Wentz Weekly Insights

What Fourth Quarter Earnings Season Tells Us

Recent Economic Data

- The ISM manufacturing index was 47.7 in February, up slightly from January, but below expectations and still below 50 for the third consecutive month signaling contracting activity. New orders are still declining, but at a lower rate than in January with the index at 47.0 with the report noting sluggishness due to disagreements between buyers and suppliers regarding price levels and delivery lead times, production weakened further, and prices picked up pace, growing again after the first month of declines since the recovery in January.

- Global PMI indexes for February:

- The U.S. PMI was at 47.3, up slightly from January but still below expectations and the fifth consecutive reading below 50, signaling contracting activity in the sectors since mid-2022. Results showing a further deterioration in operating conditions stemming from further contractions in new orders and output, while hiring was the fastest pace in five months, helping drive a drop in backlogs of work. Lower sales were attributed to customers destocking, which weighed on demand. Input costs increased at a softer rate, but the rate of inflation i still increasing as firms passed on the higher costs to customers.

- China’s PMI index increased to 51.6 in February, up from contraction levels of 49.2 in January and above expectations. This was the first increase in manufacturing activity since last July as China’s economy slowly re-opens after removing its pandemic restrictions. New business grew for the first time in seven months while production volumes improved with the first upturn in output since last August. The return of more normal business conditions helped expectations and confidence move to the highest level in almost two years.

- Japan’s PMI index was 47.7 in February, down further from 48.9 in January indicating the biggest contraction in activity since the pandemic started. Both new orders and production levels fell at the fastest pace since mid-2020 as weak demand slowed sales and volumes.

- Eurozone PMI index was 48.5, down slightly from January and also showing manufacturing activity weakened further in the month. In fact, it was the eighth consecutive month of declining activity in the sector. New orders actually improved, but production declined and suppliers’ delivery times eased (reflects worsening conditions).

- Sales of durable goods, which is an input to factory orders and a great proxy to capital investments as well as a major input to GDP, fell 4.5% in January which was near expectations, and follows a very strong 5.1% increase from December. The two months saw large swings because of large aircraft orders in December, which tend to be very volatile and cause large swings in the index. Excluding transportation, which reflects stripping out these aircraft orders, goods orders were up 0.7%, much better than no gain expected. The strength was likely due to a rebound from weak activity the end of 2022 and a warmer January.

- Construction spending in January, data that lags by a month, declined 0.1% in the month, lower than a small increase expected, driven by a 0.6% decline in spending on residential and offset by a 0.3% increase in nonresidential spending. Over the past year, construction spending is up 5.7%, cooling from the 8.7% annual increase in December, driven by a strong 15.9% increase in nonresidential spending and offset by weakness in the housing sector with a 3.8% decline in residential spending.

- The ISM services index, which surveys the non-manufacturing sector, was at 55.1 for February, relatively unchanged from January, driven by a solid growth in new orders at 62.6. Other components were mixed with business activity at 56.3, reflecting slower growth than January, with supplier delivery times improving. The prices index was 65.6, still elevated but falling again in February.

- The number of vehicle sales in February was an annualized pace of 14.9 million, falling from 15.9 million in January as demand cooled and consumers deal with inventory issues still, with the sales pace down 6.2% from January, but up 8.5% from a year earlier.

- The Conference Board’s survey of consumer confidence showed consumer’s feelings about the economy and their finances fell in February with the index falling to 102.9 from 106.0 last month. Obviously a few changes in the month – most notably stocks and bonds are lower and interest rates are higher. The present situations index increased slightly to 152.8 while the expectations index fell steeply to 69.7, down from 76.0 last month. A level below 80 typically signals a recession within the next year and the index has been below this level 11 of the past 12 months.

- US worker productivity was revised down significantly for the fourth quarter of 2022 as output increased less and hours worked increased more than expected. Output growth of 3.1% was revised lower from 3.5% in the first estimate while employees worked more hours than what was estimated in the first release last month. Unit labors costs saw a large upward revision, rising 3.2% in the quarter, due to lower productivity and a much larger increase in hourly compensation, which increased 4.9%, up from 4.1% in the first estimate.

- The number of unemployment claims filed for the week ended February 25 was 190,000, relatively unchanged from the prior week, with the four-week average at 193,000, also relatively unchanged. The number of continuing claims was 1.655 million, down 5k from the prior week, with the four-week average at 1.671 million, relatively unchanged from the prior week.

- January pending home sales increased a more than expected 8.1% for the second straight monthly increase, according to the pending home sales index. But keep in mind pending homes are based on signed contracts, and this data is prior to rates seeing the quick move higher over the past several weeks. Even though up for two months, pending home sales are still down 24.1% from last year.

