Wentz Weekly Insights

Stocks Mixed but Nvidia Drives Tech & Nasdaq to New Highs

It was a very mixed week and if it wasn’t for a strong rally by the third largest US company, Nvidia, stocks would have been lower across the board. For the week the Dow was down over 2%, Russell 2000 down 1.2%, while the S&P 500 was flat (versus the equally weighted S&P 500 index down 1.25%), and Nasdaq the outperformer with a 1.4% gain. In fact, it was more of a risk-off week with small caps, global stocks, and commodities all weaker. Despite this, volatility (as measured by the VIX) fell to a new four-year low of 11.52 before moving back to the upper 12s later Thursday.

Treasury prices moved lower with higher yields. The 2-year Treasury rose 12 basis points to 4.96% while the 10-year yield rose four bps to 4.47%. After a strong run in commodities year-to-date, it was a down week with copper down 6% and oil down 2.3% to the lowest in three months.

The NASDAQ’s gain was driven by two events, both related to Artificial Intelligence. The first was Microsoft’s annual developer conference. Shares got a boost after it said it will be building its new PCs with its AI feature Copilot built in, calling it the fastest and most AI-ready computer ever made.

The other was Nvidia, the maker of graphic chips and the company behind the technology and data centers that power accelerated computing and everything AI related. The company reported its financial results for the last three months that beat even the highest estimate from analysts.

To better understand the growth the company has seen since the capex in AI began, look at the sales and earnings figures over the past year. This past quarter the company generated $26 billion in sales. This compared to sales of $7.2 billion in the same quarter one year earlier, good enough for a 262% increase in the 12 month period. Its profit rose from $2.04 billion the first quarter last year to $14.9 billion this past quarter, a 628% increase. This growth shows why the stock is up 250% over the past 12 months.

One of the key takeaways for investors was that its new architecture it announced earlier this year, Blackwell – a new more advanced chip platform that computes 5x faster than its current platform Hopper, will begin to ship next quarter and ramp up in the third quarter, which is a little bit ahead of schedule. In addition, Nvidia dismissed some worries going into the quarter that customers would slow spending on Hopper in anticipation of the new Blackwell platform. The company added that it expects “a lot of Blackwell revenue this year” and demand is “well ahead” of supply. As a result, it increased its revenue forecast for the current quarter to $28 billion, ahead of the consensus estimates of $26.8 billion.

In addition to the blowout quarter, it announced an increase in its dividend and said it would conduct a 10-for-1 stock split that will occur after market close on June 7. The news was enough to send its stock 9.3% higher and 15% higher for the week. The weekly gain added $340 billion to its market cap, brining it to $2.61 trillion, making it the third most valuable publicly traded company in the world – just behind Microsoft and Apple (with market caps of $3.19 trillion and $2.93 trillion, respectively).

Outside of AI, the markets have looked more vulnerable. Stocks saw a sizeable decline Thursday, with no specific catalyst, but we could point to three things.

The first was the “good news is bad news” narrative. Economic data in the morning showed jobless claims fell back to the low level it has trended at since the beginning of the year, averaging about 210,000 per week. This points to continued strength in the labor market. With such strong economic data, markets took this as a lower probability the Fed would cut rates at its upcoming meetings. According to the CME FedWatch tool, rate cut probabilities for the September meeting (three meetings from now), moved from 80% last week to 50% now, while cut probabilities for one or less rate cuts by the end of the year went from 40% to 60%.

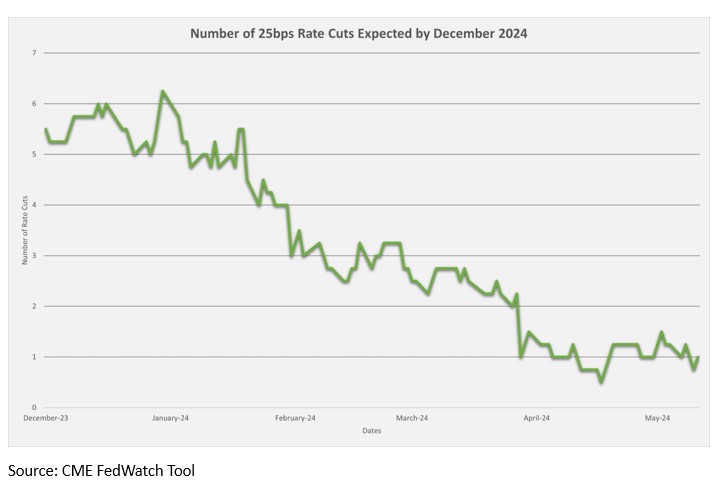

The chart below illustrates how rate cut expectations have declined since mid-December 2023. At that time, investors were expecting between five and six rate cuts in 2024. By mid April, that expectation had dropped to about one rate cut, where it still stands at today. Despite these lower expectations, stocks have remained resilient, but bond yields have risen.

