Wentz Weekly Insights

Busiest Week of Quarter Ends Positive, But not Without Volatility

In what was the busiest week of the quarter, and perhaps busiest of the year, stocks saw a gain across the board, driven by a less aggressive Fed than expected, slowing economic data (bad news is good news), and better earnings than expected from several mega cap companies. This also resulted in a rally for bonds as Treasury yields fell across the curve. The 2-year and 10-year Treasury yield both fell to the lowest level in almost a month, to 4.83% and 4.52%, respectively. The S&P 500 rose 0.55% for the week in a roller coaster ride, with a short spike in volatility prior to the Fed meeting before steadily declining to end the week.

One of the more important events was the FOMC meeting Wednesday where there was no change in interest rates, as expected. However, the bigger focus was comments around the recent reacceleration in inflation, the timing on the beginning of rate cuts, as well as the possibility of a rate hike, as markets began to price back in.

Before the press conference, the policy statement was released and included a new sentence to describe there being a “lack of further progress” toward the 2% inflation goal. The only other new item on the economy was the labor market “having moved” to better balance rather than “are moving” to better balance.

The Fed decided to reduce the balance sheet at a lower pace. Instead of letting $60 billion of Treasuries to roll of its balance sheet per month, it is now allowing $25 billion per month – this will continue to pull liquidity out of the financial system, but at a much slower pace.

There were three important things Powell addressed. The first was the recent trend in inflation. Powell did not provide much context beside saying there has been a lack of further progress on bringing inflation lower and suggesting this is still part of the “bumps” that he said were to be expected in the road to bring inflation down. He added his forecast continues to see progress on inflation moving lower for the remainder of the year despite inflation turning higher in the previous three months.

The second was the current level of policy and direction of rates from here, particularly the possibility of rate hikes as the markets have began to price in. He avoided saying policy was “sufficiently restrictive” but rather said policy is restrictive still and only time will tell if it is “sufficient” enough. His comments suggested the bar is high to begin rate cuts soon, but the bar is even higher to see a rate hike. Market appreciated the more dovish comments on rate hikes and we saw that as one reason for the move higher in stocks and move lower in bond yields.

The last topic was regarding stagflation – an environment that sees a combination of high inflation with slow growth and high unemployment. We have seen increasing comments on the possibility of a stagflationary environment among media members and strategists, and one put the question in front of Powell. He was more upbeat on the economy, saying “I don’t see the stag or the flation… I don’t really understand where that’s coming from.”

One other comment to note from Chair Powell was him suggesting rate cuts could potentially come sooner from an unexpected weakening in the labor market. This leads to the next headline which was data on the labor market, particularly the most important with the DOL employment report from Friday (along with others in the data section below).

Data showed the labor market cooled in April, but the pace of job gains still solidly above the rate of population growth. After a strong start to 2023, averaging 289,000 new jobs per month through the first six months, job gains slowed to an average of 213,000 the final 6 months of 2023. However, the pace picked back up as the calendar turned with the average at 269,000 through the first three months of the year. The new data for April showed 175,000 job gains, slightly less than expected, and along with the workweek falling 0.1 hours (to 34.3 hours), gave markets the belief the labor market was back to slowing. The labor report has two surveys and this reflects data generated from the establishment survey.

The household survey, which includes small businesses and has been distorted most likely due to the surge in immigration (survey likely does not reflect responses from immigrants), was also weaker in April, showing 25,000 more people employed. Household employment growth averaged just 157k in 2023 and just 77k the first four months of 2024, and actually declined four of the past seven months, a much weaker picture than the establishment survey.

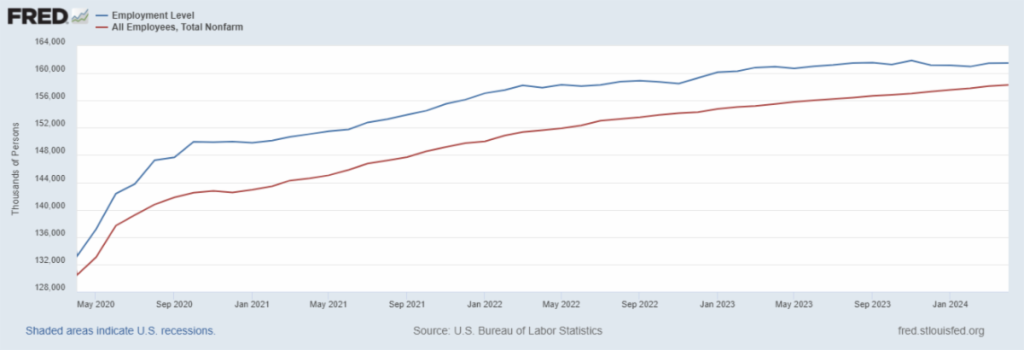

The below chart illustrates the change in the two surveys since the bottoms of the pandemic April 2020. The establishment survey reflects what businesses say about employment (red line), and may collect data on immigrants working because it is basically a head count of workers, while the household survey (blue line) reflects what households say about their employment situation and may not reflect jobs from immigrants. While nonfarm payrolls (establishment survey) continue to rise at a steady pace, civilian employment (household survey) has grown at a much weaker pace over the past one or two years.

