Wentz Weekly Insights

Tariff Tantrum – Trump Tariff Announcement Sends Stocks into Bear Market

President Trump’s “Liberation Day” tariff announcement turned out to be one of the worst outcomes and was the triggering event that sent stocks down 9.1% for their worst week since the Covid related meltdown March 2020. The Nasdaq and Russell 2000 lost 10.02% and 9.70% respectively, also the worst week since March 2020, while the Dow lost 7.86%. The losses came mostly Thursday and Friday where the S&P 500 fell 4.84% and 5.97%, which was the largest single day loss since that same week in 2020. Volatility spiked with the volatility index (VIX) up 110% to close at 45.31 which was the highest since close since April 2020.

The outperformers for the week were concentrated in defensive sectors like healthcare services, grocers, telecom, and insurance, as well as other lower risk asset classes like Treasuries. The 2-year Treasury yield fell 26 basis points to finish at 3.66% and briefly fell below 3.50% for the first time since March 2023. The 10-year yield fell 23 bps to 4.01%. The bond market priced in more fear and a bigger chance of a potential recession, with bond yields down and high yield credit spreads widening (which is the additional yield gained by investing in junk bonds over investment grade bonds of similar maturity). The spread widened to 445 basis points (4.45%) by Friday, up from 342 bps prior to the tariff announcement. While it is a large increase it is still well below the level of around 1,000 basis points the spread widens to during recessionary periods.

Even with last week’s declines, and the 17.5% decline from the all-time high mid-February, stocks are at roughly the same level they were a year ago, showing how strong and resilient stocks have been over the past twelve months.

After the market closed Wednesday, Trump held an event in the Rose Garden where he announced the steepest tariffs since the Smoot-Hawley Tariff Act in the 1930s. The intention is to narrow the $1.2 trillion trade deficit the U.S. has, which Trump described as a national emergency, and to raise billions in revenue and bring manufacturing and production of critical goods back to the U.S.

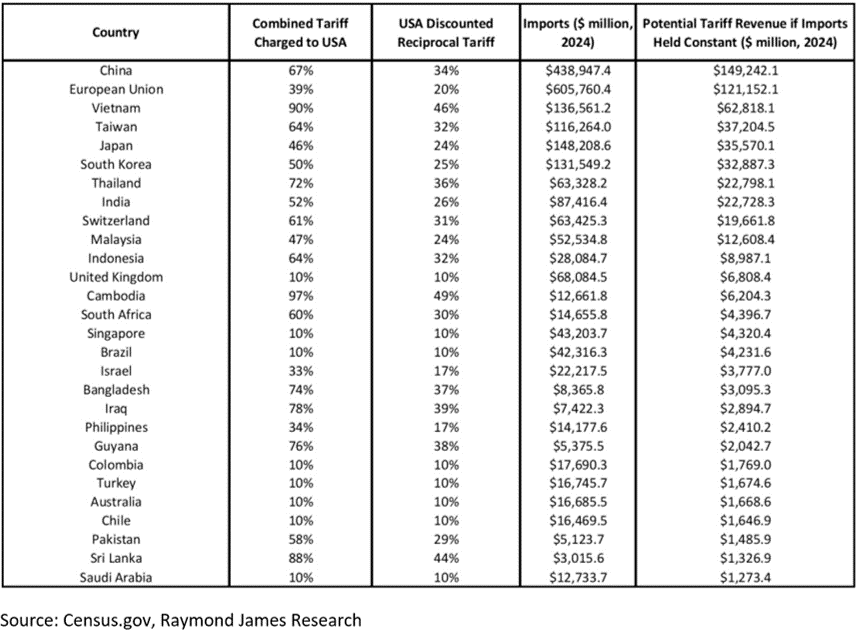

The announcement included a flat 10% tariffs on all imports to the U.S. with higher reciprocal tariffs on 60 specific countries that carry a high tariff on U.S. goods. This includes a 46% tariff on Vietnam, 34% on China, 32% on Taiwan, and 20% on the European Union. This is estimated to result in an effective rate of around 25% on $2.34 trillion worth of goods, much higher than the 10%-15% that analysts were expecting, and is estimated to raise approximately $600 billion in revenue.

