose 0.3% in June, including a 0.1% increase in the largest component which is wages and salaries. The reason for the higher income was once again due to higher transfer payments (like social security and other government benefits) which rose 1.0% in the month. This came from all categories but social security was a big one with payments up 1.9% in the month most likely due to the new law. Incomes are up 4.3% from a year ago, with wages and salaries up 3.8%, and government transfer payments up an outsized 8.6%.

- Consumer spending increased 0.3% which follows no change from May. Spending on goods rose 0.5% while services spending rose 0.3%. Spending is up 4.6% over the past year, driven mostly by services. The savings rate remained at 4.5%, still relatively low.

- The PCE price index increased 0.3% as expected, accelerating from the 0.1% increase in May. The core PCE index rose 0.3%, also accelerating from a 0.2% increase in May. Over the past year the index is up 2.8%, the highest since late 2023, with the core index up 2.8%, back up to the highest since February.

- Construction Spending: Construction spending was strong in 2024 but so far in 2025 has been consistently declining. In June construction spending fell 0.4%, coming after a 0.3% decline in May. The decline was due to a 0.7% decline in residential construction spending and a 0.1% decline in nonresidential spending. Compared to a year ago spending is down 2.9%, driven by a 6.0% decline in residential spending and to a lesser degree a 0.5% decline in nonresidential spending.

- PMI Manufacturing Index: The PMI manufacturing index for July was 49.8, down from 52.9 in June for the first sub-50 reading this year, indicating a slight decline in manufacturing activity in the month with the report noting that the tariff uncertainty continued to dominate the manufacturing landscape. New orders were up fractionally with export orders down and a weaker sales trend led to lower output volumes. As a result, employment decline however input costs continue to rise “steeply”.

- ISM Manufacturing Index: The US ISM manufacturing index was 48.0 in July, down from 49.0 in June, and also indicating a slight decline in manufacturing activity in the month. New orders and backlogs both declined, with new orders down for six straight months, which led to another drop in employment. Of the 17 industries tracked, 7 reported growth while 10 reported contraction. The price index was 64.8, still very elevated suggesting continued price increases, but down 5 points from June.

- Case Shiller Home Price Index: S&P’s Case Shiller home price index showed home prices saw another decline in June, falling 0.3% after seasonal adjustments (but up 0.4% with no adjustments). Over the past year the average home price is up 2.3%, slowing from 2.7% in May for the slowest increase since 2023 when home prices saw a brief year-over-year decline which came after the substantial pandemic related increase in prices. Midwest and Northeast cities continue to see the highest home price increases, led by New York +7.4%, Chicago +6.1%, and Cleveland +4.9%, with Southern cities seeing slight declines like Tampa -2.4% and Dallas -0.6%.

- Consumer Confidence: The consumer confidence index increased slightly to 97.2 in July, up 2 points from June, continuing to recover from April’s tariff related drop, but still below last year’s higher levels. The present situations index fell 1.5 points to 131.5 while the expectations index rose 4.5 points to 74.4, although still below 80 which is a level that typically signals recessions.

- Consumer Sentiment: The consumer sentiment index was 61.7 for the final July survey, basically unchanged from 61.8 from the preliminary survey. The current conditions index rose 3.2 points to 68, the expectations index fell 0.4 points to 57.7 (which continues to be at a depressed level). Inflation expectations soared after the April tariff announcement but have very slowly begun to come down – the one-year inflation expectation was 4.5%, down from 5.0% in June. The five-year expectation is 3.4%, down from 4.0% in June.

Company News

- Union Pacific/Norfolk Southern: In an agreement that will create the US’s first transcontinental railroad, Union Pacific said it has agreed to acquire Norfolk Southern in a stock and cash transaction which implies a $320 per share value for Norfolk Southern, reflecting a $8 billion valuation or about a 20% premium to where shares were trading prior to the first reports of a possible combination. The combined company’s enterprise value would be over $250 billion. The companies expect to realize $2.75 billion in annualized cost synergies. The combination will connect over 50,000 route miles across 43 states, linking approximately 100 ports, the companies said.

- AMD: Shares of AMD moved higher after a report said it increased the price of its high end AI chip, the MI350, by 70%, showing confidence it can compete with Nvidia and its dominant AI ecosystem. The report says the price increase indicates the company is seeing increased demand for its AI products.

- Nvidia: Reuters reported Nvidia placed orders for 300,000 H20 chips with TSM (Taiwan Semiconductor Manufacturing). These are the chips that power AI applications that Nvidia designed specifically for China due to export restrictions on its most advanced chips. The Trump Administration recently lifted the restriction for these H20 chips, after having restricted the export of them due to national security concerns, and Nvidia previously said it would work through its existing stockpile and had no plans to manufacture more. However, strong China demand has led the company to change its mind about just relying on its stockpile.

- Procter & Gamble: Procter & Gamble said it will raise prices on about 25% of its products after saying tariffs will increase its costs by $1 billion for the fiscal year. The price increases will be in the mid-single digit percentage range.