Earnings reports were very mixed last week but the overall earnings growth rate improved due to several positive mega cap company reports. Apple had a low bar to meet due to slowing iPhone sales and declining market share in China but results were better than feared, its guidance was better than feared, and it announced a new $110 billion share buyback and gave an optimistic tone that AI will have a transformative impact across its products, which it is expected reveal this summer.

Meanwhile, Amazon shares were higher as well after much stronger than expected results, mainly on its operating income, as its sales in its cloud division were strong amid higher AI implementation. In addition, it forecasted its operating income to grow faster than estimates in the next quarter.

Going into the quarter, earnings were expected to have grown 3.4%, but as of Friday this stands at 5.0%, according to FactSet. Additionally, of the 400 S&P 500 companies that have reported so far, about 79% of them have beaten earnings expectations, near the 5-year average. However, the median stock outperformed the index by less than 0.1% on its reporting day, the smallest margin since 2020, according to Bloomberg.

The weak reaction can be explained by guidance with investors punishing stocks for weaker than expected forecasts. Of the companies that issued guidance through April, only 15% provided an outlook that exceed estimates, according to the same Bloomberg report. With the valuation of the stock market already at a higher level than historical average, we need to see earnings continue to beat expectations for the upside to continue.

Recent Economic Data

- Job Openings: The number of job openings on the last day of March was 8.488 million, a sizeable decline of 325k compared to February and down to the lowest level of job openings since March 2021 during the economic reopening after the pandemic. Job openings have steadily come down from a pandemic, and all-time high, of 12.2 million March 2022, however are still about 1.4 million above the pre-pandemic average. On the other hand, the number of separations declined 340k to 5.200 million, with a smaller number of quits driving most the decline. These separations numbers may suggest employees are finding it harder to switch jobs and/or to find a better paying job.

- Jobless Claims: The number of jobless claims the week ended April 27 was 208,000, relatively unchanged from the prior week with the 4-week average another 3.5k lower to 210,000. The number of continuing claims was 1.774 million, unchanged from the prior week with the four-week average down slightly to 1.789 million.

- ADP Employment: Private employers added 192,000 jobs in April, according to ADP payroll data, which is slightly less than the gain from March and slightly more than expected. Hiring was again broad based across sectors as well as across business sizes.

- Employment Situation: The establishment survey of the monthly labor report showed nonfarm payroll increased 175,000 in April, slightly less than the 220,000 expected and a slow down from the 315,000 gains seen in March. Revisions for February and March resulted in a net 22,000 less job gains than previously expected. Job gains were seen the most in health care, social assistance, and transportation/warehousing, with all other industries seeing little change. The average hourly earnings rose 0.2% in the month, and are up 3.9% from a year ago, slowing from the 4.1% rate in March and also slightly lower than expected. At the same time, the household survey showed a labor force participation rate that was unchanged at 62.7%, still half a point below pre-pandemic levels. The survey also showed the number of people employed rose just 25,000 while the number unemployed rose 63,000, relatively small monthly changes. This resulted in a 0.1% increase in the unemployment rate to 3.9%. The establishment survey reflected a job market that continues to grow while the household data suggested more of a slowing market, as was the case last 2023.

- Employment Cost Index: The employment cost index, a measure of the change is labor costs to an employer over time, increased at a 1.2% rate for the first quarter, more than estimates and increasing from the 0.9% rate in the fourth quarter. The increase was due to a 1.1% increase in wages and salaries and a 1.1% increase in benefit costs. For the 12-month period ending March, compensation costs rose 4.2% due to a 4.4% increase in wages/salaries and a 3.7% increase in benefits. This is a closely followed data release by the Fed, which is released only quarter, due to its measure of employment costs. Markets were weak after the release as the worry was higher costs would lead to higher inflation.

- Case Shiller Home Price Index: The Case Shiller home price index showed home prices across the U.S. continue to accelerate, rising on average by 0.6% in February and are now 6.4% higher from a year ago for the highest annual increase since November 2022. Increases were seen across all 20 metro areas measured except Tampa which only saw a small decline for the month. On an annual basis, all cities tracked rose at least 2% with the fastest gains in the San Diego (+11.4%) and Detroit and Chicago (+8.9%) markets, with the smallest increases in the West like Portland and Denver. Cleveland remains in the middle with a 7.0% annual increase.

