Wentz Weekly Insights

Stocks Hit Fresh Highs, Q3 Earnings On Deck

Stocks rose another 1.1% last week making it the fifth consecutive week of gains for the S&P 500 and Nasdaq, the longest streak since May. The week also ended with a new all-time high, the first time the S&P 500 closed above the 5,800 level while the Nasdaq is now just 1.6% from its July 10 record high (and the Russell 2000, the small cap index, just 3% from its all-time highs).

The past two weeks have seen an escalation of events and increasing tension in the Middle East, hotter inflation and employment data, the repricing of interest rate cut expectations, and downward revisions to third quarter earnings. Despite these worries and increased uncertainty, stocks continued to move higher. To say the US stock market has been resilient is an understatement.

Last week we received the most recent inflation data. Since the beginning of summer inflation has decelerated, with the headline year-over-year change in inflation decelerating from 3.4% in April to 2.4% in September, but the core index (which excludes food and energy prices) has been more stubborn, only coming down 0.3% over the same period to 3.3% in September.

The latest data showed inflation increased at a slightly higher than expected 0.2% rate in September, which was held down by a 2% decline in energy prices. In fact, energy is down at a 11.2% annualized rate over the past six months thanks to lower oil prices. But the bigger component to focus on is core prices, more specifically services prices excluding housing. This index rose a hotter 0.6% in September and is up 4.4% from a year ago. This component has consistently seen sticky prices and should probably be in the Fed’s focus more.

Right around the time of the latest CPI data, last week we also learned more about the annual cost-of-living adjustment for Social Security recipients. The Social Security Administration said on Thursday that benefits will see a 2.5% cost-of-living adjustment for 2025 which would be the smallest increase in four years. This is a disappointment for most, with the CPI index up 2.9% when the third quarter started.

The average monthly benefit for retirees will be $1,976 per month, up $49 from 2024 and up 19% since the start of the pandemic. Most of this increase will be taken by Medicare with estimates from Medicare trustees in May showing an expected 6% increase in premiums for Medicare Part B. Medicare premiums are typically deducted directly from Social Security benefit payments.

The recent data caused a recalibration in interest rate expectations – prior to the two data releases, markets were pricing close to a 60% chance of three additional rate cuts by the end of the year, but that moved to 0% as of the end of last week. Consensus now sees two cuts in the final two meetings of the year, with a 25% chance of just one cut.

Moving forward, investors’ attention will turn to third quarter corporate earnings. Banks kicked off Q3 earnings season last Friday, with results mostly better than expected despite a decline in profits from a year ago.

On July 1 when the third quarter started, the consensus estimate for earnings growth for the third quarter was around 8.5%. Since then, analysts have revised their estimates downward by nearly 5%, now expecting quarterly earnings to growth just 4.0%. Analysts typically revise earnings growth estimates lower as the quarter progresses, but this downward revision was higher than the historical average.

At the same time, earnings growth is more concentrated than in the past. Only three sectors, technology, communication services, and health care, are expected to see earnings growth of at least 5%, led by a 15% growth by technology (thanks Nvidia and Artificial Intelligence!). According to Factset, if Nvidia was excluded from the technology sector, the earnings growth rate for the sector would fall in half from 15% to 7.5%. Two sectors, materials and energy, are expected to see earnings decline, while the seven other sectors are expected to see earnings growth of less than 5%.

This week we will see more results from financials and hope to gain a better sense of the health of the US consumer and businesses. Another indicator on the consumer will come Thursday with September retail sales data where economists are estimating a 0.3% monthly increase.

Week in Review:

The S&P 500 and Nasdaq both rose for the fifth consecutive week with the S&P 500 and Dow both hitting new all-time highs. The major US indices finished as follows: Dow +1.21%, Nasdaq +1.13%, S&P 500 +1.11%, and Russell 2000 +0.98%. Treasuries moved lower as yields rose across the curve after the much better than expected employment report the week before along with higher inflation data. The 2-year Treasury yield gained four basis points to 3.97% while the 10-year yield increased 15 basis points to 4.11%. Crude oil rose another 1.6% for the fourth weekly increase in the past five and back to the level it was in August. The dollar index rose 0.4% (experiencing nine straight daily gains until Friday) while gold increased 0.3% and Bitcoin increased 0.6%.