Some of the country specific rates are as high as 49%, with Asian nations seeing the highest rates. The highest tariffed nations and the potential tariff revenue from each is in the table below, per Raymond James (note the list is much longer, but we provide this as an example and to show the highest impact).

The tariffs were calculated and decided based on existing trade balances with countries running a trade surplus seeing a flat 10% rate, taking place April 5, while others on specific countries will take place April 9. Canada and Mexico were excluded from this announcement as they are in a separate tariff dispute with the U.S.

The situation is very fluid and we are continuing to monitor every moment. There have been several countries that have expressed their willingness to negotiate, including Vietnam who said they are willing to cut tariffs to 0%. Shares of companies like Nike, who manufactures about 25% of its footwear there, were higher Friday while the rest of the market saw substantial declines.

The Mexican President sent a trade chief to the U.S. to continue discussion with U.S. representatives on tariffs and trade. Mexico was one of few countries to not be included in Wednesday reciprocal tariff announcement, which Mexican President contributed to its “preferential treatment” after the relationship it has developed with Trump.

On the other hand, China was one of the first to retaliate, saying it would impose a 34% retaliatory tariff on all goods imported from the U.S. (on top of the existing tariffs it already has in place) while adding more U.S. firms to its unreliable entity list, with Canada announcing retaliatory plans as well.

Already as of Monday morning there was a brief report that Trump was considering a 90-day pause on tariffs for all countries expect China. Stocks were down 4.7% prior to that news flash but experienced a very sharp reversal and went positive to as high as +3.4% this morning before the White House said that was fake news (a full 8% swing in 30 minutes!). We are in a period where violent swings like this should be expected with these headlines over the near-term.

From the perspective of Wentz Financial Group, this is a Covid-type of event. We have never experienced anything like this before, so the markets are not knowing how to react, and the first reaction is to start selling out of fear. We expect countries to begin coming to the table to negotiate, which will create sharp bounces in stocks.

We will continue to monitor the situation and will reach out to clients when if we see changes necessary. If your financial goals for the next five years have not changed, we generally do not see any changes necessary at this time, but if they have changed, please reach out to us so we can discuss the next steps.

Since 1950 a correction has occurred 56 times (a pullback of at least 10% in stocks from recent highs). One year after those corrections, stocks were higher in 49 of those instances and of the seven that took longer than a year to recover, six of those occurred during recessions. As we said during that last pullback, keep your long-term investment and retirement objectives in mind, especially in times of volatile periods, and try to avoid making knee-jerk or emotional decisions. As we reminded in the “did you know” section of our March 23 newsletter here (the 5 year anniversary of the Covid lows), pullbacks like this look like a small blip on the longer-term chart and for most people should be viewed as a good opportunity.

If you have any questions, concerns, or would like to discuss anything more in detail, please do not hesitate to reach out.

Week in Review:

Stocks saw a sharp decline last week, seeing the largest weekly decline since the Covid induced selloff March 2020 while global markets followed with a selloff of their own. The four major U.S. indexes finished as follows: Dow -7.86%, S&P 500 -9.08%, Russell 2000 -9.70%, and Nasdaq -10.02%. The fixed income market reflected the increased fear as well with Treasury yields falling across the curve to the lowest level in months and some instances years. The 2-year yield fell 26 basis points to 3.66% while the 10-year fell 23 bps to 4.01%. The futures market is now pricing in nearly six rate cuts for 2025, up from just one rate cut a couple weeks ago. The dollar index fell 0.98%, gold fell 2.41% and Bitcoin fell 0.6%. Crude oil saw its biggest weekly decline since early 2023, down 10.6%, on recession concerns and after OPEC said it would bring more supply to the market.

