Wentz Weekly Insights

Stronger Economic Data and A More Hawkish Fed

Week in Review:

Recent Economic Data

- Consumer prices, according to the consumer price index, rose 0.5% in January, slightly more than the 0.4% increase expected. Furthermore, December’s 0.1% decline was revised up to a 0.1% increase, which makes the 0.5% January increase even more significant. The increase was driven by several different categories, including energy prices which rose 2.0%, food prices rising 0.5%, medical products rising 1.1%, apparel rising 0.8%, and the largest weight in the index shelter rising 0.7%. Excluding the volatile food and energy categories, core prices were up 0.4%, which would have been higher if it wasn’t for a 0.7% decline in medical services due to the fourth consecutive decline in health insurance, down 3.6% in the month. Over the last 12 months, consumer prices are up 6.4%, down from 6.5% the 12 months ended December, but still higher than the 6.2% expected. Core prices over the past 12 months were up 5.6%, also higher than expected.

- Producer prices, like consumer prices, rose at a faster rate than expected in January. The producer price index rose 0.7%, much higher than the 0.4% expected. It’s not volatile categories like food, which declined 1% in the month, or energy which rose a large 5.0% in the month, that is driving the gains, because the index excluding food and energy still rose 0.5%, higher than the 0.3% expected. Over the last 12 months, the index of producer prices was up 6.0%, more than 5.5% expected, while the core index was up 5.4%, more than the 5.0% expected.

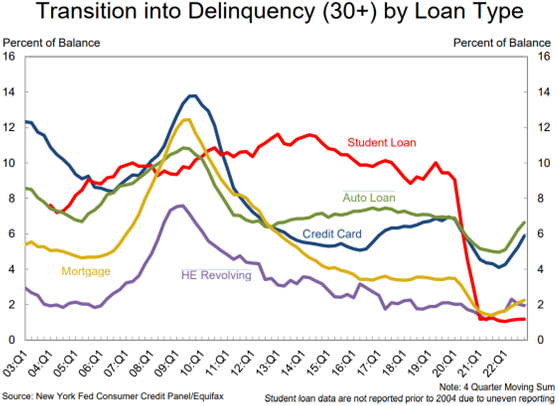

- The New York Fed survey of consumer expectations shows consumers’ expectation on inflation over the next year was 5.0%, unchanged from the prior survey, while longer term expectations (three year inflation) was 2.7%, down from 3.0%. The expectation on household income growth fell to +3.3%, representing a significant drop from +4.6% in December’s survey. The expectation on spending growth fell to 5.7% from 5.9%, the lowest since early 2022, with more people saying it is probable of missing a debt payment over the next three months.

- Monthly retail sales for January increased a very solid 3.0% in the month, much better than expectations of a 1.9% increase after four of the past six months showed declining retail sales, and up 6.4% from January 2022 levels. A solid reading was expected in January due to a variety of reasons – December was a weaker month so it makes January look better compared to December, January was much warmer than usual and people go out more and spend more when its warmer, a spike in fleet sales to rental car companies, and millions got a substantial increase in social security payments and other cost of living adjustments. All 13 major categories saw an increase in the month with the strongest in restaurants/bars +7.2%, department stores +17.5%, vehicle sales +5.9%, and home furnishing +4.4%. Excluding auto and gas sales, retail sales were 2.6% higher in the month the best since early 2021. Compared to a year earlier retail sales were 6.4% higher with the only category seeing lower sales was electronics, with restaurant/bars up 25.2%. While a 6.4% increase over the past 12 months seems solid, it is actually due to higher prices. When you take out inflation, real retail sales were unchanged over the past 12 months.

- Industrial production was unchanged in January compared to December, after falling 0.6% and 1.0% in the prior two months. The index was higher thanks to a 1.0% increase in manufacturing output and a 2.0% increase in mining output, but it was offset by a 9.9% decline in the output of utilities due to a lower demand for heating from an unseasonably warm January, the largest monthly decline since data began in 1939. Capacity utilization fell 0.1% to 78.3%, the lowest since May 2021, a rate that is 1.3% below its long run average (past 50 years).

