Wentz Weekly Insights

A Growing Divergence & Deeper Yield Curve Inversion

The markets saw a wave of weak economic data reports the second half of the week, while the Federal Reserve announced another increase to interest rates and raised their projections on where they see rates peaking, leading to a selloff to end the week. Before the Fed meeting came the highly anticipated consumer price index that showed consumer inflation rose just 0.1% in November, a significant slowdown from the 0.6% monthly increase the index has averaged over the past 24 months. The index was 7.1% higher from a year earlier for the smallest annual increase since December 2021.

It is correct inflation has moved lower and that is welcoming. However, that is due to a continued decline in energy prices and goods inflation, the unwelcoming part is services inflation and inflation in stickier categories remains high. Things that have caused high inflation for much of 2022 due to pandemic distortions are dissipating – energy price fell 1.6% (including a 2.0% drop in gas prices), car prices fell 2.9%, airline fares fell 3.0% and medical care services fell 0.7%, similar to October where the decline was driven by a large drop in health insurance. Taken altogether, goods inflation is down to 3.7% from 5.1%. The bad news is services inflation remains at 6.4%. Offsetting those declines was another large increase in shelter costs (rents and owner’s equivalent rents) rising 0.6%, food rising 0.5%, along with increases in other categories such as recreation, education, and communication. If these categories, along with wage inflation, remain elevated, we don’t expect a different message from the Fed anytime soon.

The fact headline inflation is cooling, and the Fed having already hiked rates to 4% from its zero-interest rate policy where it started the year, the policy making arm of the Fed – the Federal Open Market Committee (FOMC), raised rates another 50 basis points in last week’s meeting to a new range of 4.25% to 4.50%. The policy statement was basically unchanged from its November meeting. What was different though, was its summary of economic projections (SEP – where Fed officials use their assumptions to make projections for the next three years) compared to its last release in September.

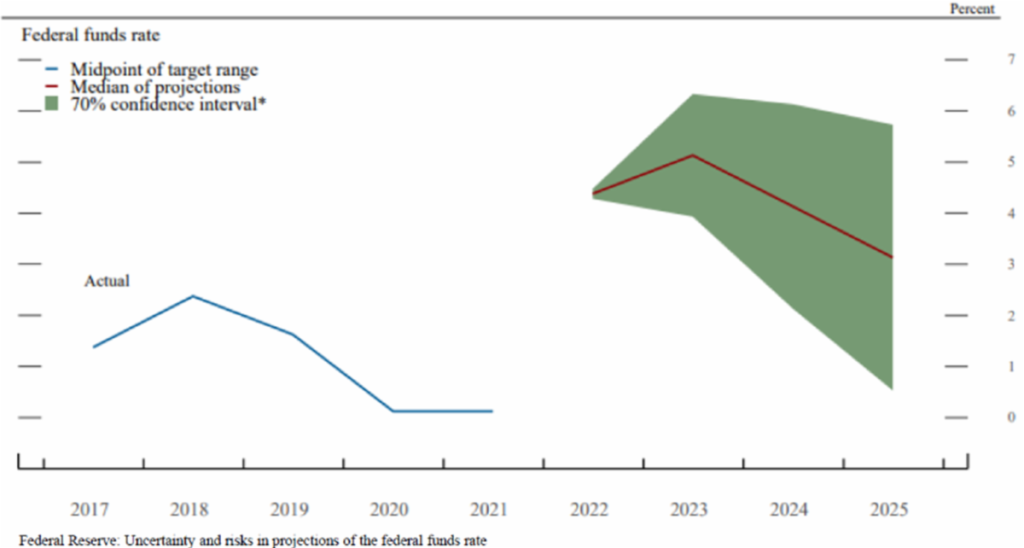

Fed officials see growth being slower in 2023, unemployment being higher, inflation higher, and a policy rate higher than what it saw just three months ago. In fact, it sees essentially no economic growth in 2023 and an unemployment rate that increases 1% from its lows of 2022, basically saying the economy will be on the verge of a recession in 2023. The most important variable for the markets for this meeting was where policymakers saw interest rates peaking in 2023. The market’s expectation is rates will peak around 4.9% but Fed projections see rates peaking at 5.1% with some officials even going as high as 6% (see green shaded area below). A divergence between policymakers is growing which makes market projections more uncertain and market positioning more difficult. However, 17 of 19 officials still see rates of at least 5% in 2023.

