Wentz Weekly Insights

“Soft Landing” Optimism Grows on Slowing, But Not (Yet) Declining, Labor Market

|

|

Recent Economic Data

- The S&P Case Shiller home price index reported home prices increased 0.7% in June for the fifth consecutive monthly increase which comes after seven straight monthly declines to close out 2022. According to the index, home prices are now back peak levels that were reached June 2022. From a year earlier, home prices are basically flat but “regional differences continue to be striking,” according to the report. Chicago +4.2% and Cleveland +4.1% are seeing the strongest growth in home prices, while San Francisco -9.7%, Seattle -8.8%, and Las Vegas -8.2% are seeing the largest declines in home prices.

- Pending home sales, which are home sales based on signed contracts that are not yet closed so typically leads existing home sales by a month or two, were up 0.9% vs a 0.5% decline expected for the best reading since January. However, pending home sales are still down 13.8% from last year. This report and the trend is another sign that the housing market may have bottomed a couple months ago.

- The average prime credit 30-year mortgage rate fell 5 basis points last week to 7.18% which, outside of the prior week’s 7.23% rate, is the highest since 2002.

- The Consumer confidence index, based on a survey of consumers by the Conference Board, was 106.1 in August, down from 117.0 in July which was the best reading in two years, and over 10 points below expectations. The present situations index fell to 144.8, down 8 points from 153.0 in July while the expectations index fell 8 points as well to 80.2. Write in answers in the survey showed consumers are worried again about prices after the recent pick up in grocery and gas prices.

- The second estimate of second quarter GDP shows a downward revision to economic growth based on more accurate economic data. The updated data shows the economy grew at a 2.1% annualized rate in the quarter, down from the 2.4% rate in the first estimate. The updated estimate reflects a downward revision to inventory growth and business fixed investments, offset by an upward revision to government spending and slight upward revision to consumer spending.

- Construction spending increased 0.7% in July, stronger than the 0.4% increase expected for the seventh consecutive positive month after ending 2022 with seven of the last eight months negative. Spending on residential construction (housing) drove most of the increase with a 1.4% gain, while nonresidential spending rose 0.1%. Residential spending is still down 5.4% from a year ago while nonresidential spending is up a robust 16.5%.

- The US purchasers manufacturing index (PMI index) was 47.9 in August, down from 49.0 in July and suggesting general manufacturing activity in the US contracted at a faster pace through August. A sharper decline in new orders led to a contraction in output with expectations on output the weakest of the year. Respondents noted inflationary pressures ticked higher but remain moderate.

- The ISM manufacturing index was 47.6 for August, a small improvement from 46.4 in July but a reading that still reflects declining manufacturing activity for the 10th consecutive month. The index on new orders was 46.8 for the 12th consecutive month under 50 (a level that separates growth from contraction) which is the longest on record. Prices paid ticked higher to 48.4 and about 4 points higher than expected.

- The number of job openings on the last day of July was 8.827 million, the lowest level since March 2021 and down from 9.152 million (which was revised down from 9.582 million) from the last day of June. The number of separations was relatively unchanged compared to June, with quits declining 253k to 3.5 million and down from the peak of 4.5 million in April 2022, with layoffs unchanged at 1.555 million, which has been stable over the past three years. It is still important to keep in mind job openings were trending around 7 million prior to the pandemic, but this is solid progress and down from the peak of 12.03 million in March 2022.

- ADP data showed 177,000 new private payrolls were added in August, slightly below expectations and down almost 200k from July. However, July payroll gains were revised 47k higher for a very strong 371k. The data showed job growth slowed most notably in leisure and hospitality but all sized businesses and all industries saw additional job gains in the month.

- The number of jobless claims filed the week ended August 26 was 228,000, down 4k from the prior week with the four-week average unchanged at 237,500. The number of continuing claims increased 28k to 1.725 million, with the four-week average moving up by 8k to 1.704 million.