- The monthly survey of manufacturers in the New York region showed activity continues to decline in February, but at a slower pace than in January. The index of general conditions was -5.8, believe it or not the best reading four months, is better than the -18 expected, and coming after a multi-year low of -32.9 in January. New orders declined modestly, shipments held steady, and combined helped shorten delivery times. Employment declined for the first time since Covid and price increases picked up.

- The index of business conditions form the monthly survey of manufacturers in the Philly region was much worse at -24.3 for February, deteriorating from -8.9 in January for the sixth consecutive monthly decline. The Philly Fed manufacturing survey results showed about 31% of firms reported decreasing activity, 7% said increasing, and 57% said activity was unchanged. Employment declined, while the prices index increased but now in line with long run averages.

- Home builder sentiment rose for the second straight month to 42, up 7 points from January. Anything below 50 is negative so the index suggest home builder sentiment is still poor, even though it was the highest since September (peaked at 81 the beginning of 2022 when rates were still low). 31% of builders said they reduced home prices in February, down from 38% in January with the average price drop of 6% versus 8% in January.

- Despite the unusually warm January, the start of construction of a new home in January was lower than expected with the number of housing starts 4.5% below December levels with a seasonally adjusted annualized pace of 1.309 million, and 21.4% below the rate from January 2022. Weaker starts was spread between single family and multi-family units. The number of permits filed to build a new home was also lower than expected, rising just 0.1% in January to as seasonally adjusted annualized pace of 1.339 million, which is still 27.3% below January 2022.

- The number of unemployment claims filed for the week ended February 11 was 194,000, relatively unchanged from the prior week, remaining at very low levels, with the four-week average at 189,500 (relatively unchanged). Continuing claims was 1.696 million, up 16k from the prior week with the four-week average moving higher by 10k to 1.673 million.

- Prices for U.S. imports fell for the seventh consecutive month after seeing a 0.2% decline in January driven mostly by a 4.9% decline in fuel prices from lower energy prices. Excluding energy, import prices rose 0.3% and over the past 12 months, import prices are still up 0.8%, down from a record high 12 month increase of 13.0% in March. Prices for U.S. exports rose for the first time in six months, rising 0.8% in the month driven by a broad range of categories like industrial supplies, vehicles and parts, and consumer goods, while it was offset with another decline in prices of agricultural goods. Over the past 12 month, export prices are still 2.3% higher, although down from the record 12 month increase of 18.6% in May and June.

- The prime 30-year mortgage rate rose sharply for the week ended February 16 to 6.32%, back to levels from the beginning of the year as bond yields have risen off multi-month lows.

Company News

- Ford said it plans to invest $3.5 billion to build a lithium iron phosphate battery plant in partnership with Chinese battery maker CATL. Production is expected to begin in 2026 and the plant will employ 2,500 people. CATL will provide licensing, materials, and its personnel/expertise for operations. Ford said the project is “aimed at derisking battery supply” chain by building in the U.S. Separately, Ford said it halted production of its electric F-150 Lightning due to potential battery issues that the company discovered during its pre-delivery quality inspections. WSJ reported later in the week the production pause was due to a battery fire.

- Twilio announced restructuring plans that will cost $100-$135 million in effort to cut operating costs, improve operating margins, and accelerate profitability. It said the restructuring will include cutting about 17% of its staff.

- Packaged foods company Post Holdings said it has agreed to buy the pet food brands including 9Lives, Rachael Ray Nutrish, and Kibbles ‘n Bits from JM Smucker for about $1.2 billion.

- Chipotle said it is ready to test a new restaurant concept called Farmesa Fresh Eatery. The first test location will be in Santa Monica and will first feature custom bowls with a limited menu of protein, green or grain, and various topping/sauce options.

- In a record setting deal for the aviation industry, Air India said it placed an order for 470 planes, including 200 Boeing planes valued at $34 billion, and 250 Airbus planes. The order is the third largest for Boeing (by dollars).

