Wentz Weekly Insights

Stocks Fall Slightly Following Best Week in Almost Two Years

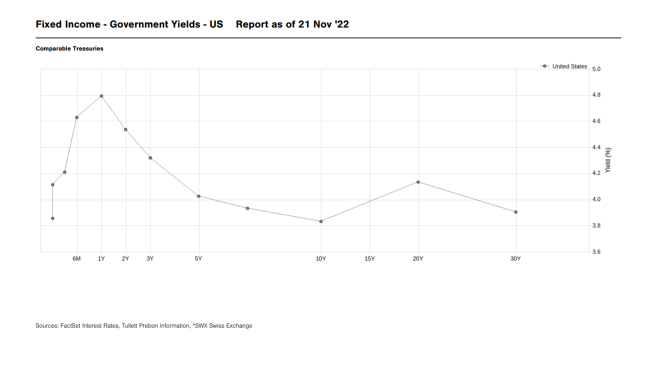

Yields on Treasuries started the week at the lowest levels in several weeks, the lowest since October 5, helped by softer than expected inflation data from the week prior. In fact, the 10-year Treasury yield fell nearly 70 basis points below the 2-year Treasury yield and 45 basis points below the 3 month Treasury yield, the largest inversions in 40 years. Typically, in a normal economic environment, investors demand a higher interest rate for committing their money for longer periods of time, which results in an upward or normal slope of the yield curve. When this curve is inverted, as it is now with shorter term rates higher than longer term rates, investors are predicting a slowdown or recession in the future, and if that happens typically monetary policy adjusts to lower interest rates. This inversion of the yield curve has been a great predictor of recessions in the past.

Even more, the Federal Funds rate, the policy rate the Federal Reserve establishes, was higher than the 10-year Treasury yield for the first time since right before the pandemic recession. This inverted for the first time Tuesday last week with the effective federal funds rate at 3.83% while the 10-year Treasury closed at 3.78%. History shows recessions typically begin between 6-18 months after this has inverted.

Recent commentary from Federal Reserve policymakers has been mixed, but markets took note when St. Louis Fed President James Bullard indicated one of the Fed’s models suggested rates could go as high as 7% to be considered “restrictive” in the current environment (versus the current 3.83%). Currently, markets have been projecting a peak rate of just under 5%, so this was a big surprise. However, this was one model, and some policymakers have dismissed its accuracy.

Either way, the most recent remarks from policymakers suggest there is still work left to do before rates peak. Inflation is still high and no where near the Fed’s goal of 2%. As such, along with other uncertainties the markets face, we will remain in a volatile period. With money market rates now approaching 4%, there are now alternatives to stocks, and these could be good places to park cash while the economy and markets works through the several uncertainties they face.

Week in Review:

Stocks opened last week lower and closed near the worst levels of the day after the New York Fed’s survey of inflation expectations showed an increase to both one year ahead and five year ahead inflation expectation. There was mixed Fed speak as well, with one official saying we are still a way off from the endpoint, while Vice Chair Brainard gave more dovish comments that policy actions are starting to show up in financial conditions and supporting slower rate increases, however mentioned there is additional work to do. Treasury yields moved higher across the curve while the S&P 500 closed down 0.89%.

Stocks got off to a good start on Tuesday, driven by growth stocks and other risky areas, after another softer than expected inflation report – this time from the producer price index. There was also global help as Chinese stocks performed well over hopes of a change in its zero Covid policy. However, the early morning strength came to an end after reports a missile killed two inside Poland, close to the Ukraine border. In corporate news, both Walmart and Home Depot reported better than expected results. Yields fell with NASDAQ gaining 1.45% while S&P 500 was up 0.87%.

Target made headlines on Wednesday after its earnings report suggested softening in consumer demand and changes in consumer behavior, with the company reporting lower margins and lowering its guidance for the important holiday shopping quarter. This was somewhat offset by better than expected retail sales for October along with better earnings from other retailers. Yields declined on the long-end and stocks were down with growth underperforming – the S&P 500 fell 0.83% while NASDAQ fell 1.54%.

