Wentz Weekly Insights

Stocks Mixed For the Week With Treasury Yields on the Rise

Stocks saw one of the more volatile weeks in some time with the S&P 500 experiencing the first consecutive days of declines in over a month. The index snapped its longest win streak of the year at six weeks after declining 0.96% for the week. However, the Nasdaq finished higher for its seventh consecutive week, helped by a +22% day on Wednesday by Tesla after its earnings helped propel the index higher, along with other favorable tech company reports like Texas Instruments.

Weakness in the S&P 500 may be driven by a couple factors; overbought conditions, uncertainty over the election, slower earnings growth, and the pickup in Treasury yields. The latter received more attention this past week – the 2-year Treasury yield rose 15 basis points last week to 4.12% while the 10-year Treasury yield rose 17 basis points last week to 4.25%, both up significant since mid-September when the Fed held is last meeting when it cut interest rates 50 basis points and signaled more cuts ahead.

There have been two driving factors for the reversal and move higher in yields. The biggest is the repricing of expectations on where interest rates will be over the next 12 months. While recent speeches by Fed policymakers have suggested there will be further rate cuts ahead, markets are confused on the pace of rate cuts.

Just one month ago, the CME FedWatch Tool, which tracks Fed Funds futures to show the probability of where interest rates will be at future Fed meetings, was showing 50/50 odds the Fed would cut rates by another 50 basis points (half of one percent) at its next meeting November 5th and a one-third chance it would cut an additional 50 basis points at the last meeting of 2024 in December (meaning 1.00% worth of rate cuts by year end through the two remaining meetings)

Expectations now are completely different – there is a 0% probability of a 50 basis point cut in November and 0% chance of four cuts by year end. Instead, the biggest probability for the November meeting in one rate cut (0.25%), with a 65% chance of another at the December meeting. Basically rate cut expectations have been cut in half over the past month.

Some believe the election odds of a Republican sweep will result in a hawkish tilt for interest rates (higher rates) with another explanation that the market has been too optimistic on the pace of rate cuts. What has really happen though it the data has shown inflation stickier than expected and job gains that have remained strong. However, jobs data has consistently been revised downward for over a year now.

We will see another update on the jobs market this week with a wave of economic reports hitting the market. The highlight is the Department of Labor’s employment report on Friday. The current consensus sees an additional 125,000 jobs added during October. We will also receive data on job openings, unemployment claims, and the employment cost index.

Markets will also be following Wednesday morning’s GDP report. In the second quarter this year the economy grew at a 3.0% annualized pace but was expected to slow through the last two quarters of the year. However stronger economic data than was expected since summer has pushed the expectation for third quarter economic growth to 3.0%, which would match Q2’s pace.

But the most action will come from the continued wave of earnings reports. This week will be the busiest of the quarter with some of the largest companies in the world set to report financial results including Amazon, Apple, Alphabet, Meta, and Microsoft (the combined market cap of the five equaling $12 trillion and who collectively make up 23% of the S&P 500’s market capitalization).

Through Friday, roughly 35% of the S&P 500 had already reported third quarter results. While results are overall better than expectations, the earnings growth rate has disappointed. The quarter began July 1 with the estimates for 8.5% earnings growth, that estimate fell to around 5% by the beginning of earnings season three weeks ago, but with 35% reporting so far it now stands at 3.6%. The big five reporting this week could change the number significantly, but the bigger picture is what will the other 495

Week in Review:

Stocks were lower last week with the exception of the Nasdaq which squeezed out a small gain due to gains in mega cap tech. The S&P 500 snapped a six week winning streak while the Nasdaq continued its streak, now at seven weeks. The major US indices finished as follows: Nasdaq +0.16%, S&P 500 -0.96%, Dow -2.68%, and Russell 2000 -2.99%. Treasury prices were lower with yields higher across the curve over a repricing on interest rate cut expectations. The 2-year yield rose 15 basis points to 4.12% while the 10-year yield rose 17 basis points to 4.25%, both the highest since late July. The dollar index rose 0.7% and is on pace for its strongest month in three years due to stronger economic data and lower rate cut expectations. Gold finished 0.9% higher with yet another new all-time high while Bitcoin fell 2.60%. Finally crude oil rose 4.5% over continued uncertainty in the Middle East and fears Israel would retaliate with strikes against Iranian oil facilities.

