Wentz Weekly Insights

The $4 Trillion Milestone

Stocks had a rocky start to the week last week after headlines that the July 9 tariff date would be delayed to August 1 (and Trump adding he had no plans to extend it beyond that date) and from the announcement of tariff rates for several specific countries. However, stocks ultimately ended only slightly lower as investors may be holding hope that Trump’s recent pattern continues where he escalates the tariffs situation to deescalate.

The big milestone reached last week was the first company to ever reach a $4 trillion market capitalization. The world’s largest company Nvidia surpassed this level Wednesday and gained about $141 billion in market cap for the week, helped by news it is planning to launch a new AI chip specifically for China.

To put this into context, it is larger than the economies of Japan and India. In fact, the only economies larger than Nvidia’s market cap is the United States, China, and Germany. It is larger than the three largest US retailers combined (Amazon, Walmart, and Costco), nearly four times larger than the main US automakers combined (Tesla, Ford, GM, and Stellantis), and larger than all major US restaurant chains combined.

Nvidia has benefited from a shift in market sentiment and a significant market rotation. As Raymond James notes, the market rotation has been a big theme the first several days in July. It notes the 20 best performing stocks from the first half of the year are down 1.55% in July (through July 9) while the 20 worst performing stocks are up 6.67%. At the same time the 100 best performing stocks from the first half of the year are down 0.09% while the 100 worst are now up 4.50% so far in July.

At the same time, volatility has returned to the lowest levels of the year with the VIX (the volatility index) falling to its lowest level since February. The VIX is down about 75% after reaching a high of 60 after the “Liberation Day” tariff announcement in early April. Investors have reached a new level of complacency and are becoming more immune to potential risks.

Outside of tariff news, it was a quiet week with no economic data of note and no notable earnings reports.

It was a little relief for markets knowing the restart of Trump’s reciprocal tariffs will be delayed further to August 1 from the initial July 9th 90 day pause. However, it was offset by Trump’s comments that the August 1 date would not be extended.

It was also offset by Trump’s move to begin sending trade letters to trading partners. In the letters it describes the importance of maintaining a trade relationship and specifically warns if no action is taken, new tariffs will begin August 1 to make “bilateral trade relationships more reciprocal over time.” The country specific tariffs range from 25% to 50% and were sent to countries like South Korea, Japan, Myanmar, Laos, Philippines, and Libya.

As Raymond James notes, the Vietnam deal announced a week and a half ago provides clarity on possible deal parameters including: 1) a 10% floor – while not a ceiling any potential deal will see tariffs no lower than 10%, 2) market access a major theme – more access to other country’s markets, 3) limited for the most part – the deal was less comprehensive and less detailed compared to historical conventional trade deals, and 4) a focus on China – Vietnam’s deal included a feature of higher tariff for transshipments (goods from China that flow through Vietnam to achieve a lower tariff) and the letters sent include higher tariffs for this activity.

Now the markets focus shifts to earnings with earnings releases ramping up the next three weeks. Earnings estimates for Q2 have been revised lower, down over 4% since the end of Q1 (March 31), to an estimated 5.0% growth rate. This would be a step lower from Q1’s 10%+ growth rate. With earnings estimates having moved lower over the course of the year, companies have a lower bar to pass. On the other hand, tariff uncertainty may lead to more volatility in forward guidance and may offset any strength from Q2.

The other focus will be the consumer price index release on Tuesday and retail sales on Thursday. The CPI (consumer price index) is expected to have accelerated in June so it will be interesting to hear the Fed’s reaction and thoughts to the new data. Meanwhile after a weak May, retail sales are expected to have remained somewhat weak with a small gain in June, which will be important to follow for signs of consumer weakness.

