Wentz Weekly Insights

US Stocks See Third Straight Year of Double Digit Returns

Despite tariff headlines dominating the market in 2025, the US stock market ended with its third consecutive year of double digit gains and its seventh year of double digit gains in the past nine years. In fact, the S&P 500 saw gains of at least 16% in the last three years – 24.2% in 2023, 23.3% in 2024, and 16.4% in 2025, for a cumulative return of 78.3%.

However, as was the case the prior two years, much of the year’s gains were top heavy again (driven by some of the largest names in the index). The equally weighted S&P 500 index, where each of the 500 components in the index have an equal weight of 0.2%, returned a little more than half the cap weighted index at 9.3%, and has seen a cumulative return of 42.6% over the past three years (versus the S&P 500’s 78.3%).

Aside from tariffs and the Federal Reserve’s rate cute cycle continuing, market headlines consistently revolved around artificial intelligence which was the main driver of market returns. This year we saw an acceleration in demand for computing, a surge in capital expenditures, with a big increase in corporate adoption. Capex (investment) in AI projects is expected to have exceeded $400 billion in 2025 and is expected to continue in 2026 with growth of over 40%.

This flood of investments has led to significant gains for some notable stocks, including some of the best performers in 2025 – Google returned 65%, Nvidia gained 39%, AMD gained 49%, Broadcom gained 50%, Micron gained 240%, and Palantir gained 135%.

But one of the most important figures for stock prices is earnings and 2025 saw double digit growth in earnings for the second straight year. Current estimates (pending Q4 results) show S&P 500 company’s profits grew 12.1% in 2025, the fifth consecutive year of earnings growth. It is important to note, much of this earnings growth was driven by the top names in the index such as those benefiting the most from AI. Some of the largest contributors to earnings growth were also some of the top performing stocks, like Google, Nvidia, and Micron.

As we noted several times over the year, S&P 500 earnings excluding the top 7 companies (Nvidia, Microsoft, Apple, Alphabet/Google, Amazon, Meta/Facebook, and Tesla) is expected to remain lower, with current estimates at 9%.

And on the political side, the Trump Administration’s priority as it began its first year of the term was to pass its tax bill to extend the tax cuts from the 2017 Tax Cuts and Jobs Act. It did so earlier in the year with the narrow passage of the One Big Beautiful Bill Act (OBBBA) which permanently extended the tax cuts that would have otherwise expired January 1.

Fed rate cuts was another major theme – in 2025 the Federal Reserve cut interest rates three times, going from 4.50% to the current 3.75%. A lower interest rate generally lowers borrowing costs for businesses.

For the equity bull market to continue, markets are looking forward to companies posting earnings growth of at least 14%, which is the current consensus. There will be several other things to watch this year; the slowing labor market, the Federal Reserve’s rate cuts, geopolitical concerns (China, Russia), AI overspending, and sticky inflation.

Here is how the year wrapped up:

S&P 500: +16.4%

Dow Jones Industrial Average: +13.0%

Nasdaq: +20.4%

S&P Mid Cap: +5.9%

Russell 2000: +11.3%

Best performing sector: Communication Services +32.4%

Worst performing sector: Real Estate -0.35%

MSCI All Country World Index Excluding US: +32.4%

Emerging Markets: +30.5%

Barclays Aggregate Bond: +6.9%

High Yield Bonds: 8.66%

2-Year Treasury Yield: down 77 basis points to 3.48%

10-Year Treasury Yield: down 40 basis points to 4.17%

30-Year Treasury Yield: up 8 basis points to 4.84%

WTI Crude Oil: -19.9%

Gold: +64.4%

Dollar Index: -9.5%

Bitcoin: -6.3%

Recent Economic Data

- Case Shiller Home Price Index: The Case Shiller home price index showed home prices increased 0.4% in October after accounting for seasonal adjustments, but down 0.2% on a nominal basis (non-seasonally adjusted). The momentum we have seen in home prices since 2023 has stalled with 16 of the 20 major cities tracked seeing falling home prices. Compared to a year ago, the average annual increase in home prices is 1.4%, essentially unchanged from 1.3% in September. Regional performance shows a stark reversal from the pandemic boom – cities like Tampa, Phoenix, and Dallas are seeing the largest price declines, while those like Chicago, Cleveland, and New York City are seeing the largest increases.

- PMI Manufacturing Index: The PMI manufacturing index for December was 51.8, indicating a sustained, albeit slower, improvement in US manufacturing, according to S&P’s PMI data. The survey respondents noted new orders declined for the first time in a year but output growth remained solid, while tariffs continue to push prices higher at an elevated pace. At the same time, it notes employment growth has strengthened.

- Construction Spending: Delayed

- Jobless Claims: The number of jobless claims the week ended December 27 was 199,000, a decrease of 16,000 from the prior week and the second lowest level of the year. The four-week average ticked down to 218,750. The number of continuing claims was 1.866 million, down 47,000 from the prior week with the four-week average down to 1.873 million.

