Wentz Weekly Insights

Earnings Preview 2024

|

|

Recent Economic Data

- The number of job openings on the last day of November was 8.790 million, little changed from the 8.852 million openings on the last day of October. This is down from the all-time high of over 12 million March 2022, but still above the pre-pandemic average of around 7.0 million. At the same time, the number of separations declined about 300k to 5.340 million, with the decline driven equally by quits and layoffs. Although job openings declined, they are still historically high, with separations declining to the lowest since early 2021.

- ADP reported its data saw 164,000 new payrolls added in December, which was above the consensus estimate of 115,000. It saw hiring in all business sizes, small, medium, and large, and saw the most hiring in leisure & hospitality, health care, construction, financial services, with a small decline in manufacturing.

- For the week ended December 30, there were 202,000 unemployment claims, a decline of 18k from the prior week, the second lowest level of initial claims of the past 11 months. The four-week average declined 5k to 207,750. The number of continuing claims was 1.855 million, down 31k from the prior week, with the four-week average relatively unchanged at 1.867 million.

- The number of job gains jumped in December more than expected, according to the establishment data by the Department of Labor. The data showed 216,000 new payrolls in the month, above the consensus estimate of about 160,000, and increased back to the 12-month average of 225,000. Employment increased 2.7 million in 2023, lower than the 4.8 million increase in 2022, but closer to the historical average. The data saw employment continue to trend up in government, health care, social assistance, and construction, while manufacturing and transportation/warehousing lost jobs. Data from the household survey painted a different picture – employment fell by 683,000 to a level of 161.183 million, however, the labor force declined by nearly the same amount (676,000), resulting in a 0.3% drop in the participation rate to 62.5%. This is back to the lowest since the beginning of 2023 after being at the highest since pre-pandemic last month. This is an unusually large decline in the labor force, and unexplained so we will see if it reverts back in next month’s data. At the same time, the unemployment rate remained at 3.7% while the underemployment rate (the U-6 rate) moved back up to 7.1%. The other major data point in this series is average hourly earnings, which increased a more than expected 0.4% in the month with the 12-month change in wages of +4.1%, above the 3.9% expected and a bump higher from the 4.0% annual increase from November.

- The US PMI manufacturing index was 47.9 for the final month of 2023, down slightly from 48.2 from November, signaling even weaker manufacturing activity in the US at the end of the year. The index is now in contraction territory (a reading of under 50) for eight consecutive months and 13 of the past 14 months. The report notes the downturn in new orders accelerated to the worst since August with output returning to declines over a faster fall in backlogs. Also a negative, inflationary pressures “intensified” as costs and selling prices increased.

- The ISM manufacturing index was 47.4 for December, a slightly improvement from 46.7 from November, nonetheless remaining in contracting territory for the 14th consecutive month. New orders, backlogs, employment, and inventories continued to shrink, while production saw a small increase. the prices index saw a decline which was led by “soft energy markets” but offset by increases in steel and aluminum markets.

- The ISM services index, an index on activity in the non-manufacturing sector, was 50.6 for December, continuing a streak of declines and lower than the 52.5 expected. Recall a reading above 50 reflects growing conditions and under 50 reflects contracting conditions. New orders, reflecting new activity, was 52.8 versus 56.0 expected, while employment fell to 43.3 for a surprise decline and the weakest since July 2020, and prices paid was 57.4, an increase from prior months suggesting price pressure remain elevated.

- Construction spending in November increased 0.4%, slightly below the expected increase of 0.6%. Spending on residential rose 1.0% while spending on nonresidential fell 0.1%. Over the past year spending has increased 3.7%, which has been driven by a 18.1% increase in nonresidential and a 3.7% increase in residential spending.

- Factory orders for November increased 2.6% in the month, a little better than expected and the best month since January 2021. However, most of the increase was due to transportation, specifically aircraft orders, which, due to their large order size, are extremely volatile month to month. Aircraft orders were up 80% in the month, after a 44% decline the prior month, while orders excluding transportation were up 0.1%. One of the more important readings, shipments of non-defense capital goods excluding transportation due to its input to GDP, declined 0.2% in the month, and is down an annualized 1.2% over the past three months.

- The number of vehicle sales in 2023 was around 15.8 million, finishing the year about 13% higher than 2022’s level. General Motors and Toyota remained the top selling automakers, with GM making up about 2.6 million of those sales (up 14% from 2022) and Toyota making up 2.25 million vehicle sales (up about 7% from 2022). The 2023 sales figures were the highest since 2019 when sales were over the 17 million mark for the fifth consecutive year.

