Wentz Weekly Insights

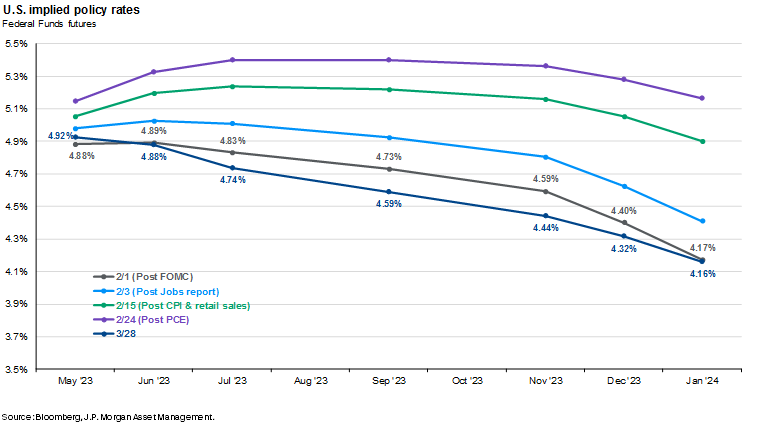

U.S. Implied Interest Rates

This week we want to show a chart that displays how the market’s expectations on interest rates have changed since the recent banking developments. The chart below shows the implied federal funds rate, based on futures contracts traded in the market. It shows the markets expectations on where interest rates will be at certain points in the future.

Recent Economic Data

- The Case Shiller Home price index shows home prices declined 0.2% in January (data lags by a month) on a seasonally adjusted basis (declined 0.5% non-seasonally adjusted), for the seventh consecutive monthly decline in home prices, after record increases in 2021-2022. Home prices are now down 5.1% from the peak in June 2022. Only one out of the 20 cities reported an increase in prices – Miami with a small 0.1% increase. Over the last 12 months, home prices are up 3.8%, down from the 12 month increase of 5.6% in December and down from the record high 12 month increase of 20.6% in March 2022. West coast cities are experiencing declining home prices over the past 12 months (Seattle, San Francisco, San Diego) while Southeast is experiencing the highest increase, with Miami prices up 13.8%, Tampa up 10.5%, and Atlanta up 8.4%. Cleveland area prices still in the middle of the pack, up 4.8% y/y.

- The Conference Board’s Consumer Confidence index was 104.2, increasing slightly from 103.4 last month, based on a survey on consumers which ended March 20. The present situations index fell to 151.1, from 153.0 while the expectations index increased slightly to 73.0 from 70.4, which is the second best reading of the past 12 months. However, the expectations index is still below 80, which often signals a recession within the next year. Expectations on inflation remain elevated, at 6.3%.

- The money supply fell 0.6% in February, a pretty large monthly decline, and is now down 2.4% from a year ago, the largest 12 month decline on record. Of course, this follows the record 40%+ increase in the money supply since the pandemic started. The drop in money supply is a welcoming sign on fighting high inflation, but the system is still working through the large 40% increase.

- The number of unemployment claims filed for the week ended March 25 was 198,000, an increase of 7k from the prior week with the four-week average at 198,000. The number of continuing claims was 1.689 million, up just 4k from the prior week and the four-week average was 1.692 million, up 10k from the prior week. Relatively unchanged from the past several weeks and remain near very low levels.

- The final revision on GDP shows growth was a bit lower in the fourth quarter than expected, with GDP increasing 2.6% in the quarter, annualized, compared to 2.7% growth in the prior two estimates. The small downward revision was due to downward revisions to exports and consumer spending.

- Monthly report on income and consumer spending:

- American’s income and spending rose as expected in February and inflation, as measured by the Fed’s preferred index, rose at a slightly slower pace than expected.

- Personal income rose 0.3% in the month and is up 7.0% from a year earlier. Finally, real income growth is positive – after adjusting for the 6.0% inflation rate income is up 1.0% over the last 12 months. The important wages and salaries category increased 0.3% in the month and is up 6.9% over the last 12 months. After adjusting for taxes, disposable personal income increased 0.5% in the month and up 7.3% from a year earlier.

- Consumer spending increased 0.2% in the month, as expected, and is up 9.2% from a year earlier. This number has improved, especially after adjusting for inflation, spending is up 3.2%, but we would expect that to continue through the year. Spending on goods was unchanged in the month and up 5.0% from a year ago, while spending on services rose 0.2% in the month and 10.3% from a year ago.

- The personal consumption expenditures price index rose 0.3% in February, against the 0.4% expectation, while the core index rose 0.3%, also against the 0.4% expectation. From a year earlier, the index is up 5.0%, slowing from 5.3% in January and the core index is up 4.6% over the last 12 months, down from the 4.7% rate in January.

Company News

- Alibaba announced it plans to reorganize the company into six business units to allow each to operate with more autonomy; Cloud, e-commerce, its Cainiao logistics, local services group (like meal delivery), global digital business, and digital media and entertainment. The company said each business group will have the flexibility to raise capital and seek its own IPO, except Taobao which will remain part of Alibaba group.

- Apple said it will roll out “Apple Pay Later,” a buy now pay later service that would allow users to split purchases into four payments spread over six weeks. Purchases can be between $50 and $1,000 and can be used on in-app purchases or where merchants that accept Apple Pay. Users would be able to manage, track, and repay the loans in their Apple Wallet. Apple says the payments will have no interest and no fees. Users will need to apply for the loan and it will not affect credit scores, but Apple said a soft credit pull will occur to be sure the user is in good financial position.

- Reports from Bloomberg say Netflix will restructure its film production group, begin cutting jobs in the division, and scale back the number of films it produces each year. The goal is to reduce its overall spending and focus on higher quality films. In addition, two executives that oversee the documentaries and the whole film group are both leaving the company after over a decade.