Other News:

- Russia Sanctions: The price for crude oil rose to its highest level in six weeks, recently moving higher after Trump threatened to increase economic sanctions on Russia if it does not agree to a truce with Ukraine within 10 days, shortening his deadline from 50 days.

- Central Bank Meetings:

- The Federal Reserve voted to not cut rates at its meeting last week. The policy statement had basically no changes – it said growth of economic activity has “moderated” instead of saying has “continued to expand at a solid pace.” The big news on the interest rate decision was the two voting members that dissented, the most dissents since 1993. This was pretty expected based on their recent public comments which voiced support for rate cuts now. In the press conference Powell talked about how the Fed is trying to meet its mandates “efficiently” by not cutting rates too soon and risking inflation reemerging, and by not waiting too long and risking a deterioration in the labor market. Markets were disappointed and moved lower during his Q&A because he shot down the possibility of cutting rates at the next meeting in September, saying the Fed remain data dependent and will look at what the data is telling them when making their decision. September rate cut odds moved to about 40%, versus 60% prior to the meeting.

- The Bank of Canada kept its policy rate at 2.75% for the third consecutive meeting as was expected but signaled it may cut again later this year if economic conditions continue to keep inflation level and trade related price pressures remain contained. It made some comments on trade and how US tariffs are disrupting trade but said its economy has remained resilient.

- The Bank of Japan held rates unchanged at 0.50% as expected, raised its inflation forecasts mostly due to elevated food prices, with markets now seeing odds of a rate hike sooner rather than later. The meeting was seen as more hawkish.

- Trade:

- Trump signed an order to end the de minimis loophole, a provision of US trade law that allowed goods below a certain value ($800) to be imported tariff free. Certain countries would use this loophole to ship large volume of goods in smaller packages to avoid the tariffs and inspections.

- Trump said the US and its largest trading partner, the European Union, reached a trade deal that includes a 15% tariff on all European imports to the US but excludes a number of key industries (like aircraft, some chemicals, agricultural goods, drugs, and several others), while US exports to the EU will be tariff free. In addition, the EU committed to purchasing $750 billion worth of LNG (liquified natural gas) over the next three years, invest $600 billion in the US, and purchase “vast amounts” of military equipment. The EU later admitted it cannot guarantee the $600 billion investment in the US, saying it would rely on the private sector.

- Trump said tariffs on India could go to 20% or 25% if talks fail to generate a trade agreement before the August 1 deadline, threatening a higher tariff because India has “charged basically more tariffs than almost any other country.” He later said the tariff would be 25% starting on the 1st and would include additional penalties due to it continuing to purchase oil and military equipment from Russia.

- Trump announced a 50% tariff on copper.

- Trump announced a 50% tariff on Brazil imports, but excludes a list of items, citing human rights violations by targeting its former President and his supporters that Trump says have eroded Brazil’s rule of law.

- Deals were reportedly made with Thailand and Cambodia, and Trump said South Korea as well, who will see a 15% tariff on their goods.

- Trump said the US will not raise tariffs on Mexico for another 90 days after a talk with Mexican president and their work on the border. Trump recently threatened to raise tariffs on Mexico to 30% that were scheduled to go into effect August 1.

- Trump said Canada, now the largest trading partner with no deal made yet, may see bigger tariffs for it recent comments about possibly recognizing Palestine as a separate independent state.

- Trump announced via an executive order the tariff rates for those that have not made an agreement with the US – there will be a baseline 10% tariff for most countries not on the list or those the US has a trade surplus with, a 15% rate to those the US runs a modest deficit with, and higher duties for those with higher deficits. The tariffs will begin to be collected on August 7, instead of the originally planned August 1.

- Commerce Secretary Howard Lutnick said in an interview that negotiations with China are proceeding with a separate deadline. Treasury Secretary Bessent said in a separate interview that negotiations continue on extending the tariff truce, with one option that seems to be likely is extending another 90 days, but Trump will make the final decision.

The Week Ahead

Earnings reports will continue to flow in this week in high numbers but there will be less on the economic data side. The week will include another large chunk of S&P 500 companies reporting quarterly financial results, about 8%, before things slow next week. Notable companies scheduled to report include Palantir, AMD, ZoomInfo, Super Micro Computer, Uber, Airbnb, Applovin, Trade Desk, Block, Snap, Caterpillar, Wayfair, Shopify, Fox, Expedia, Disney, Warner Bros. Discovery, McDonald’s, Celsius, DoorDash, Pfizer, Eli Lilly, Marathon, and APA. On the economic calendar, the biggest report is trade data that is released Tuesday morning and the first estimate of second quarter US worker productivity, a major factor in longer-term economic growth. Other data includes factory orders, ISM Services index, and jobless claims. With the Fed meeting in the rearview, we will hear from several Fed policymakers and likely get their take on the recent labor market data and last week’s Fed decision. We expect more trade deal announcements this week ahead of the new August 7 deadline. Congress is on their summer recess so the Washington will be more quiet.