Company News

- Oil producer APA Corp (formely known as Apache) said it has agreed to acquire Callon Petroleum for $4.5 billion in an all-stock transaction. The acquisition it says will help it boost its presence in the oil-rich Permian Basin. Apache is expected to issue new shares and under the deal Callon shareholders will receive 1.0425 shares of APA for each share of Callon owned.

- Amazon’s share in online orders increased again over this past holiday shopping period, according to the package tracking app Route. It said from its 55 million orders tracked, Amazon captured 29% of global order volume in the final two weeks before Christmas, up from 21% the Black Friday weekend. Out of all weeks in the holiday shopping period, Amazon had the highest percentage of orders in the weeks closest to Christmas, most likely due to its speedy delivery time and two-day delivery for Prime items.

- Microsoft said it will make the first change to PC keyboards since 1994. It said it will add an AI Copilot key in effort to integrate AI across its products. The new Copilot key will sit to the right of the space bar and is the first change since Microsoft added the Windows key nearly 30 years ago. Microsoft said it will show off its Windows 11 computers with the Copilot button at the CES conference this week. It says the button will act as a shortcut to allow users to use AI to create images, write emails, and summarize text.

Other News

- The release of the FOMC’s meeting minutes showed there was not a clear discussion on rate cuts at the most recent meeting in December, whereas investors are still betting the first rate cut could happen in as soon as two meetings from now (March). It showed policymakers agreed that the current policy rate was at or near peak, but a number of participants said there is downside risk of keeping the policy rate too high for too long. Most policymakers said it could be appropriate for the level of rates to be lower in 2024 than 2023 but still too early to tell and they need more evidence that it is coming back down to target, which may be suggesting investors have gotten overly dovish on rate cuts this year. Also noted that recent easing in financial conditions could make it more difficult in its efforts to control inflation.

- As a follow up to last week’s newsletter, tensions in the Red Sea remain high over ongoing attacks on shipping vessels that utilize the shipping route. One of the world’s top shippers, Maersk, said it will divert all of its vessels away from the Red Sea for the “foreseeable future” and warned its customers to expect significant disruptions to the global shipping network. Beside longer wait times for shipments, another consequence is shipping rates have soared back to the highest level they were since the bottlenecks from the pandemic reopening. As Bloomberg reported, the spot rate for shipping goods in a 40-foot container from Asia to northern Europe is now over $4,000, a 173% increase from mid-December. The alternative route is south past the Cape of Good Hope in southern Africa, which is much longer and more costly.

- Over the weekend, House and Senate leaders said they have come to an agreement on how to fund the discretionary portion of the government for fiscal year 2024 and includes $886 billion in defense and $733 in non-defense spending. These are top line numbers, so before a vote happens Congressional leaders will still need to fine tune the details and draft the legislation. Back in November, Congress passed a short term bill to keep the government funded until January 16, which now becomes the next deadline at which time several funding levels expire, then February 2 when all expire.

Did You Know…?

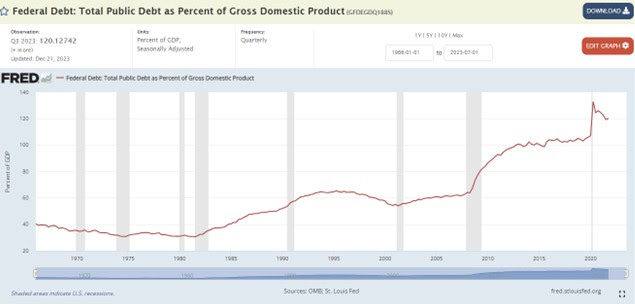

The Growing Deficit

WFG News

Economic & Market Outlook Meeting

The Week Ahead

Activity will pick up this week with several important data releases, the start of fourth quarter earnings seasons and several big corporate conferences. On the data side, the highlight of the week will be the consumer price index report on Thursday morning where consensus sees prices rising 0.2% in December with the year-over-year rate ticking up to 3.2% but falling to 3.8% at the core level. Elsewhere, trade data comes out Tuesday, jobless claims on Thursday, and the producer price index on Friday. In the Treasury market there may be heightened attention on the upcoming Treasury auctions mid-week. On the Fed front, we will see several public appearances from policymakers throughout the week. On the corporate side, the big conferences include one of the biggest tech conferences of the year – the Consumer Electronic Show (CES) in Las Vegas, the JPMorgan Healthcare Conference, and the ICR Conference which focuses on consumer companies. Finally, Friday is the unofficial beginning of fourth quarter earnings season which starts with some of the biggest banks including JPMorgan, Bank of America, Wells Fargo, and BlackRock. Other notable companies reporting this week include Albertsons on Tuesday, KB Homes on Wednesday, and UnitedHealth and Delta Airlines on Friday.