Wentz Weekly Insights

Big Week for Big Caps

|

|

Recent Economic Data

- Economic growth for the fourth quarter was expected to be somewhere between 1.5% and 2.5% (measured quarter over quarter and annualized), but the first GDP estimate showed it grew a much stronger than expected 3.3%. The most important category, consumer spending, grew 2.8% in the quarter, contributing 1.9% to GDP. Spending on goods increased 3.8% while services spending grew 2.4%. Government spending has been trending much higher since the pandemic and grew another 3.3% in Q4, contributing 0.6% to GDP. Residential investment like housing grew 1.1% while non-residential investments like business investments grew 1.9%, each contributing 0% and 0.3% to GDP, respectively. Exports grew 6.3% while imports grew 1.9% resulting in a 0.4% increase in net exports which helped GDP. Finally, the change in inventory investment increased 0.1%.

- Durable goods orders were flat in December versus the expected 1.0% increase. The important number we always refer to, which reflect core shipments and is a direct input to GDP – shipments of nondefense capital goods excluding aircraft, rose 0.1% in the month and comes after a 0.2% decline and no change the prior two months.

- In December the supply of money (including cash, deposits at banks, money market balances, etc) saw a large uptick in the month, increasing 0.5% for the largest increase since May. If you recall, money supply saw a massive increase during the pandemic due to government stimulus, increasing 40.5% from pre-pandemic levels to the highest level of the pandemic in July 2022, which has led to the inflation problem. Since then, money supply saw the largest decline on record into the first half of 2023, but is back to rising, although still down $1 trillion from the highs.

- Sales of newly constructed homes increased 8% in December (coming off the weakest level of new home sales since late 2022) to a seasonally adjusted annualized pace of 664,000 homes and 4.4% above the level from December 2022. For the calendar year 2023, 668,000 new homes were sold, about 4.2% above 2022 figures. As has been the case, supply is still challenging with just 453,000 new homes for sale, but it has approved slightly over the year.

- The number of unemployment claims jumped 25k to 214,000 in the week ended January 20. The four-week average moved down slightly to 202,250. The number of continuing claims was 1.833 million, up 27k from the prior week, with the four-week average at 1.835 million. Still very low unemployment claim levels, coming off last week which was the second lowest since the 1960s.

- Money is flowing, and people are spending. Data on personal income and outlays was released Friday morning with details below:

- The data showed personal incomes rose 0.3% in December as expected. Wages and salaries were up another 0.4% in the month and now higher by 5.9% from a year ago, up from the 4.0% increase from November. Because of a 13.3% annual decline in tax rates combined with incomes up meaningfully, disposable income has grown 7.9% over the past year.

- Meanwhile, consumer spending increased 0.7% in December, almost double expectations, continuing a streak of strong spending by consumers that continues to exceed expectations and economists’ estimates. Spending on goods has rebounded over the past several months, up a strong 0.9% in the month and now up 6.7% from a year ago, while spending on services was up 0.6%, also strong, and up 7.3% from a year ago (it has been trending at an annual rate of 8%-9% most of the year).

- The result of income and spending is the savings rate falling to 3.7%, back down to (tying) the lowest in 14 months.

- In addition, the PCE price index, the inflation reading the Fed puts most weight on, rose 0.2% in the month as expected, with the core index also up 0.2% as expected. The 12 month inflation rate decelerated to 2.6%, matching November’s, while the core 12-month rate decelerated to 2.9%, down from 3.2% in November and the lowest in almost 3 years.

Company News

- Macy’s rejected a $5.8 billion ($21/share) takeout bid by private equity firms Arkhouse Management and Brigade Capital Management. The two firms are threatening to go straight to shareholders with the offer and say they could increase their proposal if they get access to necessary due diligence from the company. Macy’s said the PE firm’s proposal is not actionable and fails to provide value to Macy’s shareholders. Later in the week, shares moved higher after another report that PE group Sycamore Partners has been in talks with Macy’s and was exploring a bid for the company.

- Netflix and TKO Group, parent company of WWE, announced a $5 billion partnership in which Netflix would become the exclusive provider of WWE events starting January 2025. Separately, Netflix shares were up over 10% after it reported its fourth quarter financial results that were mixed, but its subscriber growth of 13.1 million was well over expectations as its password sharing crackdown is working to create new subscribers and its ad-supported subscription gains traction.

- The Federal Aviation Administration said it will not allow Boeing to expand production of its 737 MAX planes, saying this will stay in place until they are “satisfied that the quality control issues” are resolved. In addition, the grounding restriction of all 737 Max 9 planes has been lifted following a comprehensive inspection of all planes in service. Separately, aircraft suppliers are recovering after preliminary reports show Boeing was responsible for the in-flight emergency on the Alaskan Air flight earlier this month as the door plug that blew off was removed then reinstalled improperly by Boeing.

- Microsoft market cap reached $3 trillion last week, only the second company to ever reach this level (Apple did last June).

- Salesforce said it would lay off another 1% of its workforce, equal to about 700 employees. This comes after it laid off 10% of its staff in 2023 after it said it hired too many people during the software boom of 2021-2022. Microsoft said it will be laying off 1,900 employees in its gaming unit, reflecting about 10% of its gaming employees. The layoffs will affect most employees at Activision Blizzard – the gaming company it acquired last year for $69 billion. Other layoffs included Business Insider, the LA Times, and Paramount. According to layoffs.fyi, there have been 24,500 layoffs between 89 tech companies so far this year. In 2023 there were over 260,000 layoffs by nearly 1,200 tech companies.