The other disconnect is between policymakers and the markets, with Fed projections at 5.1%, markets still see interest rates peaking below 5%, and this will continue to lead to volatility in the markets. For all of 2022, markets underestimated how fast the Fed would raise rates, it is now underestimating how high rates may go. The next challenge for the Fed, which will likely be a second half 2023 or 2024 story, is how long rates will stay this high before it pivots and begins loosening policy by cutting rates.

Following the announcement and release of projection materials, stocks fell immediately, the dollar strengthened, and yields rose somewhat.

The markets should not have reacted the way they did because everything we saw from the policy decision and SEP were things Powell and other officials have been saying publicly for the past several weeks. The issue is there remains a disconnect between where markets believe the peak rate will be versus where Fed officials see the peak rate, which led to the kneejerk reaction. There is also the fact markets are still expecting the Fed to pivot in the second half of 2023 and cut rates twice by the end of the year (versus the Fed not projecting a rate cut until 2024). When asked about this, Powell again referred the media to the SEP and said there are no expectations to cut rates in 2023. This goes to remarks Powell has made over the past several months and a comment he made again on Wednesday that “historical experience cautions strongly against prematurely loosening policy,” suggesting rates will stay higher much longer than what the market expects in order to kill inflation.

While inflation will soften in 2023, it is still going to be too high and likely even higher than these newly upward revised projections. Powell and the Fed will be looking at a wider range of measures going forward for signs of sustained inflationary pressures, focusing on services inflation and wage inflation. Until the labor market loosens, this is expected to remain elevated. With a growing divergence between policymakers, and between the Fed and markets, it creates more uncertainty, and this adds on to the uncertainty we have around growth concerns along with the earnings trajectory. By the end of the week the 10-year Treasury yield finished at 3.48%, and after the rate increase the fed funds rate was 4.33%. This created an even deeper inversion of the yield curve, which is concerning as this almost always is a precursor to a recession. Until we have a more clear picture on all three issues, we will remain overweight defensive positions.

Week in Review:

It has been more uneventful in recent days and that is how last week started. There was M&A in the headlines, with Amgen making a $28 billion acquisition, both Weber and Coupa Software separately going private by private equity firms, and Microsoft taking a stake in the London Stock Exchange. Outside of that it was a quiet day but volatility did pick up with the VIX rising 9.5% while stocks moved higher into the close with the S&P 500 gaining 1.43%.

The first big event of the week was the consumer price index report Tuesday morning that showed inflation rose less than expected in November, rising just 0.1%, sending stock immediately higher and bond yields lower. However, early morning strength faded through the days trading and after being up as much as 2.8%, the S&P 500 closed up 0.73% as all eyes turned to Wednesday’s FOMC decision.

Wednesday was a very volatile day, stocks opened unchanged, rose 0.5% until the 2:00 Fed announcement, which included a 50 basis point increase in rates along with updated economic projections that showed policymakers see rates peaking higher than what the market was expecting, and this sent stocks lower as much as 2.2% from the highs. Stocks bounced as Powell spoke, but ultimately ended the day down 0.61%. Bond yields spiked after the announcement due to the higher peak rate but ended up pulling back as well.