Week in Review:

Stocks were lower across the board last week, driven mostly from a small selloff Monday, though they were down about 1% or less. The four major US indices finished as follows: Nasdaq -0.08%, S&P 500 -0.31%, Russell 2000 -0.63%, and Dow -1.02%. Volatility was muted with the volatility index (VIX) relatively unchanged after falling to the lowest level since February. The Treasury markets saw less volatility as well with the 2-year Treasury yield up 2 basis points to 3.91% while the 10-year yield rose 6 basis points to 4.41%. The dollar index increased 0.69% while gold was up 0.71%. Bitcoin rose 8.77% to new record highs. Meanwhile, commodities were higher including a 2.93% gain for oil despite OPEC production increases.

Recent Economic Data

- Jobless Claims: The number of unemployment claims the week ended July 5 was 227,000, down 5,000 from the prior week, with the four-week average down about 6,000 to 235,500. The number of continuing claims increased 10,000 to 1.965 million, the highest since late 2021. The four-week average rose slightly to 1.955 million.

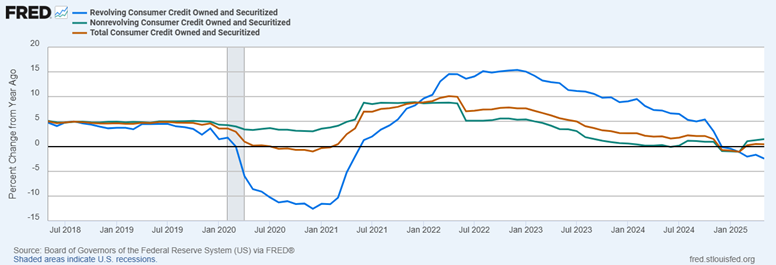

- Consumer Credit: US consumers added $5.1 billion in credit in the month of May, slowing from the $16.9 billion increase in April to bring total consumer borrowing at $5.05 trillion. Revolving credit decreased $3.5 billion while nonrevolving credit increased $8.6 billion (both seasonally adjusted, if non-seasonally adjusted revolving credit increased). Consumer credit is up $20.8 billion over the past year, or 0.4%, slowing dramatically over the past several years. The chart below shows the year-over-year change in total consumer credit (orange line), which includes revolving credit (blue line) and nonrevolving credit (green line). As you see credit balances fell significantly during the pandemic due to the shutdowns and stimulus payments (consumers paying off debt), then increased significantly as the economy roared during the reopening and consumers started spending again, now has shown recently weakness and has declined several of the past 12 months

Company News

- TikTok: The Information reported TikTok is developing a separate version of its app specifically for the US market in a move to prepare for the possible sale to an American company/investor. The report says the new app is expected to be available September 5 while the old app would be discontinued March 2026. It was last week Trump said talks with China about TikTok and a potential sale would resume and indicated an agreement is close. It was later reported by Reuters that TikTok is working to develop the app with its own separate algorithm and codebase.

- Exxon Mobil: Exxon Mobil gave a warning on Q2 profits saying lower oil and gas prices could reduce its Q2 earnings by around $1.5 billion compared to the prior quarter. However, it said better refining margins would offset a portion of that.

- CoreWeave: Artificial intelligence cloud infrastructure provider CoreWeave said it agreed to acquire competitor Core Scientific (a data center infrastructure operator) in an all-stock deal that values the company at $9 billion. Under the agreement, Core Scientific shareholders will receive 0.1235 newly issued shares of CoreWeave for each share of Core Scientific owned. It is expected Core Scientific shareholders will own about 10% of the combined companies.

- SoFi: SoFi shares were about 9% higher at one point last Tuesday after it said it was partnering with several asset managers, like Cashmere, Fundraise, and Liberty Street Advisors, to offer retail investors access to heavily sought after private-market funds. SoFi lowered the minimum investment to $10, down from its previous $25,000 requirement, making investments in private equity open to almost everyone.

- SpaceX: SpaceX is looking to raise funds and a deal could value the company at around $400 billion, according to Bloomberg. The most recent share sale was December last year when the company was valued around $350 billion. The higher valuation reflects the high growth of the Star link satellite unit and higher confidence in the Starship rocket program.