Recent Economic Data

- Existing Home Sales: Existing home sales posted a surprise decline of 1.0% in September to a seasonally adjusted annual rate of 3.84 million homes, according to the National Association of Realtors (NAR). This was a decline of 3.5% from a year earlier and is the lowest sales pace for existing homes in 14 years. The NAR chief economist said there are signs of improvement with increasing inventory, lower mortgage rates than a year ago, and ongoing economic strength. Existing home supply was 1.39 million units in the month, up another 1.5% from August and 23% from the year ago level of 1.13 million. However, despite the lower sales pace, the median sales price continues to increase, up 3.0% from a year ago to $392,700.

- New Home Sales: Sales of newly built homes increased 4.1% in September to a seasonally adjusted annual rate of 738,000 homes, which was up 6.3% from a year ago. The number of new homes up for sale has been relatively unchanged over the past year, up just 1.9% over that period. Meanwhile, the median sales price fell through the first half of the year but has since recovered somewhat, but still down 1% from a year ago to $426,300. Most of the increase in new home sales in the month was from homes not started or currently under construction.

- Unemployment Claims: The number of jobless claims the week ended October 19 was 227,000, a decline of 15k from the prior week when claims were the highest in 13 months, which most attributed to the recent hurricanes and ongoing Boeing union strike. The four-week average in claims was up 2k to 238,500. The number of continuing claims increased 28k to 1.897 million for the highest since November 2021, with the four-week average up 18k to 1.861 million.

- Mortgage Rates: After seeing mortgage rates decline from a peak of 7.79% in October 2023 to a recent low of 6.08% one month ago (lowest since September 2022), mortgage rates have since moved back up to 6.54%, according to the latest prime rate survey by Freddie Mac. This was the fourth straight weekly increase and was 10 basis points higher from a week ago.

Company News

- McDonald’s E. Coli Outbreak: Shares of McDonald’s were down 5.1% on Wednesday and a total of 7.6% for the week after the Center for Disease Control issued a warning about an E. Coli outbreak that linked it to its quarter pounder. The report said 49 people were effected with 10 hospitalized and one death due to the outbreak. The company said early findings from its investigation found the outbreak may be due to silvered onions used in the quarter pounder that came from a single suppler.

- Disney Succession Planning: Disney announced it will name CEO Bob Iger’s replacement in early 2026 and replace its board chairman, signaling to investors that the company is taking a fresh approach to succession after past turbulence. The company is reviewing external candidates for the role in addition to current executives. Among those seen as contenders are Josh D’Amaro, chairman of Disney’s experiences division, including its theme parks; Dana Walden, co-chairman of Disney’s entertainment unit, which includes all of the company’s TV and streaming operations; ESPN head Jimmy Pitaro; and Alan Bergman, co-chair of Disney entertainment.

- Starbucks’ Disappointing Preannouncement: Starbucks shares fell almost 4% after it made a preliminary earnings announcement saying its comparable store sales fell 7% during the quarter with revenues down 3%, both lower than expectations. The company said the lower results were due to softness in North America with a 10% decline in transactions as promotions through its app did not improve customer demand. Due to higher uncertainty it suspended its full year guidance so the company can complete a more complete assessment of its business and carry through on recent strategy changes.

- Qualcomm and Arm License Disagreement: Qualcomm shares fell about 4% last Wednesday after its longtime partner Arm Holdings reportedly canceled a license agreement to use its intellectual property to design chips, according to Bloomberg. The contract allowed Qualcomm to create its own chips based on Arm technology. Qualcomm supplies many of the key chips used in smartphones and computers. The report says the contract cancellation could result in a loss of nearly $40 billion in revenue for Qualcomm. Arm claims it took the step to protect its intellectual property over an ongoing dispute after Qualcomm acquired another Arm licensee and the two failed to renegotiate its existing contract.

