Wentz Weekly Insights

Time to “Recalibrate” Policy – Rate Cuts Start with More Aggressive 50 bps Cut

Thank you for reading our weekly newsletter! Please note we will be taking the next two weeks off and will be back with the weekly newsletter October 14. Our offices will be open as normal, please reach out if anything comes up. Thank you!

Recalibration and normalization. Those were the words the markets and most investors took out of the Federal Reserve policy setting committee meeting that ended last Wednesday. After the end of the two-day meeting, the Fed chose to cut interest rates by 50 basis points, equal to half a percent, bringing their new target range for short-term interest rates to 4.75% to 5.00%. This was enough to send stocks higher for the week with the S&P 500 and Dow reaching new all-time highs, rising 1.36% and 1.62%, respectively.

Going into the meeting, markets were split on whether the Fed would cut interest rates by a quarter of one percent of half a percent, the odds of which have fluctuated back and forth the past two months based on what economic data was released that day. The most impactful data on these odds was the labor market report of the past two months, as well as the annual revision to job gains. Job gains have been very strong since the pandemic lockdowns ended. However, recent months have shown a faster slowdown in job gains than anticipated.

In fact, if the Fed received the July labor report prior to its meeting on July 31, we believe the Fed would have cut rates in its July meeting, as Powell had hinted in the Fed’s post-meeting press conference. Instead, after receiving data on July and then August that showed less jobs added than expected, not to mention the annual revision that concluded the Labor Department overstated job gains by 818,000 since last year, the Fed chose to cut rates 50 basis points to “catch up”.

The reason for the bigger move was due to the central bank’s shifting focus on the softening labor market, a major swing from its focus the past three years of the highest level of inflation in over 40 years. A 50 basis point move was to try to front load rate cuts to get ahead of the curve and ahead of any further potential weakening of the labor market.

Much of Powell’s answers in his press conference dialed in on the fact the Fed wants to “recalibrate” policy away from where it was the past year, from a level that was appropriate when inflation was high and labor market was tight, to a level more appropriate to where things are now and where the Fed expects them to be; where inflation is moving lower and unemployment is increasing.

But perhaps one of the more important comments for investors was when Powell said “I don’t see anything right now to suggest that the risk of a downturn is elevated.” This most likely sparked the rally in stocks and revived the optimistic view of a “soft landing” (where the economy continues to grow as inflation moves lower).

After all, if inflation is coming down, the labor market is normalizing, and growth remains positive, company’s profits should continue to increase, which will continue to drive stocks higher. However the main worry is the jobs market is weakening faster, and less jobs means less spending which means less profits.

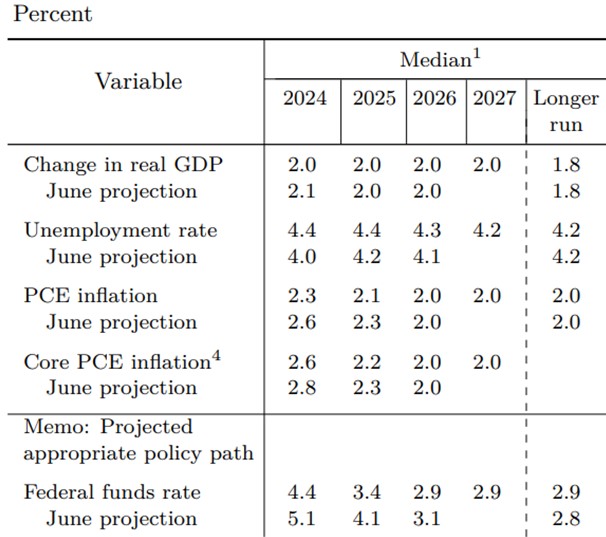

Reinforcing this view was the Summary of Economic Projections (SEPs). The Fed releases this every other meeting, or once per quarter, which provides the public a view of where every policymaker sees things such as interest rates, economic growth, inflation, and unemployment over the medium term. The chart below shows the latest projections from the FOMC. The average official sees economic growth at 2.0% this year and over the next three years despite an uptick in unemployment, a welcoming projection for markets. As Powell said, “You see growth at a solid rate, you see inflation coming down, and you see a labor market that is still at very solid levels.”

Source: FOMC

It was unusual that the Fed chose to cut rates this meeting given where we are in the year – the Fed rarely will make policy action in an election year, let alone seven weeks prior to election day. It may just be the Fed is nervous of a slowing economy and wants to avoid a hard landing as much as possible.

We will continue to focus on the labor market data over the next several months, and we believe the Fed, and especially the markets, will be super focused on new data releases similar to the way it was to inflation data the past two years. Payroll data is important but jobless claims is something to follow as well as it is more of a leading indicator.