- Construction Spending: Construction spending declined 0.2% in February, one of the first surprises to the downside in a while, which compares to a 0.3% increase expected. Spending declined 0.7% on residential construction and rose 0.2% on nonresidential construction. Over the past year construction spending is higher by 9.6%.

- Trade Data: The latest trade data showed the U.S. trade deficit was $69.4 billion in March, little change from the February deficit. In March exports fell 2.0% while imports fell a lesser 1.6%. The net change should have little impact on revisions for first quarter GDP. However, the other way to look at the data is through the volume of trade to measure cross-border activity – trade volume declined $10.7 billion in the month, a 1.8% decline compared to February and just a 1.7% increase from a year ago.

- PMI Manufacturing Index: The manufacturing PMI survey saw a drop in April reflecting a decline in new orders for the first time this year. Meanwhile, output prices rose at a slower pace, but input prices accelerated which may create upward selling price pressure in the months ahead. The PMI index was 50.0 for the month, a decline from 51.9 in March.

- ISM Manufacturing Index: The ISM manufacturing index was 49.2 for April, back in contraction territory after rising in March, which was the first increase in 17 months. New orders disappointed to the downside while production slowed. Prices accelerated and have increased at a faster pace since the beginning of the year. What looked like a turn in manufacturing in March is now a disappointment for April.

- ISM Services Index: The ISM services index, a measure of services activity, contracted in April for the first time since December 2022 according to the survey. The index disappointed at 49.4 and has seen a steady decline since the beginning of the year. The prices index increased 6 points to 59.2, and as similar to the manufacturing sector and other inflation reports, suggests inflation has re-accelerated over the past several months.

Company News

- Walmart’s New Brand: Walmart announced it will introduce a new premium private label food brand that will be called “Bettergoods” which it decided to create after shoppers wanted “elevated culinary [and] inspirational” types of food. Most of the branded item will be sold at less than $5. It said the brand is expected to appeal mostly to younger and more affluent shoppers. Separately, Walmart said it will close all of its health care clinics and telehealth provider after its push into healthcare failed. It said it could not operate a profitable business due to rising costs and a challenging reimbursement environment.

- Exxon Mobile Acquisition: U.S. regulators gave the ok for Exxon Mobil’s pending $60 billion purchase of Pioneer Resources under the condition Pioneer’s CEO does not gain a board seat on Exxon due to his alleged attempts to collude with OPEC to raise oil prices. The Federal Trade Commission, who gave the go ahead on the deal, said the CEO used his influence to align oil production in its regions of the U.S. like the Permian Basin with OPEC+ to raise prices. The deal is expected to close Friday and will make Exxon the largest oil producer in the Permian Basin.

- Tesla Supercharge Layoffs: Staff at Tesla reported the company has fired its entire Supercharger division, creating confusion throughout the industry and Tesla’s network of 50,000 Superchargers globally. Previously, CEO Musk said the firm would cut one in ten jobs across the company, as it faced tougher competition, in effort to reduce costs. The Supercharger division was responsible for designing the chargers and the worldwide buildout and employed hundreds of people.

- Paramount Global M&A?: The WSJ reported that Sony Pictures and Apollo Global, a private equity group, had made a $26 billion all-cash offer for Paramount Global. Paramount has been in exclusive and ongoing merger talks with Skydance Media for some time, but several shareholders have pushed back against such deal, and the exclusivity period expired on Friday so now sale talks can happen with anyone.

WFG News

Last Call! – Estate Planning Seminar

WFG Summer Hours

Please note that beginning Memorial Day (May 27), Wentz Financial Group will be implementing its summer hours. We will be open and available between 8:30am and 4:00pm Monday through Friday from Memorial Day through Labor Day. As always, if you need to speak or meet outside these hours, please contact us and we are happy to set up a time that works.

The Week Ahead

While the most busy week of the quarter is behind us, this upcoming week will still include several notable items on the calendar. The most important this week is earnings season continuing to roll on with 15% of the S&P 500 companies set to report results, but the focus will be more on smaller sized companies with roughly 30% of the Russell 2000 (index of 2000 small cap companies) reporting. The focus will move to health care and small/mid cap tech. Notable companies reporting include Palantir Technologies, Tyson Foods, BP, Walt Disney, Global Foundries, Datadog, Uber, Airbnb, Shopify, Trade Desk, Affirm, Warner Bros. Discovery, Dropbox, and AMC networks. The economic calendar is very light before turning to inflation data next week. This week includes jobless claims Thursday and consumer sentiment on Friday. We will also see the Senior Loan Officer Opinions Survey on Bank Lending Practices from the Fed on Monday which provides anecdotal evidence of credit conditions in the economy. After the recent FOMC meeting, Fed officials are out of the blackout period so public speeches will resume with at least 10 Fed officials making public appearances.