Fed speak was back in the headlines Thursday after governor Bullard said policy rates are not restrictive and suggested the peak rate would be between 5% and 7%. There were more retail earnings that rolled in, mostly positive, while economic data on housing was about in line with expectations while manufacturing data was weak. Stocks closed slightly lower with the S&P 500 down 0.31%.

Existing home sales data Friday morning showed a ninth consecutive decline as the sales pace came in weaker than expected. It was a more quiet day with the S&P 500 rising 0.48%.

For the week, oil declined 10% for the worst week since June over Covid concerns in China despite rolling back some measures. Treasury yields started the week at the lowest levels in several weeks, seeing a deeper inversion, and the 10-year yield even inverting with the Fed funds rate in the beginning of the week. Stock performance favored value and defensive sectors over growth/tech sectors, with major indices finishing as follows: Dow -0.01%, S&P 500 -0.69%, NASDAQ -1.57%, and Russell 2000 -1.75%.

Recent Economic Data

- Producer prices rose 0.2% in October, half the increase expected, and follows a 0.2% increase in September. Compared to a year ago producer prices are 8.0% higher. The price index for final demand was due to a 0.6% increase in goods which was offset by a 0.1% increase in services. Minus the volatile food, energy, and trade services categories, producer prices rose 0.2% in the month, following a 0.3% increase in September.

- Prices for goods and services imported to the U.S. declined 0.2% in October and this follows a 1.1% decline in the previous month. In fact, import prices have not increased since June. The decline was due to lower energy prices, as has been the case for the previous months. Import prices compared to a year ago were up 4.2%, decelerating from 6.0% last month and the peak of 13.0% in March. Prices of goods and services exported from the U.S. fell 0.3% in October, also the fourth consecutive monthly decline. The decline was due to agricultural prices falling, along with industrial supplies and materials. Compared to a year ago export prices are up 6.9%, decelerating from 9.2% in September and the peak of 18.6% in June.

- The Empire State Manufacturing survey index for November was 4.5, much better than the -6.0 expected and moving back into positive territory from the -9.1 in October, indicating manufacturing activity grew slightly in the month. New orders fell slightly with shipments and deliveries little changed. Employment for the region improved while prices increased at about the same pace as last month.

- The Philly Fed manufacturing survey index was -19.4 for November, well below the expectations of -6.0 and suggests worsening conditions due to the -8.7 reading from last month and the fifth negative reading out of the past six. The report notes activity in the region continued to decline due to another decline in new orders. Seeing slight growth was shipments, employment, and prices.

- U.S. retail sales rose 1.3% to $694.5 billion for the month of October, beating the expectations of a 1.0% increase for the best increase in eight months. Compared to a year ago, retail sales are 8.3% higher. The increase was due to 10 of the 13 categories seeing gains, driven mostly by a 4.1% increase in gas sales, 1.6% increase in restaurants/bars, 1.4% increase in grocery stores, and a 1.3% increase in vehicles and parts. This was offset by a 0.3% decline in electronics and appliances, a 0.3% decline in sporting goods, and a 0.2% decline in general merchandise stores. Compared to a year ago, all major categories are positive with the exception of electronics which saw a 12.1% decline. The largest increases have come from service oriented categories like restaurants/bars. The data is solid, but not so much when compared with inflation, which was up 7.7% over the same period, giving retail sales only a 0.6% increase from a year ago.

- The number of housing starts in October fell 4.2% to a seasonally adjusted annualized rate of 1.425 million. This is 8.8% below the rate from a year ago. Single-family housing starts fell 6.1% in the month to an annualized rate of 855k but are down 20.8% from a year ago while multi-family units are down 17.8%. The number of permits filed to build a new home fell 2.4% to a seasonally adjusted annualized rate of 1.526 million but is 10.1% below the rate October 2021. Both housing starts and permits beat expectations slightly in the month.