Recent Economic Data

- Existing Home Sales: Existing home sales for April was another disappointment, with sales falling 1.9% in the month (versus an expected increase), and down 2% from a year ago, to a seasonally adjusted annualized sales rate of 4.14 million homes. Existing home sales did see a bounce the beginning of 2024, but since have decline back near the worst sales pace of 2023 and the post-pandemic recovery. Supply of existing homes improved somewhat, up 9% in the month and 16% from a year ago to 1.21 million homes. However, most the increase has come from homes priced at the higher end (those over $1 million), with supply increasing 34% from a year ago. The median sales price of an existing home rose 5.7% over the past 12 months to $407,600. Properties were on the market for an average of 26 days in April, down from March but up from 22 days a year ago.

- New Home Sales: New home sales in April declined almost 5% to a seasonally adjusted annualized rate of 634,000, and about 8% below the level from a year earlier. New home sales have trended in the 600k-700k range for about a year now, which is about 50k-100k below the pre-pandemic trend. New home sales are based on signed contracts (unlike existing home sales which are based on closings) so these numbers reflect sales made in April when mortgage rates rose about 40 basis points through the month from 6.80% to 7.20%. The median sales price continues to rise, up 3.9% over the past year. Home builders say they cannot cut prices because property and material costs are so much higher. The good news is supply of new homes has steadily improved, with 474k new homes available, up from 419k a year ago.

- Mortgage Rates: The average 30 year prime mortgage rate fell 8 basis points last week to 6.94%, down for the third straight week after reaching the highest level since last November (at 7.22%). However, the average rate is still up from 6.61% when the year started.

- Jobless Claims: Jobless claims for the week ended May 18 was 215,000, a decline of 8k from the prior week, bringing the four-week average to 219,750. The number of continuing claims was 1.794 million, a slight increase from the prior week with the four-week average up slightly to 1.782 million.

- Durable Goods Orders: New orders for durable goods increased a strong 0.7% in the month which compared to the estimate of a 0.5% decline. The first thing to look at is the transportation index since aircraft orders skew the index so much, where orders fell 8.0% (after rising 7.7% and 17.7% the prior two months). Excluding transportation, orders were up 0.4%. The most important number of the report which feeds into GDP is shipments of nondefense core capital goods excluding aircraft which rose 0.4% (a rebound from a 0.3% and 0.8% decline the prior two months).

Company News

- Nvidia’s Slow Start in China: A day after its earnings report, a Reuters report stated Nvidia’s chip it developed specifically for China (due to the U.S. export restrictions) has gotten off to a slow start, with “abundant supply,” signaling weak demand of the chips. As a result, the report says Nvidia has cut the price of those chips below that of Huawei, one of the largest rivals in China.

- JPMorgan CEO Comments: At a JPMorgan Investor Day event, CEO Jamie Dimon said the bank will not purchase a lot of its shares at the current stock price, implying the stock was overvalued at these levels, with Dimon saying purchasing shares at 2.3x book value would be a “mistake.” Regarding the economy he said he is cautiously optimistic and talked a lot about geopolitical risks. The company also raised its net interest income guidance for the year.

- Microsoft’s Developer Event: Microsoft made headlines the beginning of last week with its Build event that discussed a lot of AI related things and revealed several new products. It said it is building the fastest and most AI-ready computer ever made, integrating its Copilot AI tool.

- Target Cutting Prices: Target said it would cut prices on over 5,000 items across many categories in effort to stay competitive. It said prices will particularly be cut in areas such as food, adding that it sees consumers more pressured to make the most out of their budgets. Later in the week it reported its quarter earnings that came in below expectations while noting a spending decline in discretionary categories.

- Lam Research New Buyback and Split: Lam Research, maker and servicer of semiconductor equipment, shares move higher after it announced a new $10 billion share buyback as well as announcing a 10-for-1 stock split. It had previously said it plans to return 75% to 100% of free cash flow to shareholders through dividends and share buybacks.

- StreamSaver: Comcast said its streaming service bundle with other providers that it announced two weeks ago, which would include Peacock, Netflix, and AppleTV+, will be called StreamSaver and will cost $15/month. The subscriptions are those that include ads. This is roughly a 30% discount versus subscribing to all three services separately.

- Live Nation Being Sued: The Department of Justice, along with 30 states, filed a lawsuit against Live Nation (owner of Ticketmaster) over antitrust violations. The lawsuit alleges Live Nation’s grip on the industry drives up the prices of tickets to live events. Live Nation’s stock was down about 7% after the news broke. The lawsuit is targeting remedies including splitting up the company.

- DuPont Splitting in Three: DuPont announced it will split into three publicly traded companies in effort to unlock shareholder value, splitting its electronics and water units though tax free transactions, with the remaining diversified industrials remaining part of the existing business (water & protection, industrial solutions, biopharma, and adhesives). DuPont was previously spun out from a larger conglomerate, DowDuPont, in 2015 after DuPont and Dow Chemical merged into one then split into three.

- Less Boeing Plane Deliveries: Boeing CFO said its plane deliveries are not expected to improve this quarter from first quarter levels, and the company is now expected to see negative cash flow for the year, including similar or even worse cash flow for the current quarter compared to last quarter when it lost $4 billion in cash.