Weak economic data, from manufacturing indexes indicating contracting conditions, a large decline in retail sales, and weak data from China, along with investors still digesting the Fed’s hawkish projections, had stocks moving lower in Thursday’s session. The only positive data was jobless claims declined, reflecting the very tight labor market, but that good news was bad news for investors – the Fed wants the labor market to weaken and this showed the opposite. There were also several other central banks around the globe that announced an increase to policy rates on Thursday. It was a risk-off day with the tech/growth heavy NASDAQ down 3.23%, the Dow down a lesser 2.25%, while treasury yields were lower as prices moved higher.

Stocks got off to a weak start again on Friday, with a substantial increase in volume due to quadruple witching – when four major stock options expire, along with the rebalancing of the S&P 500, both of which lead to increased trading. There was heavy downside volume with 2.25 declining stocks to advancing stocks with the S&P 500 finishing down 1.11%, although off the lows of the day.

After rising over 2% the first two days of the week, stocks moved lower the remainder of the week after another hawkish meeting by the Fed and ended the week lower as follow: Dow -1.66%, Russell 2000 -1.85%, S&P 500 -2.08%, and NASDAQ -2.72%. Bonds were much less volatile with the 10-year Treasury yield trading between 3.42% and 3.63% for the week but ultimately ending lower at 3.48% over more slowdown and recession concerns. There wasn’t much news in the oil market with crude finishing higher by about 2%.

Recent Economic Data

- The consumer price index rose 0.1% in November, less than the 0.3% increase expected and slowing from the 0.4% increase in October. Compared to a year ago the index is up 7.1%, decelerating from the 7.7% rate in October and also 0.2% lower than expected. The slower inflation is due to a 1.6% drop in energy prices over the month, which includes a 2.0% decline in gasoline and 3.5% drop in utility gas services. Also helping push the index lower was a 2.9% decline in car prices, the fifth consecutive decline, a 3.0% drop in airline fares, and a 0.7% drop in medical care services, which was driven by another large drop in health insurance. Offsetting the declines in these areas was another large increase in shelter which rose 0.6%, food which rose 0.5%, along with categories like communication, recreation, vehicle insurance, education, and apparel. Core prices, which exclude food and energy categories, rose 0.2% in November, half the expectation and rose 6.0% from a year ago, down from 6.3% in the prior month. One thing to note, prices of services, less energy, were up 6.8% from a year ago, up from 6.7% last month.

- Prices of goods and services imported to the U.S. decreased 0.6% in November, slightly more than the 0.5% decline expected and follows a 0.4% decline from October. Compared to a year earlier, import prices are up just 2.7%, down from 4.1% in October and decelerating significantly from the high water mark of 13.0% in March. Exports prices decreased 0.3% in November, less of a decline than the 0.6% decrease expected and follows a 0.4% decrease in October. Compared to a year earlier export prices are still up 6.3%, down from 7.4% in October and well below the record increase of 18.6% in May and June.

- The number of unemployment claims filed the week ended December 10 was 211,000, falling 20k from the week prior with the four-week moving average down 3k to 227,250. The number of continuing claims, which lags by a week, was relatively unchanged at 1.671 million. The four-week average was 1.625 million, rising 43k from the week prior. After several weeks of increasing, jobless claims fell to the lowest level since September.

- The Philadelphia Fed Manufacturing survey index was -13.8 for the December survey, a small improvement from -19.4 in November but still indicating conditions continue to contract for the fourth consecutive month and six of the last seven. The percentage of firms noting declining activity was 31%, and 17% said activity increased, while 51% said there was no change in the level. New orders and shipments both declined with the index for new orders falling to -25.8 for its lowest since the middle of the pandemic April 2020. Employment weakened while the price index fell but remains elevated.

- The Empire State Manufacturing survey index was -11.2 for December, worsening from 4.5 in November. About 34% of respondents said conditions worsened while 23% said conditions improved. New orders declined at -3.6 while shipments were barely positive and manufacturers are continuing to work through orders with unfilled orders declining 11.2. The price index held steady at a very elevated 50.5.