Recent Economic Data

- Employment Report: The Department of Labor’s March establishment survey showed businesses hired 228,000 people in the month, higher than the 12-month average of 158,000. We expect to see a slowdown in government hiring, which has been one of the largest growing sections in the labor report, but job gains were still 19,000. Most industries saw job gains, led by education and health services. The household survey data showed similar strength with the number of Americans claiming themselves as employed rising 201,000 to 164.508 million. The increase could be due to the number of people in the labor force rising 232,000. The number unemployed rose 31,000. The unemployment rate was 4.2%, rising from 4.1% last month. Wages increased 0.3% and are up 3.8% from a year ago, still higher than the 10-year average. The report suggest the labor market is back on a solid track.

- Job Openings and Labor Turnover Survey (JOLTS): After declining from record highs of over 12 million in 2022, job openings have steadily moved lower and have leveled out over the past year in the 7 million range. In February the number of job openings was 7.568 million, down 194,000 from the prior month and down about 900k from a year ago. The number of hires has slowed as well, down about 250k over the past year to 5.4 million, with a 3.4% hiring rate. The number of separations fell 200k with the number of quits down 300k to 3.195 million and a 2.0% quits rate. The data seems to show much less business hiring and people remaining at their jobs longer versus switching as has been the case the past five years.

- ADP Payrolls: ADP’s payroll data showed 155,000 new payrolls added in March, a little above the 120,000 increase expected and jumping from just 84,000 additions in February. Payroll gains were pretty widespread – seen across all business sizes and all industries.

- Jobless Claims: The number of jobless claims fell 6,000 to 219,000 for the week ended March 29, with the four-week average down slightly to 223,000. The number of continuing claims was 1.903 million, up 56k from the prior week for the highest since late 2021. The four-week average was up to 1.871 million.

- PMI Manufacturing Index: The PMI manufacturing index was 50.2 for March, up from 49.8 in the flash reading but slowing from 52.7, indicating manufacturing activity saw basically no growth in March, slowing from February (50 is the breakeven level – anything over 50 indicated expanding activity). The report noted production declined in March as order book growth slowed on tariff uncertainty. Price pressures intensified with the cost inflation index rising to the highest level since August 202.

- ISM Manufacturing Index: The ISM manufacturing index was 49.0 for March indicating a slight decline in activity in March and down from February’s 50.3 which was actually the second straight month of expansion after 26 straight months of contraction. The report noted all measures of activity weakened with demand, new orders, and output leading the way while the prices paid index rose again showing prices accelerated to the upside with the index at the highest since 2022.

- Construction Spending: Construction spending in February increased 0.7%, a little above expectations and comes after a larger than expected drop of 0.5% in January, which could be cold weather related. Spending on residential saw a solid bounce, rising 1.3% in the month, while nonresidential spend rose 0.3%. Construction spending has trended lower over the past year, but February was encouraging. Spending over the past year was up 2.9%, down from January’s 3.3% annual rate, with residential spending up 1.6% and nonresidential up 3.9%.

- Trade Deficit: The trade deficit in February was smaller than January’s record high deficit, but is still the second highest monthly deficit ever. The U.S. imported $122.7 billion more of goods and services than it exported, down from $130.7 billion in January. This is resulting in negative growth estimates for first quarter GDP (one of the more common measures of domestic economic growth), since a trade deficit subtracts from GDP growth. The booming deficit is likely due to companies importing more to get ahead of any potential tariffs. Exports increased 2.9% to $278.5 billion in the month while imports were relatively unchanged at $401.1 billion. Total trade activity is up 13.1% from a year ago, but up 8% just the past two months.

- ISM Services Index: The ISM services index was 50.8 for March, another decline from 53.5 in February. The report said ten industries reported growing activity, down from four in February, while seven reported contracting activity. There was a much higher number of comments on tariffs, but businesses remain split on sentiment on the future. The employment index saw a large decline and is now signaling contracting conditions. The price index fell a little in March, but remains higher than normal with 14 of the 18 industries reporting higher prices.

