Wentz Weekly Insights

“The Time Has Come”

For Rate Cuts

US stocks had another solid week with the S&P 500 rising 1.45% and narrowly missed on a new all-time closing high. Treasury yields are back near the lowest level since the beginning of August, over the expectation for future rate cuts, and if they drop below that it would be the lowest since July 2023. It was more of a quiet week, with earnings season slowing down considerably and a lack of economic data. But the main event for the week happened on Friday with the highly anticipated speech by Fed Chairman Jerome Powell at the Jackson Hole Economic Symposium.

Following his speech, stocks took another move higher and bond yields fell across the curve. What’s better for markets and investors is market breadth has improved – over 70% of stocks in the S&P 500 are trading at levels above their 50-day moving average, versus less than 45% just three weeks ago. Even more, the equally weighted S&P 500 is at new highs and outperformed the cap-weighted S&P 500 for the week.

As we have written and talked about so much recently, the ‘Magnificent 7’ stocks (which include Apple, Microsoft, Nvidia, Amazon, Alphabet, Meta, and Tesla) have driven much of the market’s performance over the past 20 months. In fact, as of the end of last month, those seven companies now make up a 31.1% weight in the S&P 500 (which is comprised of, you guessed it – 500 companies). Their combined performance since the beginning of 2023 is 127.5%, while the S&P 500 performance is 43.8%. The S&P 500 performance excluding these seven names is just 24.0% over the same period.

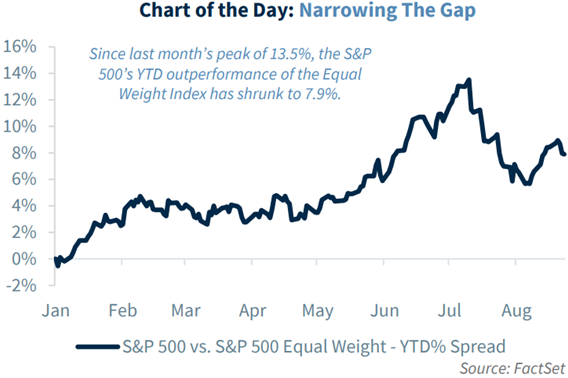

A broadening out in stocks is just what is needed after the narrowness we have seen in markets the past 20 months. This caused the outperformed of the S&P 500 over the equally weighted index to shrink to 7.9% from 13.5% just last month, as seen in the chart below from Raymond James.

The broader performance is most likely from the Fed indicating it is ready to take a less restrictive approach to monetary policy with the beginning of rate cuts at the Fed’s next meeting in September now all but certain. This was the takeaway from last week’s central bank event in Jackson Hole. Leading up to the keynote speech by Chairman Powell on Friday was many other remarks by regional Fed presidents, where comments were mostly mixed but the number of policymakers supporting 2024 rate cuts now higher now than just a month ago.

A common theme was the belief the economy remains strong, consumer remains resilient, jobs market is slowing but still solid, and inflation is gradually coming down to the Fed’s target. Several officials suggested it is now time for the Fed to focus on the employment side of its dual mandate (which includes stable inflation and maximum employment) since there is more confidence inflation is better controlled.

Then on Friday Powell told the public “The time has come for policy to adjust,” paving the way for the rate cut cycle to begin in September. Powell added the Fed does not see the labor market as a source of inflationary pressures and as a results does “not seek or welcome further cooling in labor market conditions” as it had since it began raising interest rates. As has been the case during every speech, Powell reiterated the timing and pace of rate cuts will depend on incoming data, its outlook, and the balance of risks (between inflation and employment).

All this came despite the Bureau of Labor Statistics saying payroll growth over the last 12 months was overstated by 819,000 for the largest revision since 2009. The BLS releases revisions every year based on more comprehensive data such as states’ unemployment benefits. Analysts were expecting a downward revision, but only somewhere around 400,000. Markets did not react much even though it was a quiet day elsewhere Wednesday.

With odds of rate cuts at 100% based on interest rate futures, according to the CME FedWatch Tool, markets will shift their focus back to Nvidia and AI this week. We are at the tail end of Q2 earnings season but will get one of the most important company reports this week with Nvidia after the close on Wednesday. Valuations are high and expectations are high so investors will be hoping for another beat and raise (guidance) quarter. Outside of that, it will be another quiet week with several smaller economic data releases. Trading volume this week is historically the second lowest volume week of the year.

Recent Economic Data

-

The number of existing home sales in July grew 1.3% to a seasonally adjusted annual rate of 3.950 million homes, snapping a four month streak of declines and coming off the lowest level since the large drop during the pandemic. Compared to last year, the pace of existing home sales are down 2.5%. The median price of an existing home sold was $422,600, rising 4.2% over the past year. The reason for the price increases despite the lack of sales is due to the lack of available homes for sale. The inventory of unsold homes was at 1.33 million, equivalent to 4.0 months’ supply. Existing home sales are measured by closings, so this represents homes that went under contract in June, just before rates saw the bigger move lower. With rates continuing to move lower in July, we hope to see sales increase again which would provide another boost to the economy. Outside of one month in 2023, this is the best sales pace since March 2022.

-

New homes sales beat the expectation by a wide margin, with the number of new home sales rising 10.6% in July for the largest monthly increase in two years to a seasonally adjusted annual rate of 739,000, 5.6% above the level from a year earlier. The median sales price was $429,800, up 3.1% in the month but down 1.4% from a year ago. The number sold was spread pretty evenly across homes where construction was not started yet, homes that were under construction, and homes that were completed.

