Wentz Weekly Insights

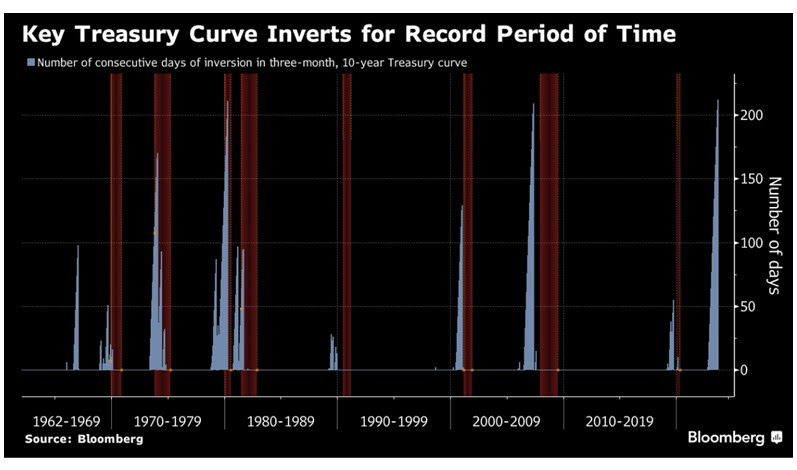

Yield Curve Inversion Has Never Lasted This Long – 213 Trading Days & Counting…

Recent Economic Data

- The NY Fed’s survey of consumer expectations showed households were less optimistic about their financial situation in August. First, the most important part in the current environment, inflation expectations over the next year rose to 3.6% from 3.5%, while longer term inflation expectations rose 0.1% to 3.0%. Expectations on income growth fell 0.3% to 2.9% with expectations on spending growth falling 0.1% to 5.3%. The probability unemployment will be higher a year from now rose with the expectations on job loss at the highest since April 2021.

- Inflation accelerated in August to the fastest monthly pace since June 2022 with the consumer price index rising 0.6% in the month, as expected. The index is up 3.7% over the past 12 months, rising for two consecutive months after a two-year low of 3.1% in June. The acceleration in prices was due mostly to the rise in energy price which increased 5.6% in August, however are still down 3.6% from a year ago. Growth in food prices remain relatively stable, rising 0.2% in the month. The more important number for markets was the core inflation reading (excluding food and energy) which increased 0.3% in the month, slightly more than the 0.2% increase expected, and is up 4.3% from a year ago, as expected and slowing from the 4.7% 12-month pace in July for the lowest 12-month increase since late 2021. Transportation services came in hot with a 2.0% monthly increase and are up 10.3% from a year ago. Other items in the core index include new vehicle prices up 0.3%, used vehicles down 1.2%, medical care commodities up 0.6%, medical services up 0.1%, and the largest component shelter slowing to a 0.3% increase. The index the Fed is following closely called the “super core” index (core prices minus shelter and other goods – focuses more on services) rose 0.4% in the month and 4.0% from last year, still double the Fed’s target.

- The producer price index, which measures inflation seen by domestic producers of goods/services, rose 0.7%, almost double expectations, and are up 1.6% from a year ago, double the 12-month pace from July. However, most of this monthly increase was due to energy prices which rose 10.5% for producers. Stripping out food and energy prices, the index rose just 0.2% as expected. More importantly, prices for final demand services (not goods) rose 0.2% in the month, led by a 1.4% increase in transportation and warehousing.

- The level of inflation for goods/services imported to the US rose 0.5% in August coming after a 0.1% increase the month prior and the largest monthly increase in 15 months. Import prices are still down 3.0% from 12 months earlier. The larger monthly increase was due to a 6.7% increase in fuel prices. Prices excluding fuel were down 0.1%, matching the recent trend (have not seen a monthly increase for six months). The price for US exports rose 1.3% in the month, the largest monthly increase in 15 months as well, however export prices are still down 5.5% from a year ago. Price increases were driven by industrial supplies, capital goods, and autos, offset by a 2.2% drop in agricultural export prices.