- Google’s AI Response to Include Ads: Alphabet recently rolled out its AI Overviews feature at its annual developer conference where its Google service provides AI-generated summaries in response to Google Search questions. Last week it said it will begin testing search ads and shopping ads in these answers, similar to Google search.

Other News

- FOMC Meeting Minutes: The minutes from the Fed’s most recent FOMC meeting on May 1 didn’t reveal much new information, reiterating that the progress to achieving its 2% inflation goal will take longer than previously thought. It saw data through April as “disappointing” in which it did not gain the greater confidence or evidence disinflation was continuing as it had expected. Participants talked about keeping policy rates at current levels for longer, however, one key difference from Powell’s press conference was several participants mentioning they would be willing to tighten policy further if upside inflationary pressure materializes.

- If Fed cuts, It Wont be “One and Done”: Fed Governor Christopher Waller reiterated many of the comments that other Fed officials have said, including it make sense to wait longer to cut rates to have better confidence that inflation continues to move lower. He added some context on the inflation dynamic, saying 2023 saw a major unwinding on the supply side with supply normalizing, and the beginning of 2024 saw more demand side issues – too much demand that is keeping inflation higher. He suggested current policy will start to “slowly grind down” the economy while “not pushing it off the cliff.” What the markets mostly appreciated was Waller saying doing one rate cut and being done doesn’t really make sense, it makes more sense to do a sequence of rate cuts.

Did You Know…?

529 Day

- Easy to open and maintain

- Can invest the funds for long-term growth

- Contributions made with after tax funds

- Tax-deductible contributions

- Tax free growth (if used for qualified expenses)

- Tax-free withdrawals (if used for qualified expenses)

- Anyone can contribute

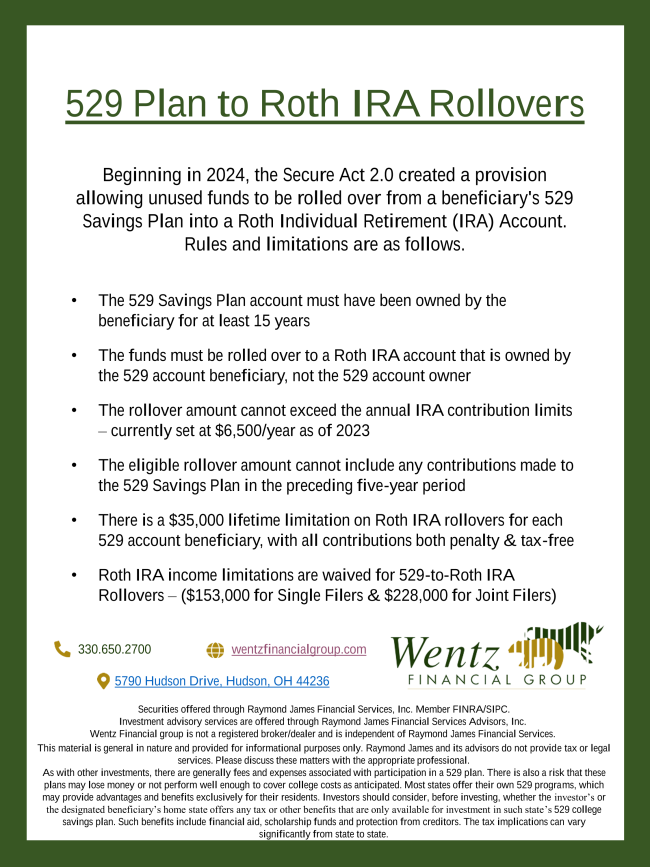

- If there is leftover 529 money, after the passage of the Secure Act 2.0, individuals can roll over un-used 529 funds from the 529 to a Roth IRA in the name of the beneficiary. See below for more details on this new feature.

WFG News

New Settlement Period Beginning May 28

Welcome our Newest Team Member!

WFG Summer Hours

The Week Ahead

It will be a holiday shortened week with the main focus on Friday’s economic data. After this week’s earnings reports the earnings calendar will slow down significantly until mid July. Retailers are the focus again with companies like Dick’s Sporting Goods, American Eagle, Kohl’s, Dollar General, Best Buy, Costco, and Ulta Beauty reporting quarterly results, along with several tech companies like Salesforce, Okta, HP, Marvell Tech, Dell, MongoDB, and Veeva Systems. Elsewhere on the corporate side, it is a busy week of investor events such as sector conferences and individual investor day meetings. The economic calendar is light of releases, but will include a key inflation report. On Tuesday we will see an update on home prices with the Case Shiller home price index along with the consumer confidence report and money supply. Thursday will see jobless claims, pending home sales index, and the second estimate on first quarter GDP. The first estimate saw first quarter GDP growing at an annualized rate of 1.6%, and with more complete data the new estimate is expected to come in at 1.5%. Then Friday has the most anticipated event of the week with the release of the personal income and outlays report that provides data on consumer spending, income growth, as well as the Fed’s preferred measure of inflation with the PCE price index. The index is expected to have increased 0.3% in April with a 0.2% increase in core prices. On the Fed side, we will see many more public appearances from policymakers, and expect the tone to remain the same.