- Consumer spending on retail items slowed substantially in November and a trend we have been seeing all of 2022 accelerated in the month with spending on goods declining and spending on services rising, now accelerating inflationary pressures in the services sector. The other takeaway was spending on discretionary categories fell while spending on consumer staples categories did well. Sales for retail and food services for November fell 0.6%, a larger than expected decline in retail sales and comes after a stronger 1.3% increase in October. Vehicle sales fell 2.3% while gasoline sales fell slightly by 0.1%, thanks to a drop in gas prices. Excluding these two more volatile categories that can sometime cause swings in the headline, show retail sales were still down but by a less 0.2% and compared to the 0.2% increase that was expected. Nine of the thirteen categories saw a decline, with a 2.6% decrease in furniture, 2.5% decline in building materials, 1.5% decline in electronics/appliances, and 0.9% decline in online sales. The categories seeing an increase were more service (and consumer staple!) related, reflecting the recent trend – grocery store sales up 0.8%, health care/personal care up 0.7%, and bars and restaurants up 0.9%. Compared to a year ago retail sales are up 6.5% but 6.7% excluding food and gas. It will be troubling if this becomes a trend, especially as inflation remains high as “real” retail sales, inflation adjusted, were down 0.7% and down 0.6% from a year earlier. But it reflects consumers have spent down much of their savings and/or are becoming more cautious about spending and the future.

- US industrial production, which covers the growth in manufacturing, mining, electric and gas utilities, declined 0.2% versus the 0.1% increase expected. Manufacturing output contributed to most of the decline, falling 0.6% with auto production falling 2.8% and non-auto manufacturing down 0.4%. Utilities output offset manufacturing decline in the headline number with a 3.6% increase. The decline should not be too much of a disappointment considering the shift away from goods and to services from consumers, along with manufacturing indexes showing declines in activity. Capacity utilization, measuring how much factory capacity is in use, fell to 79.7% from 79.9% in November. Anything over mid-80s typically is too high because that can create bottlenecks and additional inflationary pressures.

- Mortgage rate continues to fall, following Treasury yields lower, with the 30-year prime mortgage rate now at 6.31%, down just 2 bps from the prior week and down from the cycle high of 7.08% in the beginning of November. However, this is still much higher than where it started the year at 3.11%.

- On Thursday morning, China released some economic data that was disappointing. The data included retail sales that were down 5.9% from a year ago in November, almost doubling the decline that was expected, industrial production that grew less than expected in the month, and fixed investments (business investment) rising less than expected. The data was for the month of November which was the same time China implemented tough Covid restrictions after the spread of the virus intensified.

Company News

- Biotech company Amgen said it will acquire Horizon Therapeutics, a biotech focusing on rare diseases, for $116.50 per share in cash which would value Horizon at $27.8 billion. The $116.50 per share purchase was about a 20% premium to the price of shares right before the announcement.

- Weber said it accepted a $8.05 per share offer to take the company private by private equity firm BDT Capital which values the company at $3.7 billion. The buyout price is about a 24% premium to where shares were trading prior to the announcement.

- Business spend management software company Coupa Software said it would be acquired by private equity firm Thoma Brave for $81 per share, valuing the company at $8 billion. The buyout price is about a 77% premium to where shares were trading right before the announcement.

- In a financial and strategic outlook update, Delta raised its EPS forecast (from $1.17 at the midpoint to $1.37 at the midpoint vs $1.15 consensus) for the current quarter and also raised full year earnings and revenues forecast. In addition, it provided longer-term guidance, $5.50 of EPS in 2023 and over $7 in 2024, both above consensus of $4.80 and $6.62, respectively. CEO Ed Bastian noted “Demand for air travel remains robust as we exit the year and Delta’s momentum is building.”

- United Airlines said it will purchase 100 of Boeing’s 787 Dreamliner passenger jets through 2032, with the option to purchase 100 more, as well as 100 Boeing 737 MAX jets. Boeing says the Dreamliner order is the largest ever of its kind. Shares of United slid about 7% after the news as the orders will push capital expenditures to $9 billion in 2023 and $11 billion in 2024.