Company News

- Apple: Bloomberg reported Apple is making a new healthcare push by working on a new Health app and an AI doctor service. The project, named Mulberry, involves a revamp Health app and health coach powered by AI that is meant to replicate a real doctor. The Health app would collect data from the users’ devices and the AI coach will use that information to offer tailor-made recommendations on ways to improve health. Apple is working to bring in doctors and exports to create videos for users. The release could come as early as iOS 19.4 which is scheduled for next spring or summer.

- Microsoft: There was more reports, this one coming from Bloomberg, last week that said Microsoft has pulled back data center projects around the world. It said Microsoft has recently halted talks for, or delayed the development of, data center sites in places like Illinois, North Dakota, Wisconsin, and globally like the UK, Indonesia, and Australia. It added it was uncertain if the pullback reflected diminishing demand or temporary construction challenges like power and building materials. Microsoft acknowledged making changes to its plans but declined to discuss details on the projects.

- Rocket Companies: Rocket Companies said it has reached an agreement to acquire home loan originator and servicer Cooper Group in an all-stock transaction for $9.4 billion in equity value, a 37.2% premium to where shares traded prior to the announcement. Cooper shareholders will receive 11 Rocket shares for each Cooper share owned, with Rocket shareholders owning 75% of the combined company and Cooper shareholders owning 25%. This comes less than a month after Rocket Companies said it was acquiring real estate brokerage firm Redfin.

- Tesla: Tesla said it delivered 336,681 vehicles in the first quarter, below the consensus expectation of 377,600 deliveries and well below the 462,890 deliveries from the prior quarter, for the lowest since 2022. It also said it produced 362,615 vehicles in the quarter, adding it lost several weeks of production from changing over the Model Y lines across all four of its factories but the ramp of the New Model Y “continues to go well.”

- TikTok: There have been many reports of the past week that have said several companies are making bids for TikTok. A deal was close on Wednesday that would have ByteDance (the parent company of TikTok) stake in the company being diluted to below 20% so it is no longer controlled by a foreign adversary. Companies rumored to have been involved include Amazon, Oracle, Walmart, and AppLovin. The New York Times later reported ByteDance had been in discussions with the U.S. government to come to a deal but would be “subject to China approval.” The deadline for a deal, or a full ban of TikTok, was April 5 but Trump extended the deadline another 75 days. The latest news from Reuters is a potential deal/spinoff is paused as China signaled it would block any proposal after Trump’s tariff announcement.

- Visa: The Wall Street Journal reported Visa has offered Apple roughly $100 million to take over its credit card network from Mastercard, which is up for grabs as the current bank Goldman Sachs is exiting the consumer lending business. The report says Apple is expected to select the network for the card before it selects the bank to replace Goldman Sachs. Visa offered a similar payment to Costco when the wholesale club was selecting its network about 10 years ago. Others in the mix are American Express, who is trying to become both the issuer and network of the Apple card, while Mastercard is trying to retain its role.

Other News:

- Moody’s Recession Probabilities Rise: Moody’s Chief Economist Mark Zandi said they see a 40% probability the economy slips into a recession this year mostly due to the implementation of tariffs and government job cuts, up from the prior estimate of a 15% probability from January. He added recent economic data, including falling consumer confidence, slower consumer spending, and high inflation, is disconcerting. It is noted this comment was released prior to Trump’s tariff announcement Wednesday.

- OPEC Raising Oil Production Faster: Crude oil saw a 10% decline last week, and the most since July 2022, not only due to recession fears after the tariff announcement but also because OPEC’s decision to increase output quicker than it previously announced. The oil producing group had supply cuts in place for roughly three years before announcing last month it would gradually bring back that supply reduction, which it initially said would be 138,000 barrels per day. It was a big reversal for OPEC, who just as recently as February was discussing delaying the output hike further.