- The Financial Times reported Apple is having a difficult time ramping production in India. The company reportedly is dealing with issues at an Indian factory where only 50% of the components produced were in good enough shape to be sent to Foxconn for assembly, whereas Apple’s goal is zero defects. The low yield is making it difficult for Apple to expand its production capabilities in the country as it tries to become less reliant on China for production.

- Boeing CFO said in a conference last week the production of new planes is still being impacted by shortages of parts with the global supply chain remaining unpredictable. Despite this, the CFO said the company is confident it can achieve its cash flow goals for 2023.

- TravelCenters of America, a Westlake, OH based operator of travel centers/truck stops, agreed to be acquired by BP for $86/share, or approximately $1.3 billion, representing a 74% premium to shares before the acquisition was announced.

- Tesla said it will recall about 363,000 vehicles due to the risk its driver assistance system could cause crashes because the system does not adequately adhere to safety laws, according to US regulators. The recall will allow Tesla to update its Full Self-Driving (FSD) Beta software after regulators found it allowed the vehicles to exceed speed limits or go through intersections in unlawful and unpredictable manners.

- Earnings recap:

- Airbnb stock was higher after it reported stronger than expected quarterly results and generated it first annual profit ever. The company said guest demand remained strong throughout the year with all regions seeing significant growth in the year. It saw an increase of 900k listings, ending the year at 6.6 million global active listings, easing some analyst concerns over lack of host supply.

- Digital advertising company The Trade Desk posted better than expected fourth quarter results, with revenues rising 24% from a year ago. Its Q1 forecast were above expectations for both revenues and EBITDA. It also announced a $700 million share buyback program.

- Cleveland Cliffs missed expectations with EBITDA of $123 million, down from $1.5 billion a year ago as prices were down approximately 60% from the April peak. It said it renewed a large portion of fixed price contracts and expects another $115/ton selling price increase to its automotive business (negotiated up from $100/ton). Expects $2 billion reduction in steelmaking costs in 2023 compared to 2022 which will help it achieve better EBITDA. Expects higher EBITDA this quarter versus the 2022 Q1.

- Coca-Cola had another solid quarter, its organic sales growth was +15% versus the +11% expected due to better price/mix, along with better margins that helped the company beat expectations. Its 2023 forecast sees organic growth of 7-8% vs 7% consensus estimates with EPS of $2.59 vs $2.56 consensus estimates.

- Twilio beat expectations, revenues growing 21%, while issuing guidance for the current quarter above analysts consensus expectations. Its increasing focus on profitability and the upside to its forecast had the stock higher. The company also announced a new $1 billion share buyback program.

- Roku beat expectations, saying the overall ad market was “muted” in Q4 with ad spending in consumer categories like restaurants and travel “appear to be improving thus far in Q1,” however other verticals remain pressured. It also provided current quarter guidance that was above consensus estimates.

Other News

- In an attempt to have more electric vehicle charging stations available across the country, Telsa agreed with the Biden Administration to have all its charging stations available to all EVs by 2024 (along with commitments from GM, Ford, EVgo, Hertz, BP, and ChargePoint). This allows Tesla the others to qualify for a share of the $7.5 billion federal grant under the Infrastructure Investment and Jobs Act and the plan to create a network of 500k chargers. The agreement with Tesla makes at least 7,500 of its charging stations, currently compatible with only Tesla vehicles, open to all non-Tesla vehicles when it upgrades the stations by the end of 2024.

- The Congressional Budget Office warned in its 2023-2033 economic and budget outlook that the Treasury will be unable to fully pay its bills sometime between July and September. It also said the 2023 budget will have a deficit of $1.4 Trillion and the debt will expand to $52 trillion by 2033 (from approximately $31 trillion now).

- President Biden nominated current Vice Chair of the Federal Reserve (the 2nd position behind Chairman Powell), Lael Brainard, to join his team and lead the National Economic Council. She submitted her resignation as vice chair of the Fed Tuesday and now a new Vice Chair will need to be nominated. Brainard has historically been a known dove on the committee, siding with a less aggressive approach on policy.

