Wentz Weekly Insights

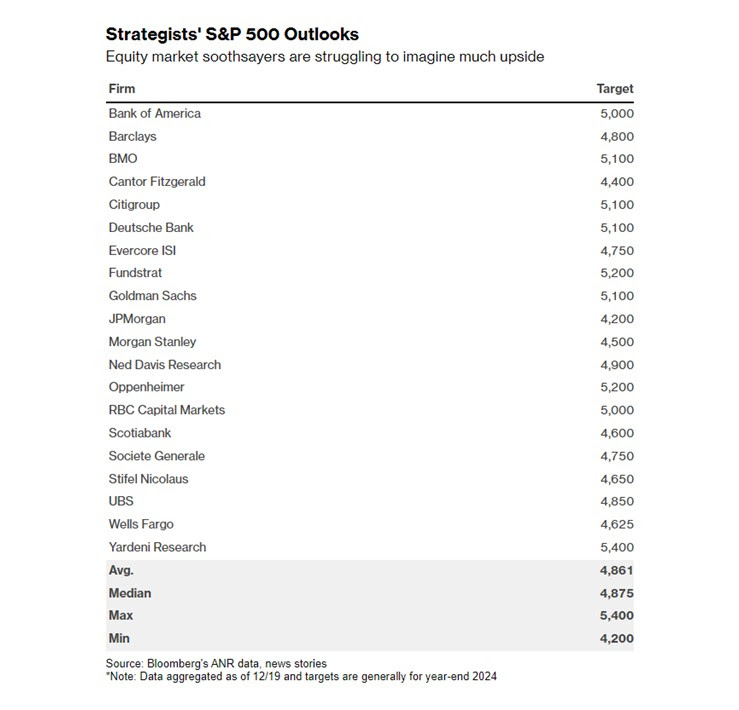

Strategists Expecting Another (Slightly) Positive Year For 2024

Recent Economic Data

- Inflation picked up its pace slightly in December, according to the latest data on the consumer price index. The index increased 0.3% in December, after a 0.1% and 0.0% increase the prior two months but was slightly more than the 0.2% increase expected. Over the past 12 month, the index is 3.4% higher, up from the 3.1% 12-month rate in November and slightly more than expected. Core prices, which is the index minus energy and food categories, were the same story – prices rose a slightly more than expected 0.3% (although matching the prior months increases) with the annual rate at 3.9%, although slowing from 4.0% in November (the first time below a 4.0% annual rate since early 2021). Looking more at the details, higher electricity prices drove the 0.4% increase in energy prices, food away from home (restaurants) continues to run hotter and is up 5.2% over last 12 months, and within the core index small declines were seen in medical care commodities and vehicle maintenance, but inflation is still running hot in vehicles, shelter (by far the largest part of the index), medical care services, and transportation (particularly insurance costs and airfares). In addition, the “super core” index, which excludes food, energy, certain goods, and housing, rose 0.4% for the second consecutive month and is up an annualized 4.5% over the past six months. This inflation report was a reversal from the prior several months which saw inflation cooling slowly. This should cause markets to slow its rate cut expectations and matches the Fed’s message that progress on inflation will not be a straight line (will be up and down).

- Inflation at the producer level declined slightly in December, according to the producer price index. The index fell 0.1% versus the expected 0.2% increase, while core prices were flat, also slightly less than the expected increase. Over the last 12 months the index is up 1.0% with core prices up 1.8%. The index was driven down by a 0.9% decline in food and 1.2% decline in energy prices on the goods side, and a 0.8% decline in trade services and 0.4% decline in transportations/warehousing in the services side. Excluding food, energy, and trade services, the index was up 2.5% from a year ago.

- The number of unemployment claims filed to the states for the week ended January 6 was 202,000, relatively unchanged from the prior week, with the four-week average also relatively unchanged at 207,750. The number of continuing claims fell to 1.834 million, down 34k from the prior week for the lowest since October. The four-week average of continuing claims fell slightly to 1.862 million.

- The U.S. trade deficit shrunk slightly in November, at $63.2 billion for the month, down from $64.5 billion in October. The small drop was due to a 1.9% decline in exports (to $253.7 billion) and a 1.9% decline in imports (to $316.9 billion). The smaller deficit is a slight positive to fourth quarter GDP but the report should be viewed as a bigger negative due to the drop in trade activity/volume. Through the first 11 months of 2023, the deficit decreased 18.4% compared to 2022, with imports down 3.6%, or $133 billion from 2022 levels. The total volume of trade fell $11 billion in November, or 0.2%, from the same period a year ago due to a 0.4% increase in exports and 0.1% increase in imports.