- According to headline retail sales for August, the consumer remains resilient as spending continues to grow. Monthly retail sales for August rose 0.6%, well above the expected 0.2% increase, and follows a 0.5% increase from July. However, digging deeper the consumer may not have been as strong as what the headline suggest. The prior month was revised down 0.2% from a 0.7% increase, while a 10.6% surge in gasoline prices drove the headline index higher. Vehicle sales rose another 0.3% and stripping out these two volatile categories (gasoline and autos) retail sales rose just 0.2% in the month, slightly above the 0.1% increase expected. Of the 13 major categories, 10 saw an increase in spending in the month, led by gas sales, apparel up 0.9%, electronics up 0.7%, and personal care stores up 0.5%. Categories that saw a decline were furniture, sporting goods, and miscellaneous store sales. Retail sales are up 2.5% from a year ago and 3.6% excluding vehicles and gas. However, the control group, which feeds into the GDP calculation, rose 0.1%, below the estimates of a 0.2% gain.

- The number of jobless claims file the week ended September 9 was 220,000, a slight increase of 3k from the prior week for the first increase in four weeks, with the four-week average falling 5k to 224,500. Continuing claims were relatively unchanged at 1.688 million, while the four-week average fell slightly to 1.697 million. These are still very low levels that are associated with a strong labor market.

- The index on manufacturing conditions in the New York region for September was 1.9, according to the Empire State Manufacturing survey that is conducted by the New York Fed. It was an improvement from -19.0 from August and better than -10.0 expected (zero is breakeven). It was just the fifth positive reading of the past 17 months but shows manufacturing conditions are still weak. The pace of input price increases were similar to last month while selling price increases pick up pace. Employment levels fell, while new orders and activity picked up. A mixed report overall.

- Industrial production increased 0.4%, above the expectations of a 0.1% increase for the third best reading of the year and coming off a 1.0% increase last month. The increase was due to a 1.4% increase in mining, 0.9% increase in utilities, and 0.1% increase in manufacturing. Capacity utilization was 79.7%, the second best reading of the year (after April), it is worth noting last year’s high of 80.7% was the best since 2008, so it has been drifting lower off a 15 year high.

- The average 30-year mortgage rate for the prime borrower creeped back up last week, rising 6 basis points to 7.18% and just below the high of the year and a 23 year high of 7.23% reached three weeks ago. The low of the year was 6.09% in February.

Company News

- Bloomberg reported, after reports two weeks ago that China was banning the use of iPhones by government employees, that China’s first remarks on the issue noted the government found security issues with the iPhones, while adding it was not banning purchases.

- Qualcomm shares were up 4% yesterday after it was announced it has extended its agreement with Apple to supply modem chips/5G chips until at least 2026. Estimates show Qualcomm’s iPhone business generates $2-$3 in EPS for the company. Apple has been rumored as trying to make its own modem chips internally which has been a big headwind for Qualcomm’s stock.

- Disney and Charter Communications (owner of Spectrum) agreed to a deal early last week that resolves a carrier issue where Spectrum customers were blacked out from watching any Disney programs (ESPN, ABC, etc).

- Reports came out last week from Bloomberg that Disney was in early stage talks about selling its ABC networks and stations to Nexstar Media, a separate broadcast company, but the talks did not go far enough to talk about valuations. Nexstar recently did a presentation at an investor conference where it talked about being interested in acquiring legacy assets from media companies looking to restructure. Separately, Bloomberg also reported that Byron Allen made a $10 billion offer to acquire ABC network and local stations, along with FX and National Geographic from Disney. Byron Allen, a media mogul, said earlier in the year he was interested in acquiring TV broadcast affiliates to add to his other broadcast networks.