- Employment in August increased 187,000, according to the DOL’s establishment survey, less than the 12-month average of 271,000 but slightly better than the 170,000 expected. Revisions to the past two months were pretty high, with June revised down 80k from 185k to 105k, while July was revised down 30k to 157k. Employment growth was seen in leisure & hospitality, health care, social assistance, and construction, declined in transportation and warehousing, and was relatively unchanged in other areas – all consistent with recent trends. The household survey showed a pretty large increase in the labor force, up 736k to bring the participation rate to 62.8%, the highest since the pre-pandemic trend of 63.3%. The number of people employed rose 222,000 to 161.484 million while the number unemployed saw a significant jump of 514,000 to 6.355 million, the highest since January 2022. As a result the unemployment rate rose 0.3% to 3.8% with the underemployment rate (the U-6 rate) rising 0.4% to 7.1%. The average wage grew just 0.2%, slightly below the 0.3% increase expected, with wages up 4.3% from a year ago, slightly below expectations and slower than July’s 12-month increase of 4.4%.

- The personal income and outlays report:

- Personal incomes rose 0.2% in the month of July and are up 5.0% from a year earlier. More importantly, wage & salaries (obviously the most important component of income) rose 0.4% in the month and are 5.5% higher than a year ago, picking up from the 5.3% pace in June.

- Consumer spending saw another strong increasing in the month, growing 0.8% for the fastest monthly increase since January. Spending grew 6.4% over the past 12 months, accelerating from a 5.4% 12-month rate in June. Services continues to see a bulk of the spending, up 0.8% in the month and 8.3% from a year ago, but spending on goods picked up in July with a 0.7% increase, but up only 2.8% over the past year.

- The personal savings rate, what is left over from income after taxes and discretionary spending, fell to a 10-month low of 3.5%, less than half the historical average and back near the lowest levels on record.

- The PCE price index, the Fed’s favorite inflation reading, rose 0.2% in July as expected, and is up 3.3% from July 2022. Core prices which exclude food and energy prices rose 0.2% in the month and are up 4.2% from a year ago, both as expected but the 12-month rate picking up from 4.1% from June. Most importantly, the measure the Fed is following closely is the index of services prices excluding housing which rose 0.5% in July and is up 4.7% from a year ago. This has made very little progress as the peak was 4.9% all the way back in November 2021.

- The data was pretty much as expected, but continued stronger spending, particularly on services, and above average income growth, are two areas the Fed wants to see cool further.

Company News

- 3M said it had agreed to a $6.0 billion settlement, paid out over five years, to resolve the thousands of lawsuits that it sold defective combat earplugs to the US military (some analyst estimates had the settlement at $10-$15 billion). Its subsidiary that made the earplugs, Aearo Technologies, recently attempted to file for chapter 11 bankruptcy but a federal judge dismissed the filing claiming it was made in bad faith in attempt to resolve its legal liabilities and did not have a valid reason for reorganization. The settlement removes another worry from investors and comes after another large settlement from recent lawsuits that 3M polluted water systems with “forever chemicals” which it tentatively settled for $12.5 billion.

- A report from Bloomberg said Apple is testing 3D printers to help make some of its devices which would all be done in house. The 3D printing would be used to make the steel chassis used by some of its watches and Apple sees it as a way to make the supply chain more efficient and cut the time it would take to produce the devices while reducing its environmental impact by using less material. If all goes well, Apple would attempt to expand into other product lines in the future.

Other News

- For the first time ever, the government will negotiate with drugmakers on drug prices under Medicare. Last week the Centers for Medicare and Medicaid Services (CMS) announced the first ten drugs that will be subject to Medicare negotiations that include drugs from companies such as Merck, Bristol-Myers, Pfizer, Amgen, Novartis, and AstraZeneca. The new process was introduced in the Inflation Reduction Act but will be lengthy; the new negotiated prices will not take effect until 2026.

- It was announced last week that China’s state banks are getting ready to announce rate cuts on most of the nation’s existing mortgages, another step it is taking to boost consumer spending and stimulate its economy amid weakening economic data. In addition, it is expected to cut its deposit interest rate following the mortgage rate cuts.

- Cryptocurrencies saw a big week after a federal court vacated a SEC ruling that prohibited Grayscale from converting its Bitcoin Trust into a bitcoin ETF, granting Grayscale’s petition for review. The court said the SEC failed to explain why it approved the listing of two bitcoin futures ETPs but not Grayscale’s proposed Bitcoin ETF.