Recent Economic Data

- Consumer Price Index: The consumer price index increased 0.2% in September, matching the increase from August, but slightly higher than the 0.1% increase that was expected by economists. The food category increased 0.4%, the highest monthly increase since January 2023, and accelerating to a 2.4% annual gain. The energy category saw a 1.9% decline in prices, following a 0.8% decline in August and decreasing at a 11.2% annualized rate over the past six months (down 6.8% over the past year), mostly due to lower gas/oil prices. The core index, which excludes food and energy prices, rose a more than expected 0.3%, matching the increase in August, with core prices up 3.3% over the past 12 months, up from the 3.2% rate in August. Within the core category, apparel saw a 1.1% increase in prices, transportation saw a 1.4% increase and medical care saw a 0.7% increase while shelter, one of the largest components of the overall index, only increased 0.2%, a welcoming slowdown from the prior three years. New and used vehicles saw a small monthly increase, but still seeing a decline in prices over the past 12 months. The index that centers on services prices excluding shelter (housing) saw a big jump with a 0.6% monthly increase, and is up 4.4% from a year ago, still over double the Fed’s target.

- Producer Price Index: The producer price index was lower than expected with the index unchanged in September, versus the expected increase of 0.2%. Prices however accelerated on an annual basis to 1.8% from 1.7% in August. The core index, excludes food and energy, rose 0.2% as expected, and is up 2.0% from a year ago. Prices for final demand goods drove most of the downside to the headline number with a 0.2% decline, due to a 2.7% drop in energy, while the prices for final demand services rose 0.2%.

- Jobless Claims: The number of unemployment claims filed the week ended October 5 was 258,000, an increase of 33,000 from the prior week, one of the largest weekly jumps in a while and bringing claims to the highest level in 13 months. A possible explanation for the jump in claims could be related to Hurricane Helene. The four-week average was 231,000, up 7k from the prior week. The number of continuing claims was 1.861 million, up 42k from the prior week, just 10k below the cycle high, with the four-week average up 5k to 1.832 million.

- US Trade Data: The US trade deficit improved in the latest month of data, shrinking from $78.9 billion in July to $70.4 billion in August. The lower deficit was due to a $5.3 billion increase in exports (which was up 2.0% and totaled $271.8 billion in the month), and a $3.2 billion decline in imports (which was down 0.9% and totaled $342.2 billion in the month). Year-to-date, the deficit has increased $47.1 billion, or 8.9% from the same period last year. The volume of trade, or the dollar of goods and services crossing the borders, was up $2.1 billion or 0.3% in the month and up 6.5% from a year ago, a measure indicating solid global demand.

- Consumer Sentiment: The consumer sentiment index was 68.9 for October, lower than the 71 expected and 70.1 from September. The current conditions index fell about half a point to 62.7 while the expectations index fell about 1.5 points to 72.9, both lower than expected. The expectation for inflation over the next 12 months was 2.9%, which increased from 2.7% last month (which was the lowest expectation since December 2020), while the longer-term inflation expectation was unchanged at 3.0%.

- Consumer Credit: US consumer credit increased at an annual rate of 2.1% in August to total level of $5,097.6 trillion. Nonrevolving credit (like mortgages and auto loans) increased 0.3% in the month, or a 3.3% annual rate. Revolving credit (like credit cards) declined 0.1% in the month or at an annual rate of 1.2% for the first monthly decline since April 2021. Revolving credit totaled $1,357.5 trillion, up 5.4% from a year ago, however the pace of growth has slowed since the beginning of the year.

Company News

- Another AI Beneficiary: Shares of Super Micro Computer, known best for its liquid cooling technology, rose more than 15% last Monday after it disclosed it is deploying over 100,000 GPUs per quarter with its new liquid cooling system for large AI data centers and other cloud service providers. In addition, it said its liquid cooling systems cut customers’ power demand by up to 40%.

