Wentz Weekly Insights

Stocks Recover to End Week Flat as Volatility Spikes

Last week’s market action started in one of the worst ways possible. Pre-market the major indexes were down over 6% and opened that way with volatility, measured by the VIX, spiking to the third highest level in history. Much of this was downside momentum from the week prior and the disappointing labor market data (as noted in last week’s newsletter here), but also contributing was a carry over from international trading, particularly in Japan where the “carry trade” was unwinding.

Some of the largest companies in the world whose share prices have risen substantially over the past 12 months and make up a majority of the S&P 500 index gains, sold off the most on Monday. However, stocks ended up recovering half of the losses by Monday’s close, though still finishing down 3.0% on the day in a very broad selloff for what was the worst day since September 2022. What was even better is the selling did not carry over to the remainder of the week. With a positive Tuesday, Thursday and Friday, the S&P 500 finished the week basically unchanged (-0.04%).

The Nikkei 225 index, Japan’s most followed stock market index, saw a 12.4% decline on Monday for its largest drop since Black Monday in 1987. The index was up 31.1% over the 12 months prior. However, like US markets, the Japanese markets recovered most of the losses and recorded just a 2.5% decline for the week.

As we mentioned last week, we thought much of the selloff Monday was from investors panic selling after digesting details from the Fed meeting and latest labor market data that indicated a slowing jobs market, creating more recession worries. But intensifying the selloff was additional technical factors including the unwinding of the carry trade. A carry trade is an investment strategy where an investor borrows money in a currency with a low interest rate and invests the money in a currency with higher yielding investments. This was the case in Japan, who has maintained ultra-low interest rates, whereas the remainder of the world have generally the highest rates in years.

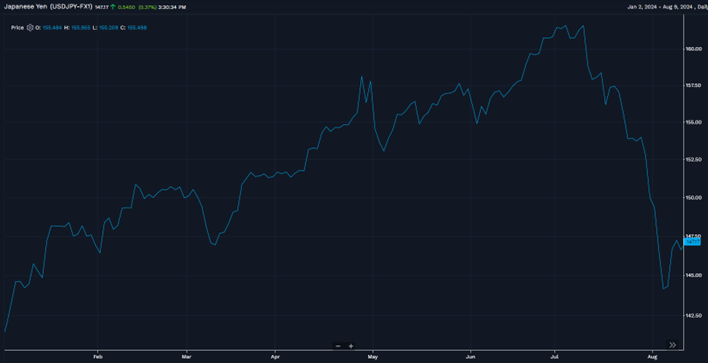

This trade quickly unwound due to the Bank of Japan making its first interest rate increase and deteriorating US data increasing the odds of rate cuts by the Fed. The result was a significant appreciation in the Japanese yen (as illustrated below – shows the USD-JPY exchange rate since January 1, 2024). The potential for a profitable carry trade was eroding from these factors, with investors selling to close out the trades and the selloff intensifying before buyers came in.

The fact is, drawdowns are a normal part of the markets and healthy in a bull market. A correction, considered a pullback of 10% or more, typically happens every year with a pullback of 5% or more happening multiple times per year on average. After Monday’s close, the S&P 500 was only down 8.5% from its all time high a month ago and as of Friday’s close was down just 5.5% from all-time highs.

In times of heightened volatility and extreme moves like Monday, the first thought for some may be to panic sell, however that could be one of the worst things to do. It is important to note pullbacks are common, happen more often than one may realize, and a far majority of the time create buying or rebalancing opportunities. Some of the strongest up days occur immediately after some of the largest down days. As Raymond James notes, missing the 10 strongest days over the past 50 years reduced the average annual return by 1.7% (from 8.3% to 6.6%).

While markets had a solid end to the week, volatility is likely to continue for at least the next several months. There is the obvious uncertainty with the US election, but also uncertainty on if inflation is moving sustainably lower and uncertainty on the actual strength in the labor market. We will see more data on the former on Wednesday with the latest consumer price index report for July. In addition, earnings season moves to retailers which may provide hints on the health of consumer spending, as well as July’s retail sales report. We don’t expect a day like Monday to happen again, but we do expect the second half of the year to be much different (more choppy) than the first half.

Recent Economic Data

-

ISM Services Index: The ISM services index (non-manufacturing) was 51.4 for July, slightly better than expected and a big improvement from June’s reading of 48.8 that suggested the industry was contracting (below 50). The survey respondents said increased costs continue to impact their business and had positive commentary on business activity being flat or expanding gradually. The report noted 10 of the 18 major industries saw growth in the month with the other 8 seeing declining activity.

-

Trade Deficit: The Department of Commerce trade data shows the US trade deficit was $73.1 billion in June, a little smaller than the deficit of $75.0 billion in May. The change was due to a large increase in exports which increased $3.9 billion, or 1.5%, to $265.9 billion, and a $2.0 billion, or 0.6%, increase in imports to $339.0 billion. Year-to-date the deficit has increased $22.7 billion, or 5.6%, from the same period in 2023. On the other hand, the volume of trade increased $38 billion from a year ago, a solid 6.7% increase.