- Existing home sales fell for the ninth month in a row to a seasonally adjusted annual rate of 4.43 million, a 5.9% decline from September that is slightly better than expected. Compared to a year ago, sales are down 28.4%. The Chief Economist of the NAR which releases the data noted “more potential homebuyers were squeezed out from qualifying for a mortgage in October as mortgage rates climbed higher.” Supply of homes has not helped, with inventory down about 1% from September, and October a year ago, to 1.22 million units, leading to supply that would last just 3.3 months at the current sales pace. Prices have not helped either – the median existing home price in October was $379,100, up 6.6% from last year. In October, still about 24% of homes received over the asking price.

- The number of unemployment claims fell 4,000 for the week ended November 12 to 222,000. The four-week average remained relatively unchanged at 221,000. Continuing claims moved higher by 13k to 1.507 million, with the four-week average continuing to creep higher, now at 1.481 million, up another 31k in the month.

Company News

- Live nation fell late last week after a report that the Justice Department launched an investigation into whether its Ticketmaster business has abused its power over the music industry. This comes just after Ticketmaster was forced to cancel public ticket sales of Taylor Swift’s tour due to record amount of demand and glitches in the system. Taylor Swift’s tour, the first in five years, sold over 2 million tickets in one day for the most in a single day ever.

- In an unexpected move, the board of Disney has dismissed CEO Bob Chapek from his role and replace him with longtime Disney CEO Bob Iger. The Board said Iger will serve two years to “set strategic direction for renewed growth” and to work on creating a successor to lead the company. Bob Iger was last head of the company in 2020 but remained on the board as executive chairman until last year.

- Micron fell further last week after warning that the outlook for 2023 has weakened. As a result it is reducing its DRAM and NAND wafer starts by approximately 20% versus the current quarter and is looking for additional capital expenditure cuts. For 2023, it expects bit supply growth from DRAM to be negative and in the single-digit range for NAND.

- There were many more high-profile tech/large cap company layoffs last week. Additional announcements came from Cisco, Roku, Carvana, and Disney.

Other News

- President Biden and Chinese President Xi held an in-person meeting last week to discuss high level issues. The White House said the meeting produced positive conversation around the U.S. and China remaining competitive, but the competition should not turn into conflict or increased tensions. Regarding the increasing tensions over Taiwan, it said the U.S. one China policy has not changed and the U.S. opposes any changes to the status quo by either side. The two ended the meeting agreeing to a follow up, when Secretary of State Blinken visits China.

- OPEC has cut world demand growth for oil for both 2022 and 2023, citing China’s zero Covid policy, geopolitical uncertainties, and weaker global economic growth. The 2022 oil demand growth forecast was cut by 100 bbl/day to 2.5 million bbl/day, while the 2023 forecast was cut by 100k bbl/day to growth of 2.2 million bbl/day. The organization also reaffirmed its 2023 supply forecast, but said they see upside potential from producers, including the U.S, offsetting declines from Russia.

- There are increasing reports that India, one of Russia’s largest oil buyers, is more wary about buying oil from Russia after the European Union price caps go into place in December. It also said Indian and Chinese refiners are slowing purchases now and even not placing orders after the December 5 price cap date. Indian refiners are worried of the reaction from foreign banks due to their exposure to the financial system of western nations.

Did You Know…?

WFG News

The Week Ahead

It will be a holiday shortened week this week as both bond and equity markets are closed Thursday for Thanksgiving and close early on Black Friday (at 1:00 pm for equities and 2:00 pm for fixed income). As such, it will be a lighter week of trading volume, as well as a lighter week of economic data and earnings reports. The economic calendar has nothing until Wednesday, when October durable goods orders, weekly jobless claims, new home sales for October, and consumer sentiment are released. However, the highlight will most likely be the Federal Open Market Committee’s meeting minutes from the most recent meeting several weeks earlier. Investors will look for hints on any changes in the pace of rate increases or conversation around changes in the peak rate. On the earnings calendar, notable quarterly earnings releases will be seen from Oshkosh Corp, JM Smucker, and Zoom Video on Monday, followed by a busier Tuesday with Best Buy, HP, VMWare, Dick’s Sporting Goods, and a handful of other retailers, and finishing with Deere on Wednesday. Data on Black Friday shopping period will be in focus as we end the week and move into next week, as investors look for hints at consumers’ spending trends, especially after several disappointing retailer reports recently.