- Spirit & Frontier Merger Speculation: Shares of Spirit Airlines moved higher mid-week after a WSJ report said the airline is holding early-stage talks with Frontier Group about a potential merger. The news comes just a day after shares spiked on news Spirit said it agreed to a debt refinancing extension with creditors to extend its debt refinancing deadline to December. Spirit has been on a downward spiral over rising debt and slowing demand after its proposed merger with JetBlue was blocked by a federal judge on antitrust concerns in January. Frontier had previously offered to buy Spirit in February 2022 before JetBlue outbid it.

- Boeing Burning Through Cash: Boeing reported earnings for the third quarter that were in line with its preannouncement but said its significant cash burn, seeing a cash burn of more than $10 billion through the first nine months this year, will continue into the first half of 2025, before a recovery in the second half of 2025. In addition, the company and its largest union failed to come to new labor contract agreement, keeping employees on strike for the sixth week. The new contract proposal would have increased wages 35% over four years. Near the end of the week, reports also surfaced that Boeing is considering a sale of its space business.

- Volkswagen Shuttering Plants: Volkswagen said it will shut at least three factories in Germany, downsize its remaining plants and lay off tens of thousands of staff, according to the company’s works council. They also plan to cut workers’ pay by 10% and freeze pay increases for the next two years. Volkswagen is under pressure to cut costs amid a tough economic environment, the need to invest in electric vehicles and increasing competition from Chinese EV makers in both China and Europe. It recently slashed sales and profit forecasts for the year, and last month warned that it was considering factory closures in Germany to boost its competitiveness.

- Tapestry & Capri Merger Blocked: A federal judge blocked luxury handbag maker Tapestry from closing its $8.5 Billion acquisition of rival Capri, dealing a blow to their ambitions to create a house of brands including Coach, Kate Spade, Michael Kors, Versace and Jimmy Choo. The U.S. District sided with the Federal Trade Commission (FTC), which had sued to block the $8.5 billion deal on the grounds that it would reduce competition in the so-called accessible luxury-handbag category and raise prices for budget-strapped consumers. Tapestry and Capri said they would appeal the ruling.

- Keurig Dr Pepper New Acquisition: Keurig Dr Pepper struck a deal to acquire energy-drink maker Ghost for more than $1 Billion. Keurig is expected to make an initial cash investment of about $990 million in exchange for a 60% ownership stake in Ghost, then later acquiring the remaining 40% stake in 2028. Ghost would mark its biggest deal since the maker of Keurig coffee machines took over Dr Pepper Snapple Group in 2018. Keurig also said it plans to invest up to $250 million beginning in the middle of next year into Ghost’s distribution network as it moves the energy-drink business over to its own delivery network.

Other News:

- IMF Global Growth Forecast: The International Monetary Fund lowered its global growth forecast for 2025 while crediting central banks around the world for helping ease inflation without causing a global slowdown, however warned of increasing risks on geopolitical tensions and trade uncertainty. It said it expects global GDP to rise 3.2% in 2025, just below the 3.3% estimate from July. Separately, recent headlines have shown the IMF is getting ready to warn that public debt levels are on track to reach $100 trillion this year.

- Bank of Canada Rate Cuts: The Bank of Canada cut its policy interest rate by 50 basis points (equal to half of one percent) due to inflation that is decelerating and growth that is trending lower than recent expectations. It cut its annualized third quarter growth forecast to 1.5% from 2.8% in its recent forecast from July. There is increasing speculation Canada’s central bank could cut rates another 50 basis points at its next meeting in December.

- European Central Bank: Policymakers at the European Central Bank are reportedly beginning to debate if it needs to cut interest rates below its neutral rate, a rate that would begin to stimulate the economy, according to Reuters. This would mark a significant change to current policy, where rates have remained “restrictive”, or high enough to slow economic growth – the purpose to slow inflationary pressures, but the report says the decision is still a ways off.

- Oil Price Volatility: Oil prices have been on the rise in recent weeks over the ongoing conflict in the Middle East, but fell more than 4% early Monday morning after Israel’s strike at Iran over the weekend steered clear of oil and nuclear facilities, signaling a more calibrated response. The retaliatory attack struck missile-manufacturing and surface-to-air missile-defense sites across Iran, easing fears of supply disruptions in the region.