Moving into this week, it will be quieter with a light earnings and economic calendar. The Fed is out of blackout period so we expect to hear more insight on policy from several policymakers, with Micron the main focus on the earnings calendar, and the personal income and outlays report on the economic calendar that includes the PCE price index, the Fed’s preferred inflation reading.

Week in Review:

It was another strong week for US stocks, one in which the S&P 500 and Dow hit new all-time highs. The major indices finished as follows: Russell 2000 +2.08%, Dow +1.62%, Nasdaq +1.49%, and S&P 500 +1.36%. Despite the Fed reducing interest rates, Treasury yields rose along the curve except the very short end – the 2-year Treasury yield rose 5 basis points to 3.61% while the 10-year Treasury yield increased 8 basis points to 3.74%. Gold also hit a new high with a 1.4% increase for the week while the dollar fell 0.4%. Oil saw the second straight weekly gain of 3.4% after several weeks of declines.

Recent Economic Data

-

Monthly retail sales of $710.8 billion posted a surprise gain of 0.1% in August, versus the expected 0.3% decline and comes after a very strong July when sales rose 1.1%. Of the 13 major retail categories, only six of them saw an increase in the month. Vehicle sales fell 0.1% and gasoline sales fell 1.2%, excluding these two larger spending categories, sales rose 0.2%. Other categories with a decline were grocery, electronic, and furniture stores. Gains were seen in miscellaneous stores, online sales, and sporting goods. Compared to a year ago retail sales are up 2.1%, but are declining if accounting for inflation.

-

The Empire State Manufacturing index was 11.5 for September, much better than -3.9 expected and -4.7 prior, both of which are considered contraction territory (below zero). The report noted growth in activity for the first time in almost a year and was the fastest pace of growth since April 2022, according to the index level. New orders, shipments and delivery times all expanded but employment continued to decline with the pace of price increases little changed.

-

The Philly Fed manufacturing index was 1.7, up from a -7.0 from August and roughly in line with expectations, and somewhat matches the small growth that was seen in the Empire State survey/index. The survey responses from this noted mixed activity overall, while the general activity index was slightly position (barely above zero), new orders and shipments turned negative. About 22% of firms reported increases in general activity, 20% reported decreases, and 51% reported no change. Meanwhile the prices indexes moved higher, continuing to indicate an overall increase in prices.

-

The housing market index, a measure of homebuilder sentiment, moved back up to 41 where it was two months ago after falling to 39 last month for the lowest since December, breaking a four month declining streak. The index for present sales was 45, up from 44, the index for sales over the next six months was 53, up from 49, while the index for traffic of perspective buyers was 27, up from 25. While these all moved higher in September, most likely due to lower rates and optimism that will help the market, the sentiment is still quiet depressed, near the lowest since late last year.

-

The number of housing starts was at a seasonally adjusted annual rate of 1.356 million in August, up 9.6% from July and up 3.9% from a year ago level. the number of building permits for a new home were 1.475 million, up 4.9% from July but 6.5% below the level from a year ago. Markets, and potential home buyers, would love to see these numbers move higher due to the extremely low level of supply. The number of homes authorized but not yet started has moved higher over the last year, at 285k now, up from 267k when the year started.

-

Existing home sales for August had a surprise decline of 2.5% with the annualized sales rate at 3.860 million homes. Existing home sales have declined 4.2% from a year ago and remain near the lowest sales pace since 2010, shortly after the housing crisis. Existing sales represent contracts that have closed, so these sales numbers reflect houses that went under contract most of July and that is right before mortgage rates saw the big move lower. There is a wide belief sales will pick up over the next several months due to much lower mortgage rates and improved inventory. The supply of existing homes, which has been a major issue since the pandemic, was up 0.7% in July and up 22.7% from a year ago to 1.350 million units. On the other hand, prices are strong with the median existing home price up 3% to $416,700. The median price is up 60% from pre-pandemic levels.

-

The average prime 30 year mortgage rate was 6.09% last week, according to the Freddie Mac survey. This is another 11 basis point decline from the week prior, with mortgage rates down from the summer peak of 7.22% in May and down about 70 basis points in just seven weeks for the lowest since September 2022.

-

The number of unemployment claims was 219,000 for the week ended September 14, down 12k from the prior week. The four-week average was 227,500, down 4k from the prior week. The number of continuing claims dropped 14k from the prior week to 1.829 million with the four-week average down 7k to 1.844 million.

Company News

-

Apple fell early last week after analysts noted delivery times for the new iPhone 16 models indicated weaker demand than expected. Data from Bank of America Research, and reported by Reuters, showed shipping times were 14 days for the iPhone 16 Pro versus 24 days for the iPhone 15 Pro last year. The demand issues could be stemming from the delayed rollout of many of Apple’s artificial intelligence features. Alternatively, some analysts pointed out the shorter shipping times could be due to better supply versus last year’s iPhone 15 that ran into supply issues.