Company News

- Nvidia shares rose to new all-time highs after it unveiled three new, more powerful graphic processing units (GPUs) that it says will let gamers, graphic designers and computer users to make better use of AI.

- Twilio announced its new CEO, the former President of Twilio Communications, to succeed the outgoing CEO and co-founder, and with the announcement said its Q4 and full year results are expected to exceed its outlook. Shares were up nearly 7% on the news.

- After several reports on Monday, Hewlett Packard Enterprise announced on Tuesday evening it has agreed to acquire the network gear maker Juniper Networks for $14 billion, or $40 per share, about a 32% premium to where shares traded prior to the initial report. The report said the deal would help bolster the company’s artificial intelligence offerings and expand its total addressable market.

- CVS, along with other US health insurers, shares dropped after its executives said at the JPMorgan Healthcare conference that its medical costs as a percentage of premiums collected would be higher than its previously expected, adding that it continues to see pressure in the healthcare benefits business. In the previous quarterly update, the company forecasted medical costs as a percentage of premiums (the medical-loss ratio) would be 86%, but now is forecasting it to be over 87%.

- Car rental company Hertz said it will be selling about one-third of its electric vehicle fleet, equal to about 20k vehicles, in a strategic move to bring supply back in balance with where demand is, according to the company. This reverses a move that started in 2021 to invest heavily in its EV fleet with 100k new Tesla vehicles and tens of thousands more from others, but due to low demand and higher operating costs, it will now sell the vehicles and use the proceeds to purchase combustion engine vehicles.

- Netflix head of advertising Amy Reinhard said at the CES last week that the company had exceeded 23 million global subscriber of its advertising based plan, up from about 15 million in its October update. She added the company is most excited about the engagement of consumers, with more than 85% streaming for two hours or more per month. The ad based plan has been out for about 13 months now and costs $6.99 per month, about half the cost of the no-ad plan of $15.49 per month.

- Chesapeake and Southwestern Energy announced they have come to an agreement to merge in an all-stock deal valued at $7.4 billion. Under the deal, Southwestern shareholders will receive 0.0867 shares of Chesapeake for each share of Southwestern owned which will result in Chesapeake shareholders owning 60% of the combined company and Southwestern shareholders owning 40%.

- DocuSign shares traded higher on Thursday after a Reuters report that private equity firms Bain Capital and Hellman & Friedman were in competition to acquire the company. The report said the PE firms have not made a joint bid, but it is possible they could go in on a deal together. This report follows a recent one several weeks earlier from the WSJ that DocuSign could be going private through a leveraged buyout.

Other News

- For the first time, the SEC approved 11 spot Bitcoin exchange traded products (ETPs) which comes after a series of cryptocurrency ETF rejections over the years. The SEC Chairman said the “action is cabined to ETPs holding one non-security commodity, bitcoin. It should in no way signal the Commission’s willingness to approve listing standards for crypto asset securities.” SEC Chair Gary Gensler made it clear to point that the SEC was in a way forced by the courts, and made it clear of the difference between Bitcoin ETFs and ETFs that track commodities like previous metals, saying the “underlying assets in the metals ETPs have consumer and industrial uses, while in contrast bitcoin is primarily a speculative, volatile asset that’s also used for illicit activity including ransomware, money laundering, sanction evasion, and terrorist financing,” and the SEC did “not approve or endorse bitcoin.”

- Due to the ongoing attacks on shippers traveling through the Red Sea (one of the world’s biggest shipping routes that takes ships through the Suez Canal and eventually the Mediterranean Sea and Europe and North America) by Yemen’s Houthi rebels, a U.S. led coalition along with the UK launched dozens of airstrikes on Houthi targets in Yemen. This came several days after Yemen forces ignored an ultimatum to stop attacks on ships traveling through the Red Sea, according to the WSJ. The Houthi attacks, which are back by Iran, are said to be in response to Israel’s attacks on Hamas in the Gaza Strip. Following the strikes, the Houthis said they would not back down and will continue to target ships adding any “American attack won’t go unpunished” and would cause a response from the rebels.

- Volatility in crude oil has been higher lately due to the events happening in the Red Sea and Middle East, but the price of crude moved lower to begin the week after Saudis said they would lower its selling price to all buyers including Asian buyers which is its largest market. This came in response to lower demand (mainly from China) and increasing global supplies as the U.S. saw new production records.