Other News

- China intervened in effort to try to stop the drawdown in its stock markets and its currency, the yuan. Chinese state owned banks tightened liquidity in the foreign exchange market and actively sold US dollars. Its index of mainland stocks, the CSI 300, is down almost 25% over the past year and has fallen to a five-year low. On Friday, its brokerage firms suspended short selling to help prevent more downside. Early last week, Bloomberg reported Chinese authorities were considering a package of measures to prevent a further decline in its stock market, after previous attempts fell short. The measures reportedly include mobilizing about $280 billion from offshore accounts from Chinese state owned enterprises to a state owned stabilization fund to buy onshore shares through the Hong Kong exchange. Then, around mid-week, China said, to further support its economy and markets, it would cut its reserve requirement ratio by 0.50% for all banks. China’s central bank, the People’s Bank of China, said the move is expected to inject about $140 billion of liquidity into the financial system.

- Central Bank updates:

- The Bank of Japan as expected kept its monetary policy unchanged, keeping rates slightly negative and continuing its yield curve control which means not letting its 10-year government bond yield rise above 1.0%. The Bank of Japan has been one of the only major central banks to not raise interest rates or tighten policy over the past couple years (its inflation remains low and economic growth has been very low).

- The Bank of Canada said at its most recent policy meeting it will keep monetary policy unchanged, holding rates at current levels of 5% for the fourth straight meeting. The statement on policy was slightly more dovish with it removing the statement on it being prepared to raise rates again if needed. However, it did discuss its continued concerns about inflation remaining too high and risks that inflation could persist.

- The European Central Bank said it will keep its policy rate unchanged after its most recent meeting, saying the economy appears to be developing as expected. The ECB did not give many hints on rate hikes or cuts in the near future, saying rates will stay “sufficiently restrictive for as long as necessary.” Separately, reports from Reuters say the ECB has asked some banks to monitor social media to monitor sentiment and look for any early signs of bank runs.

Did You Know…?

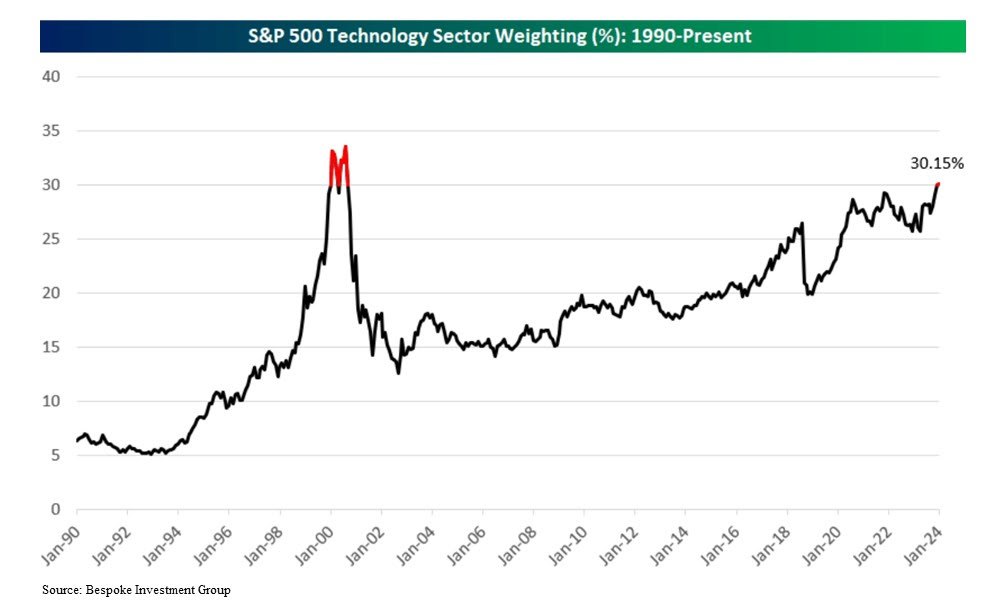

Technology’s Big Weighting

WFG News

Economic & Market Outlook Meeting

The Week Ahead

This week will be one of the busiest of the quarter, full of quarterly earnings reports, economic data, a Fed meeting and Treasury announcement. On the earnings side, there will be about 40% of the S&P 500 companies reporting their fourth quarter results this week with notable reports coming from the mega cap tech companies Alphabet, Microsoft, Apple, Amazon, and Meta. Other notable reports will come from General Motors, UPS, Pfizer, Starbucks, AMD on Tuesday, Boeing, Qualcomm, Mastercard on Wednesday, Honeywell, Altria, Merck on Thursday, and AbbVie, Exxon Mobil, and Chevron on Friday. On the economic calendar the focus will be on the labor market. The job openings and labor turnover survey results are released Tuesday morning, followed by ADP’s employment report Wednesday, jobless claims on Thursday, and the Department of Labor’s employment report on Friday. The consensus estimate currently sees 170,000 new jobs in December, slightly lower than recent trend. Other economic data releases include the Case Shiller Home Price Index and consumer confidence on Tuesday, the employment cost index on Wednesday, fourth quarter productivity and costs data, the PMI and ISM manufacturing indexes, and construction spending on Thursday, and wrapping up with factory orders and consumer sentiment on Friday. Investors will be focused on the Treasury market Wednesday morning when the U.S. Treasury announces its quarterly funding needs, which includes how much and which securities will be offered and the dates. Last quarter the Treasury announced more funding than expected which attributed to the rise in Treasury yields three months ago. Also on Wednesday, investors will be focused on the Federal Reserve in the afternoon after the FOMC meeting concludes with a policy decision announced at 2:00 pm. While no change in policy is expected at this meeting, markets will be looking for clues on when rate cuts will begin.