- JD.com stock moved higher after it said it intends to spin-off JD property and JD Industrial businesses via a separate listing on the Hong Kong exchange, with the company continuing to indirectly hold over 50% of the shares in JD Property and therefore remaining a subsidiary of JD.com.

- Roku was the latest tech company to announce a round of layoffs and restructuring of its business. It said it will remove about 200 positions, or 6% of its workforce and restructure its business to reduce operating expenses and prioritize projects, focusing more on those with higher return on investments.

- WWE and UFC parent company Endeavor announced they will combine to form a new global sports and entertainment company. The deal values WWE at about $106 per share, about a 16% premium to the price prior to the announcement, or a market cap of approximately $9.3 billion. The combined company will be worth roughly $21.4 billion. The companies expect to generate $50 to $100 million in cost synergies.

Other News

- Vice Chair for supervision Michael Barr testified to Congress last week on the banking crisis and in his prepared remarks said Silicon Valley Bank’s failure is a direct result of the bank’s mismanagement, more specifically its management of its holdings of longer-term securities and failure to develop interest rate risk measurement tools, models, and metrics, as well as its deposits being highly concentrated (to venture capital firms). He added that the events show there is a need for ongoing review of the banking system regulation and supervision.

- There has not been much progress on the debt ceiling debate out of Congress as of late, but a recent Bloomberg article said Republicans are demanding legislation that would ease energy permits to gain their support on raising the debt ceiling.

- Flows into money market funds have been in focus lately as consumers shift cash from deposits at banks, after concerns arose after two high profile bank failures, to money market funds to achieve higher interest rates on their cash. The latest data on flows shows last week saw the 17th largest inflow into money market funds with $61.5 billion flowing into the space, after seeing $115 billion in inflows the week prior and $108 billion in the week prior to that.

- The oil cartel OPEC+ met over the weekend and said it would cut oil production 1 million barrels per day, coming after assuring markets it would keep production unchanged. Crude oil moved over 6% higher after the announcement and will be sure to complicate the Fed’s view and fight against inflation. It comes at a time where the oil markets still appears to be undersupplied, despite crude oil falling from near $100/barrel as recent as August, to a recent low of $62/barrel – the lowest since the end of 2021, prior to Russia invading Ukraine. The expectation was building that the U.S. and global economy would fall into a recession, with demand shrinking and the markets becoming too oversupplied, bringing prices lower. However, it appears OPEC+ wants prices to be higher or is preparing for a demand slowdown. Meanwhile, a spike in energy prices will complicate the Fed’s goal of bringing inflation back down to its desired level. Energy prices have helped the consumer price index move lower over the past year and this could potentially reverse that trend.

- Federal Reserve Comments:

- Minneapolis Fed President Kashkari said the recent stress in the banking system “definitely brings us closer” to a recession, adding that there are other banks with exposure to long-dated treasury bonds with duration risks, and a lot of commercial real estate assets with losses working their way through the system, but what is uncertain is how much is leading to a widespread credit crunch. He added the strains could bring inflation down so there could be less rate hikes. He mimicked recent comments that bank deposit outflows have slowed, and confidence is being restored.

- St Louis Fed Bullard said in an essay published last week that “monetary policy can continue to put downward pressure on inflation,” at the same time that “appropriate macroprudential policy can contain financial stress in the current environment.”

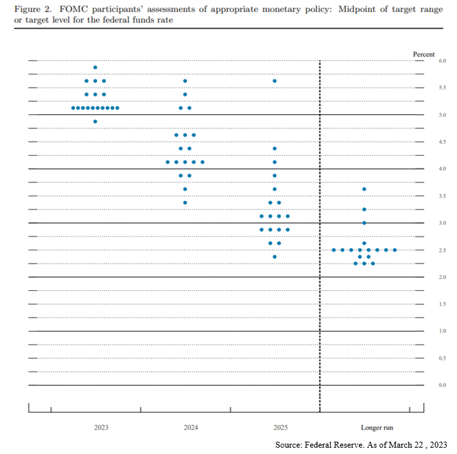

- Boston’s Collins said she expects some modest additional tightening in policy then holding it there for the rest of the year (exactly what the Fed projections showed), saying inflation is still too high and the Fed still has work to do and sees inflation getting back to 2% goal by 2025.

- Richmond’s Barking said rates could rise further if inflation remains high and added backing off inflation too soon will have inflation coming back stronger, and this will require the Fed to do more and cause more damage.

WFG News

Updates on 2022 Tax Documents

The Week Ahead

With the second quarter beginning this week, there will be very few earnings reports until first quarter earnings season picks up next week with the big banks, with markets more focused on the busy economic calendar. It will begin Monday with several indicators on the manufacturing sector including the PMI and ISM manufacturing survey indexes, where results reflected recessionary conditions the past few months. We will also see data on construction spending in the morning on Monday, followed by factory orders and vehicle sales for March on Tuesday, and trade data and the non-manufacturing ISM index on Wednesday. The biggest focus will be on the labor market data. On Tuesday the latest on job openings is released, followed by payroll data from ADP on Wednesday, jobless claims on Thursday, and the Department of Labor’s March employment report on Friday. Economists are estimating another solid month of 240,000 job gains in March, after what was a more than expected 311,000 job gains in February. The only notable reports on the earnings calendar will come from Conagra on Wednesday and Constellation Brands and Levi Strauss on Thursday. Elsewhere, the energy sector will receive some attention as OPEC is scheduled to meet at the beginning of the week to discuss oil production. It will be a shortened as the stock exchanges will be closed on Friday in observance of Good Friday while bond markets will be open half a day.