-

Jobless Claims: The number of jobless claims the week ended August 3 was 233,000, a drop of 17k from the prior week, which was a one-year high. The four-week average was 240,750, an increase of 2.5k from the prior week. The number of continuing claims was 1.875 million, up 6k from the prior week and at the highest level since the recovery from the pandemic spike in late 2021.

-

Mortgage Rates: The average 30-year prime mortgage rate was 6.47% for the week ended August 8, according to the weekly survey by Freddie Mac. That is a decline of 26 basis points (0.26%) from last week’s average rate and down from its low of the year in January and is at the lowest level since May 2023. The highest rate this cycle was 7.79% in October 2023.

Company News

-

Nvidia Delaying Launch of New Chip: Part of Nvidia’s big decline on Monday was a report by The Information that the company is being forced to delay the launch of its new, more advanced artificial intelligence chip by at least three months due to design flaws. The report said Nvidia recent told Microsoft, one of its top customers, about the delay, which will affect many of its largest customers including Meta and Google. The chip was revealed as part of Nvidia’s Blackwell GPU architecture back in March. In response to the report, Nvidia shifted focus to its current GPU architecture Hopper and its strong demand while saying sampling for Blackwell has started with production expected to ramp in the second half.

-

Candy/Snack Merger: The WSJ reported that Mars, owner of candy brands like M&Ms, is in advanced talks to acquire Kellanova, the parent company of snack brands like Eggo, Pringles, and PopTarts. The report said a deal could happen at any moment and added the deal could value Kellanova at about $30 billion, which would be approximately 36% higher than its market cap prior to the report. Kellanova became the snack food company of Kellogg after being spun off from Kellogg last year.

-

Delta’s Outage Costs: Delta Airlines disclosed it saw a direct revenue impact of $380 million related to the outage incident. The impact was primarily from refunding customers for cancelled flights and providing compensation via cash and Skymiles. Nonfuel expenses and operational recovery are expected to cost about another $170 million due to customer reimbursements and cost related to its crew. On the flip side, its fuel expense was estimated to be $50 million lower as a result from more than 7,000 flights being cancelled. It said it is still pursuing legal claims against CrowdStrike and Microsoft.

-

Costco’s Crackdown: In a move to crackdown on membership sharing, Costco said it will begin setting up devices at its store entrances to scan memberships to discourage non-members from entering its stores.

-

Warner Bros. Discovery Big Writedown: Warner Bros. Discovery shares fell last week to its new all-time low after it said it is takings a $9.1 billion charge for writing down the value of its TV networks, saying the cable channels are no longer worth what they were when the merger of Discovery and Warner Media happened in 2022. The decision by the NBA to drop Warner Bros. as a broadcast partner also likely made an impact on the valuation.

Other News:

-

Carry Trade Unwinds: Last week started with substantial volatility, a spike of 180% in the VIX (volatility index) at the highest point of the day. The rout started in Asia, where Japan’s most followed index, the Nikkei 225, declined over 12% for its biggest decline since the 1987 crash. A big reason for this plunge is that many investors around the world have participated in the so called carry trade. This is when an investor borrows Japanese yen due to Japan’s ultra-low interest rates (whereas global rates are much higher) and low currency to fund higher yielding investments. However, in recent weeks the Japanese Yen has appreciated rapidly, causing an “unwind” of the carry trade and squeezing the carry trade as a result and exacerbating the downside.

-

Senior Loan Officer Opinion Survey: The Fed’s Senior Loan Officer Opinion Survey showed that banks had tighter credit standards for loans to businesses and business demand for commercial and industrial loans were unchanged over the past quarter and weaker for commercial real estate loans. For loans to households, banks reported lending standards that were basically unchanged and weaker demand among all categories of real estate compared to the first quarter, tighter lending standards and weaker demand for auto and consumer loans, and tighter lending standards and unchanged demand for credit cards.

The Week Ahead

Most of the attention this week will be on the next batch of inflation readings. On Wednesday the Bureau of Labor Statistics releases the consume price index where, after a small decline in June, economists are expecting to see a 0.2% increase in the index in July and a 12 month change of 3.0%. Core prices are expected to have increased 3.2% over the past year. The retail sector will also be in focus with July retail sales closely watched with the ongoing worries about a possible slowdown in consumer spending. Sales at retail stores are expected to have increased 0.3% in July after seeing no change in June. The producer price index, import and export prices, jobless claims, Philly Fed and Empire State manufacturing indexes, industrial production, the housing market index, housing starts and permits, and consumer sentiment will all also be released this week. We are now near the end of earnings season, with 90% of S&P 500 companies having reported quarterly results already, where focus will shift mostly to retailers. Notable earning reports this week will come from Home Depot, Walmart, Deere, Cisco, and Chinese companies Alibaba and JD.com. The political and Fed calendars are light, but there are several noteworthy public appearances by Fed policymakers throughout the week and investors will be focused on their thoughts on the latest inflation data Wednesday morning.