WFG News

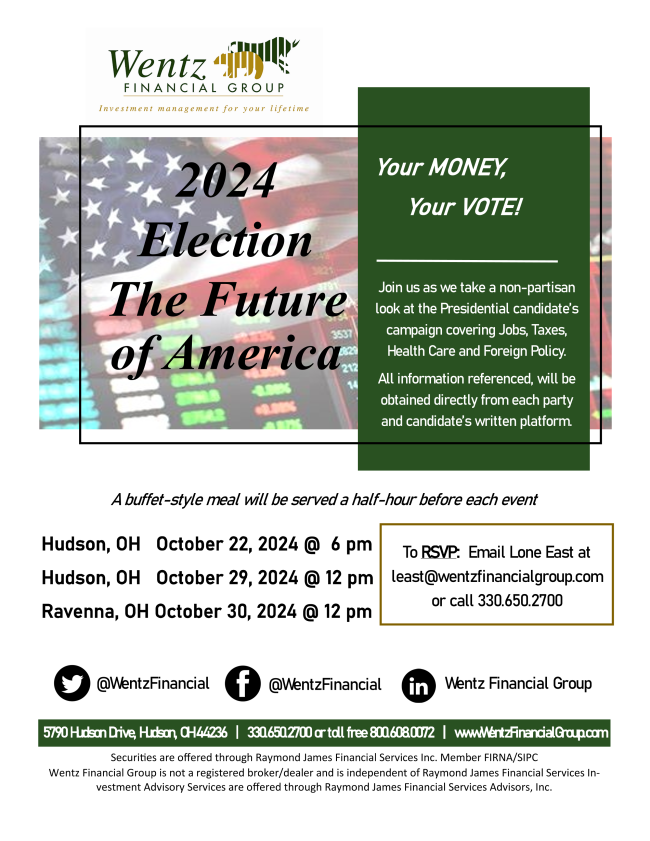

Your Money, Your Vote

Join us as we discuss the 2024 Election and take a deeper dive into each of the Presidential Candidates’ campaigns. We will have a specific focus on the economy. All information provided will be obtained directly from each candidates’ platforms.

Please RSVP as soon as possible as seats will fill quickly!

We have two remaining sessions to choose from:

Hudson Office – October 29 @ 12:00pm

Ravenna Office (Basement Hall) – October 30 @ 12:00pm

The Week Ahead

The next two weeks will certainly be the biggest of the quarter with a bulk of earnings reports coming in, important economic data, particularly on the labor market, the second to last Fed meeting of the year, and the US presidential election. On the earnings side, this week will see a little over 30% of the S&P 500 reporting third quarter financial results, a large portion of which will come from the technology and industrial sectors. This includes some of the largest companies in the world like Alphabet, Meta, Microsoft, Amazon, and Apple, who alone represent about $12 trillion in market capitalization, or approximately 23% of the S&P 500. Other notable company reports include Ford on Monday, AMD, PayPal, Snap, Visa, Chipotle, McDonald’s, Pfizer, SoFi on Tuesday, Caterpillar, Etsy, Eli Lilly, Roku on Wednesday, Uber, Mastercard, Intel, US Steel, and Altria on Thursday, and Exxon Mobil, Chevron, and Wayfair on Friday. On the economic calendar the focus is on the labor market and GDP. Data will come from the job openings and labor turnover survey, ADP’s employment report, jobless claims, the employment cost index, and the DOL’s employment report on Friday. Current estimates see 125,000 jobs added in October after a hotter than expected September. The GDP report is released Wednesday morning where the consensus expectation sees economic growth up at an annualized pace of 3.0% in the third quarter, which would match Q2’s pace of growth. Other data releases will come from the Case-Shiller home price index, pending home sales index, consumer confidence, the ISM manufacturing index, construction spending, and the important personal income and outlays report that includes the latest inflation data. There will be no Fed public comments as all policymakers enter the quiet period ahead of next week’s FOMC meeting. Other central bank news includes the policy decision from the Bank of Japan on Thursday where rates are expected to remain unchanged. Finally, the Treasury will announce its refunding needs for the next two quarters on Wednesday, which has received heightened attention as of late due to the government’s massive borrowing.