- Possible Google Breakup: As part of its ongoing antitrust case against Google, the US Justice Department said late Tuesday in a court filing that it was considering asking a federal judge to force a possible breakup of Google’s main businesses including its Chrome web browser and Android operating systems. Regulators have been weighing solutions to reduce Alphabet’s dominance in the Search business, claiming Google gains scale and data from illegal distribution agreements with tech companies by making Chrome its default browser option.

- CrowdStrike’s Outage Impact on Delta: Delta said in its third quarter earnings report that the tech glitch from Crowdstrike that resulted in a widespread outage it experienced in the third quarter cost the company $380 million in revenue and had a $0.45 impact on earnings per share in the quarter. The outage results in the grounding of about 7,000 flights over a five day period. The revenue impact was due to customer refunds, compensation in the form of Skymiles, as well as crew-related costs.

- Zoom Video’s New Target: Zoom Video shares rose about 3% Wednesday after it gave a presentation at its Zoomtopia conference saying it now expects its long-term operating profit target to be between 33%-36%, up from the prior range of 28%-32%.

- Boeing Workers’ Strike: Boeing workers have been on a strike for nearly a month now with no resolution and a will continue to be on one after Boeing withdrew its pay offer to the union and halted talks. S&P estimates that the strike is costing Boeing $1 billion per month and importantly is risking Boeing investment grade credit rating. If Boeing’s credit rating gets cut to junk by the credit rating agencies, Bloomberg notes it would cost the company another $100 million in interest costs (due to higher interest rates), adding to the ongoing troubles at the company. The credit agencies are reviewing Boeing’s credit for a possible downgrade, with Boeing reportedly considering ways to avoid a downgrade including raising $10 billion by selling shares to boost its cash position and avoiding adding more debt.

- Robotaxi Revealed: Tesla shares moved about 9% lower on Friday after it held its “We, Robot” event Thursday evening where it unveiled its highly anticipated Robotaxi. Overall, analysts have said the event underwhelmed and provided a lack of details. The new “cybercab” would cost under $30,000 and come without a steering wheel or pedals.

Other News

- China’s Wild Ride: Chinese stocks have been on a tear since mid-September, rising over 30% after China announced one of the largest stimulus measures since the onset of the Covid pandemic in effort to stimulate its struggling economy and property market. However, Chinese stocks took a sudden turn lower mid-week after China’s economic planner announced a special purpose bond issuance to local governments to help stimulate growth, falling short of expectations for another wider economic stimulus package. The MSCI China ETF fell over 10% on the news. After the news, China announced a Finance Ministry briefing this past Saturday in which it promised more support for its property sector and hinted at more government action, however falling short of market expectations again. Separately, China reported its consumer inflation unexpectedly slowed in September while its producer price index continues to show declines.

- Cost-of-Living Adjustments: Last week, the Social Security Administration announced that Social Security benefits will see a 2.5% cost-of-living adjustment for 2025 which would be the smallest increase in four years. The average monthly benefit for retirees will be $1,976 per month, up $49 from 2024 and up 19% since the start of the pandemic. Most of this increase will be taken by Medicare with estimates from Medicare trustees in May showing an expected 6% increase in premiums for Medicare Part B. Medicare premiums are typically deducted directly from Social Security benefit payments.

- FOMC Minutes: The Fed released the minutes to its most recent FOMC meeting on September 18, where it noted most policymakers supported a 50 basis point cut to interest rates although some noted plausible cause for just a 25 basis point cut. Most members agreed that upside risks to inflation had diminished while downside risk to employment had increased. Most also agreed that economic growth remained solid.

- Fed’s Dilemma: Atlanta Fed District President Raphael Bostic became one of the first Fed policymakers to voice support for no rate cut at the next Fed meeting. In a WSJ interview he said he was “definitely open” to holding rates unchanged at the Fed’s November meeting after seeing last week’s consumer price index inflation data, saying he thinks the Fed can wait and “let things play out a little longer”. Just two weeks ago he was voicing support for another 50 basis point cut at the next meeting.

Did You Know…?