-

The number of jobless claims the week ended August 17 was 232,000, an increase of 4k from the prior week, with the four-week average relatively unchanged at 236,000. The number of continuing claims was 1.863 million, up 4k from the prior week for another new 3 year high. The four-week average in continuing claims increased 5k to 1.866 million.

-

The Bureau of Labor Statistics released benchmark revisions to the last 12 months of payroll data (relating to the monthly employment data). With the lack of data last week and the higher focus on employment lately, this received an unusual amount of attention. The preliminary revisions (final revisions come out next March) show a downward revision of 818,000 payrolls over the 12 month period, meaning instead of 250k payroll gains per month, it was around 183k. The Bureau of Labor Statistics releases revisions based on a variety of reasons, including looking at more business records, unemployment benefits, and the birth/death model form businesses. The estimates were broad and were for a downward revision between 350,000 and 1,100,000. This was the largest downward revision since 2009.

Company News

-

AMD agreed to acquire ZT Systems, an AI infrastructure company, in a deal worth about $4.9 billion. AMD is making the purchase to add a hyperscale GPU rack systems designer and manufacturer, taking direct aim at Nvidia, and aims to take more from the AI data center market.

-

Shares of Netflix reached new all-time highs last week, receiving a boost after it said in a blog post that its upfront advertising commitments increased 150% over the past year. Ad commitments include spots for a broad range of businesses from technology, entertainment, to consumer products, retail and restaurants. The head of advertising at Netflix said the ad commitments were in line with the company’s expectations.

-

Ford said it is changing its EV strategy and will delay the production of a next gen all EV pickup truck and cancel plans for a three row all electric SUV. It will instead focus on developing hybrid and electric commercial vehicles. As a result it will take a $400 million write down of manufacturing assets, including cancelling the three row EV SUV.

Other News:

-

Powell/Jackson Hole review

-

Fed Governor Michelle Bowman gave a more cautious stance on rate cuts in prepared remarks last week. She citing the upside risks to inflation and discrepancies in recent jobs data, adding the recent increase in the unemployment rate could be exaggerated due to the recent strength of job gains over the past couple years being overstated. Due to “increased measurement challenges and the frequency and extent of data revisions” she prefers to remain cautious.

-

Kansas City Fed President Schmid leaned a bit more hawkish, saying he needs more data before making a final decision on if he would support rate cuts, citing the strong labor market.

Boston’s Collins said the job market remains healthy, adding that the consumer is resilient and sees no red flags in the consumer or within consumer spending. This, with inflation continuing come down, provides her for reasoning that rate cuts will soon be appropriate.

Philly Fed President Harker said he is ready for the Fed to begin cutting rates in September, but noted any rate cuts at this point need to be gradual and rate cuts will take time.

-

-

The Harris campaign said if she wins the election, she will propose to increase the corporate tax rate back to 28% (from the current 21%) with the campaign saying it would be a “fiscally responsible way to put money back in the pockets of working people and ensure billionaires and big corporations pay their fair share.” This is likely one of her ways to help pay for the other proposals like expanded child tax credit, $25k credits for homebuyers, forgiving medical debt, etc. Trump cut the corporate tax rate from 35% to 21% during his presidency.

-

The Robert Kennedy jr. campaign, running as an independent party, was considering dropping out of the race for the White House and will endorse Donald Trump, according to his running mate Nicole Shanahan in an interview, and made that decision official on Friday. The alternative to running was staying in the race to try to win more than 5% of the popular vote and establish themselves as a third party alternative to Republicans/Democrats to build on ballot access for 2028.

-

After a 2.5 hour meeting, US Secretary of State Andrew Blinken said that Israel PM Netanyahu had accepted a proposal for a ceasefire deal in Gaza, based on US proposals to bridge the gaps on differences between the wants to Israel and Hamas, and it is now in the hands of Hamas to accept the deal.

Did You Know…?

The Investment In Data Centers:

According to CBRE Research Group, a global real estate and investment firm, the amount of data center supply under construction in North America is 69% higher compared to a year ago, to a record 3.9 gigawatts. The figure would be higher if it was not for a shortage of the available power and longer lead times for electrical infrastructure, according to the report. The substantial increase is attributed to the rush of investment in data centers mainly some of the largest tech players to advance their artificial intelligence offerings, as well as the continued investment by cloud providers. Data centers are basically computer warehouses that house the chips that power AI. They are measured mostly by the amount of power that they consume. Supply has increased 10%, or 515 megawatts, in the first half of 2024, and 24%, or 1,100.5 megawatts, over the past 12 months. The Northern Virginia market holds the most data center inventory with 2,611 megawatts, followed by Dallas-Fort Worth with 591 megawatts. At the same time, Phoenix and Northern Virginia markets carry the highest rental rates.

The Week Ahead

Volume is expected to be pretty low this week with data showing it is historically the second lowest volume traded week of the year. The most anticipating event for investors will be Nvidia’s earnings report this week, which will be released after market’s close on Wednesday and has the potential to move many other tech/semi stocks, and even the market as a whole. Expectations, and valuation, is high, so investors are hoping for another quarter of strong growth and increased guidance. Other notable companies reporting quarterly earnings come from more retailers and tech including PVH, Dollar General, Gap, Lululemon, Ulta Beauty, Best Buy, Salesforce, CrowdStrike, HP, Okta, Dell, Marvell Technology, and Autodesk. The big release on the economic calendar is the personal income and outlays report Friday morning that will include data on income, consumer spending, and the Fed’s preferred measure on inflation. Other data releases include money supply, durable goods orders, Case Shiller home price index, the second revision on second quarter GDP, jobless claims, consumer confidence, and consumer sentiment. Fed activity quiets down after a busy week last week, as well as on the political front