- Kellogg: Ferrero, the privately owned Italian candy company that includes brands like Nutella and Tic-Tac, has agreed to acquire the cereal brand WK Kellogg for $23 per share in cash, or approximately $3.1 billion. This represents about a 36% premium to where shares traded the day prior to the news breaking of a potential deal.

- MP Materials: The US government announced plans to take a large stake in rare earth mineral miner MP Materials in effort to help the company accelerate the output of rare earths. It will make the Department of Defense the largest shareholder in the company and guarantees a floor for rare earth mineral prices of about twice the market price of Chinese imports.

Other News:

- FOMC Meeting Minutes: Fed officials are becoming increasingly divided, as has been seen from recent public comments as well as the FOMC meeting minutes that were released last week from the Fed’s June meeting. The minutes revealed all Fed officials saw it appropriate to hold rates in June, but some said they would be open to rate cuts as early as the next meeting in July (something that was already known), while others see no rate cuts at all this year. There remain mixed opinions on tariffs and the impact to inflation with some seeing it taking time for tariffs to cause an increase in prices. The consensus thought on the labor market is it has diminished but remains elevated.

- Trade/Tariffs:

- Trump said before last week’s opening, most countries will have their tariffs set by July 9, either in the way of a letter sent to them or via a deal, and if they see higher tariffs they will start August 1. He said there are over 170 countries so the US would send letters out probably 10 at a time and tariffs would range 10% to 70%. He confirmed later in the week tariffs will begin August 1 and “no extensions will be granted.”

- Trump said in a social media post Monday that he issued letters to South Korea and Japan that they will see tariffs of 25% which will be separate from the sectoral and retaliatory tariffs already in place. He added if the countries retaliate, he will increase the US tariff by the same amount. He also sent a letter to 12 other nations with the highest tariff at 40% (for Myanmar and Laos). The second round of letters went to 7 countries (including Philippines, Libya, and Moldova) with tariffs ranging from 20% to 30%.

- China issues a warning to the US against reinstating tariffs on its exports and threatened to retaliate against countries that make deals with the US that exclude China from their supply chains.

- Trump said in a cabinet meeting Tuesday afternoon the US will implement a 50% tariff on all copper imports. As a result, copper future contracts rose over 13% to new all-time highs, for the largest single-day increase going back to when records started in 1968, according to Dow Jones Market Data. Copper futures are up around 40% year-to-date.

- Trump said his Administration will be announcing something “very soon about pharmaceuticals… we’ll tariff them at a very high rate, around 200%.” He added the tariffs would not be immediate, “we’re going to give people about a year, a year and a half, to come in and after that, they’re going to be tariffed.”

- Trump sent a letter to Canada and posted on Truth Social that Canadian imports will see a 35% tariff and said the US is ready to increase the tariff rate more if Canada retaliates. The tariff rate is higher than the 25% rate that was previously in place. Some goods are excluded under the United States Mexico Canada Agreement (USMCA).

- Bloomberg reported Vietnam was taken back and was caught off guard by Trump’s announcement of a trade agreement that the tariff rate was 20%. The report adds Vietnam believed the tariff rate was lower and is still negotiating to bring the rate lower.

The Week Ahead

$4 Trillion Club: Last week chip maker Nvidia became the first to close above a $4 trillion market capitalization. It recently surpassed Microsoft and Apple again to become the world’s most valuable company. The first chart below shows the market cap of the three largest companies over the past three years (Nvidia in green, Microsoft in blue, Apple in grey). Three years ago Nvidia’s market cap was less than $400 billion. Shares are up over 21% this year, outperforming the S&P 500’s 6% return, after growing 239% in 2023 and 171% in 2024, and is up a combined 1,000%. To put the market cap in perspective, as Raymond James notes in the second chart below, NVIDIA’s market cap now exceeds five S&P 500 sectors: Consumer Staples, Energy, Materials, Real Estate, and Utilities.