Fiscal 2024 Federal Deficit

The CBO (Congressional Budget Office) said the US budget deficit was $1.83 trillion in the latest fiscal year that ended September 30. The government received $4.92 trillion in revenue, a $479 billion or 11% increase from the prior year, and spent $6.75 trillion, a $617 billion or 10% increase from the prior year. The higher deficit was driven by higher spending on interest on government debt (which rose by $240 billion to $950 billion), which was a higher cost than spending on the military. Other areas that saw spending increase include education which saw the largest increase of $308 billion, and federal entitlement programs like Social Security and Medicare.

WFG News

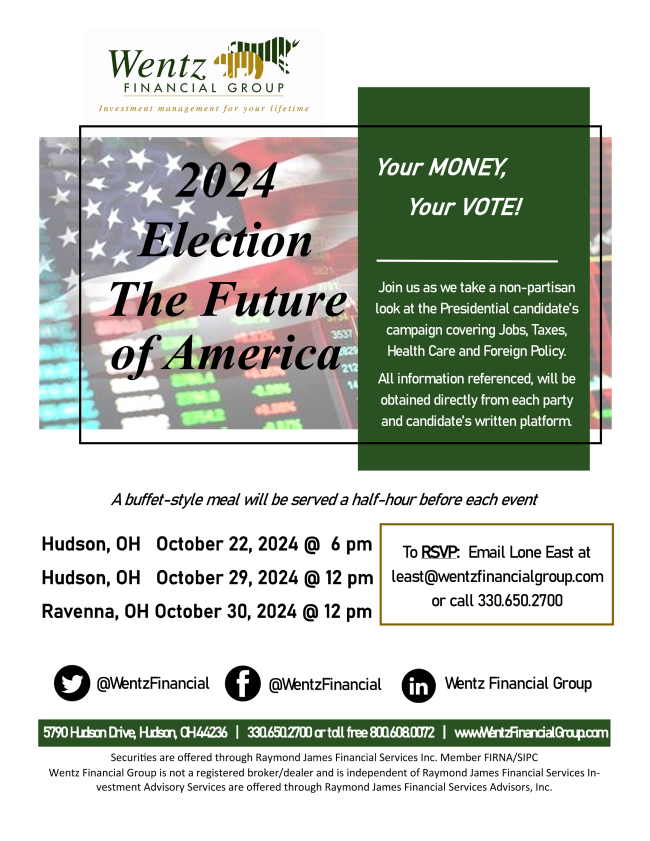

Your Money, Your Vote

Join us as we discuss the 2024 Election and take a deeper dive into each of the Presidential Candidates’ campaigns. We will have a specific focus on the economy. All information provided will be obtained directly from each candidates’ platforms.

Please RSVP as soon as possible as seats will fill quickly!

We have three sessions to choose from:

Hudson Office – October 22 @ 6:00pm

Hudson Office – October 29 @ 12:00pm

Ravenna Office (Basement Hall) – October 30 @ 12:00pm

The Week Ahead

The calendar is much more busy this week with plenty of economic data, Fed speeches, and earnings for markets to digest. The highlight on the economic calendar is Thursday’s retail sales data. Current expectations see retail sales increasing 0.3% in September which would be higher than the 0.1% that was seen in August. Other data comes from manufacturing with the Empire State and Philly Fed manufacturing indexes, industrial production, as well as housing market data with the housing market index, housing starts and permits, along with data on weekly jobless claims. The pace of third quarter earnings reports pick up this week with approximately 10% of S&P 500 companies releasing their quarterly results this week before ramping up next week. A bulk of this week’s reports will come from financials. Highlights include Charles Schwab, Bank of America, Goldman Sachs, Citigroup, PNC, UnitedHealth, Johnson & Johnson, Walgreens on Tuesday, Morgan Stanley, US Bancorp, Discover Financial on Wednesday, Netflix, Taiwan Semiconductor on Thursday, and American Express and Procter & Gamble on Friday. Investors will hear a lot from Fed officials again this week with over a dozen public appearances planned throughout the week. Markets will look for hints on the pace of rate cuts through the remainder of the year after hotter than expected inflation and employment reports the past two weeks. On the other side of the Atlantic, the European Central Bank will meet this week to make its latest policy decision where the expectation is for another rate cut.