- Mortgage Rates: The average 30-year mortgage rate for the prime borrower finished 2025 at 6.15%, the lowest level of the year, falling from 6.91% when the year started and down from the highs of the year in mid-January a 7.04%. If the 30-year mortgage rate falls below 6% it will be the lowest since September 2022. The 15-year mortgage rate average 5.44% to end 2025, versus 6.13% where it started the year.

Company News

- Meta: Meta, parent company of Facebook, said it has agreed to acquire the Singapore based AI startup company Manus, which specializes in general purpose AI agents for tasks like research, coding, data analysis, and resume screening, integrating its advanced AI solutions into Meta’s products. The deal values Manus at more than $2 billion.

- Nvidia: Reuters is reporting that Nvidia has approached chip manufacturer Taiwan Semiconductor about increasing the production of its H200 chips as it is seeing a surge in demand from China after recently receiving approval from the US to export the advanced chips. Sources say Chinese tech companies have ordered over two million H200 chips from Nvidia for the coming year, but Nvidia has only 700k in stock. The report does not cite how many more chips it is asking Taiwan Semi to provide but says the increase will likely begin in the second quarter. The report also notes China still has not yet decided to allow the H200 chips into the country. Nvidia later said Chinese orders will not impact its ability to supply US customers.

- Trump/Zelensky meeting: President Trump said last week that talks to end the Russia/Ukraine war is “getting a lot closer, maybe very close” after his meeting with Ukrainian President Zelenskyy. It is expected meetings will continue with the US and European leaders in the coming weeks while Zelenskyy told reporters US/Ukraine security guarantees were 100% agreed upon. Trump said one of the main issues that remain come down to the territory, which neither Russia nor Ukraine want to give up.

WFG News

Upcoming Events:

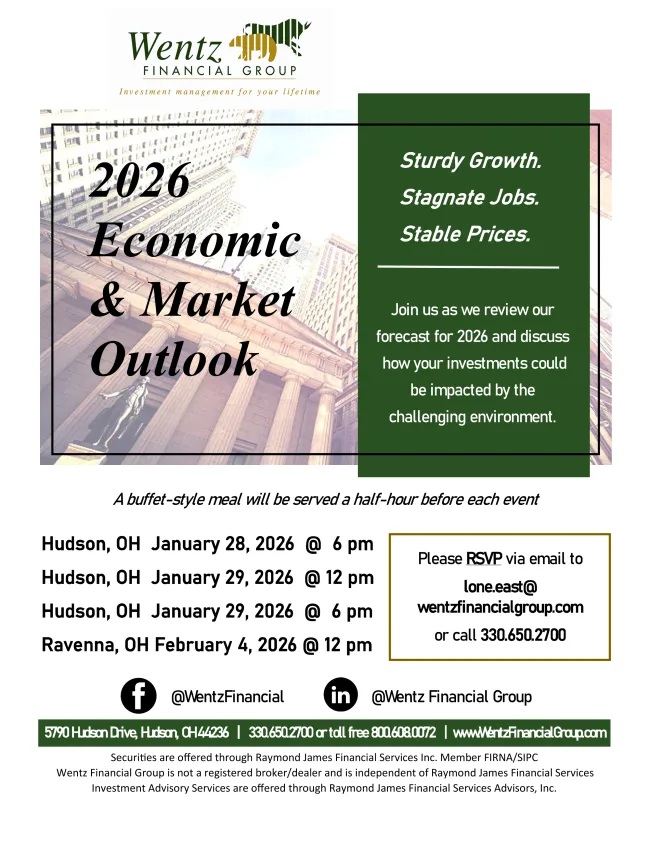

See the flyers below for our upcoming events. In late January, we will host our 2026 Economic and Market Outlook meeting, where we will review key developments from 2025 and share our outlook for how we see 2026 shaping up.

In March, we will welcome a Social Security Specialist who will provide an overview of how Social Security works and discuss key strategies to help maximize your benefits.

Click the links below to RSVP today!

WFG Investment Classes:

Interested in learning more about investing and how the markets work? Wentz Financial Group holds various Investment Basics classes throughout the year. Contact us for details!

The Week Ahead

After a very quiet two weeks for the calendar, the pace picks back up this week with a busy week of economic data reports, many of which are delayed reports from the government shutdown. The highlights will come from the labor market with reports on the job openings and labor turnover survey, ADP payroll numbers, jobless claims, as well as the DOL’s monthly labor report on Friday. The consensus estimate sees 54,000 new jobs added in December, which would be relatively in line with the 12-month average. Other data reports include the ISM index from the surveys for manufacturing and services, auto sales for 2025, factory orders, trade balance, US productivity, housing starts and permits, and the consumer sentiment index. The earnings calendar remains quiet with no notable earnings reports to note this week before things pick up next week when fourth quarter earnings season kicks off. One of the largest and most notable annual tech conferences, the Consumer Electronic Show (CES) 2026, kicks off this week, led by presentations from AI leaders Nvidia and AMD.