- The U.S. Energy Information Administration said in its latest short-term energy outlook report that U.S. oil production will hit new records over the next two years, but grow at a slower rate than recent years. It forecasts 2024 crude oil production to rise to an average of 13.2 million barrels/day and increase again to an average of 13.4 million bbl/day in 2025. This is up from the average production of roughly 12.9 million bbl/day from 2023 which was a 1 million bbl/day growth from 2022 levels from higher drilling activity.

- Fed updates:

- Dallas President Logan made a case that the Fed could slow its balance sheet runoff plans while adding the recent easing of financial conditions (lower treasury yields and market rates and higher asset prices) could reverse the progress made on inflation, leaving a rate hike on the table.

- Boston’s Fed Bostic said inflation has fallen faster than expected but progress still needs to be made.

- Governor Bowman said rate hikes are likely over, but said cuts are not appropriate yet and upside risks to inflation remain (she has been one of the bigger hawks).

- NY Fed President Williams said his base case sees current policy as restrictive and will continue to bring inflation lower but expects to stay at these restrictive levels “for some time” adding it will only be appropriate to dial back when the Fed is confident inflation is moving back to 2% on a “sustained basis.” He was one of the first to push back against rate cut expectations after the Fed’s most recent December meeting. He also touched on quantitative tightening (shrinking the balance sheet), saying “we don’t seem to be close” to slowing or stopping the shrinking of the balance sheet (comes after recent comments from Lorie Logan that suggested it made sense to slow QT).

Did You Know…?

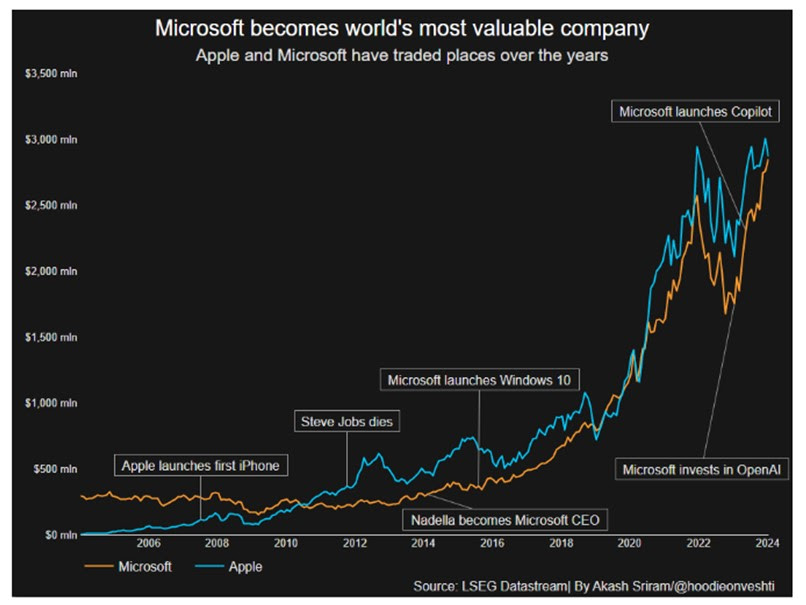

The Magnificent Seven

WFG News

Economic & Market Outlook Meeting

The Week Ahead

Stock and bond markets are closed Monday to observe Martin Luther King Jr Day, leading to a shorter week, but it will be busier than recent weeks. The pace of fourth quarter earnings reports picks up with the focus still on financials/banks. Notable reports will come from Morgan Stanley, Goldman Sachs, PNC on Tuesday, Charles Schwab, U.S. Bancorp, Alcoa on Wednesday, Truist Financial, KeyCorp, Fastenal on Thursday, and Comerica and Fifth Third on Friday. The economic calendar will be lighter of major events, with most focus most likely on December retail sales which are estimated to be up 0.4% in the month, with a 4.8% 12 month increase. Updates will also come from the housing market with the housing market index, housing starts and permits, and existing home sales at the end of the week. Other data releases include the Empire State Manufacturing survey index on Tuesday, import and export prices, industrial production on Wednesday, jobless claims, the Philly Fed Manufacturing survey index on Thursday, and consumer sentiment on Friday. Fed speak will continue with at least eight public speeches scheduled this week by policymakers. We are sure to see political headlines as well with the Iowa caucuses Monday, continued negotiating on a 2024 budget with possibly another shorter-term bill in the works, and more developments from the Red Sea as the Houthi rebel group continues its attacks on shipping vessels.