- S&P said its Case-Shiller home price index showed home prices declined 0.5% in December, right in line with expectations, and follows a 0.5% decline in November. In fact, it was the sixth consecutive monthly decline in home prices. For 2023, home prices were 5.8% higher, down from the 12 month increase of 7.6% in November, and follows the record gain of 18.9% in 2021. Prices fell in all 20 cities in the index with prices in San Francisco and Seattle in outright contraction over the past year while Miami (+15.9%), Tampa (+13.9%), Atlanta (+10.4%), and Charlotte (+9.9%) saw the largest increases. Cleveland remains in the middle, with the average home price up 6.0% over the past year.

- Mortgage rates are back on the move with some surveys showing the average 30-year rate is back over 7%. The Freddie Mac Mortgage survey, which we reference in our newsletters, shows rates rose again last week with the prime 30-year mortgage rate averaging 6.65%, up from 6.09% just a month earlier.

Company News

- Qualcomm CEO Cristian Amon said he does not expect the company will continue providing Apple with modem chips for its iPhones after 2024. While the company is making no plans for 2024, he said it is up to Apple to decide to use its modem chips or not. Apple is widely believed to be developing its own in-house modems after acquiring Intel’s modem business in 2019.

- European regulators extended the timeline on its review of the Microsoft/Activision deal by two weeks to April 25, with sources telling Reuters that regulators are not expected to demand Microsoft sell assets to satisfy the deal. This comes after Microsoft lawyers met with regulators. It was reported late in the week from Reuters that European regulators are likely to award an approval on the deal.

- Target beat earnings and sales expectations for its fourth quarter, but provided forecasts that was cautious and lower than expected. It saw strength in food & beverage, beauty, and household categories but was offset by weakness in discretionary categories. Its gross margin fell again reflecting higher clearance and promotional markdowns and higher merchandise costs. For 2023, it expects comparable store sales and earnings below what analysts were estimating with the CEO noting it continues to be a very challenging environment, but optimistic it can return to pre-pandemic operating income margins of 6% in 2024.

- Micron said at an investor conference that customer inventories are improving but they still remain elevated and there is still significant supply demand imbalance in the industry, adding that pricing trends remain challenging, particularly with NAND. It said this could result in a significant inventory write-down, affecting margins and earnings more than what it expected in its last earnings release with an “adverse impact” on next current revenue and margins.

- Tesla held its investor day last week which some are calling disappointing due to the high expectations going into the event. There was a lack of detail on its upcoming low cost vehicle, financial targets, Tesla bot, and little detail on the redesign of its Model 3, saying it would make a new product announcement at a later date. It did talk about a 50% cost reduction target for its next generation model, leaving investors with a positive.

Other News

- Multiple reports have said conservative Supreme Court justices are skeptical and questioning Biden’s student loan forgiveness plan and the authority he has on cancelling federal student loans, which was mostly expected, in its hearing on the issue.

- Last week, the Senate passed a bill that would overturn a Labor Department rule that would allow retirement plans like 401k’s and its fiduciaries to consider ESG factors (environmental, social, and governance) when making investment decisions. President Biden already said he would veto the measure. Republicans and opponents say the rule would force companies to follow liberal agenda at the expense of profits while Democrats and advocates of the rule say addressing climate change and corporate governance can boost profits.

- Based on multiple reports, the U.S. is discussing with allies and gathering support for sanctions on China if it follows through on providing weapons and financial support to Russia.

- An article from Bloomberg noted Chinese leaders are surprised by the pace of its economy’s rebound and thus are unlikely to roll out a large stimulus plan.

- At the opening of China’s National People’s Congress, Premier Li Keqiang said China has set an economic growth target of 5%, slightly below a level of around 6% economists and analysts were expecting. There were reports leading into the parliamentary meetings it was becoming increasingly ambitious with its growth goal for 2023. It also set a 3% goal for inflation, a 5.5% unemployment rate for people in cities, and 12 million new urban jobs, up from 11 million in its 2022 target. Last year, China’s GDP rose just 3% due to its stringent Covid restrictions, which missed its goal for the year of 5.5%.

- Oil has traded rangebound for roughly four months, but risks moving higher. Data in the U.S. shows there has been a recent slowing in the pace of crude inventory builds along with a steady decline in the number of active rigs. On top of that, there were reports last week that the U.S. may be getting ready to start refilling its Strategic Petroleum Reserve, after using millions of barrels of oil last year when oil prices were over $100/barrel. In addition, there is increasing confidence in China’s recovery that will push its demand for oil higher.