- In Google’s antitrust trial it claimed consumer choose Google’s search because it “delivers value to them, not because they have to,” according to Bloomberg. Google’s lawyer claimed companies chose its Google search as the default search engine for browsers and smartphones because it is the best one, not because of a lack of competition. The Department of Justice says Google uses its market power and pays more than $10 billion each year to keep its position as the default search engine on browsers and smartphones.

- The airlines sector was down last week after several airlines, including Frontier, American, and Spirit, cut profit forecast for the current quarter, all that were below the consensus analysts’ estimates as well. The airlines attributed the lower forecast to higher jet fuel prices, declining booking trends, and higher promotional activity.

- Semiconductors, particularly semiconductor equipment and services companies saw weakness last week after a Reuters report said Taiwan Semiconductor (one of the largest contract semiconductor manufacturers in the world) told its suppliers to delay the delivery of high-end chipmaking equipment in an effort to control costs and reflecting its growing caution on the outlook. When asked, the company referred to its July comments that noted growing concerns about customer demand and reflects its cautious outlook.

- Executives at Netflix said the company saw a “muted” reaction in regards to cancellations after it cracked down on password sharing. They said those password sharing subscribers that canceled are trending more toward ad-free subscriptions at a time where it is trying to build out its ad business, and this trend is not necessarily ideal for building that part of the business. This has been a drag on its average revenue per user. It was estimated 100 million people were password sharing.

Other News

- The European Central Bank raised rates another 25 basis points last week for the tenth consecutive rate increase, bringing its policy rate to 4.5%. The market was split on what the central bank would do, but it seemed more likely than not they would increase rates based on comments from its policymakers at Jackson Hole last month and recent remarks earlier in the week. It hinted it may be done raising rates though, saying policy may be at a sufficiently restrictive level, but is now determining for how long it needs to be sufficiently restrictive. It also lowered its economic growth and increase its inflation projections through 2025.

- China’s central bank, the People’s Bank of China, said it will cut its reserve requirement ratio by 25 basis points for banks, another step it is taking to stimulate growth. This comes after a series of policy moves to support growth including a cut to mortgage rates last month.

- About 13,000 United Auto Workers union members went on strike against the Big Three automakers (Ford, GM, and Stellantis) after the previous four-year labor contract expired at midnight on Thursday. According to the union president, the union and the Big Three automakers “remain far apart” in talks for a new labor agreement. The UAW is reportedly pushing for a 40%+ wage increase over a new four-year contract while the companies have offered anywhere between a 15%-20% wage increase. Estimates by BoA say a strike lasting a full quarter would shave 1.6%-2.2% from GDP due to lost production. The union began strikes at plants that targeted the automakers’ most profitable models and threatened the strike could expand to further plants if talks continue to go nowhere. The union has approximately 146,000 members. The latest news over the weekend was the UAW chief rejected a 21% pay increase from the automakers as “definitely a no-go.”

WFG News

The Election & Its impact on The Markets:

The Week Ahead

The focus will be shifted back to the Federal Reserve this week as the policy making committee, the Federal Open Market Committee (FOMC), holds its sixth meeting of the year. It is likely and expected for it to not adjust policy or raise rates for the second time this year, but we will see updated projections from officials on things such as inflation, economic growth, and labor market strength. There will be other central bank meetings going on around the world as well – the Bank of England is expected to raise rates again on Thursday, and Friday the Bank of Japan will hold its meeting a decision where no change in policy is expected. On the economic calendar, we will see an update on the housing sector with the housing market index Monday, August housing starts and permits on Tuesday, followed by August existing home sales on Thursday. Economists’ estimates see home sales relatively consistent with the last couple months, although activity still down significantly from last year. Elsewhere on the calendar is jobless claims and the Philly Fed manufacturing index on Thursday. The earnings calendar remains very light of releases with the only notable companies releasing quarterly results coming from Stitch Fix on Monday, AutoZone on Tuesday, FedEx, General Mills, KB Home on Wednesday, and Darden Restaurants on Thursday.