- Netflix was the fifth worst performer in the S&P 500 Thursday, falling over 8% after a report from Digiday said Netflix is allowing advertisers to reclaim funds after missing some viewership guarantees on its newer ad-supporter service. It says some ads have yet to be ran on Netflix, citing ad agency executives. Netflix’s ad-supported service takes a “pay on delivery” approach and lets advertisers pay based on the number of viewers the ad reaches. It says Netflix is missing viewer guarantees by varying amounts. Netflix later sent a statement to Bloomberg saying it was pleased with its successful launch of the subscription tier.

Other News

- U.S. regulators said they now have “complete access” to the books of public accounting firms in China and Hong Kong which allows them to inspect the full details of financial statements of Chinese companies. This was a big part of the deal to allow Chinese companies to maintain their listings on US stock exchanges. Recently new regulations says the SEC has the power to de-list shares of these companies if US regulators were unable to inspect audit reports for three consecutive years. US regulators plan to continue inspecting Chinese auditors books in the early 2023.

- The House and Senate passed a one-week stopgap funding bill to avoid a government shutdown on Friday. The stopgap provides Congress with additional time to negotiate a longer-term solution to keep the government funded through most of 2023. The Senate is close to agreeing on a $1.7 trillion funding bill. Separately, Congress passed a $858 billion defense authorization bill which includes repealing the Covid vaccination mandate for military.

- Global Central Bank news:

- The Bank of England raised its policy rate 50 bps to 3.50%, but it was a 6-3 vote with 2 policymakers wanting no change and the other wanted a 75 bps increase. Inflation remains top concern and its statement said further rate increases are expected.

- The European Central Bank raised rates another 50 bps, this comes after a 75 increase at the last two meetings. The central bank says rates will “still have to rise significantly at a steady pace” to bring down inflation. It said the euro economy may contract this quarter and next quarter mostly due to the energy crisis and high uncertainty. It will also begin reducing its balance sheet by €15 billion per month until the end of Q2 and will reassess then. It is also worth noting that ECB President Lagarde said the markets are underestimating how high the central bank will have to go to kill inflation. Later in the week, ECB member Villeroy said quantitative tightening by the ECB is likely to get more aggressive after July.

- The Swiss National Bank raised policy rate another 50 bps to 1.00% and said more rate increases cannot be ruled out.

- There were also rate increases from central banks in Norway, the Philippines, and Taiwan as well.

WFG News

As an update on the Wentz Financial Group staff, please note Eryn Bruback is no longer an employee at Wentz Financial Group. Eryn had a great passion of helping clients with whatever service need they had, we appreciate her efforts and hard work and we wish her well as she moves on to another business opportunity. If there are any questions or needs, please forward those to Eryn’s replacement, Ryan Fitzgerald at rfitzgerald@

Required Minimum Distributions

The Week Ahead

There will be several economic data reports on the housing market in the week ahead. Monday begins with the housing market index in the morning, followed by housing starts and new housing permits on Tuesday, and the National Association of Realtors’ existing home sales report on Wednesday. The consensus sees another 5.9% decline in the sales pace in November and down nearly 30% from a year earlier. The week wraps up with the more volatile new home sales on Friday. Outside of that, we will see the survey of consumer confidence on Wednesday, the final revision of third quarter GDP and jobless claims on Thursday, followed by durable goods orders, consumer sentiment survey, and personal income and outlays for November on Friday, which will include the Fed’s preferred measure of inflation. A number of earnings releases come out this week, with notable results from Nike, FedEx, and General Mills on Tuesday, Micron and Rite Aid on Wednesday, and CarMax and Paychex on Friday. Politics will be in the headlines most likely toward the end of the week with Congress needing to pass a longer-term funding package to keep the government funds through September 2023.