- Tax Bill Proposal: Reports from Bloomberg say Republicans continue to work on the tax bill and are working on increasing the state and local tax (SALT) deduction cap to as high as $25,000, up from $10,000 as House Republicans from swing districts in high tax areas push for the change. The increase would be offset by a reduction in the deduction businesses can claim on state and local taxes. The plan includes extending the 2017 tax cuts and also include some of Trump’s campaign pledges including eliminating taxes on tipped income and overtime pay. Republicans hope to pass the proposal by August. However, over the weekend there are more reports some Republican deficit hawks are concerned that there are insufficient spending cuts in the Senate budget blueprint. Republicans are also discussing potentially adding another tax bracket for those with income over $1 million as another source of higher tax revenue.

- Executive Order on Ticketing:President Trump signed an executive order that pushes to protect fans from “exploitative ticket scalping” and reforming the live entertainment ticketing industry. The order addresses issues like ticket scalping and price gouging by directing federal agencies to enforce existing laws like the BOTS (Better Online Ticket Sales) Act and promote transparency.

- China Limits Investments in U.S.:A report from Bloomberg said China has taken steps to restrict local companies from investing in the U.S., a move that could give China more leverage in potential trade negotiations, citing people familiar with the matter. It said several of China’s agencies have been instructed to hold off on approval for firms that are looking to invest in the U.S.

- Trump/Russia: Trump said he was “pissed off” at Putin after he made comments about replacing Ukraine’s leadership, saying replacing Ukrainian President Zelenskyy would make a potential peace deal more difficult to achieve and adding if he finds out Russia is responsible for delaying a peace/ceasefire agreement he would consider secondary tariffs on Russian oil. The sanctions would include a 25% to 50% tariff on any country buying Russian oil.

- Fed:

- Richmond Fed President Barkin said he thinks part of the flattening of the yield curve is from uncertainty and recession risks, adding policy uncertainty has clouded the outlook which has made it difficult for businesses to make investment decisions. He said the Fed’s policy framework needs a review as the Fed shouldn’t be providing specific rules as to rates but should provide a guide as to how the Fed thinks about policy.

- New York Fed President Williams said current policy is well positioned but Fed has the ability to wait for more data before changing policy. He expects the economy to grow at a slower pace this year but does not see stagflation.

- Fed Chairman Powell made a public appearance Friday afternoon and spoke on the recent tariff announcement, reiterated comments from the Fed meeting and his last speech that the U.S. economy is “in a good place” but he added uncertainty is high and downside risks “have risen” with elevated risks in higher employment and higher inflation. He said the Fed does not need to be in a hurry with changing rates/policy and that it is a good time to step back and wait for greater clarity. He said tariffs were larger than expected and the Fed will watch for impacts on the economy but inflation is going to be moving up.

WFG News

Tax Documents

Please see this release to understand the timing on when to expect tax documents.

Investment 101 Class

Interested in learning more about the basics of investing and how the markets work? Join us in our next Investment 101 class on April 15 at 4:00pm!

This is a great opportunity to learn in a small setting about key financial principals, like risk and return, liquidity, inflation, diversification, growth versus income, time value of money, account types, and how your money can work harder for you!

The Week Ahead

Tariffs and any potential update on negotiations or doubling down will be top of mind for investors and we expect to continue to see very high volatility and potentially violent swings in stocks depending on news flow. While that will be in focus, there is important economic data released Thursday morning with the latest inflation data. The consumer price index is expected to have slowed to a 0.1% increase in March but core prices are expected to see a 0.3% monthly and 3.0% annual increase. Other data includes the producer price index, jobless claims, and the first look at April consumer sentiment. Earnings season kicks off later this week with several big banks and it is a crucial time as we expect companies to mention a lot of uncertainty and either cutting forecasts or foregoing guidance outright. Notable earnings reports this week include Levi, Constellation Brands, Delta Airlines, JP Morgan Chase, Wells Fargo, and Morgan Stanley. On the Fed side, the minutes to the March meeting will be released on Wednesday. The corporate event calendar like conferences is a little quieter this week but Walmart will hold its Investor Day event on Wednesday.