- Federal Reserve news and comments:

- Atlanta Fed president Bostic said he expects the Fed funds rate to reach 5%-5.25% and stay there “well into 2024” in order to bring inflation under control, with the time allowing tighter policy to filter through the economy and bring supply and demand back in balance, while saying the reason inflation is stubborn is because of the tight labor market, pointing out the mismatch between supply and demand of labor. He said so far higher rates have not yet resulted in lower demand across the wider economy, noting housing cooling but consumer spending still strong. Bostic said he would need to see rebalancing in the labor market and slower aggregate demand before considering a shift in policy. In addition, he said he is firmly in the camp of raising rates 25 bps at the next meeting.

- Minneapolis Fed president Kashkari said he is open minded when it comes to raising rates 25 or 50 basis points at the next Fed meeting March 22 as economic data remains concerning, adding that he supports raising rates further. He said what is more important is what the Fed signals in its dot plot at the next meeting, which he is not sure where his dots will be yet (reflecting where he projects rates at the end of the year). He said while there is optimism on a soft landing, he is not so sure that can be done with the main concern being the rate hikes have yet to impact the service side of the economy adding that wage growth is too high as well, needing to get that to 3% to be consistent with 2% inflation.

Did You Know…?

Fed Agressiveness

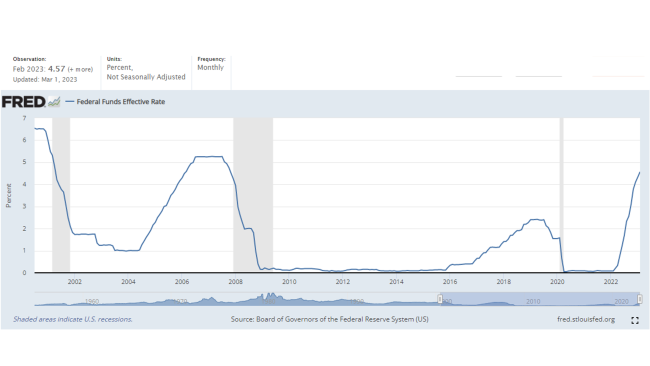

It was one year ago that the Federal Reserve raised interest rates for the first time since 2018 in its effort to bring inflation down. Since that first rate increase, the Fed has raised rates a total of eight times, brining its target range to 4.50% to 4.75%, up from 0% where it started 2022. It started with a 25 basis point increase, then 50 bps, then four consecutive meetings of 75 bps increases, followed by a 50 bps increase and finally a 25 bps increase in its last meeting on February 1. For the next meeting March 22, the futures swap market is pricing a 70% chance the Fed will raise rates 25 bps and a 30% chance it will raise rates 50 bps. The chart below shows the Federal Funds Rate over since 2000 with the far right showing the rate during the current rate hike cycle. Grey bars indicate recessionary periods. As you may notice, the far right upsloping line has a steeper slope upwards than the other lines, reflecting the Fed’s most aggressive rate hiking cycle currently since the 1970s.

WFG News

Updates on 2022 Tax Documents

Please note tax documents will not start mailing until January 31. Most retirement accounts will see 1099-R and form 5498 mailed on January 31. Retail accounts will see 1099 and related documents mailed by February 15. Certain accounts with more complex securities may have 1099’s mailed as late as March 15. Please see this email for more details. If there are any questions on tax documents, please reach out to us at 330-650-2700.

The Week Ahead

Markets will remain focused on the Federal Reserve this week and guessing its next moves and the ultimate level of interest rates after the Department of Labor reports on the labor market in February. The consensus expectation is we saw around 215,000 job gains in the month after over 500,000 in January. Jerome Powell will be testifying in front of Congress Tuesday and Wednesday and is expected to reiterate his message the Fed is committed to bringing inflation down by raising rates and holding them there for some time. While we do not expect anything new, markets will be looking for hints on how far rates will go and for how long. Elsewhere on the economic calendar is factory orders on Monday, January trade data and the Beige Book are released on Wednesday, and other data on the labor market that includes job openings and the ADP employment report on Wednesday, and jobless claims on Thursday. With about 99% of the S&P 500 reporting Q4 earnings already, earnings season is wrapping up and this week will include several small tech companies and more retailers with notable reports from Dick’s Sporting Goods, CrowdStrike on Tuesday, United Natural Foods, Campbell Soup, MongoDB on Wednesday, and JD.com, DocuSign, Oracle, Gap, and Ulta Beauty on Thursday. A couple other high profile investor events will take place as well, including Apple’s annual shareholder meeting and GE hosting an investor day. On the political side, President Biden is expected to unveil his budget blueprint this week and Norfolk Southern will testify in front of Congress for the first time since the train derailment that caused a toxic spill in Ohio.