- Biden is reportedly considering nominating Chicago Fed President Austan Goolsbee as the new Vice Chair of the Fed (replacing Lael Brainard). Goolsbee just started his position as head of the Chicago Fed last month.

- Fed speak:

- Dallas Fed president Lori Logan provided detail in what she is looking at for inflation to come down including inflation statistics and a clear change in underlying factors like the imbalance of supply and demand resulting from the “very tight labor market.” She said when inflation repeatedly comes in higher, like last year, or when the labor market show hundreds of thousands more jobs than anyone expected, its “hard to have confidence in any outlook.”

- Philly Fed president Harker said while the Fed is not done yet, it is likely close. Said at some point this year it is expected the policy rate will be restrictive enough and no more increases necessary, with the rate above 5% but how far above 5% depends on the data.

- NY Fed President Williams said getting to the 2% inflation goal will require a “period of subdued growth and some softening of labor market conditions.”

- Cleveland Fed President Mester, who is known to be more hawkish, said she saw a “compelling case” for a 50 basis point increase at the FOMC meeting earlier this month. She says with the incoming data, it has not changed the view that rates need to get to at least 5% and be held there for some time, as the CPI report showed “no improvement in underlying inflation.” She continues to see the risk to inflation to the upside and that suggests the cost of doing too little still outweighs the costs of doing too much.

- In the afternoon after Mester’s comments, St. Louis Fed President James Bullard said he supported a 50 bps increase at the February meeting and that inflation remains too high and as a result he wouldn’t rule out a 50 basis point increase at the next meeting. He said the economy is growing faster than previously tough and labor market continues to be strong with unemployment below its long-run natural level, supporting his few for further increases.

Did You Know…?

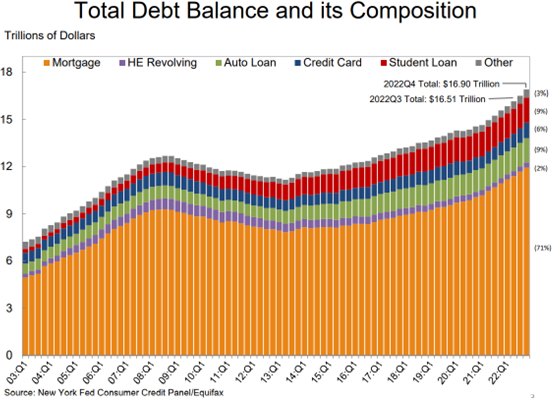

Record High Household Debt

WFG News

Updated on 2022 Tax Documents

Please note tax documents will not start mailing until January 31. Most retirement accounts will see 1099-R and form 5498 mailed on January 31. Retail accounts will see 1099 and related documents mailed by February 15. Certain accounts with more complex securities may have 1099’s mailed as late as March 15. Please see this email for more details. If there are any questions on tax documents, please reach out to us at 330-650-2700.

The Week Ahead

It will be a shorter week with stock and bond markets closed Monday for Presidents Day, but the remainder of the week will still be full of economic data and earnings releases. The economic calendar will include several reports on the housing market including existing home sales on Tuesday and new home sales on Friday. The sales pace is expected to remain stable from December’s pace, despite warmer than average weather in the month. Thursday morning will see the second revision on fourth quarter GDP along with the latest weekly jobless claims count. Then Friday we will see consumer data with personal income and spending for January along with the consumer sentiment survey where all eyes will be on inflation expectations. The Federal Reserve will be releasing its February FOMC meeting minutes where investors will pay close attention to the debate around how high to raise rates, and the pace of increases after last week’s Fed speak included several policymakers that now support a faster increase in rates. The earnings calendar turns to the retail sector with big box retailers reporting over the next three weeks. Highlights this week include Home Depot, Walmart, Palo Alto Networks on Tuesday, eBay, TJX, Nvidia, Baidu on Wednesday, Alibaba, Wayfair, Block, Booking Holdings, and Warner Bros. Discovery on Thursday. Companies may make headlines with several conferences on the schedule as well, including consumer companies at the CAGNY Conference and transportation companies at the Barclays Industrials Conference.