- The Biden Administration is looking to move forward with a proposal for mandatory overtime pay for salaried workers that would require employers to pay overtime to workers who earn a salary of less than $1,059 per week, or $55,068 per year, above the current $35,000/year that was set by the Trump Administration. Salaried workers above that threshold would still be eligible for overtime pay if they are not in management-related roles.

Did You Know…?

Monthly Returns:

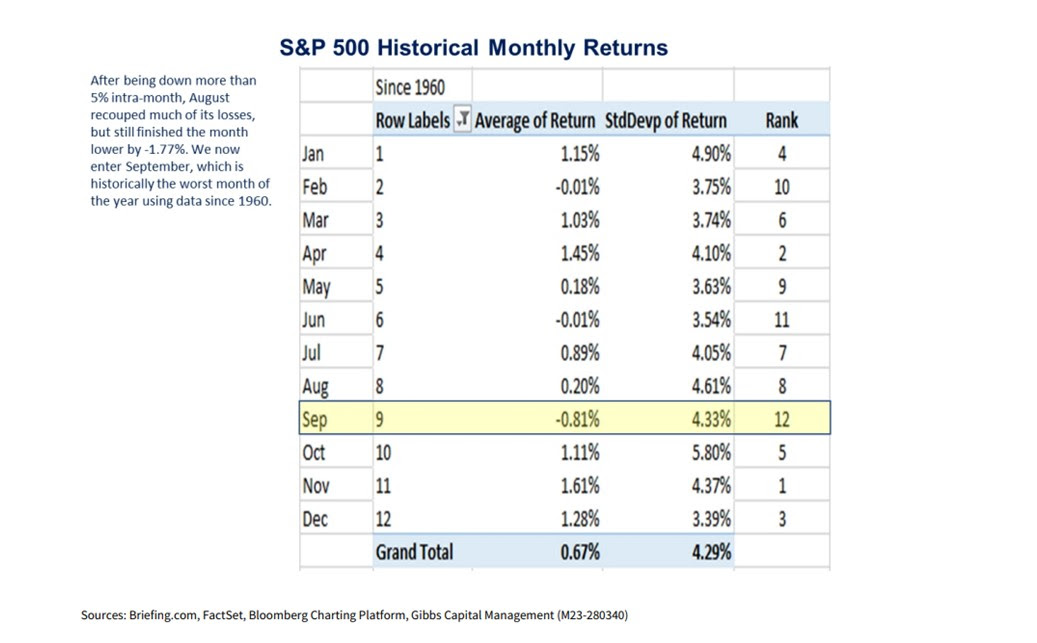

Stocks are entering the worst month of the year, based on historical data. Data from Raymond James shows the S&P 500 sees an average return of -0.81% for September, going back to 1960. This ranks last out of all months by a wide margin. The second worst month is June with an average return of -0.01%. The S&P 500 is coming off a 1.77% decline in August.

WFG News

The Election & Its Impact on The Markets:

Office Updates:

We will be returning to normal office hours after Labor Day and will operate from 8:30 until 5:00 each day. As always, if you need to speak or meet outside of those hours, please reach out and we will be happy to set up an appointment.

The Week Ahead

It will be one of the more quiet weeks we have seen in a couple months as the economic calendar, earnings calendar, and Fed are light on events this week in addition to it being a four-day holiday shortened week. On the economic calendar market participants will be focused on the ISM services index on Wednesday, a survey on activity in the services sector, along with jobless claims on Thursday. Elsewhere we will see factory orders on Tuesday, trade data and the release of the Beige Book (summarizes economic conditions across the US), the revision to second quarter productivity and employment costs on Thursday, and consumer credit on Friday. It will be the last week of Fed speak, with only a couple Fed policymakers making public appearances, before they go into a quiet period before the next FOMC meeting September 19-20. There are not many earnings releases to look forward to with the only notable companies reporting including HealthEquity on Tuesday, GameStop, American Eagle, and C3.ai on Wednesday, DocuSign, on Thursday, and Kroger on Friday.