-

After recently announcing it will explore options in effort to turn around its business, Intel said it plans establish Intel Foundry (which produces the chips) to an independent subsidiary of Intel. It will also pause plant construction plans in Germany and Poland to save costs. In addition, it agreed to a deal with Amazon to manufacture its custom made chips for its artificial intelligence as well as extending it partnership to manufacture its custom processing chips for its Amazon Web Services. Separately, it was reported it has received a $3.5 billion grant from the US government to make chips for the military.

-

Chipmaker Qualcomm reportedly approached Intel to talk about a possible acquisition of all or part of the company. Initial analysis has said an acquisition would result in a setback to Qualcomm’s gross margins, profits, and cash flow, however reduce its reliance on Taiwan Semiconductor for fabrication.

-

Tupperware is preparing to file for bankruptcy at any time, according to Bloomberg. It adds that its preparations for bankruptcy come after long negotiations with lenders over how to manage its more than $700 million in debt with lenders agreeing to give the company breathing room after it violated loan terms, but its financials continue to deteriorate.

-

Bloomberg reported the proposed Nippon Steel deal to acquire US Steel is getting an extension on the national security review that will push the review deadline past the presidential election.

-

Darden Restaurants, owner of brands like Oliva Garden and Longhorn Steakhouse, announced it and Uber reached a multi-year delivery partnership. Darden will begin with a pilot at a select number of Olive Garden locations where customers and order through its app, with Uber integrated in the app, and Uber will deliver the order.

-

Nike shares rose late last week after announcing Elliott Hill, who held a Nike senior leadership position for a long time including President and head of marketing operations, will return as its CEO next month, replacing John Donahoe after he announced his retirement. This was viewed as positive after Nike has dealt with falling sales and a lack of a strategy recently. Early reports say Hill will focus on rebuilding the company’s culture and reviving relationships with retails in attempt to boost sales.

Other News:

- Central Bank headlines – After this past week, of the 33 major central banks around the world, 60% of them are now in a rate cutting cycle, according to Raymond James, coming not long after a large majority were in a rate hike cycle in effort to control inflation. This is the highest number of central banks cutting rates in a non-recessionary environment since 2015.

- The Bank of England said this morning it was keeping rates unchanged in an 8-1 vote, with one policymaker voting to cut rates. The policy committee said it wants to continue taking a gradual approach to removing/reducing policy restraint.

- The Norges Bank (of Norway) voted to keep its policy rate unchanged at 4.5%. It is expected the interest rate will remain unchanged for the remainder of the year. It has been dealing with a weak currency, the krone, which has made it more difficult to bring inflation down.

- The Bank of Japan kept its key interest rates unchanged at 0.25% as expected, after raising them for the first time in July. Its policy statement was short with no forward guidance although there is a wide expectation it will maintain an upward bias to raising interest rates.

- The People’s Bank of China kept its rates unchanged which have been at current levels since July when it cut them to provide support/stimulus to its economy. There has been increasing expectations for more cuts amid China’s slowing growth, but stimulus may come from other government actions.

- Hong Kong’s central bank cut its policy rate 50 basis points to 5.25%. It policy moves in tandem with the Federal Reserve as its currency is pegged to the dollar.

WFG News & Events

Your Money, Your Vote

Join us as we discuss the 2024 Election and take a deeper dive into each of the Presidential Candidates’ campaigns. We will have a specific focus on the economy. All information provided will be obtained directly from each candidates’ platforms.

Please RSVP as soon as possible as seats will fill quickly!

We have three sessions to choose from:

Hudson Office – October 22 @ 6:00pm

Hudson Office – October 29 @ 12:00pm

Ravenna Office (Basement Hall) – October 30 @ 12:00pm

The Week Ahead

This week will be more quiet than the past several. The most notable will be the number of Fed policymakers speaking this week. Markets will look for any hints of future policy moves and the pace of rate cuts going forward. This most anticipated speech will come from Chairman Powell on Thursday where he delivers opening remarks to the US Treasury Market Conference. The only data releases on the economic calendar include the Case Shiller home price index, new home sales, durable goods orders, jobless claims, consumer confidence, consumer sentiment, and the personal income and outlays report. This includes data on the PCE price index, which is the inflation reading the Fed puts most weight on. The index is expected to have increased 0.1% with the core index up 0.2% and 2.7% from a year ago, rising from 2.6% annual gain in July. Earnings are light with the only notable quarterly results coming from AutoZone, Costco Wholesale, KB Home, and Micron.